A significant number of American households invest in mutual funds, with over half of households owning shares in a mutual fund in 2023. This number has been steadily increasing over the years, with 43.6% of households owning mutual funds in 2016, 52.3% in 2022, and 54.4% in 2023. The primary goal for most mutual fund owners is saving for retirement, with 79% of households investing in mutual funds for this purpose. The typical mutual fund owner is middle-aged, employed, educated, married or living with a partner, and has a moderate income of around $100,000. Mutual funds are an attractive investment option due to their accessibility, professional management, and cost-effectiveness, allowing investors to build personalized portfolios.

| Characteristics | Values |

|---|---|

| Year | 2023 |

| Percentage of US households with mutual fund investments | 52.3% |

| Number of US households with mutual fund investments | 68.7 million |

| Number of individual investors with mutual fund investments | 116 million |

| Median household income of US households owning mutual funds | $100,000 |

| Percentage of mutual fund-owning households with more than half of their financial assets invested in mutual funds | 66% |

| Percentage of mutual fund-owning households with more than one fund | 78% |

| Percentage of mutual fund-owning households with equity funds | 79% |

| Percentage of mutual fund-owning households willing to take substantial or above-average risk for financial gain | 30% |

What You'll Learn

Mutual funds are a key component of household balance sheets

ICI's research also revealed that mutual funds are a crucial component of retirement planning for many Americans. Almost three-quarters of mutual fund-owning households hold these investments through employer-sponsored retirement plans, with 79% of households saving for retirement. Mutual funds are an accessible, professionally managed, and cost-effective tool for Americans to meet their financial goals, especially for moderate-income households.

The popularity of mutual funds can be attributed to their advantages over direct investment in individual securities. Mutual funds provide increased diversification, stability in price due to daily liquidity, and access to investments typically only available to larger investors. They are also more stable in price due to daily liquidity, ensuring a minimum loss of value.

However, it's important to consider the disadvantages as well. Mutual funds come with inevitable fees associated with professional management, and investors have less control over the timing of recognizing their gains. Despite this, mutual funds remain an essential part of household finances in the United States, with a growing number of households investing in them.

Funding an Investment Farm: Strategies for Success

You may want to see also

Retirement savings are the primary goal for most mutual fund owners

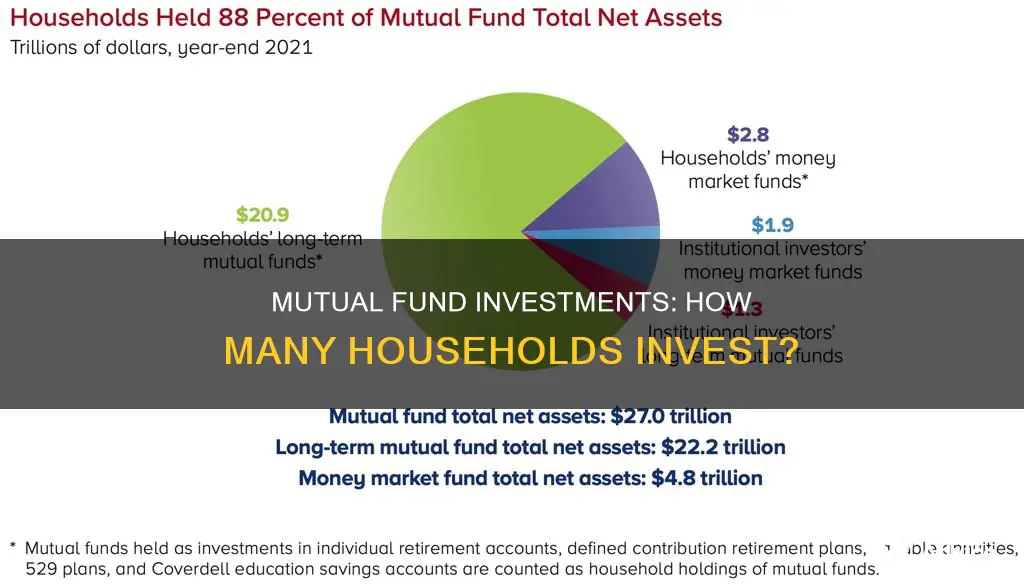

In 2022, 68.6 million households in the United States owned mutual funds, representing 52.3% of households. This figure rose to 54.4% in 2023, with 68.7 million households owning mutual funds. The increase in mutual fund ownership is a result of employer-sponsored retirement plans, with nearly three-quarters of mutual fund-owning households investing through these plans.

The majority of mutual fund shareholders are in their peak earning and saving years, with more than two-thirds earning less than $150,000. Mutual fund-owning households are also more willing to take on investment risk, with 30% willing to take substantial or above-average risks for financial gain in 2023. This is in comparison to 12% of households not owning mutual funds and 22% of all US households.

Mutual funds are a key component of household balance sheets, with two-thirds of mutual fund-owning households investing more than half of their financial assets in mutual funds. The funds provide a diversified and professionally managed investment option, which enables investors to access investments that would normally only be available to larger investors.

Additionally, mutual funds offer price stability as daily liquidity ensures minimum loss of value. They also provide investors with the benefit of professional investment expertise and the clout of a mutual fund.

Mutual Fund Investment: Smart Money Moves to Make Now

You may want to see also

Mutual fund owners are more likely to take investment risks

In 2023, 52% of US households owned shares in a mutual fund, according to the Investment Company Institute (ICI). This is a significant increase from 5.7% in 1980 and 46.3% in 2013.

The higher risk appetite among mutual fund owners may be influenced by their confidence in the funds' performance and their overall positive impression of the mutual fund industry. In 2023, 80% of mutual fund-owning households expressed confidence in mutual funds, and investment performance was cited as the most influential factor shaping their opinions of the industry.

Additionally, mutual fund owners tend to have a more diverse range of investments. In 2023, two-thirds of these households had more than half of their financial assets invested in mutual funds, and 78% held more than one fund. This diversification can potentially contribute to their willingness to take on more investment risk.

The accessibility and advantages of mutual funds make them an attractive investment option for many. They are professionally managed, stable in price, and enable participation in investments typically available only to larger investors. Mutual funds also provide increased diversification and ease of comparison for investors. These factors, combined with the potential for higher returns, likely contribute to the higher risk tolerance among mutual fund owners.

Schwab S&P 500 Index Fund: Where Your Money Goes

You may want to see also

Mutual fund ownership is higher among older generations

According to the Investment Company Institute (ICI), 52.3% of US households owned mutual funds in 2022, representing 115.3 million individual investors. This is an increase from previous years. The ICI also found that mutual fund ownership occurs across all ages and incomes, with more than two-thirds earning less than $150,000. However, the data shows that mutual fund ownership is higher among older generations.

In 2022, 56% of households headed by Baby Boomers (born between 1946 and 1964) owned mutual funds. Baby Boomers also held the largest share of households' mutual fund assets, reflecting the time they have had to accumulate savings. Generation X (born between 1965 and 1980) followed closely behind, with 55% of their households owning mutual funds. Millennials (born between 1981 and 1996/97), on the other hand, are still approaching a majority, with 47% of their households owning mutual funds. This difference in ownership rates between generations can be partly attributed to the fact that older generations are more likely to be in their peak earning and saving years.

The trend of higher mutual fund ownership among older generations has been consistent over the years. In mid-2015, about half of Baby Boom and Gen X households owned mutual funds, compared to only one-third of Millennial households. Additionally, the median age for first purchasing mutual funds was lower for Millennials (23) compared to Gen X (26) and Baby Boomers (in their thirties). This indicates that while Millennials are investing at a younger age, they have not yet caught up to the ownership levels of the older generations.

The higher incidence of mutual fund ownership among Baby Boomers and Generation X can be attributed to several factors. Firstly, these generations have had more time to accumulate savings and build their investment portfolios. Secondly, employer-sponsored retirement plans, which are often the gateway to mutual fund ownership, may be more accessible to older generations due to their longer tenure in the workforce. Finally, individuals in their peak earning and saving years tend to have more disposable income to invest, and they may be more focused on long-term financial goals such as retirement planning.

Understanding TIAA Fund Investments: Where Is My Money?

You may want to see also

Mutual funds are an accessible investment tool

The Investment Company Institute (ICI) reports that mutual funds are a key component of household balance sheets for millions of Americans, especially those with moderate incomes, helping them to build a secure financial future. ICI's research also found that mutual funds are the most common type of investment company owned, and that they are owned by people from all age and income groups. Over two-thirds of households with mutual funds earn less than $150,000, and a third earn less than $75,000.

The popularity of mutual funds as an investment vehicle can be attributed to several factors. Firstly, they are an accessible, professionally managed, and cost-effective tool for meeting personalized savings goals. The wide range of available mutual funds, from domestic and world equity funds to bond funds and money market funds, enables investors to build tailored portfolios that match their financial objectives and risk tolerance levels. Secondly, employer-sponsored retirement plans, such as 401(k) plans, have become the most common channel through which households own mutual funds. These plans provide a convenient and tax-advantaged way to invest in mutual funds, making them an attractive option for many employed individuals.

Furthermore, mutual funds offer increased diversification and ease of comparison for investors. The collective investment nature of mutual funds allows individuals to pool their money with other investors, enabling them to participate in investments that would typically only be accessible to larger investors. The professional management of these funds also ensures price stability, as daily liquidity maintains a minimum loss of value.

While there are disadvantages to consider, such as fees and a reduced ability to customize investments, mutual funds remain a popular and accessible investment tool for a significant portion of US households.

Transferring Funds: TD Direct Investing Simplified

You may want to see also

Frequently asked questions

In 2023, 52% of US households owned shares in a mutual fund. This is a significant increase from 5.7% in 1980, and 43.6% in 2016.

In 2023, 68.7 million households owned mutual funds. This is an increase from 58.7 million households in 2020.

The primary goal for most mutual fund owners is saving for retirement. In fact, 79% of households with mutual funds cite this as their main goal.