Index funds are a popular investment choice due to their low costs, diversification, and passive management strategy. They aim to mirror the performance of a specific market index, such as the S&P 500, by holding the same stocks or bonds. This passive approach means index funds are less expensive than actively managed funds and often outperform them over the long term.

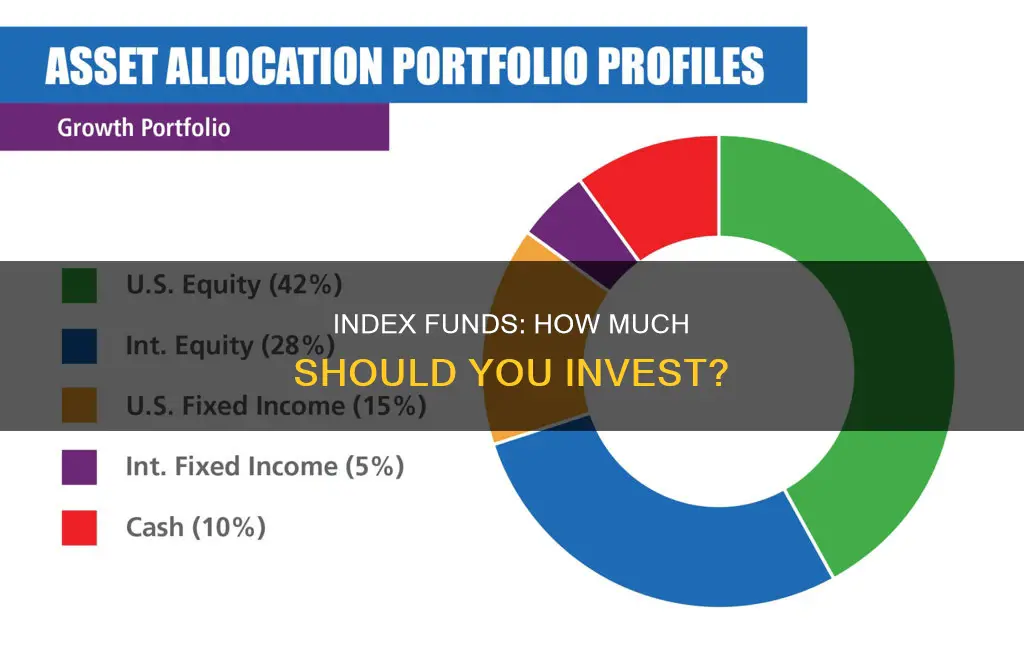

When considering the percentage of your portfolio to allocate to index funds, there is no one-size-fits-all answer. It depends on your investment goals, risk tolerance, and personal preferences. Some investors choose to put their entire portfolio in index funds, while others allocate a smaller percentage, such as 20-30%.

The benefits of index funds include lower fees, broad market exposure, and diversification. On the other hand, critics argue that index funds lack flexibility and are unable to pivot when the market shifts. Additionally, they automatically include all securities in an index, which may result in investing in overvalued or weak companies.

When deciding how much to invest in index funds, it's essential to consider your financial situation, goals, and risk tolerance. Understanding the pros and cons of index funds is crucial to making informed investment decisions.

| Characteristics | Values |

|---|---|

| Popularity | Index funds are popular with investors because they promise ownership of a wide variety of stocks, greater diversification, lower risk, and low cost. |

| Returns | The S&P 500 has made long-term returns of about 10% annually. |

| Diversification | One share of an S&P 500 index fund provides ownership in hundreds of companies, while a share of Nasdaq-100 fund offers exposure to about 100 companies. |

| Risk | Index funds are lower risk than owning a few individual stocks because they are diversified. |

| Cost | Index funds are low cost with a low expense ratio. For larger funds, investors may pay $3 to $10 per year for every $10,000 invested. |

| Performance | The S&P 500, Nasdaq-100, Russell 2000, and Dow Jones Industrial Average are some of the most popular indexes tracked by index funds. |

| Expense Ratio | The average stock index mutual fund charges 0.05% and the average stock index ETF charges 0.16%. |

What You'll Learn

Index funds vs. individual stocks

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are a passive investment strategy, meaning they are designed to replicate the performance of financial market indexes without actively picking securities or timing the market. This makes them a low-cost, low-maintenance way to build wealth over the long term.

On the other hand, investing in individual stocks gives you more control over your portfolio and the potential for higher returns. However, it also comes with higher risk and requires more time and effort to research and monitor your investments.

Risk and Diversification

Index funds are generally considered less risky than individual stocks because they are diversified across a wide range of stocks and assets. This means that even if one company loses value, it is likely that others in the fund will make up for those losses. In contrast, investing in a single stock means that your returns are entirely dependent on the performance of that one company, which can be more volatile.

Performance and Returns

Index funds typically aim to match the performance of the market index they are tracking, while individual stocks have the potential to outperform the market. However, it is difficult to consistently pick winning stocks, and the majority of actively managed funds fail to beat the S&P 500 in the long term. Index funds also tend to have lower fees than actively managed funds, which can improve overall returns.

Management and Control

Index funds are passively managed, meaning they require less time and effort to manage than individual stocks. With index funds, you don't need to actively research and monitor your investments, as the fund's performance is tied to the underlying index. In contrast, investing in individual stocks requires ongoing research and analysis to pick winning stocks and time your trades.

Suitability for Different Investors

Index funds are often recommended for beginners and long-term investors who are looking for a simple, low-cost way to build wealth over time. They are also suitable for investors who want a more hands-off approach to investing or who may not have the time or interest in actively managing their portfolio.

Individual stocks, on the other hand, may be more suitable for experienced investors who enjoy the challenge of trying to beat the market and are willing to take on more risk. They can also be a good option for investors who want more control over their portfolio and are comfortable with the additional time and effort required.

Percentage Allocation

When deciding how much to invest in index funds versus individual stocks, it is important to consider your financial goals, risk tolerance, and investment horizon. Index funds are generally recommended as a core component of a well-diversified portfolio, with individual stocks making up a smaller, more speculative portion.

For example, a common rule of thumb is to allocate 50% to 70% of your portfolio to broad stock market index funds, such as the S&P 500 or total stock market index funds. The remaining 30% to 50% can then be allocated to other asset classes, such as international stocks, bonds, real estate, or individual stocks, depending on your specific goals and risk tolerance.

However, the appropriate allocation will vary depending on your individual circumstances, and it is always a good idea to consult with a financial advisor to determine the right mix for your needs.

Bond Fund Investment: What Percentage is Smart to Invest?

You may want to see also

Advantages of index funds

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500. They are passively managed, meaning they aim to mirror the performance of a specific index rather than trying to beat the market. This passive management strategy offers several advantages over actively managed funds:

Lower Costs

Index funds typically have lower expense ratios because they are passively managed. They require less work than managed accounts, as they don't need to actively decide which investments to buy or sell. As a result, they have lower fees, transaction costs, and commissions than actively managed funds.

Market Representation and Broad Diversification

Index funds aim to mirror the performance of a specific index, offering broad market exposure and diversification across various sectors and asset classes. This is advantageous for investors seeking a diversified investment that tracks overall market trends and reduces the risk of losing money.

Transparency

Since index funds replicate a market index, their holdings are well-known and easily accessible on investing platforms. This transparency allows investors to understand the composition of their investments and make informed decisions.

Historical Performance

Over the long term, index funds have often outperformed actively managed funds, especially after accounting for fees and expenses. This is because actively managed funds rarely beat the market over extended periods, and their higher fees can eat into returns.

Tax Efficiency

Index funds generally have lower turnover rates, resulting in fewer capital gains distributions and making them more tax-efficient than actively managed funds. Actively managed funds, with their higher turnover ratios, tend to trigger more short-term capital gains taxed at higher rates.

While index funds offer these advantages, it's important to remember that they are not a one-size-fits-all solution. They may not be suitable for all investors, and it's essential to consider your financial goals, risk tolerance, and other factors before making investment decisions.

Savings Strategy: Mutual Funds Investment Allocation

You may want to see also

Disadvantages of index funds

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500. They are designed to mirror the performance of financial market indexes and are a popular choice for investors seeking low-cost, diversified, and passive investments. However, they also come with certain disadvantages that investors should be aware of. Here are some of the key drawbacks of index funds:

Lack of Flexibility: Index funds are designed to mirror the performance of a specific market index, which means they decline in value when the market does. They lack the flexibility to pivot away from a declining market and cannot actively adjust their holdings to take advantage of new opportunities or mitigate losses.

Inclusion of All Securities: Index funds automatically include all the securities in an index, which means they may invest in overvalued or weak companies. This can result in lower returns compared to actively managed funds that can choose which securities to hold based on their performance and potential.

Market-Cap Weighting: Many index funds use market-cap weighting, where companies with higher market capitalisations have a more significant influence on the fund's performance. This concentration can lead to excessive dependence on the fate of a few large companies, magnifying the risks if these companies underperform.

Limited Downside Protection: In prolonged downtrends, index funds can perform poorly in line with the broader market. Unlike actively managed funds, index funds do not have the flexibility to limit downside risk by holding only performing securities or moving to cash positions.

Potential Opportunity Cost: By investing in index funds, investors may miss out on the potential for higher returns offered by actively managed funds. If fund managers can successfully identify and invest in securities with strong performance, the returns may surpass those of index funds, which are limited by their passive nature.

How to invest in index funds

Index funds are a low-cost, easy way to build wealth. They are a group of stocks that mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index. Index funds don't try to beat the market or earn higher returns compared to market averages. Instead, they try to be the market by buying stocks of every firm listed on a market index to match its performance.

Here's how to invest in index funds:

- Have a goal for your index funds: Know what you want your money to do for you. If you're looking to make a lot of money in a few years and are willing to take risks, you may be more interested in individual stocks or cryptocurrencies. However, if you want to slowly grow your money over time, especially if you're saving for retirement, index funds may be a great investment for your portfolio.

- Research index funds: Once you know which index you want to track, look at the actual index funds you'll be investing in. Consider factors such as company size and capitalization, geography, business sector or industry, asset type, and market opportunities.

- Pick your index funds: Choose which corresponding index fund to buy, often based on cost. Index funds are cheap to run because they are automated to follow shifts in value in an index. However, they still carry administrative costs that are subtracted from each fund shareholder's returns as a percentage of their overall investment.

- Decide where to buy your index funds: You can purchase an index fund directly from a mutual fund company or a brokerage. Exchange-traded funds (ETFs) are like mini mutual funds that trade like stocks throughout the day. When choosing where to buy an index fund, consider fund selection, convenience, trading costs, impact investing, and commission-free options.

- Buy index fund shares: You can open a brokerage account that allows you to buy and sell shares of the index fund that interests you. Alternatively, you can open an account directly with a mutual fund company that offers the index fund you want. Look at costs and features when deciding the best way to buy shares of your index fund.

- Keep an eye on your index funds: Although index funds are passive investments, you should still monitor their performance. Your index fund should mirror the performance of the underlying index. Check the index fund's returns on the mutual fund quote page and compare them to the performance of the benchmark index.

Index funds are a great investment for building wealth over the long term, especially for retirement investors. They are less expensive than actively managed funds and typically carry less risk than individual stocks.

When to invest in index funds

Index funds are a great investment for building wealth over the long term. They are a group of stocks that mirror the performance of an existing stock market index, such as the Standard & Poor's 500 Index.

Index funds are considered a passive management strategy as they don't require active decision-making on which investments to buy or sell. They are also a great way to balance the risk in an investor's portfolio as market swings tend to be less volatile across an index compared to individual stocks.

Long-term Performance:

It is important to evaluate the long-term performance of an index fund, ideally over a period of at least five to ten years, to understand its potential future returns. While past performance does not guarantee future results, it gives you a good indication of how the fund has fared over time.

Expense Ratio:

The expense ratio is the ongoing fee charged by the fund company, expressed as a percentage of your overall investment. It is important to compare the expense ratios of different funds tracking the same index, as there can be significant variations. For example, funds tracking the S&P 500 Index typically have lower expense ratios compared to funds tracking other indexes.

Trading Costs:

Consider the trading costs associated with purchasing the index fund. Some brokers may offer attractive prices for mutual funds, while others may charge commissions or transaction fees. When it comes to ETFs, most major online brokers now allow trading without commissions.

Investment Minimums:

Mutual funds often have a minimum investment amount for your initial purchase, which can range from a few hundred to a few thousand dollars. In contrast, ETFs usually do not have a minimum investment requirement, and some brokers even allow you to buy fractional shares.

Taxes:

Mutual funds tend to be less tax-efficient than ETFs due to taxable capital gains distributions at the end of the year. ETFs, on the other hand, do not have this requirement, making them more tax-efficient.

Broad Diversification:

Index funds offer immediate diversification, allowing you to own a wide range of companies across different sectors and industries with a single purchase. This lowers your risk compared to investing in individual stocks, as your portfolio is not dependent on the performance of a few companies.

Market Conditions:

Index funds are suitable for long-term investing, and it is generally a good time to invest if you are prepared to hold them for the long term. The market tends to rise over time, and by investing regularly, you can take advantage of dollar-cost averaging to lower your risk.

In summary, when deciding when to invest in index funds, consider the fund's long-term performance, fees, trading costs, investment minimums, tax efficiency, diversification benefits, and market conditions. Remember to choose funds that align with your investment goals, risk tolerance, and time horizon.

Frequently asked questions

An index fund is a group of stocks that aims to mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index.

There is no right answer to this question. It depends on what you are comfortable with and your style of investing. Some people put it all into the index, some people put 20-30%.

Index funds are a low-cost, easy way to build wealth. They are less expensive than actively managed funds and typically carry less risk than individual stocks. They are also popular with retirement investors.

Index funds are vulnerable to irrational market forces. They may also be too heavily exposed to a particular asset or sector, which could result in losses.

You can purchase an index fund directly from a mutual fund company or a brokerage. You will need to open an investment account, such as a brokerage account, individual retirement account (IRA) or Roth IRA.