American Funds, a division of Capital Group, charges a combination of front-end loads, back-end loads, and higher expense ratios to compensate the brokers and financial advisors who market their funds. The front-end sales charges range from 0% to 5.75%, depending on the amount and type of investment. For instance, investors with less than $25,000 invested in a class share equity fund are subject to a 5.75% charge, which decreases incrementally until reaching $1 million, at which point no charges apply. Additionally, American Funds offers a variety of funds with different expense ratios, such as the American Funds Fundamental Investors (ANCFX), which has an expense ratio of 0.24%.

| Characteristics | Values |

|---|---|

| Front-end sales charges | 0% to 5.75% |

| Bond funds sales charges | Up to 3.75% |

| Portfolio series and retirement funds sales charges | 5.75% to 0% |

| Annual management fees | 0.24% to 0.61% |

| Annual expense ratio | 0.60% |

| Turnover rate | 30% |

| 10-year return | 11.8% |

| Expense ratio | 0.58% |

What You'll Learn

- American Funds charges a front-end sales fee of up to 5.75%

- American Funds has higher expense ratios than Vanguard

- American Funds' total net asset value was $24.29 trillion as of June 2023

- American Funds' mutual fund expense ratio is 0.58%

- American Funds' annual management fee for SMALLCAP World is 0.61%

American Funds charges a front-end sales fee of up to 5.75%

American Funds, a division of Capital Group, charges a front-end sales fee of up to 5.75% on its investment products. This fee, also known as a front-end load, is a percentage-based charge applied to the initial investment amount. For example, if you invest $10,000 in an American Funds product with a 5% front-end load, you will pay $500 in fees upfront, leaving $9,500 to be invested.

The amount of the front-end sales fee varies depending on the specific fund and the amount invested. For instance, the fee structure for equity funds is different from that of bond funds. Additionally, American Funds offers a range of share classes, and the fees may differ depending on the share class chosen.

It is important to note that American Funds also charges back-end loads and higher expense ratios compared to some of its competitors, such as Vanguard. The back-end load, or contingent deferred sales charge (CDSC), is a fee paid when selling or redeeming shares, and it usually decreases the longer you hold the investment.

When considering investing in American Funds, it is essential to review the fund's prospectus, which outlines the fees and expenses associated with the investment. The prospectus provides detailed information on the sales charges, annual expenses, and other relevant costs.

Furthermore, American Funds takes a managed investment approach, actively managing its funds through portfolio managers. This active management strategy aims to provide consistent results, value, and diversification for investors. The fund managers focus on the fund's investment objectives, which often include current income, growth of capital, and conservation of principal.

In summary, American Funds charges a front-end sales fee of up to 5.75%, but the actual fee percentage depends on the specific fund and investment amount. It is crucial to carefully review the fees and expenses associated with any investment product before making a decision.

Investing in an L 2050 Fund: A Smart Move for 35-Year-Olds?

You may want to see also

American Funds has higher expense ratios than Vanguard

American Funds and Vanguard are two of the largest mutual fund managers in the world. While they share the same purpose, they differ in many ways. One of the most notable differences is their expense ratios. American Funds charges a combination of front-end loads, back-end loads, and higher expense ratios, while Vanguard offers no-load funds with lower expense ratios.

American Funds come with both front-end and back-end loads, and their fees are higher than Vanguard's. American Funds has front-end sales charges ranging from zero to 5.75%, depending on the investment type and amount. For example, if you invest less than $25,000 in a class share equity fund, you will be charged 5.75%. This charge decreases incrementally as your investment amount increases, and there are no charges if you invest $1 million or more. Bond funds follow a similar schedule, with a maximum charge of 3.75%. Portfolio series and retirement funds range from 5.75% to zero, depending on the invested amount. It's important to note that some American Fund share class funds have no sales charges or annual expenses.

On the other hand, Vanguard is known for its low-cost funds and has an average mutual fund expense ratio of 0.09%. While there are a few funds with purchase and redemption fees, Vanguard primarily offers no-load and no-commission funds. For example, the Vanguard Balanced Index Fund (VBIAX), a mutual fund providing exposure to stocks and bonds, has an expense ratio of 0.07%. The Vanguard FTSE Social Index Fund Admiral Shares (VFTAX), a socially responsible investment fund, has an expense ratio of 0.14%.

The higher expense ratios of American Funds are used to compensate traditional brokers and financial advisors with commissions. These funds are actively managed by portfolio managers, and the expense ratios cover portfolio management, administration, marketing, and distribution costs.

In contrast, Vanguard, as a mutually-owned company, passes all potential profits back to the funds in the form of lower asset management fees, resulting in the lowest expense ratios in the mutual fund industry. Vanguard is a leader in passively managed index funds, an approach pioneered by its late founder, Jack Bogle.

When considering investment options, it is essential to evaluate the expense ratios as they directly impact your investment returns. While American Funds provides a variety of investment options and actively managed funds, their higher expense ratios mean that a larger portion of your returns will go towards covering these expenses. Vanguard, with its lower expense ratios, allows you to keep more of your investment returns.

Strategies for Investing in US-Based Hedge Funds

You may want to see also

American Funds' total net asset value was $24.29 trillion as of June 2023

The total net asset value of American Funds' mutual funds was $24.29 trillion as of June 2023. This substantial figure underscores the company's position as one of the largest mutual fund managers in the world.

To understand this impressive number, it's important to grasp the concept of net asset value (NAV). NAV is calculated by subtracting a fund's liabilities from its assets, then dividing that amount by the number of shares outstanding. In simple terms, it represents the value of an investment fund. The per-share NAV is the price at which investors buy and sell the fund's shares.

American Funds, a division of the privately owned Capital Group, stands out for its active fund management approach. Its portfolio managers focus on value and maintain low turnover rates. This hands-on strategy comes at a cost, with American Funds charging both front-end and back-end loads, resulting in higher expense ratios compared to passively managed funds.

The $24.29 trillion net asset value encompasses both long-term and money market funds. This diverse range of assets underscores American Funds' expertise in various investment classes, including asset allocation and fixed-income funds.

American Funds' substantial net asset value highlights the company's ability to attract and manage significant investment capital. With its active management approach, the company strives to provide attractive returns for its clients while navigating the complexities of the financial markets.

In summary, American Funds' total net asset value of $24.29 trillion as of June 2023, reflects the company's scale, expertise, and ability to manage substantial investment portfolios across diverse asset classes. This position as a leading mutual fund manager comes with the responsibility of delivering returns that justify the higher fees associated with their active management style.

TSP G Fund: A Guide to Investing

You may want to see also

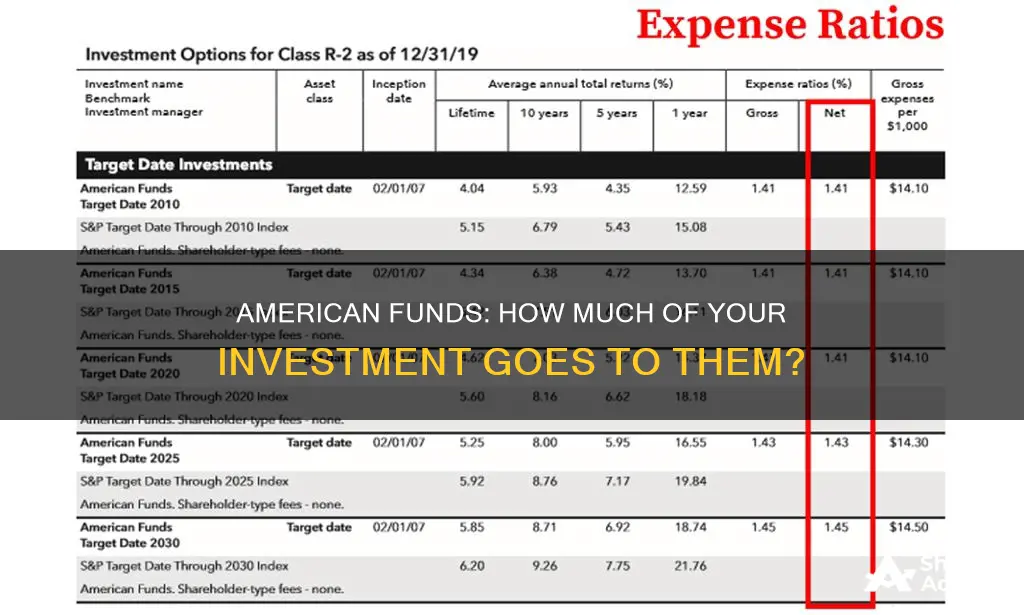

American Funds' mutual fund expense ratio is 0.58%

The expense ratio of a mutual fund is the annual cost paid to fund managers by investors. This ratio is calculated by dividing a mutual fund's operating expenses by the average total dollar value of all the assets in the fund. For example, if a fund has operating expenses of $100,000 and assets worth $2,000,000, the expense ratio would be 5% ($100,000/$2,000,000 = 0.05 or 5%).

American Funds is one of the largest mutual fund companies in the world, with over $2.2 trillion in assets under management. It is a division of privately owned Capital Group, which was founded in 1931 and is based in Los Angeles.

American Funds offers a variety of funds in several asset classes, including asset allocation funds and fixed-income classes of funds. The funds are actively managed by portfolio managers who pay attention to value and keep turnover rates low.

The American Funds mutual fund expense ratio is 0.58%. This is considered a low expense ratio compared to other actively managed funds, which typically have ratios ranging from 0.5% to 0.75%. Actively managed funds are more expensive than passively managed funds because the fund managers actively monitor and change the assets in the fund to maximize performance.

In addition to expense ratios, American Funds also charges front-end and back-end loads, which are sales charges paid when investors buy or sell shares. These loads can range from zero to 5.75%, depending on the type of fund and the amount invested.

It's important for investors to consider the impact of fund expenses on their returns. A fund with a high expense ratio can significantly eat into the overall returns generated by the fund. Therefore, investors should compare expenses when researching different funds and consider the trade-off between the potential for higher returns with an actively managed fund and the lower fees of a passively managed fund.

Pension Planning: Choosing the Right NPS Fund

You may want to see also

American Funds' annual management fee for SMALLCAP World is 0.61%

American Funds, a division of Capital Group, charges a combination of front-end loads, back-end loads, and higher expense ratios to pay commissions to traditional brokers and financial advisors. The total net asset value of American Funds' mutual funds was $24.29 trillion as of June 2023.

The American Funds SMALLCAP World (SMCWX) is a small-cap-focused fund targeting growth. It was established in April 1990 and had a 10-year return of 7.87% and 9.20% since its inception. With almost $69.7 billion in assets under management (AUM), this fund comes with annual management fees of 0.61%.

The fund's investment objective is to provide long-term growth of capital by investing in some of the fastest-growing and most innovative companies in the world. It primarily invests in common stocks, government and corporate debt, and cash and equivalents. The fund has no specific limit on holdings outside the US and has historically invested a substantial portion of its assets in the US due to the number of small-cap opportunities.

The fund's portfolio management team has extensive experience, with some members having over 30 years of experience with the Capital Group and the investment industry.

Mutual Funds: Recession-Proof Investment Strategy?

You may want to see also

Frequently asked questions

American Funds' front-end sales charges range from 0% to 5.75%, depending on the type of fund and the amount invested. For example, if you have less than $25,000 invested in a class share equity fund, you will be charged the maximum 5.75%.

The expense ratio varies depending on the fund. For example, the American Funds Fundamental Investors (ANCFX) fund has an expense ratio of 0.24%, while the Growth Fund of America (AGTHX) fund has an expense ratio of 0.60%.

The average annual return varies depending on the fund and the time period. For example, the American Funds American Mutual Fund has returned 0.80% over the past year, 9.49% over the past three years, 7.60% over the past five years, and 8.44% over the past ten years.

In addition to front-end sales charges, American Funds also charges back-end loads and higher expense ratios. These fees are used to pay commissions to brokers and financial advisors who sell their funds.