Bitcoin is a highly volatile cryptocurrency with a finite supply of 21 million coins worldwide. Its value has fluctuated from less than a penny at its inception to a historical high of over $73,000. The percentage of people who have made money investing in Bitcoin is difficult to determine due to its decentralised nature and the anonymity of transactions. However, surveys indicate that a significant proportion of investors have lost money, with 38% of American investors selling their crypto for less than they paid for it, while 28% turned a profit.

What You'll Learn

Bitcoin's value and number of users

Bitcoin's value has been extremely volatile since its launch in 2009. Starting from a value of less than a penny, Bitcoin's value rose to over $73,000 in March 2024. As of May 2024, the total market capitalization of all cryptocurrencies is around $2.33 trillion, with Bitcoin contributing $1.2 trillion of that.

It is difficult to determine the exact number of Bitcoin users due to the technical setup of the protocol. However, estimates place the number of Bitcoin users at around 50 million, while others place it at 81.7 million as of June 2023. There are more than 50,000 confirmed transactions of Bitcoin daily, and the average number of daily transactions between January 29 and March 18, 2024, was approximately 378,000.

Bitcoin's popularity varies across different demographics. For example, younger generations are more likely to own Bitcoin than older generations, with Millennials being the most likely to currently own Bitcoin, followed by Gen Zers and Gen Xers. Additionally, higher-income earners are more likely to own Bitcoin, with 25% of those making $100,000 or more annually owning it, compared to 14% of those making less than $35,000.

A Beginner's Guide: Getting Started with Bitcoin

You may want to see also

Who uses Bitcoin?

Bitcoin is the most popular cryptocurrency, with around 50 million people owning it and more than 50,000 confirmed transactions taking place daily. A 2020 survey by HSB revealed that 36% of small-medium businesses in the US accept Bitcoin, and currently, over 15,000 businesses worldwide accept Bitcoin, including about 2,300 companies in the United States. Most crypto-friendly companies are small businesses, and shoppers may not think to ask if they take Bitcoin. In California alone, over 400 companies accept cryptocurrency, from nail salons and sushi restaurants to convenience stores and auto repair shops.

Some of the notable companies that accept Bitcoin include:

- Wikimedia (Wikipedia)

- Microsoft

- AT&T

- Burger King

- Subway

- Amazon

- Pizza Hut

- Dallas Mavericks

- Virgin Mobile and Virgin Airlines

- Norwegian Air Shuttle (Norwegian)

- Overstock

- Dish Network

- AMC Theatres

- Whole Foods

- Adidas

- Nike

- PlayStation

- Pottery Barn

- Ray-Ban

- Best Buy

- Bloomingdales

- Columbia Sportswear

- Dior

- Disney

- GameStop

- Hulu

- Lyft

- Uber

- Airbnb

- Hotels.com

- American Airlines

- Southwest Airlines

- Shopify

- ExpressVPN

- Newegg

- PacSun

- JomaShop

While many large companies are accepting Bitcoin as a legitimate source of payment, it is important to note that Bitcoin and other cryptocurrencies are not yet universally accepted as a payment method.

Coinexchange: The Best Place to Invest Your Money?

You may want to see also

Concerns about safety and reliability

The safety and reliability of Bitcoin are questionable due to its high volatility, security risks, and market, regulatory, and cybersecurity concerns.

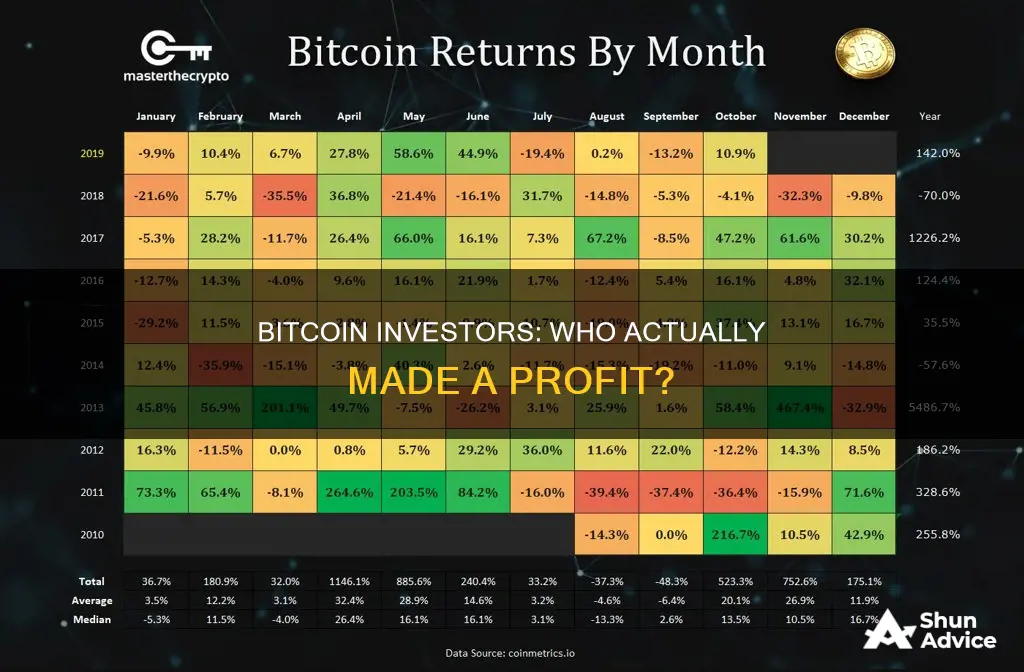

Bitcoin's extreme price volatility makes it a risky investment. In 2022, the price of Bitcoin dropped from almost $48,000 to lows of around $16,000, and it has seen declines as steep as 40% in a 12-month period. This market volatility can make Bitcoin feel unsafe, especially for new investors.

Additionally, Bitcoin is subject to security risks, such as online hacking and wallet security. Online hacking incidents and hard drive crashes can result in the loss of Bitcoin, with limited recourse for recovery. Bitcoin exchanges, which are the primary gateways for consumers to buy and sell Bitcoin, have been targeted by hackers, leading to concerns about the security of Bitcoin holdings. While exchanges implement measures to protect deposits, such as cold storage, some industry experts recommend using hardware wallets for added security.

Market risk is another significant concern, as Bitcoin prices can fluctuate wildly. Historical data shows that Bitcoin prices tend to dip when the Fed raises interest rates, as investors move towards more stable investments. Regulatory uncertainty also poses a risk, as seen in China's ban on cryptocurrency in 2021. The lack of an overarching regulatory framework similar to that for traditional financial institutions adds to the uncertainty.

Cybersecurity is a chief concern, with the potential for hacking and phishing scams. Transactions are only as secure as the wallet information and passwords used, and even blockchain transactions can be traced by law enforcement. The rising threat of cryptocurrency crime, including scams and fraud, further underscores the importance of cybersecurity measures.

Overall, while Bitcoin has survived unscathed for over a decade, these concerns about safety and reliability highlight the speculative nature of the investment and the need for investors to carefully consider the risks before diving into the volatile world of cryptocurrencies.

Elon Musk's Bitcoin: A Guide to Investing

You may want to see also

Celebrity endorsements

Some of the most prominent celebrity endorsements of Bitcoin and other cryptocurrencies include:

- Elon Musk: The CEO of Tesla and SpaceX has been a vocal supporter of Bitcoin and is often credited with influencing its price. Musk's company, Tesla, purchased a significant amount of BTC, and he has also expressed his love for Dogecoin, contributing to its rise.

- Jack Dorsey: The CEO of Twitter and Square is a long-time Bitcoin investor and advocate. Dorsey's payment company, Square, has made substantial investments in Bitcoin, and he also runs his own Bitcoin node.

- Mark Cuban: The billionaire investor and owner of the NBA team Dallas Mavericks has had a love-hate relationship with Bitcoin. While he has advised people to invest in Bitcoin, he has also made contradictory statements and admitted to holding various other cryptocurrencies.

- Snoop Dogg: The iconic rapper is one of the longest-running supporters of Bitcoin, accepting it as payment for album sales as early as 2013. Snoop Dogg has also released NFTs and helped promote the bull run in 2021.

- Gene Simmons: The bassist and frontman of the band KISS is a fan of Cardano and Dogecoin. Simmons has used his platform to support and purchase Cardano, and he also proclaimed himself the "God of Dogecoin."

- Floyd Mayweather Jr.: The professional boxer is a well-known celebrity investor in Bitcoin. However, he was fined by the SEC in 2018 for promoting an illegal initial coin offering (ICO).

- Richard Branson: The founder of the Virgin Group invested in BitPay, a Bitcoin payments processing platform, in 2014. While he has not disclosed his personal Bitcoin holdings, he has recognized the potential benefits of Bitcoin developments.

- Gwyneth Paltrow: The actress has endorsed and invested in various cryptocurrency projects, including Abra and Bitcoiin2Gen. However, her involvement with Bitcoiin2Gen led to a fine from the SEC.

- Maisie Williams: The Game of Thrones star purchased Bitcoin in 2020 despite divided opinions from her Twitter followers. She also considered investing in Ethereum.

- Kanye West: The rapper has expressed his support for Bitcoin, noting that it could lead to the true liberation of America. However, it is unclear how much Bitcoin he holds.

These celebrity endorsements have brought mixed results, with some celebrities facing fines and backlash for their involvement with shady crypto assets or undisclosed paid promotions. Nonetheless, celebrity endorsements have contributed to the popularity and legitimacy of Bitcoin and cryptocurrencies, especially among their massive fan bases and the general public.

Bitcoin Millionaires: How Did They Do It?

You may want to see also

How to invest in Bitcoin

Investing in Bitcoin can be a risky endeavour, so it's important to do your research and understand the market before you begin. Here is a step-by-step guide on how to invest in Bitcoin:

- Choose a cryptocurrency exchange platform: Select a reputable and well-known exchange platform that offers a wide range of cryptocurrencies and has reasonable fees. Examples include Gemini, Kraken, Coinbase, and Crypto.com.

- Create an account: You will need to provide personal information and verify your identity to register on the platform.

- Fund your account: Before buying any Bitcoin, you need to deposit funds into your account. You can do this by linking your bank account or using a credit or debit card.

- Place a buy order: Decide how much Bitcoin you want to purchase and submit a buy order through the exchange platform.

- Store your Bitcoin in a digital wallet: You can choose to store your Bitcoin in a hot wallet, which is typically provided by the exchange, or a cold wallet, which is a small encrypted portable device that you can use to carry your Bitcoin.

It is important to note that the cryptocurrency market is highly volatile, and the value of Bitcoin can fluctuate significantly. Always make sure you understand the risks involved and only invest what you can afford to lose. Additionally, be cautious of transaction fees, which can vary widely between currencies.

The Bitcoin Investment Journey: A Billion-Dollar Adventure

You may want to see also

Frequently asked questions

It is impossible to give an exact figure, but sources suggest that around 50 million people own Bitcoin.

The average amount invested in crypto is $7,738, with a median of $500. 14% of people who've invested in crypto put in $10,000 or more, while 76% have invested less than $5,000.

28% of Americans who have held a form of cryptocurrency have sold it for more than they bought it for, while 38% have sold it for less.

38% of Americans who have held a form of cryptocurrency have sold it for less than they bought it for.