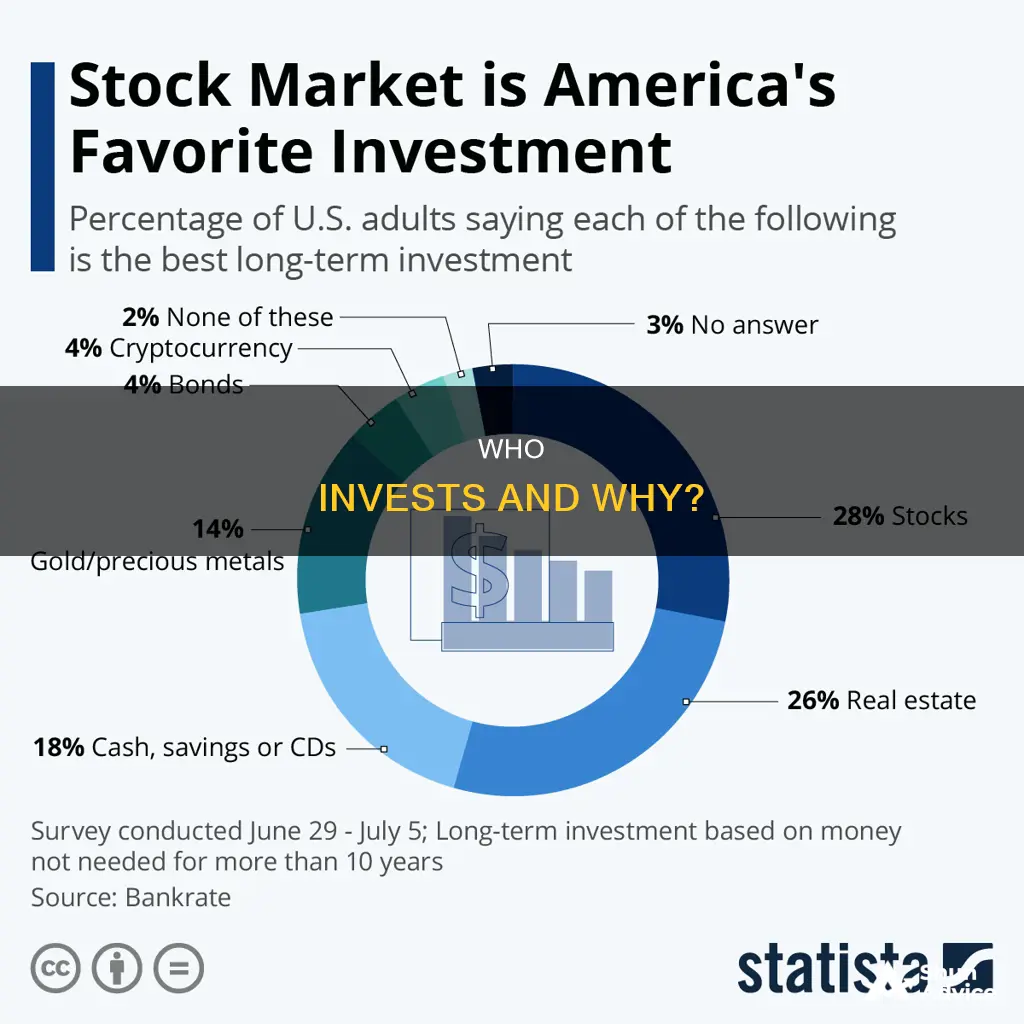

The percentage of people who invest varies depending on the population and region surveyed. In the US, about 55% to 61% of Americans own stocks, with the top 1% holding 49% of stocks. In Canada, about 33% of the population had invested in the stock market in 2021, and Canada has the highest rate of Gen Z investors, with nearly 74% reporting that they have at least one type of investment.

What You'll Learn

Racial and ethnic gap among investors is narrowing

While the racial wealth gap in the United States remains stark, there are some signs that it is beginning to narrow. This is particularly true when it comes to investing in stocks, which is increasingly accessible thanks to technological advancements.

Historical Context

The racial wealth gap in the US has been exacerbated by centuries of discriminatory public policies, financial practices, and societal norms that have limited Black wealth accumulation. This includes practices such as segregation, redlining, and blockbusting, which have resulted in racial disparities in homeownership. Additionally, the relative youth of the Hispanic population and their immigration status have contributed to lower wealth accumulation for this demographic.

Current State

Despite these longstanding disparities, there are indications that the racial and ethnic gap among investors is narrowing. According to a 2015 survey by Ariel, when asked if they owned stocks or stock mutual funds, 86% of whites said they did, compared to 67% of African Americans. While this disparity persists, it has improved since Ariel's 2010 survey, which showed a 7% increase for both groups.

Similarly, a comparison of wealth distribution within racial and ethnic groups from 2019 to 2021 reveals a narrowing gap. For example, the ratio of wealth between richer and more solvent Black households decreased from 136 in 2019 to 62 in 2021. The same trend was observed among Hispanic households, with the ratio decreasing from 45 in 2019 to 28 in 2021.

Factors Contributing to the Narrowing Gap

Several factors are contributing to the narrowing racial and ethnic gap among investors. One key factor is the increasing accessibility of investing due to technological advancements. Today, anyone with internet access and some capital can easily open a trading account and start investing. This has helped level the playing field, making it easier for individuals from diverse backgrounds to enter the world of investing.

Additionally, online investing and education tools are playing a crucial role in bridging the gap. These tools provide individuals from underrepresented groups with the knowledge and resources they need to make informed investment decisions. Demographic changes, with a more diverse and tech-savvy generation entering the workforce, are also contributing to the narrowing gap.

Challenges and Opportunities

While the gap is narrowing, it is important to acknowledge that significant disparities remain. For instance, Black and Hispanic households still trail White and Asian households in terms of overall wealth. Additionally, Black and Hispanic communities tend to have lower financial literacy rates, which can impact their investment decisions and wealth accumulation.

To further narrow the gap, it is essential to address the structural barriers and socioeconomic factors that contribute to the racial wealth gap. This includes tackling discrimination, providing equal access to financial education, and promoting business ownership within underrepresented communities. By addressing these issues, we can work towards a more equitable future where the racial and ethnic gap among investors is truly bridged.

Fitness Investment: What's the Priority?

You may want to see also

Investing gets gamified

The world of investing has traditionally been seen as a complex and exclusive domain, but a new wave of innovation is challenging this perception. Through the "gamification" of investing, the financial landscape is becoming more accessible and appealing to a broader audience. This trend is particularly evident in the rise of smartphone-based trading apps, which have tapped into the gaming psyche to attract millions of new investors.

Breaking Down Barriers

Investing was once the preserve of a wealthy minority, with high costs and a lack of information creating barriers for everyday consumers. However, the emergence of commission-free trading apps, such as Robinhood, has disrupted this traditional model. By integrating game-like elements, these platforms have simplified the investment process, making it more user-friendly and engaging.

Intuitive interfaces, progress bars, achievement badges, and user-friendly dashboards have replaced the confusion of industry jargon and technical intricacies. This gamified approach has effectively lowered the psychological barriers associated with finance, enticing a new generation of investors.

Education Through Entertainment

Gamification also offers an innovative way to educate investors. Tutorials, quizzes, articles, and videos are seamlessly integrated into the investment experience, empowering users to make informed decisions. Some platforms even provide simulations that allow users to practice trading with virtual currency, offering a risk-free learning environment.

This fusion of gaming and education is a powerful tool for nurturing confidence and financial literacy among investors. It encourages users to explore the market, learn about investment strategies, and manage their portfolios with enthusiasm, going beyond the dry, text-heavy financial resources of the past.

Competition and Community

The competitive aspect of gamification is introduced through leaderboards, where users can compete with friends and peers, adding a layer of challenge and achievement. Investing becomes a social activity, with online communities and forums dedicated to discussing specific stocks or market trends.

This sense of community and competition can be particularly appealing to younger investors, who may view investing as a hobby or a game. It adds an element of interactivity and excitement to the financial world, fostering a sense of engagement and ownership among users.

Navigating Risks

While gamification has undeniable benefits, it's important to acknowledge potential drawbacks. One concern is that gamified platforms can encourage impulsive or risky trading behaviour. The pursuit of rewards and higher scores may lead to excessive risk-taking, with investors prioritising short-term gains over long-term financial strategies.

To address this, investors must recognise their role in managing risks. This involves conducting thorough research, understanding the potential consequences of their actions, and maintaining a long-term perspective. Additionally, platform developers should prioritise education and encourage smart decision-making, rather than solely focusing on quick, impulsive actions.

A Balanced Approach

Gamification has the potential to revolutionise the investing experience, making it more accessible and enjoyable. However, it must be approached with vigilance and responsibility. Investors, platform developers, and regulators all have a role to play in encouraging the benefits of gamification while mitigating potential risks.

By combining the engaging elements of gaming with financial discipline and education, investors can leverage the advantages of gamification while safeguarding their financial future. This balanced approach ensures that the investing game is played wisely and responsibly.

Cruise Investments: Worth the Money?

You may want to see also

New retail investors are younger and lower income

The COVID-19 pandemic saw a surge in new retail investors entering the stock market, with 15% of current retail investors beginning their investment journey in 2020. This new wave of investors has been dubbed ""Generation Investor" by Charles Schwab, with a median age of 35 compared to the pre-2020 investor median age of 48. The average age of individual investors has dropped by 8 years to below 50 in the past three years.

Generation Investor is a diverse group, with over 50% millennials, 22% Gen X, 16% Gen Z, and 11% baby boomers. They are also more financially impacted by the pandemic, with 55% starting to invest to build an emergency fund and 53% seeking an additional source of income. This group is optimistic about the market, with nearly three-quarters confident in the U.S. stock market's future and over half believing the market will increase in 2021.

The pandemic and lockdown measures influenced a shift in behaviour, with many turning to the stock market as a substitute for sports gambling. Smartphone apps such as Robinhood, aimed at younger traders, played a significant role in this trend. The rise of neo-brokers, or new market intermediaries based outside of France, has also contributed to the increase in younger investors. The percentage of transactions through neo-brokers jumped from 10% in Q3 2018 to 21.8% in Q3 2021.

While the top 1% of Americans hold 49% of stocks, the younger Generation Investor group largely falls into the bottom 50% of stock ownership. This younger cohort is gradually investing more, with millennials increasing their stock ownership over the last decade, and Gen Z investors entering the market.

Investing: Inspired by Future Security

You may want to see also

Young investors seek advice from social media

Social media has become a popular source of financial guidance for young people, with a notable proportion of young investors making investment decisions based on social media advice. This shift has raised concerns about the reliability and accuracy of the financial information disseminated on these platforms.

Prevalence of Social Media for Financial Advice

According to a Deloitte survey of over 2,500 UK consumers in 2023, 25% of 18-24-year-old banking customers use social media for financial guidance. This trend is not limited to the UK; a survey by the Cyprus Securities and Exchange Commission (CySEC) found that 22% of retail investors across the UK, France, Germany, and Cyprus are influenced by social media promotions or celebrity endorsements in their investment decisions.

Investment Decisions Influenced by Social Media

The influence of social media on investment choices is significant, with one in five (20%) 18-24-year-olds in the UK investing money based on social media recommendations. This influence extends to cryptocurrency, with 21% investing in crypto due to social media guidance. Platforms such as TikTok, YouTube, Instagram, and Twitter are particularly popular among young people seeking financial content, with 31% of respondents making financial investments based on influencer advice on these channels.

Risks and Concerns

While social media can provide a sense of community and engagement for investors, there are concerns about the quality and reliability of financial advice offered on these platforms. The rise of "fintech influencers" or "finfluencers" has led to worries about the spread of financial misinformation and the promotion of ill-advised products. Margaret Doyle, chief insights officer at Deloitte, cautions that relying on social media for financial advice makes individuals vulnerable to scams, phishing, and risky financial decisions.

Investor Profile

Investors who use social media as an information source tend to be younger, less likely to be women, and have lower-valued investment portfolios and lower objective financial knowledge. They also tend to trade more frequently and are motivated by social connection, a desire to be socially responsible, and a willingness to learn about investing.

Impact of Social Media on Investor Behaviour

The growing influence of social media on investment decisions has had a noticeable impact on investor behaviour. For example, the "meme stock" phenomenon, where social media hype fuelled frenzied investment in stocks like GameStop, and the surge in retail stock buying in 2021, led by coordinated retail investors on social media.

Investor Education and Protection

As social media continues to shape investment trends and decisions, there is a growing need for investor education and protection. While some investment information on social media is of high quality, there is also a significant amount of unreliable content. Researchers have found that investors often rely on social media advice, even when it is low in quality. This highlights the importance of critical evaluation of online financial advice and the role of financial professionals in providing reliable information to counter potentially harmful content.

Social media has become an influential source of financial guidance for young investors, shaping their investment decisions and behaviours. While it offers benefits in terms of accessibility and community engagement, the risks associated with misinformation and unreliable advice cannot be overlooked. As social media's role in financial decision-making evolves, there is a pressing need for investor education, protection, and the provision of reliable information by financial professionals to ensure positive outcomes for young investors.

Poor People: Investing Risk?

You may want to see also

Financial literacy is declining in the US

One reason for this decline could be the decrease in math skills, as financial literacy often depends on basic math abilities. Additionally, the questions on financial surveys may be becoming less relevant to the lives of most Americans, with many individuals struggling to pay rent or facing credit card debt instead of dealing with mortgages or investments.

The lack of financial literacy education in schools is also a contributing factor. While subjects like math and science receive consistent focus and funding, personal finance education is often lacking in the classroom. This is reflected in the fact that only 17% of US adults reported taking a personal finance class in high school, and 88% felt that high school did not prepare them for handling money in the real world. As a result, many Americans are left to learn financial skills from friends and family, which can lead to lower rates of financial literacy and higher rates of overconfidence.

Despite the decline in financial literacy, stock ownership in the US has been increasing. As of 2024, about 61% of Americans own stock, up from 56% in 2021 and the highest it has been since 2008. However, stock ownership is unevenly distributed, with the wealthiest 1% holding 49% of stocks. Direct stock ownership has also increased, reaching pre-2008 levels, driven in part by COVID-related behavior changes and the rise of smartphone-based trading apps.

Investing in People: The Church's Role

You may want to see also

Frequently asked questions

In the US, about 61% of adults invest in the stock market, according to a 2024 Gallup survey. In Canada, about a third of the population had invested in the stock market in 2021.

The percentage of people investing in the stock market has generally increased over time. In the US, stock ownership averaged 62% between 2001 and 2008, fell after the 2007-2009 recession, and has been increasing since 2013, reaching pre-2008 levels in 2022.

Stock ownership varies significantly by demographic. In the US, older, wealthier, non-Hispanic white Americans are more likely to own stocks. Baby boomers hold the largest share of stocks, while Gen Z investors are learning how to invest and entering the market. The racial gap in stock market participation is narrowing, with younger Black Americans participating more in stock market investing.