Understanding the level of investment spending and private savings is crucial for evaluating a country's economic health and potential for long-term growth. Private savings, comprising household and business savings, represent the lifeblood of a nation's economic potential. These savings contribute to the domestic supply of loanable funds, which are then invested in businesses, infrastructure, and other productive activities, ultimately driving economic growth. On the other hand, investment spending involves borrowing funds for ventures such as factories, materials, and personnel. The interplay between private savings and investment spending is intricately linked to a country's financial landscape and prospects.

What You'll Learn

The relationship between private savings and national savings

Private savings and national savings are closely intertwined, with private savings acting as a crucial component of a country's overall financial picture. National savings are influenced by both private and public savings, and understanding their relationship is essential for assessing a country's economic health and potential for long-term prosperity.

Private savings refer to the money that households and businesses set aside instead of spending on consumption. This includes funds in bank accounts, retirement funds, and profits that businesses reinvest in their operations. Private savings contribute to the domestic supply of loanable funds, which are available for investment in businesses, infrastructure, and other productive activities. They play a vital role in boosting capital accumulation and lowering borrowing costs, ultimately fuelling economic growth.

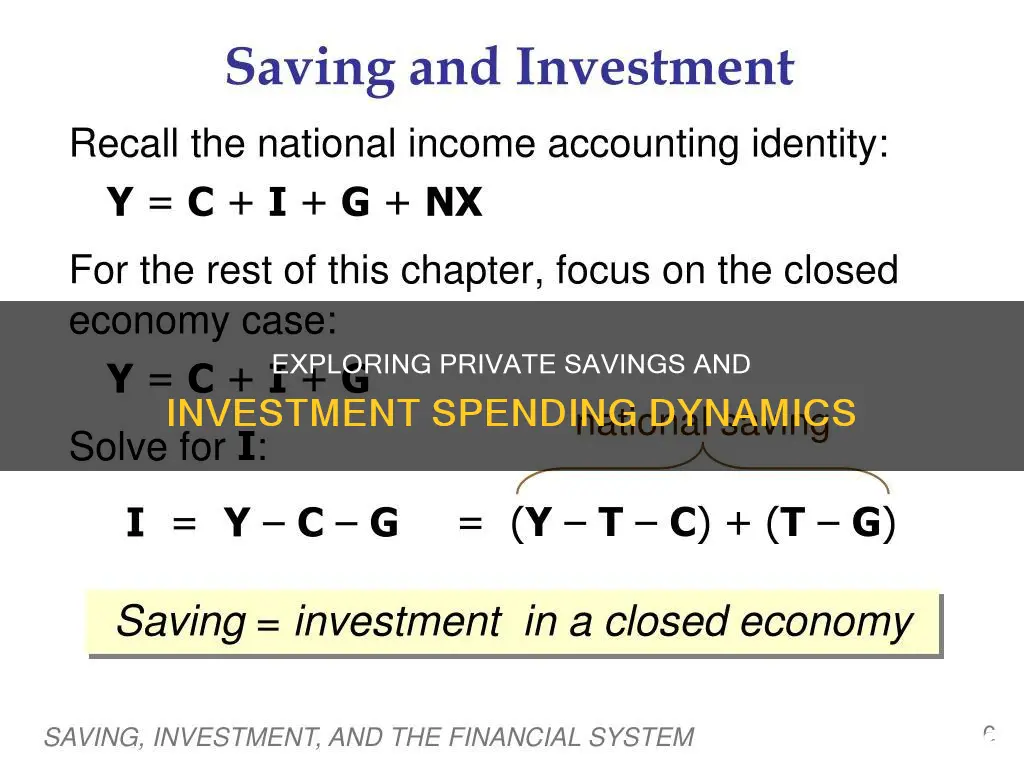

On the other hand, national savings represent the total amount of money saved within a country, including both private and public (government) savings. In a simple economic model, national savings can be understood as the remaining income that is not consumed or spent by the government, assuming that any unspent income is invested. This relationship is expressed as: National Saving = Income – Consumption – Government Spending.

The connection between private and national savings can be expressed by the formula: National Savings (Sn) = Private Savings (Sp) + Public Savings (Sg). This highlights that private savings are an integral part of a country's overall savings picture.

The level of private savings within a country is influenced by various factors, including income, wealth, debt, interest rates, inflation, government policies, trade performance, and demographic factors. Higher income and wealth tend to encourage higher savings, while debt and high interest rates may deter savings. Government policies, such as budget surpluses or deficits, can also impact private savings rates and overall national savings.

The relationship between private and national savings has important implications for a country's economy. For instance, high levels of national savings, fuelled by both private and public savings, can contribute to increased productivity, economic output, and the creation of new jobs. Additionally, they can lead to lower borrowing costs for both businesses and individuals, further stimulating investment and economic growth.

In summary, private savings are a critical component of national savings, and understanding their interplay is crucial for assessing a country's financial health and potential for long-term economic prosperity. The relationship between private and national savings has significant implications for investment, productivity, and overall economic growth.

Invest Wisely for Your Grandchild's Future: A Guide

You may want to see also

The impact of government borrowing on investment

The National Saving and Investment Identity:

The relationship between government borrowing and investment can be understood through the lens of the National Saving and Investment Identity. This economic concept states that the quantity of financial capital supplied in the market must always equal the quantity of financial capital demanded. In other words, the money available for investment must be balanced by the demand for that investment. This relationship holds true regardless of whether an economy is closed or open to foreign trade and capital flows.

Sources of Financial Capital:

In a macroeconomic context, there are three possible sources of funds when a government borrows:

- Households may increase their savings.

- Private firms may borrow less, making more funds available for government borrowing.

- Foreign financial investors may provide the additional funds from outside the country.

Impact on Interest and Exchange Rates:

When a government borrows, it affects interest rates and exchange rates. The interest rate is the cost of borrowing and the return on lending in the financial market. As government borrowing increases, the demand for loanable funds increases, which can lead to higher interest rates. This, in turn, makes borrowing more expensive for businesses and individuals.

Effect on Private Investment:

Government borrowing can also impact private investment. If the government borrows more, it may lead to a decrease in private investment. This is because the increased government borrowing reduces the amount of financial capital available for private firms to invest in their projects.

Consequences for the Trade Balance:

Government borrowing can have a significant impact on a country's trade balance. When a government borrows from foreign financial investors, it increases the inflow of foreign financial capital, contributing to a trade deficit. Conversely, if a government reduces its borrowing and acts as a saver, it can supply financial capital to the market, improving the trade surplus.

Overall Economic Impact:

The level of government borrowing can have both positive and negative effects on an economy. On the one hand, government borrowing can stimulate the economy by increasing investment in infrastructure and other productive activities. This can lead to increased productivity, economic output, and job creation. On the other hand, excessive government borrowing can lead to higher interest rates, making it more challenging for private firms to invest and grow. Additionally, budget deficits resulting from government borrowing may have negative implications for the long-term health of an economy if not managed sustainably.

Car Savings: Invest or Keep?

You may want to see also

How private savings fuel a nation's economic growth

Private savings are essential for a nation's economic growth as they represent the money that households and businesses set aside for future investment, rather than spending it all on consumption. These savings become available for investment in businesses, infrastructure projects, and other productive activities, ultimately driving long-term economic growth.

Firstly, private savings boost capital accumulation. A higher level of savings allows businesses to invest in new machinery, buildings, and technology, leading to increased productivity. This increased productivity, in turn, contributes to economic growth.

Secondly, private savings help lower borrowing costs. When there is a surplus of loanable funds, interest rates tend to be lower, making borrowing more affordable for businesses and individuals. This stimulates investment spending, which is crucial for economic growth.

Additionally, private savings contribute to a nation's overall savings picture. Along with public savings (government savings), they make up national savings, which represent the total amount of money saved within a country. A high level of national savings indicates a healthy economy with more sources of funds available for investment. This, in turn, can lead to deeper and more advanced financial markets, facilitating the efficient allocation of savings towards productive investments.

Furthermore, private savings can have a positive impact on a country's trade balance. When there is a surplus of domestic savings, the country may invest in foreign markets, leading to a trade surplus. This, in turn, can attract foreign investment and contribute to economic growth.

Lastly, private savings can help reduce a country's reliance on foreign capital. A high level of private savings means that the country has a larger pool of domestic funds available for investment. This reduces the need for foreign investment and makes the country's economic growth more stable and sustainable.

Saving vs. Investing: Ramsey's Key Differences Explained

You may want to see also

The demand for and supply of financial capital

The quantity of financial capital supplied in the market must always equal the quantity demanded. This relationship is known as the national saving and investment identity. In algebraic terms, this can be expressed as:

Supply of financial capital = Demand for financial capital

S + (M - X) = I + (G - T)

Where:

- S = Private savings

- M = Imports

- X = Exports

- I = Investment

- G = Government spending

- T = Taxes

This equation highlights the interplay between savings and investment in an economy. For instance, if domestic investment increases while private and public savings remain unchanged, the trade deficit will increase as more capital will need to be borrowed from abroad.

The national saving and investment identity also helps explain the balance of trade. A country's balance of trade is determined by its levels of domestic saving and investment. If a country has a trade deficit, it means money is flowing into the country from foreign investors, contributing to the supply of financial capital. Conversely, a trade surplus indicates a country is investing its excess financial capital in other countries.

Additionally, the interest rate plays a crucial role in balancing the supply of and demand for financial capital. When the interest rate is higher, saving becomes more attractive as it offers better returns on saved funds. This can lead to an increase in the supply of loanable funds. On the other hand, higher interest rates may also discourage borrowing, reducing the demand for loanable funds.

In summary, understanding the demand for and supply of financial capital is essential for analyzing a country's economic health and growth prospects. The national saving and investment identity provides a framework for examining these dynamics, with interest rates also playing a pivotal role in balancing supply and demand.

Investing vs. Saving: Which is Riskier?

You may want to see also

The role of interest rates in the economy

Interest rates play a crucial role in the economy, influencing both savings and investment decisions. As the cost of borrowing and the return to lending in financial markets, interest rates affect the equilibrium between savings and investment. When the interest rate is high, saving becomes more attractive as individuals earn a better return on their saved funds. Consequently, higher interest rates can lead to an increase in private savings, which contributes to the overall national savings of a country.

On the other hand, high-interest rates can make borrowing more expensive for businesses and individuals, reducing their investment spending. This is because, at higher interest rates, fewer investment projects become profitable. Therefore, changes in interest rates can impact the demand for loanable funds, with higher rates potentially reducing the demand for investment.

The relationship between savings and investment is described by the national saving and investment identity, which states that the quantity of financial capital supplied in the market must equal the quantity demanded. This identity includes both private and public savings, with public savings being the government's budget surplus or deficit. When the government runs a budget deficit, it acts as a borrower in the financial market, demanding financial capital. Conversely, during a budget surplus, the government acts as a saver, supplying financial capital to the market.

Interest rates play a role in bringing the financial markets into equilibrium by adjusting to balance savings and investment. When government spending or taxation levels change, it affects the demand for the economy's output of goods and services, impacting national savings, investment, and the equilibrium interest rate. For example, an increase in government purchases increases the demand for goods and services, leading to a fall in investment and a subsequent rise in interest rates.

Additionally, interest rates can influence investment demand due to technological innovations. When a new technology, such as computers, is introduced, businesses and households may need to invest in the new innovation, increasing the demand for investment goods. This can lead to a rise in the interest rate as the demand for funds exceeds the supply, assuming savings remain fixed.

In summary, interest rates are a key factor in the economy, impacting both savings and investment decisions. They help bring equilibrium to financial markets by adjusting to balance the supply of loanable funds (savings) and the demand for those funds (investment). Changes in government spending, taxation, and technological innovations can all influence interest rates and their impact on the economy.

Chris Gardner's Life Savings Investment: A Fateful Decision

You may want to see also

Frequently asked questions

The saving-investment identity states that the amount saved in an economy will be the amount invested in new physical machinery, inventories, and similar areas. In other words, investment is financed by savings.

Private savings are the money that households and businesses set aside instead of spending on consumption. This includes money in bank accounts, retirement funds, and profits that businesses retain instead of paying out as dividends.

Private savings are a crucial component of a nation's overall savings picture. They act as the domestic supply of loanable funds, which can be invested in businesses, infrastructure projects, and other productive activities, ultimately driving economic growth.

Higher levels of private savings mean more money is available for investment. This can boost capital accumulation, allowing businesses to invest in new machinery, buildings, and technology, leading to increased productivity. Additionally, a surplus of loanable funds can lower borrowing costs, making investment more affordable for businesses.