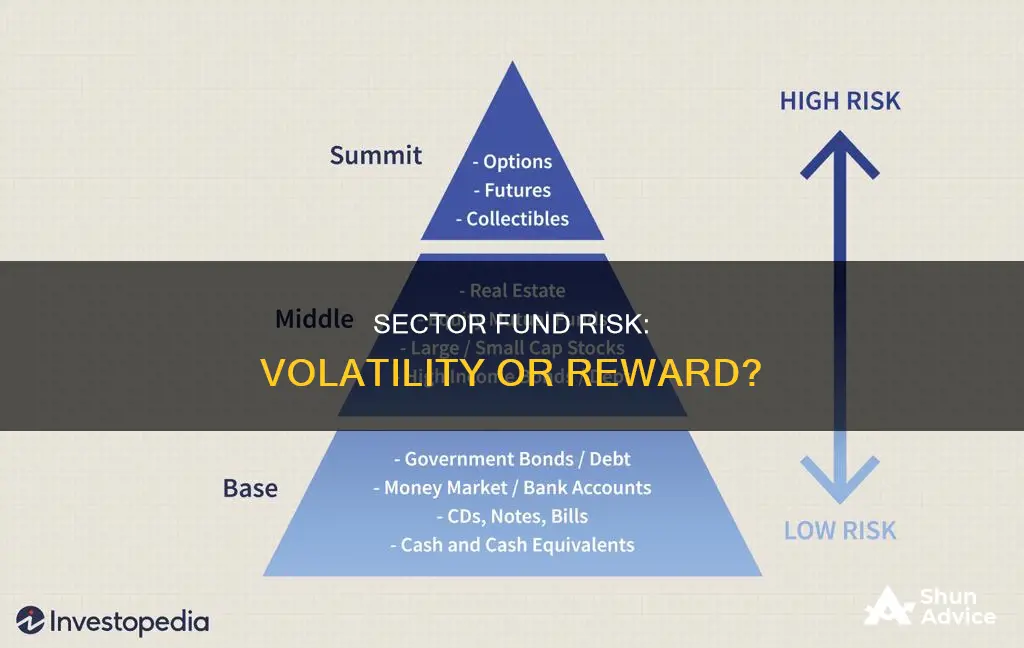

Sector funds are a type of investment fund that focuses solely on businesses operating in a specific industry or economic sector. While they offer the potential for higher returns, the primary risk of investing in sector funds is their lack of diversification. By concentrating on a single sector, these funds are more volatile and susceptible to economic changes impacting that particular industry. This means that if the chosen sector underperforms, the fund's performance will suffer without the benefit of offsetting gains from other sectors. As a result, sector funds carry a higher risk compared to diversified equity funds, making them suitable for investors with a high-risk appetite and a strong conviction about the future performance of a specific sector.

| Characteristics | Values |

|---|---|

| Risk | Higher than a diversified equity fund |

| Volatility | High |

| Diversification | Low |

| Performance | Based on a specific sector |

| Investment Type | Mutual or exchange-traded fund (ETF) |

| Investment Objective | Long-term investment horizon |

| Investment Strategy | Active or passive management |

| Portfolio Constraints | Limited to a specific sector |

| Investment Horizon | Minimum of 3-5 years |

| Allocation | No more than 5-10% of a portfolio |

What You'll Learn

Lack of diversification

Sector funds are investment funds that focus on a single sector or industry of the market, such as energy, utilities, healthcare, or technology. They are typically structured as mutual funds or exchange-traded funds (ETFs) and are considered to have higher risk potential and more volatility than diversified funds.

The lack of diversification in sector funds means that investors are exposed to the performance of a single sector. If the chosen sector performs poorly, the fund will also perform poorly, without the benefit of offsetting gains from other sectors. This concentration of investment in one area means that sector funds are more susceptible to economic changes or downturns affecting that specific sector.

For example, a sector fund focused on the banking industry will be impacted by interest rate changes, while a fund focused on automotive companies will be affected by shifts in consumer demand.

To manage the risk of lack of diversification, financial planners generally advise that investors allocate no more than 5-10% of their portfolio to sector funds. Additionally, investors should ensure that the sector fund chosen contains stocks that are not already held in their portfolio to maximize diversification within the chosen sector.

While sector funds offer targeted exposure to specific sectors, the lack of diversification means they carry a higher level of risk that investors should carefully consider before investing.

Oil Fund Investment: A Guide to Getting Started

You may want to see also

Higher volatility

Investing in sector funds carries a higher risk than investing in a diversified equity fund. The primary risk of investing in sector funds is higher volatility.

Sector funds are investment funds that focus on a single sector or industry, such as healthcare, energy, financials, or technology. They are typically structured as mutual funds or exchange-traded funds (ETFs). Due to their narrow focus, sector funds have no diversification. This means that if the specific sector or industry experiences a downturn, the fund's performance will be negatively impacted without any offset from investments in other sectors. As a result, sector funds tend to be riskier and more volatile than broad market index funds.

The volatility of sector funds can be further affected by economic cycles and market conditions. For example, consumer cyclical stocks, which include companies in the automotive, housing, entertainment, and retail industries, tend to perform well during economic growth periods but struggle when the economy is struggling. In contrast, consumer staples stocks, such as companies involved in home utilities, food, and household items, are known to be more stable across all types of market cycles.

The level of risk associated with sector funds also depends on the specific sector. For instance, the technology sector has historically reported higher volatility than the utilities sector. Additionally, subsectors within a broader sector can exhibit even higher volatility. For example, biotechnology, a subsector of the healthcare sector, is known to be highly volatile.

To manage the risk of higher volatility, investors should carefully consider the weight of sector funds in their portfolio. Financial planners generally recommend allocating no more than 5-10% of one's portfolio to sector funds. Additionally, investors can employ strategies such as dollar-cost averaging or periodic portfolio rebalancing to reduce the inherent volatility of sector funds.

Direct Mutual Funds: Offline Investing Strategies and Steps

You may want to see also

Sector funds are subject to economic cycles

For example, consumer cyclical stocks, which include companies in the automotive, housing, entertainment, and retail industries, tend to perform well when the economy is growing but poorly when the economy is struggling. On the other hand, consumer staples stocks, such as companies involved in home utilities, food, and household items, are typically more stable through all types of market cycles.

As a result of their lack of diversification, sector funds tend to carry higher risk than diversified equity funds. Due to this high risk, financial planners generally recommend that investors allocate no more than 5-10% of their portfolio to sector funds.

Sector funds are also subject to higher turnover than other types of funds, so investors should pay close attention to capital gains distribution rates. Additionally, the timing of specific sectors of the market can be more difficult and riskier than timing the market as a whole. Subsector funds, which focus on a specific subsector of the economy such as banking or semiconductors, are even more vulnerable to economic cycles and tend to be more volatile than broader-based funds.

Despite the risks, sector funds can provide investors with the ability to target a specific market area and potentially achieve higher returns than broad-market index funds. They are suitable for investors with a strong opinion about the future performance of a particular sector and those with a long-term investment horizon who can tolerate higher risk.

Invest in SBI Tax Advantage Fund: A Guide

You may want to see also

Portfolio constraints

The investment manager of a sector fund is bound by the fund's targeted objective and must select investments that fall within that specific sector. For example, a technology sector fund will only invest in companies that deal with computers, electronics, and information technology. The investment manager is not allowed to invest in any other sectors per the mandate of the firm. This constraint can limit the diversification of the portfolio and increase risk.

If the chosen sector underperforms or experiences difficulties, the fund's performance will be negatively impacted without the potential offset from investments in other sectors. This lack of diversification is a significant portfolio constraint and contributes to the higher risk associated with sector funds compared to diversified equity funds.

To manage this risk, it is generally advised that investors allocate a small portion of their portfolio to sector funds, typically recommended as no more than 5-10%. Additionally, investors should be prepared to stay invested for a longer time horizon, typically at least 5-10 years, to ride out the cyclical nature of sector performance.

Sector funds are suitable for investors with a strong opinion about the future performance of a specific sector, a higher risk tolerance, and a long-term investment horizon.

Investing in Your 20s: Exchange-Traded Funds for Beginners

You may want to see also

Higher fees

Sector funds typically have higher fees and expenses than more general investment funds. This is because sector funds have a narrower focus and invest in a specific sector or industry. As a result, they have a smaller asset base than larger, more diversified funds. The lack of economic diversification in sector funds leads to reduced economic scale pricing, resulting in higher costs for investors.

The fees associated with sector funds include sales charges and annual expenses. These fees can eat into investment returns and impact overall profitability. It is important for investors to closely monitor the fees they are paying for sector funds to ensure they are not paying excessive amounts.

Additionally, sector funds may have higher portfolio constraints, requiring the portfolio manager to select investments that align with the fund's specific sector focus. This can limit the investment manager's flexibility and increase costs, as they are restricted to investing within a particular industry or sector.

It is worth noting that sector funds that are structured as exchange-traded funds (ETFs) tend to have lower fees than traditional open-end mutual funds. ETFs are traded like stocks on an exchange and often have lower expense ratios than mutual funds. However, investors should still be mindful of the fees associated with sector ETFs and consider the potential impact on their investment returns.

Overall, higher fees and expenses are a significant risk associated with investing in sector funds. Investors should carefully consider the potential benefits and drawbacks of sector funds before making any investment decisions. Understanding the fee structure and monitoring fees regularly can help mitigate the risk of higher costs associated with sector funds.

Parag Parikh Long Term Equity Fund: A Smart Investment Strategy

You may want to see also

Frequently asked questions

A sector fund is a mutual or exchange-traded fund (ETF) that invests in a particular economic sector, such as healthcare, energy, or financials.

The primary risk of investing in sector funds is the high volatility and lack of diversification. Sector funds focus on one specific area of the market, which means that if that sector performs poorly, the fund will be affected without any offset from other sectors.

Sector funds are generally considered riskier than investing in diversified equity funds or the broad market due to their lack of diversification.

Sector funds are suitable for investors with a high-risk appetite and a long-term investment horizon who are looking for targeted bets on the appreciation potential of a specific sector.

Due to the high risk of sector funds, financial planners recommend allocating no more than 5-10% of your portfolio to these funds.