Investment advisors charge performance fees based on how much money is earned from the investments they choose for their clients. Performance fees are usually charged as a percentage of investment profits. These fees are separate from management fees, which are calculated based on a percentage of the total assets held under the advisor's management.

Performance fees incentivise investment managers to earn their clients the most money possible, as doing so will also earn them more. However, this also means that advisors may be more likely to take risks with their client's money.

| Characteristics | Values |

|---|---|

| Type of fee | Performance-based fee |

| Who charges this fee | Investment advisors |

| Basis of fee | Performance of investments chosen for clients by an advisor |

| Fee amount | Not specified in sources |

| Other fees | Management fees, flat-rate fees, commission-based fees, hourly fees |

What You'll Learn

- Performance fees are based on the performance of investments chosen for clients by an advisor

- Performance fees incentivise advisors to earn their clients the most money

- Advisors may charge a percentage of assets under management

- Advisors may charge a flat fee for a financial plan

- Fee-only advisors do not accept commissions for products sold

Performance fees are based on the performance of investments chosen for clients by an advisor

Performance fees are a type of fee structure where investors pay their investment advisors based on the performance of the investments chosen for them. This means that if the investments meet a certain predetermined threshold, the investor will have to pay a fee. This threshold is outlined in a contract agreed upon by both parties.

Performance fees are different from management fees, which are generally paid in addition to any performance fees. Management fees are calculated as a percentage of the total assets held under the advisor's management. The more money an investor makes, the higher the management fee, as the amount of money in their account increases.

Performance fees are calculated in a predetermined way before the investor signs on with a financial advisor. They are generally charged as a percentage of investment profits. These fees can be charged on any profit, or they can only be charged if the management of funds outperforms a predetermined benchmark.

Hedge funds, for example, often use performance-based fees. These fees are how hedge fund managers make a lot of their money and how the top hedge fund managers become extremely wealthy.

There are pros and cons to performance fees. On the one hand, they incentivize investment managers to earn their clients the most money possible because it will also earn them more money. On the other hand, advisors may be more likely to take unnecessary risks with their client's money because a major return could mean a large payday for them.

When deciding on an advisor, it is important to understand their fee structure. Some advisors charge performance fees in addition to management fees, and these fees are based on investment returns. Generally, the fee is a percentage of that return.

Pay Off the House or Invest: Where Should Your Money Go?

You may want to see also

Performance fees incentivise advisors to earn their clients the most money

Performance fees are beneficial because they incentivise investment managers to earn their clients the most money possible. This incentive could make advisors who are more inclined to be conservative and simply collect a management fee think harder about investments and go for a big increase in value for their clients.

However, this advantage also has its drawbacks. Advisors who know that a major return could mean a big payday for them are more likely to take risks with their clients' money that could result in a major loss. While advisors are generally bound by fiduciary duty to act in the best interest of their clients, performance fees could still lead advisors to take unnecessary chances with their clients' money in the hope of meeting benchmarks that will earn them higher performance fees.

Performance fees are most commonly used by hedge funds, which are investment products generally reserved for extremely wealthy investors.

US Investment Trends: Where's the Money?

You may want to see also

Advisors may charge a percentage of assets under management

Investment advisors may charge a percentage of the total assets held under their management. This is known as an AUM fee, or assets under management fee. The fee is typically 1% per year, but can range from 0.25% to 1%. The actual cost of an advisor's AUM fee depends on the amount of assets a client has invested. For example, a client who invests $10,000 with an advisor who charges a 0.5% management fee will pay $50 a year, while a client who has $100,000 invested will pay $500.

Robo-advisors, or computer-based investment services, typically charge lower AUM fees than traditional, in-person financial advisors. Robo-advisors' fees tend to range from 0.25% to 0.50% per year.

AUM fees are usually charged in addition to performance fees, which are based on the performance of investments chosen by the advisor. If the investments meet a predetermined threshold, the client will have to pay a performance fee.

While some advisors charge a flat or hourly fee, AUM fees are the most common fee structure used by traditional, human financial advisors.

Retirement Planning: Overcoming Investment Inertia

You may want to see also

Advisors may charge a flat fee for a financial plan

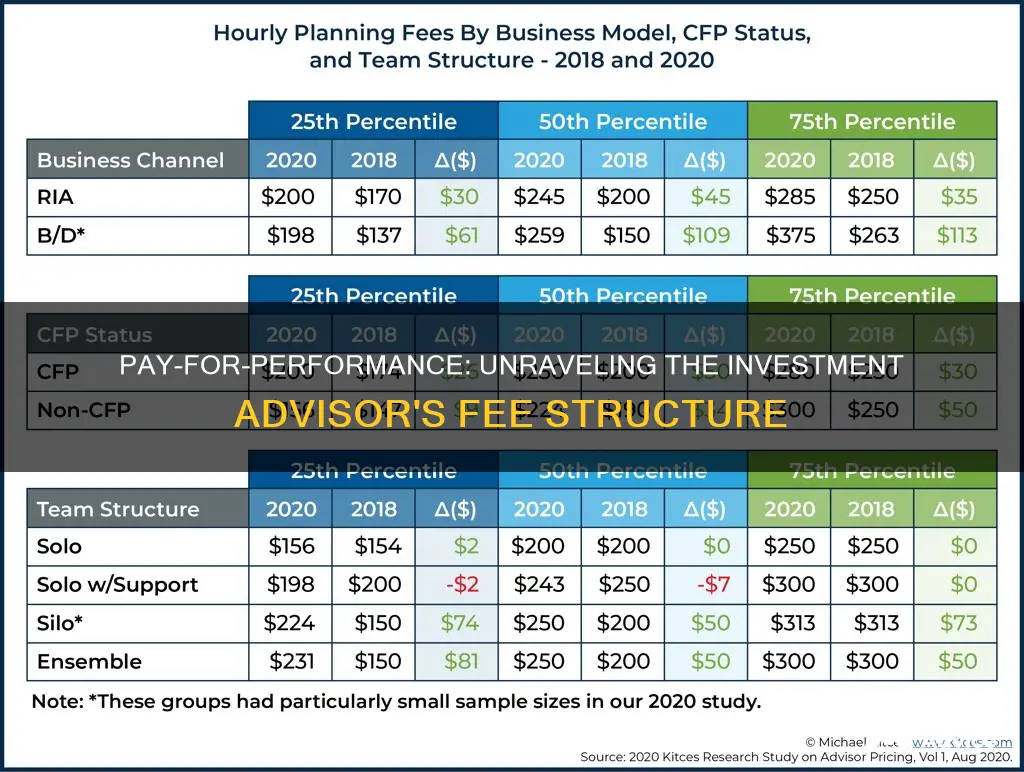

While there is no standard fee for investment advisors, flat fees for their services are an option for those who don't want to pay a percentage of their assets under management (AUM). Flat fees are usually charged for financial plans, and they can be a one-time payment or an annual, monthly, or quarterly charge.

Flat fees for financial plans typically range from $1,000 to $3,000, but they can go as high as $7,500 per year. These fees are usually separate from investment management fees. The flat fee is often based on the complexity of the financial plan and the advisor's expertise.

There are several benefits to charging a flat fee. Firstly, it creates a more direct link between the fee and the service provided. Secondly, it can reduce conflicts of interest that may arise when advisor compensation is tied to asset management. For example, a flat-fee advisor is less likely to discourage a client from actions such as paying off a mortgage or buying a vacation home, as this would not affect their revenue. Flat-fee structures also make it easier for clients to track expenses and ensure cost predictability.

However, it's important to note that flat fees might not always be the most cost-effective option, especially for those with smaller accounts or limited resources. In some cases, paying a percentage of AUM might result in lower fees. Additionally, flat fees might not incentivize advisors to prioritize investment performance as they don't receive incremental rewards for their clients' investment success.

Should I Liquidate My Investments to Pay Off Debt?

You may want to see also

Fee-only advisors do not accept commissions for products sold

Fee-only advisors are compensated solely by the fees their clients pay and do not accept commissions from the sale of financial products. This means they are less biased and more focused on giving clients personalised advice based on their financial goals and interests.

Fee-only advisors charge a set rate for their services, which can be a flat retainer or an hourly rate for investment advice. If they are actively managing a portfolio, they will likely charge a percentage of the assets under management. This is often between 1% and 2% of the total assets of a client's account, following a tiered schedule where the higher the asset level, the lower the percentage fee.

The benefits of fee-only advisors include transparency, no hidden charges, and no conflicts of interest in selling a certain product line or company offering. However, they may be more expensive, and the services and products offered may be more limited.

Fee-only advisors are also bound by fiduciary standards, meaning they must always act in the best interest of their clients and disclose any potential conflicts of interest. They must also conduct a thorough analysis of investments before making recommendations and utilise the best execution of trades when investing.

College: Investing in a Brighter Future

You may want to see also

Frequently asked questions

A pay-for-performance charge is a fee that is based on the performance of the investments chosen by the advisor. If the investments meet a certain threshold, the client will have to pay a fee. This is different from a management fee, which is generally paid in addition to any performance fees and is calculated as a percentage of the total assets under management.

The typical pay-for-performance charge by an investment advisor can vary depending on the firm, the fee structure, and the client's geographical location. According to a 2023 report by Advisory HQ, the average financial advisor fee was 1.02% for $1 million in assets under management (AUM). This adds up to $10,200 annually.

The exact way a performance fee is calculated will be determined before signing on with a financial advisor. It is usually charged as a percentage of investment profits and can be applied to any profit or only when the funds outperform a predetermined benchmark.