Investing a portion of your income is a great way to build wealth and secure your financial future. But how much should you invest? The answer depends on various factors, including your income, financial goals, and risk tolerance.

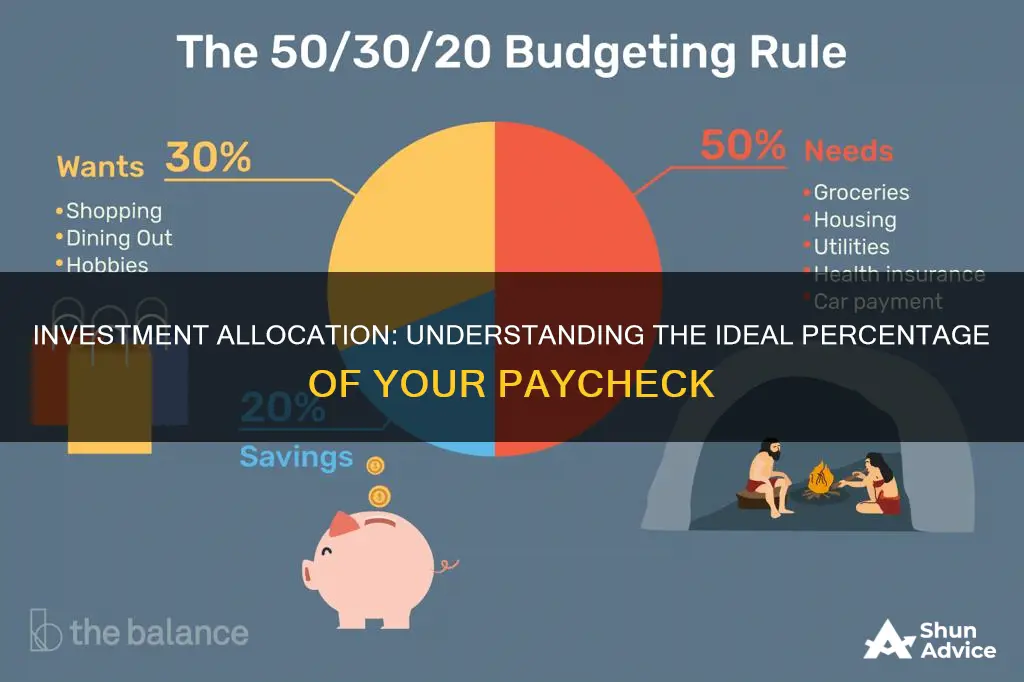

Experts generally recommend investing around 10% to 20% of your income. The 50/30/20 rule is a popular guideline, suggesting that 50% of your income should cover essentials, 30% should be for discretionary spending, and 20% should go towards savings and investments.

However, the amount you invest should be tailored to your unique financial situation. If you have ambitious financial goals and a high-risk tolerance, you may invest a larger percentage. Conversely, if you have immediate financial needs or a lower risk tolerance, you may opt for a smaller percentage.

It's important to remember that investing is a long-term commitment, and you should carefully consider your financial objectives and risk tolerance before deciding on an investment strategy.

| Characteristics | Values |

|---|---|

| Recommended percentage of income to invest | 10-20% |

| Percentage of pretax income to invest according to the 50/15/5 rule | 15% |

| Percentage of pretax income to invest according to the 50/30/20 rule | 20% |

| Percentage of pretax income to invest to retire as a millionaire by 65 according to The Financial Geek | 15% |

What You'll Learn

How much should you invest based on your income?

Investing is an effective way to grow your wealth over time and achieve financial stability. While there is no one-size-fits-all answer to how much of your income you should invest, there are some key principles and guidelines to consider.

Key Principles to Consider

Firstly, it is important to take stock of your unique financial situation and create an investment strategy that works for your budget. Consider your disposable income, financial goals, tolerance for risk, and investment horizon.

General Guidelines

A commonly recommended guideline is to allocate around 10-20% of your income towards investments. This range allows for a balanced approach, providing potential growth while still leaving room for other financial obligations and savings.

The 50/30/20 rule is also a widely recognised budgeting strategy, which breaks down your monthly budget into three categories: 50% for essentials, 30% for discretionary spending, and 20% for savings and investments.

Factors Affecting How Much You Invest

However, the percentage of your income that you invest can vary depending on several factors, including your income level, savings, debts, financial goals, and risk tolerance.

If you are just starting out and cannot afford to invest 10-20% of your income, you can start with a smaller amount or a set dollar amount and gradually increase your contributions over time.

It is also important to prioritise paying off any high-interest debt and creating an emergency fund before investing large amounts.

Seeking Professional Guidance

Investing can be daunting, especially if you are new to it or have specific financial objectives. In such cases, it is advisable to seek guidance from a licensed financial planner or investment advisor, who can provide expert advice tailored to your situation.

Doge Investors: Who and How Many?

You may want to see also

How does investing help you achieve financial goals?

Investing is a crucial aspect of achieving financial goals, as it enables individuals to grow their wealth over time and secure their future aspirations. Here's how investing can help you reach your financial milestones:

Wealth Accumulation

Investing provides an opportunity to grow your money over time. By allocating a portion of your income towards investments, you can harness the power of compound interest, where your initial investment grows exponentially through regular contributions. This wealth accumulation can serve as a nest egg for retirement, education funding, or other financial aspirations.

Hedging Against Inflation

Investing is a strategic way to protect your money from the eroding effects of inflation. As the purchasing power of money decreases over time due to rising prices, investing in assets such as stocks, bonds, real estate, or commodities helps maintain and even increase the value of your savings. This ensures that your financial goals remain achievable despite inflationary pressures.

Achieving Financial Goals

Investing is a versatile tool that can help you achieve both short-term and long-term financial goals. For instance, if you're aiming to buy a car or go on a vacation in the near future, investing in short-term instruments or high-yield bonds can help you accumulate the necessary funds. On the other hand, if your goal is to save for retirement or buy a house, you'd consider longer-term investments that provide better returns over an extended period.

Diversification and Risk Management

Investing allows you to diversify your portfolio and manage risk effectively. By allocating your funds across different asset classes, such as stocks, bonds, real estate, and commodities, you reduce the impact of market volatility on your portfolio. Additionally, investing strategies can be tailored to your risk tolerance, with options ranging from conservative approaches focusing on stable assets like bonds to more aggressive strategies involving growth stocks or cryptocurrencies.

Enhanced Employment Income

Investing can serve as a supplementary source of income, enhancing your employment earnings. It empowers you to purchase desired items, such as a new car or a vacation, without solely relying on your salary. This aspect of investing provides individuals with financial flexibility and the ability to achieve their financial goals faster.

In summary, investing is a powerful tool that enables individuals to build wealth, protect their savings from inflation, achieve diverse financial goals, manage risk, and enhance their overall income. By setting clear financial goals, understanding investment options, and seeking guidance when needed, individuals can harness the benefits of investing to reach their desired milestones.

Bankers: Social Butterflies or Lone Wolves?

You may want to see also

What are the benefits of investing in stocks?

When it comes to investing, individuals often wonder how much of their income should go towards it. While there is no one-size-fits-all answer, a common recommendation is to invest around 15% of your income. This can vary depending on factors such as income, savings, and debts, with some experts suggesting a range of 15% to 25%.

Now, onto the benefits of investing in stocks.

Building Wealth

Investing in stocks can be an effective way to grow your wealth over time. Stocks have the potential for higher returns compared to traditional savings accounts, and by reinvesting profits, you can take advantage of compound interest, which can lead to significant gains.

Protecting Against Inflation

The purchasing power of money decreases over time due to inflation. Stocks can act as a hedge against inflation, as they historically tend to outperform it. This helps your savings retain their value and purchasing power in the future.

Income Generation

Some companies pay shareholders dividends, which are portions of the company's profits distributed to shareholders. Dividends can provide a regular income stream and enhance your overall investment returns.

Tax Advantages

Equity investments often come with favourable tax treatment, especially for long-term capital gains and dividend income. This means more money stays in your pocket, as these types of income are typically taxed at a lower rate than employment income.

Diversification

Stocks allow you to own a piece of a company, and by investing in multiple companies across different sectors and industries, you can diversify your portfolio. Diversification helps to manage risk and ensure that all your eggs are not in one basket, so to speak.

Long-Term Growth

While stock prices fluctuate, historically, they tend to rise over the long term. Taking a long-term perspective can smooth out the short-term ups and downs and provide a more stable growth trajectory.

Voting Rights and Control

Owning stocks, especially common stocks, often comes with voting rights. This gives shareholders a say in how the company is run and provides a level of control over its direction.

Liquidity

Stocks are typically more liquid than other investments, such as real estate or collectibles. They can be bought and sold relatively quickly and easily, providing investors with access to cash when needed.

Lower Risk with Proper Due Diligence

While investing in stocks carries risk, conducting thorough research on companies before investing can help mitigate this risk. Analysing a company's financial health, business activities, and future strategy can provide insights into its potential for growth or decline.

In summary, investing in stocks offers the potential for wealth accumulation, income generation, and protection against inflation. It provides an opportunity to own a piece of a company, participate in its growth, and benefit from tax advantages. However, it's important to remember that investing in the stock market carries risk, and proper due diligence and diversification are key to managing that risk effectively.

Hydrogen's Future: Invest Now

You may want to see also

How to determine how much to invest?

When it comes to determining how much of your income should go towards investing, there is no one-size-fits-all answer. However, a good place to start is by understanding your current financial situation, setting clear investment goals, and considering various budgeting strategies. Here are some guidelines and steps to help you determine how much to invest:

- Understand your current financial situation: Evaluate your taxed income, any existing debt, emergency funds, and rainy-day funds. Prioritize paying off high-interest debt and creating savings funds to cover unexpected expenses.

- Set clear investment goals: Determine what you are investing for, such as retirement, purchasing a home, or funding your child's education. Having specific and measurable financial goals will help shape your investment decisions and enable you to track your progress over time.

- Consider budgeting strategies: There are several budgeting strategies that can guide how much you should allocate towards investments. One common strategy is the 50/30/20 rule, which suggests allocating 50% of your income to essentials, 30% to discretionary spending, and 20% to savings and investments. Another similar strategy is the 50/15/5 rule, which suggests 50% for essential expenses, 15% for retirement, 5% for short-term savings, and 30% for discretionary expenses.

- Assess your risk tolerance: Investing carries a certain level of risk, and you need to decide how much risk you are comfortable with. If you are risk-averse, you may prefer a more conservative approach with a smaller percentage allocated to stocks or other volatile assets. If you have a higher risk tolerance, you may consider allocating a larger portion to riskier investments.

- Consult a financial advisor: If you are unsure about how much to invest or how to allocate your investments, consider seeking guidance from a financial advisor. They can provide personalized advice based on your financial situation, goals, and risk tolerance.

Remember, the percentage of your income that you invest may vary depending on your unique circumstances, financial goals, and risk tolerance. The key is to start investing early and consistently, even if you can only afford a small amount. Over time, you can work towards increasing your investments to achieve your financial goals.

Unlocking Clean Geothermal Energy Potential

You may want to see also

How to create a realistic spending plan?

Creating a realistic spending plan is an effective way to manage your finances and ensure you are spending within your means. Here is a step-by-step guide to help you create a realistic spending plan:

Calculate your net income:

Start by figuring out your net income, which is your take-home pay after deductions for taxes and any employer-provided programs such as retirement plans or health insurance. This step is crucial as focusing only on your total salary may lead to overspending. If you have irregular income, such as a freelancer, keep detailed records of your contracts and payments.

Track your spending:

Once you know your income, the next step is to understand your expenses. Begin by listing your fixed expenses, which are regular monthly bills like rent, utilities, and car payments. Then, list your variable expenses that may change from month to month, such as groceries, gas, and entertainment. Credit card and bank statements can be helpful in itemizing your monthly expenditures. Record your daily spending using a method that works for you, whether it's pen and paper, a smartphone app, or budgeting spreadsheets.

Set realistic goals:

Before analyzing your tracked information, set short-term and long-term financial goals. Short-term goals could include building an emergency fund or paying off credit card debt, while long-term goals might involve saving for retirement or a child's education. Identifying your goals will motivate you to stick to your budget and make necessary adjustments.

Differentiate between needs and wants:

Break down your expenses into needs and wants. For example, gasoline for your daily commute is a need, while a monthly music subscription is a want. This distinction is essential when deciding where to cut back on spending to meet your financial goals.

Adjust your spending:

Now that you have a clear picture of your income and expenses, make adjustments to ensure you don't overspend. Start by reducing expenses on wants, and if further cuts are needed, reevaluate your fixed expenses. For example, you could shop around for better rates on insurance. Remember that even small savings can add up to a significant amount over time.

Regularly review your budget:

Your budget is not set in stone. Regularly review your spending plan to ensure it aligns with your financial situation and goals. Circumstances may change, such as receiving a raise or reaching a savings milestone, and your budget should be flexible enough to accommodate these changes.

Consider your investment goals:

As part of your spending plan, allocate a portion of your income towards investments. While the specific percentage may vary depending on your financial situation and goals, a common guideline is to invest 15% of your pretax or post-tax income. This can include contributions to retirement accounts, such as a 401(k) or IRA, or investing in stocks, bonds, or other alternative investments.

In summary, creating a realistic spending plan involves understanding your income, expenses, and financial goals, and making informed decisions about where to allocate your money. Remember to regularly review and adjust your plan as needed to ensure it remains realistic and helps you achieve your financial aspirations.

Rich People: Where They Invest

You may want to see also

Frequently asked questions

While there is no one-size-fits-all answer, experts recommend investing 10-20% of your income, with some suggesting up to 25% of your post-tax income.

You should consider your disposable income, financial goals, risk tolerance, and investment horizon.

The 50/30/20 rule is a budgeting strategy that suggests dividing your income into three categories: 50% for essentials, 30% for discretionary spending, and 20% for savings and investments.