Private equity funds are a popular alternative investment option for those looking to diversify their portfolios. They are a form of investment that takes place outside of the public stock market, allowing investors to gain an ownership stake in private companies. The minimum investment in private equity funds varies, with some traditional funds requiring commitments of up to $25 million. However, in recent years, the minimum investment amount has become more variable, with some firms accepting as little as $25,000. This change has been driven by a desire to attract a wider range of investors. It's important to note that private equity investing is not easily accessible to the average investor and is typically reserved for institutional investors or high-net-worth individuals.

| Characteristics | Values |

|---|---|

| Minimum Investment | $25 million (although it can be as low as $250,000 or even $25,000) |

| Investor Type | Institutional investors or high-net-worth individuals |

| Investor Requirements | Accredited investor with a net worth of over $1 million or an annual income of over $200,000 in the last two years |

| Investment Period | Minimum of 10 years |

What You'll Learn

- The minimum investment in a private equity fund is typically $25 million, but can be as low as $250,000

- To invest in private equity, you must be an accredited investor with a net worth of over $1 million or an annual income of over $200,000

- There are non-direct ways to invest in private equity, such as exchange-traded funds (ETFs), which don't require high minimum investments

- Private equity firms pool investors' money and invest in companies, aiming to sell them later at a profit

- Private equity investments have long time horizons, often requiring investors to hold their investment for at least 10 years

The minimum investment in a private equity fund is typically $25 million, but can be as low as $250,000

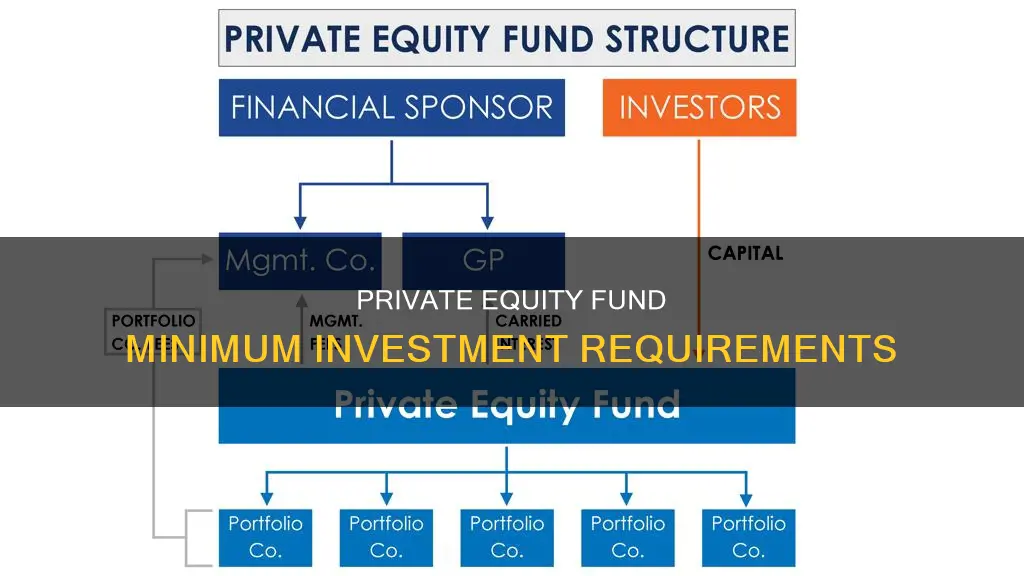

Private equity funds are a form of investment that takes place outside of the public stock market. They allow investors to gain an ownership stake in private companies and are typically used by accredited investors and institutional investment firms to diversify their portfolios.

Private equity funds are not easily accessible to the average investor. The minimum investment in a private equity fund is usually around $25 million, but this can be as low as $250,000. Some firms have even dropped their minimum investment requirements to $25,000, though this is still out of reach for most people.

The high minimum investment requirements of private equity funds are due to the nature of the investments being made. Private equity funds often invest in early-stage, high-risk ventures, usually in sectors such as software and healthcare. These investments tend to be very speculative and therefore risky. There is no guarantee that the companies the fund invests in will succeed, and few protections for investors if they fail. As a result, private equity firms want to ensure that their investors are financially stable and able to absorb potential losses.

In addition to the minimum investment requirements, investors in private equity funds are often expected to hold their investments for at least 10 years. This long time horizon is due to the illiquid nature of private equity investments and the time it takes for the fund to make improvements to the companies it invests in and eventually sell them for a profit.

For those who cannot meet the minimum investment requirements of private equity funds, there are alternative ways to gain exposure to private equity. One option is to invest in a fund of funds, which holds shares of many private partnerships that invest in private equities. This can provide greater diversification and potentially lower risk compared to investing directly in a private equity fund. Another option is to purchase shares of an exchange-traded fund (ETF) that tracks an index of publicly traded companies investing in private equities. These options typically have lower minimum investment requirements than private equity funds but may involve additional layers of fees.

Viaticals: Mutual Funds for Alternative Life Settlements

You may want to see also

To invest in private equity, you must be an accredited investor with a net worth of over $1 million or an annual income of over $200,000

Accredited investors are required to have a high net worth or income because private equity funds often have very high minimum investment requirements, which can range from a few hundred thousand to several million dollars. These high minimum investments are due to the fact that private equity is a way for accredited investors and institutional investment firms to diversify their portfolios and take on more risk in exchange for the potential to earn higher returns than they might by investing in public companies.

In addition to the financial requirements, accredited investors must also have a foundational knowledge of the industry. This includes understanding the language and field of alternative investments, as well as the different types of private equity strategies such as venture capital, growth equity, and buyouts.

It's important to note that not all private equity funds have the same minimum investment requirements. While the standard minimum investment amount has historically been $25 million, some firms have lowered this threshold to as little as $25,000 in an effort to attract a wider range of investors. Additionally, there are non-direct ways to invest in private equity, such as through mutual funds, exchange-traded funds (ETFs), or crowdfunding, which may have lower minimum investment requirements.

Overall, investing in private equity comes with uncertainty and illiquidity, but the potential payoff can be significant. It's crucial for investors to carefully consider the risks and ensure they meet the financial and accreditation requirements before investing in this asset class.

Mutual Fund Money: Strategies for Success

You may want to see also

There are non-direct ways to invest in private equity, such as exchange-traded funds (ETFs), which don't require high minimum investments

Private equity funds are pooled investments offered by private equity firms, allowing investors to combine their assets to invest in private companies. These funds are typically only accessible to institutional investors or high-net-worth individuals who can meet the high minimum investment requirements, ranging from a few hundred thousand to several million dollars.

However, there are non-direct ways to invest in private equity without the need for high minimum investments. One such way is through exchange-traded funds (ETFs). ETFs offer exposure to publicly listed private equity companies, allowing individuals to invest in private equity without going through a traditional private equity firm. By investing in ETFs, individuals can track the success of these companies and benefit from their performance without having to meet hefty minimum investment requirements.

ETFs can be purchased through brokerage platforms, providing an accessible way to invest in private equity. While ETFs do add an extra layer of management expenses, they offer a more affordable option for those who want to invest in private equity without the high barriers to entry of traditional private equity funds.

In addition to ETFs, there are other non-direct ways to invest in private equity, such as funds of funds, special purpose acquisition companies (SPACs), and crowdfunding platforms. These options can provide greater diversification and lower minimum investment requirements compared to traditional private equity funds. However, it is important to carefully consider the risks and fees associated with each investment option before making any decisions.

Best Vanguard Funds for Your Taxable Investment Portfolio

You may want to see also

Private equity firms pool investors' money and invest in companies, aiming to sell them later at a profit

Private equity firms act as intermediaries, bringing together investors' capital and strategically investing it in target companies. They employ various strategies, including venture capital investments in early-stage startups, growth equity investments in middle-stage companies, and buyouts of mature companies. The goal is to identify businesses with growth potential or those that can be improved and then sell them for a profit.

Investing in private equity comes with certain requirements and risks. Investors need to become accredited, meeting specific income or net worth thresholds. Additionally, private equity investments are known for their long time horizons, often requiring a commitment of at least ten years. The illiquid nature of these investments means that accessing returns can take a significant amount of time.

To mitigate risks, investors should conduct thorough research before selecting a private equity firm. It's crucial to understand the language and field of alternative investments, including the different strategies employed by firms. Due to the unregulated nature of the industry, private equity firms seek financially stable investors who can bear potential losses.

While private equity investments offer the potential for high returns, they also carry significant risks. The fees associated with these investments can be higher than those of conventional investments, impacting overall returns. Additionally, the success of the investment depends on the performance of the target companies, which may not always meet expectations.

Crowdfunding: Invest Your Money Wisely to Make a Profit

You may want to see also

Private equity investments have long time horizons, often requiring investors to hold their investment for at least 10 years

Private equity investments are known for their long time horizons, often requiring investors to hold their investment for at least 10 years. This is due to the nature of private equity firms' investment strategies, which typically involve investing in early-stage startups, middle-stage companies, or mature companies with long-term growth plans.

The lengthy time horizon provides a passive investment approach, allowing investors' money to work for them over an extended period. During this time, private equity firms actively manage the capital, aiming to generate returns by improving the performance and profitability of the companies they invest in.

The long time horizon also aligns with the illiquid nature of private equity investments. Investors typically need to commit a set amount of money, which the firm can utilise within a specified period through capital calls. This means that investors may not have immediate access to their funds during this time.

Additionally, the process of investing in private companies, improving their operations, and eventually selling them for a profit can take several years. This extended timeline contributes to the long time horizon associated with private equity investments.

It's important to note that while private equity investments offer the potential for higher returns, they also carry significant risks. The long time horizon is a factor to consider when evaluating the overall risk and return profile of private equity opportunities.

Overall, the long time horizon of private equity investments, often spanning a decade or more, is a key characteristic of this investment class. It requires investors to have a long-term perspective and the ability to commit their capital for an extended period.

Unlock Real Estate Funding: Strategies for Investors

You may want to see also

Frequently asked questions

The minimum investment in a private equity fund is typically $25 million, although it can be as low as $250,000 or even $25,000 in some cases. However, some sources state that there is no set minimum, and that each deal is negotiable.

Traditional private equity funds are reserved for institutional investors or high-net-worth individuals due to their high minimum investment requirements. To be considered an accredited investor, an individual must have a net worth of over $1 million or an annual income of at least $200,000 in the last two years.

Private equity firms pool investors' capital and invest it in private companies, typically with a focus on improving and selling those companies for a profit. Investors contribute capital, firms allocate and manage it, and companies use it to generate returns.

Private equity investing is considered very risky due to its illiquid nature and the lack of regulation by the SEC. There is also a potential for higher fees and reduced returns, and investors must be prepared to commit their capital for a long period, usually at least 10 years.

There are a few non-direct ways to invest in private equity, such as funds of funds, exchange-traded funds (ETFs), and special purpose acquisition companies (SPACs). These options may have lower minimum investment requirements but also add an extra layer of fees.