Saving and investment spending are fundamental components of personal finance and economic growth. Saving is setting aside money for future use, often in a low-risk account, to build an emergency fund or achieve short-term financial goals. On the other hand, investment spending involves purchasing assets or spending on human capital with the expectation of long-term financial gains. While saving prioritises financial security and accessibility, investment spending focuses on growing wealth over time by taking on calculated risks. The relationship between these two concepts is intricate and essential for understanding economic trends and an individual's financial trajectory.

| Characteristics | Values |

|---|---|

| Definition of Saving | Setting aside money for future use, emergencies, or a future purchase |

| Definition of Investment | Buying assets such as stocks, bonds, mutual funds, or real estate with the expectation of making money |

| Risk Involved | Saving is low-risk; Investment involves taking on some risk |

| Returns | Savings have low returns; Investments have the potential for higher returns |

| Time Horizon | Saving is for short-term goals; Investment is for long-term goals |

| Examples of Saving | Putting money in a savings account, buying stocks, or contributing to a pension plan |

| Examples of Investment | Buying shares of a company's stock, investing in a 401(k) retirement plan, or purchasing bonds or mutual funds |

| Pros of Saving | Provides a financial safety net, liquidity for short-term goals, minimal risk of loss |

| Cons of Saving | May lose out to inflation, opportunity costs of not investing in higher-yielding assets |

| Pros of Investment | Potential for higher returns, ability to grow wealth over time, helps achieve long-term financial goals |

| Cons of Investment | Risk of losing money, requires discipline and a long-term perspective, may require longer time horizons |

What You'll Learn

- Saving money is setting it aside for future use, whereas investment spending is putting it towards assets or ventures with the expectation of making money

- Saving is low-risk and liquid, while investment spending carries the risk of loss but also has the potential for higher returns

- Saving money is often for short-term goals, whereas investment spending is usually for the long term

- Saving is influenced by interest rates and confidence, while investment spending is influenced by interest rates, confidence, and economic growth

- A country's national savings include private savings and public savings, while the demand for financial capital represents groups that are borrowing money

Saving money is setting it aside for future use, whereas investment spending is putting it towards assets or ventures with the expectation of making money

Saving money and investment spending are fundamental aspects of personal finance and economic growth. While they are distinct concepts, they are closely intertwined and essential for different reasons.

Saving money involves setting aside funds for future use, often in a bank account or as physical cash. It is income that is not spent, and it can be stored in various savings vehicles, such as a savings account, money market account, or certificate of deposit (CD). Saving is typically associated with short-term financial goals and building an emergency fund to provide a safety net for unexpected expenses. It is generally considered low-risk, as the funds are readily accessible and protected from significant losses. However, savings accounts also offer lower interest rates, which may not keep up with inflation.

On the other hand, investment spending involves purchasing assets or ventures with the expectation of generating returns. It is a way to grow one's money over time by putting it into financial instruments such as stocks, bonds, mutual funds, or real estate. Investment spending often carries a higher level of risk compared to saving, as there is always the possibility of losing money. However, it also offers the potential for higher financial returns. Investment spending is usually associated with long-term financial goals, such as saving for retirement, a child's college fund, or a down payment on a house.

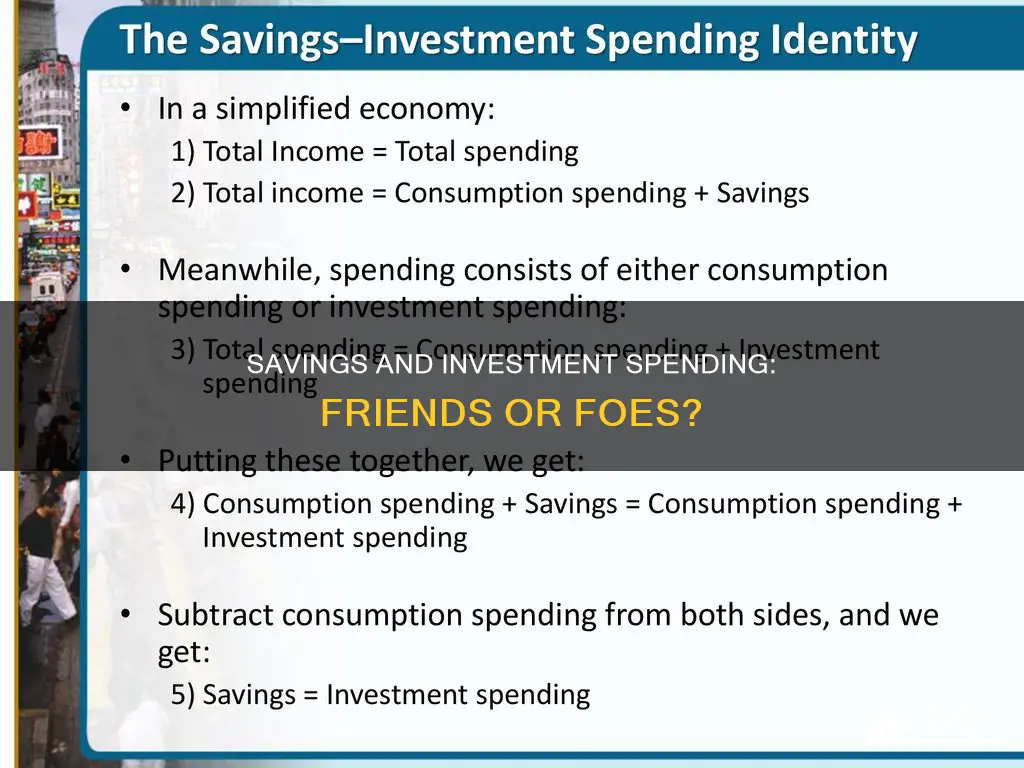

The relationship between saving and investment spending is crucial in economic theory and practice. In neoclassical economics, it is assumed that the level of saving will equal the level of investment spending. This is because investment spending is determined by the available savings in the economy. When individuals save more, banks have more funds to lend to businesses for investment projects, thereby increasing investment spending. This relationship is known as the savings-investment spending identity.

Additionally, saving and investment spending play a significant role in a nation's trade balance. A country's domestic saving and investment levels determine its balance of trade. When domestic investment exceeds domestic saving, the country will likely experience a trade deficit, as it needs to bring in financial capital from abroad to fund its investments. Conversely, when domestic saving surpasses domestic investment, the country may have a trade surplus, allowing it to invest its excess financial capital in other countries.

In conclusion, saving money and investment spending are distinct yet interconnected concepts. Saving is setting aside funds for future use, often in low-risk accounts, to achieve short-term financial goals and build an emergency fund. On the other hand, investment spending involves purchasing assets with the expectation of financial returns, typically over the long term. The relationship between saving and investment spending is vital for personal financial planning and macroeconomic dynamics, influencing interest rates, economic growth, and a country's trade balance.

Mortgages: Investment or Saving? Understanding Your Financial Future

You may want to see also

Saving is low-risk and liquid, while investment spending carries the risk of loss but also has the potential for higher returns

Saving and investing are both critical components of personal finance, but they serve distinct purposes. Saving is setting aside money that can be quickly accessed and used for emergencies or future purchases. It is often done through a savings account or by storing cash. Savings generally offer low returns and are considered low-risk, meaning there is a minimal chance of losing value. On the other hand, investing involves purchasing assets such as stocks, bonds, or real estate, with the expectation of earning higher returns over time. Investments are typically chosen to meet long-term goals and carry a certain level of risk, including the possibility of losing money.

Saving is often associated with low risk and liquidity. When individuals save, they put their money in safe and accessible accounts, such as savings accounts, money market accounts, or certificates of deposit (CDs). These savings products offer low returns but also come with a low risk of losing value. Saving is ideal for short-term financial goals, such as buying a new gadget or going on vacation, and for building an emergency fund. By regularly setting aside a portion of their income, individuals can ensure they have a financial cushion for unexpected expenses.

In contrast, investment spending typically carries a higher risk of loss but also offers the potential for higher returns. Investing involves purchasing assets that may fluctuate in value, and there is no guarantee of making money. For example, investing in stocks means owning a small piece of a company, and the value of the investment depends on the company's performance. If the company does well, the stock value may increase, resulting in profits. However, if the company performs poorly or goes bankrupt, the investment could lose value or become worthless.

While saving provides stability and liquidity, investment spending focuses on long-term growth. The higher risk associated with investing is justified by the potential for more significant financial returns. By diversifying their portfolio and choosing investments that align with their goals and risk tolerance, individuals can balance the risks and rewards of investing.

In conclusion, saving and investment spending play complementary roles in financial planning. Saving is ideal for short-term goals and provides liquidity and security, while investment spending targets long-term objectives and offers the potential for higher returns despite the inherent risks. A balanced approach that includes both saving and investing can help individuals build wealth, protect against financial shocks, and secure a more prosperous future.

Retirement Planning: 401(k)s, Investing, or Saving?

You may want to see also

Saving money is often for short-term goals, whereas investment spending is usually for the long term

Saving money and investment spending are two critical aspects of personal finance that are often used interchangeably but carry distinct meanings and purposes. Saving money is typically associated with short-term financial goals and unexpected expenses, while investment spending is geared towards long-term objectives.

Saving money involves setting aside unspent income for future use, often in a bank account or as physical cash. It is a conservative approach to personal finance, prioritising liquidity and safety over potential returns. Savings are generally low-risk, offering stable yet modest returns, making them ideal for short-term goals. For instance, saving a portion of one's allowance or salary monthly can help accumulate funds for purchases like gadgets or vacations without relying on credit. Additionally, savings provide a financial safety net for emergencies, such as car repairs or medical bills, protecting individuals from high-interest debt.

On the other hand, investment spending involves purchasing assets such as stocks, bonds, mutual funds, or real estate, with the expectation of earning higher returns over time. Investments usually carry more risk than savings but offer the potential for significant financial growth. This makes them suitable for long-term goals, such as saving for a child's college fund, a house down payment, or retirement. For example, investing in stocks of a company like Apple carries the risk of losing money if the company underperforms but offers the opportunity to benefit from its growth and profits.

The relationship between saving and investment spending is fundamental to economic growth. In a simple economic model, an increase in savings can lead to more funds available for investment projects, as banks can lend more to firms. However, the decision to save or invest depends on individual financial goals, risk tolerance, and circumstances. A balanced approach to financial planning combines both, utilising savings for short-term goals and emergencies while investing for higher potential returns and long-term financial security.

While saving is essential for short-term stability and flexibility, investment spending is crucial for long-term financial growth and achieving milestones. Each plays a vital role in an individual's financial journey, and understanding their unique characteristics helps in making informed decisions to build wealth and security.

Maximizing Your Savings Account: A Guide to Smart Investing

You may want to see also

Saving is influenced by interest rates and confidence, while investment spending is influenced by interest rates, confidence, and economic growth

Saving and investment spending are influenced by various factors, including interest rates and confidence, with investment spending also influenced by economic growth.

Saving Influenced by Interest Rates and Confidence

Interest rates play a crucial role in determining the attractiveness of saving. Higher interest rates make saving more appealing, as individuals receive higher interest payments on their deposits. Consequently, people are incentivized to save more to benefit from the increased returns. On the other hand, lower interest rates tend to discourage saving, as the rewards are diminished. However, the relationship between interest rates and saving is complex, and other factors, such as economic confidence, also come into play. During times of economic uncertainty or pessimism, households may be more inclined to save, regardless of interest rates, to prepare for potential financial challenges.

Confidence in the economy and future income prospects significantly impact saving behavior. When individuals are optimistic about the economic outlook, they are more likely to spend and less likely to save. Conversely, during periods of economic downturn or uncertainty, such as the 2008-2013 recession, saving levels tend to increase as people become more cautious and focus on building financial buffers.

Investment Spending Influenced by Interest Rates, Confidence, and Economic Growth

Interest rates also play a pivotal role in investment spending. Lower interest rates make borrowing more affordable for both businesses and consumers, encouraging investment in new projects, expansions, and purchases. Businesses take advantage of reduced borrowing costs to invest in new machinery, equipment, or buildings to enhance their competitive position and increase profits. Additionally, lower interest rates can stimulate corporate borrowing, leading to increased investment spending.

Confidence is another critical factor influencing investment decisions. Uncertainty about the future, including potential economic downturns or political changes, can reduce confidence and cause firms to postpone their investment plans until a more stable environment emerges. Changes in national income can also impact investment spending through the accelerator effect, where small changes in income can lead to more substantial changes in investment levels.

Economic growth is closely tied to investment spending. Net investment, which excludes the replacement of assets, is a key driver of economic growth. When firms invest in new assets, it increases the economy's productive capacity, leading to long-term economic expansion. Therefore, investment spending is a critical component of a growing economy.

Maximizing UK Savings: Investment Strategies for Beginners

You may want to see also

A country's national savings include private savings and public savings, while the demand for financial capital represents groups that are borrowing money

A country's national savings are made up of private and public savings. Private savings can refer to putting money in the bank, buying stocks, or contributing to a pension plan. However, economists define savings as consuming less in the present to be able to consume more in the future. Private savings can be calculated as the disposable income of households minus consumption.

Public savings, also known as a budget surplus, is the government's revenue through taxes minus its expenditure on goods and services and transfers. National savings can be thought of as the amount of remaining income that is not consumed or spent by the government. In a simple model of a closed economy, any income that is not spent is assumed to be invested.

The demand for financial capital, on the other hand, represents groups that are borrowing money. Financial capital is the monetary assets required for a business to provide goods and services. It is commonly viewed as debt or equity. Debt capital is money borrowed from financial institutions, individuals, or the bond market, and it is used to make an investment. The interest rate is always the cost of borrowed capital.

Increased profits can be obtained through borrowed capital, but it can also result in greater losses as the borrowed money must be paid back, regardless of the investment's performance. This is especially true for businesses, which require capital to operate and grow profits.

Emergency Savings: Invest or Keep?

You may want to see also

Frequently asked questions

Saving is setting aside money for future use, emergencies, or purchases. It is often stored in a savings account or as cash. On the other hand, investing is putting money into financial instruments, real estate, or other assets with the expectation of making a profit.

In a closed economy, the level of savings is assumed to equal the level of investment spending. An increase in savings allows banks to lend more to firms for investment projects, thus increasing investment spending.

Saving provides a financial safety net for unexpected expenses and helps achieve short-term financial goals. It also carries minimal risk of loss. However, savings may lose out to inflation and may miss out on the potential higher returns from riskier investments.

Investing has the potential for higher returns than savings and can help achieve long-term financial goals. However, it comes with the risk of losing money and requires discipline and a long-term commitment.