Navigating 401(k) investments during election years can be challenging due to the heightened volatility and uncertainty that often accompany political transitions. This guide aims to provide insights into safe investment strategies for 401(k) plans during election years, helping investors make informed decisions to protect and grow their retirement savings.

What You'll Learn

- Market Volatility: Understand how election years impact stock and bond markets

- Economic Policies: Research how new policies might affect your 401(k) investments

- Political Uncertainty: Assess the potential risks and rewards of uncertain political landscapes

- Diversification Strategies: Explore ways to diversify your 401(k) portfolio for election-year volatility

- Tax Implications: Learn about potential tax changes and their impact on your retirement savings

Market Volatility: Understand how election years impact stock and bond markets

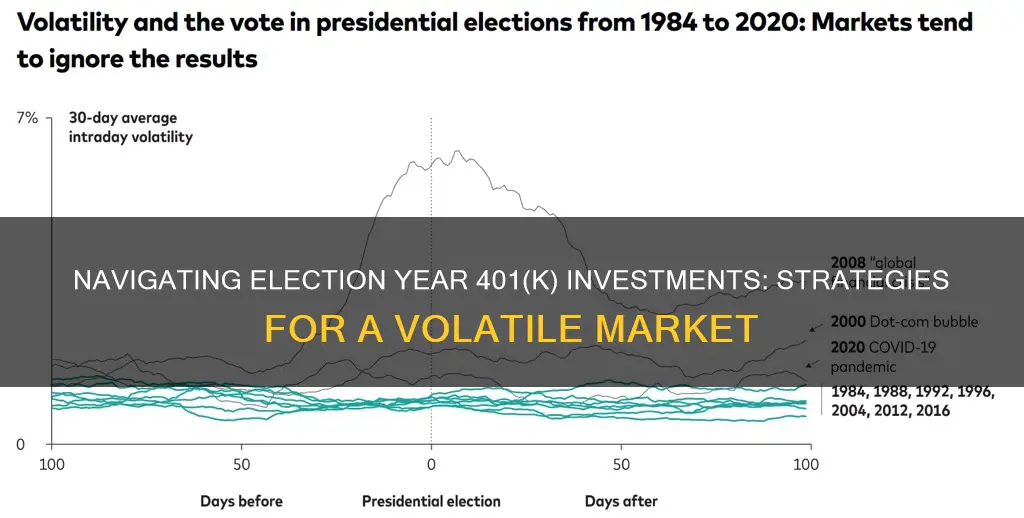

Election years often bring a unique set of challenges and opportunities for investors, particularly those looking to safeguard their retirement savings in a 401(k) plan. The political landscape can significantly influence market dynamics, causing volatility in stock and bond markets. Understanding these patterns is crucial for making informed investment decisions.

During election years, the stock market tends to experience increased volatility. This is primarily due to the uncertainty surrounding policy changes and economic directions that a new administration might bring. Investors often witness heightened market swings as political events and campaign promises drive sentiment and market reactions. For instance, a presidential candidate's focus on tax reforms or trade policies can lead to rapid shifts in stock prices, especially for sectors directly impacted by these potential changes.

Bonds, on the other hand, may offer a more stable investment option during election years. Historically, bonds have been considered a safe-haven asset, providing a hedge against market volatility. When stocks become uncertain, investors often turn to bonds for their perceived stability. Government bonds, in particular, are frequently sought after as they are seen as a low-risk investment, especially in times of political uncertainty.

However, it's important to note that election years can also present opportunities for investors. Market downturns often create attractive entry points for long-term investors. When the market becomes volatile, prices of quality stocks and bonds may become undervalued, offering potential gains for those who buy at the right time. Diversification is key during these periods, ensuring that your 401(k) portfolio is spread across various asset classes to mitigate risk.

In summary, election years can impact investment strategies in various ways. While stock markets may become more volatile due to political uncertainty, bonds can provide a stable counterbalance. Investors should stay informed about political developments and market trends to make timely adjustments to their 401(k) portfolios, ensuring a balanced approach that aligns with their risk tolerance and retirement goals.

Is Robinwood a Safe Investment Choice? Unlocking the Truth

You may want to see also

Economic Policies: Research how new policies might affect your 401(k) investments

During election years, the political landscape can shift dramatically, and this often has a significant impact on investment strategies, especially for 401(k) plans. As an investor, it's crucial to understand how economic policies and political decisions can influence your retirement savings. Here's a breakdown of how to approach your 401(k) investments during an election year:

Research and Stay Informed: Start by researching the economic policies and stances of the major political parties and candidates. Election years often bring about changes in tax laws, trade policies, and fiscal spending, all of which can affect the stock market and various asset classes. For instance, a candidate's platform might include plans to increase or decrease taxes, regulate specific industries, or implement new trade tariffs. These policies can directly impact the performance of certain sectors and companies. Utilize financial news sources, government websites, and reputable investment research platforms to gather information.

Diversify Your Portfolio: Election uncertainty can lead to market volatility, making diversification even more critical. Consider rebalancing your 401(k) portfolio to include a mix of asset classes such as stocks, bonds, real estate investment trusts (REITs), and alternative investments. Diversification helps reduce risk by spreading your investments across different sectors and asset types. During election years, certain sectors might perform better or worse based on policy changes, so having a well-diversified portfolio can provide a more stable investment experience.

Consider Sector-Specific Opportunities: Research specific sectors that might benefit or suffer due to potential new policies. For example, if a candidate proposes significant changes to healthcare regulations, the healthcare sector's performance could be impacted. Similarly, sectors like energy, finance, or technology might be affected by different economic policies. Understanding these sector-specific trends can help you make informed decisions about buying or selling certain investments within your 401(k) plan.

Monitor Market Sentiment and Volatility: Election years often bring increased market volatility due to uncertainty and potential policy shifts. Keep a close eye on market sentiment and be prepared to adjust your investments accordingly. This might involve regularly reviewing your 401(k) holdings and making strategic moves to protect your portfolio. For instance, you might consider moving a portion of your investments to more conservative asset classes during periods of high market volatility.

Seek Professional Advice: Consider consulting a financial advisor or retirement specialist who can provide personalized guidance based on your risk tolerance and investment goals. They can help you navigate the complexities of election-year investments and ensure your 401(k) strategy remains aligned with your long-term financial objectives. A financial advisor can also assist in creating a robust investment plan that accounts for various economic scenarios.

Investment Managers: New Products, Alpha Generation?

You may want to see also

Political Uncertainty: Assess the potential risks and rewards of uncertain political landscapes

In times of political uncertainty, especially during election years, investors often face a challenging environment for their 401(k) investments. The outcome of elections can significantly impact various sectors and industries, creating a volatile market. Here's an analysis of the risks and potential rewards in such a scenario:

Risks of Political Uncertainty:

- Policy Changes: Election years often bring about policy shifts, especially in areas like taxation, trade, and regulation. Uncertain political landscapes may lead to sudden changes in tax laws, which could affect the performance of certain investments. For instance, a new administration might introduce higher taxes on dividends or capital gains, impacting the overall returns on stocks and mutual funds.

- Market Volatility: Political instability can cause market volatility, especially in the short term. Investors might witness increased market fluctuations as news and policies are announced, potentially leading to losses if not managed properly. This volatility can be particularly concerning for retirement accounts, where long-term growth is a primary goal.

- Sector-Specific Impact: Different political agendas can favor or disfavor specific sectors. For example, a shift towards environmental policies might benefit renewable energy companies but could negatively impact traditional energy industries. Investors should carefully consider their asset allocation to avoid concentrated risk.

Rewards and Opportunities:

- Stimulus and Infrastructure: Election years sometimes result in stimulus packages or infrastructure investments, which can boost the economy. These initiatives might lead to increased corporate profits and stock market gains. Sectors like construction, transportation, and technology could potentially thrive during such periods.

- Long-Term Growth Potential: Despite short-term volatility, uncertain political landscapes can create opportunities for long-term investors. History shows that markets tend to recover and grow over time, especially after periods of political transition. Diversified portfolios that include a mix of stocks, bonds, and alternative investments can weather these storms.

- Strategic Asset Allocation: Investors can strategically adjust their 401(k) portfolios to navigate political uncertainty. This may involve rebalancing towards more defensive assets like bonds or considering international investments to diversify away from domestic political risks.

During election years, staying informed about political developments and their potential economic implications is crucial. Investors should consider consulting financial advisors to create a well-diversified portfolio that aligns with their risk tolerance and retirement goals. While political uncertainty presents risks, a thoughtful investment strategy can help mitigate these challenges and potentially capitalize on the rewards that emerge from political transitions.

Vacuum's Impact on Investment Powder: Rise Explained

You may want to see also

Diversification Strategies: Explore ways to diversify your 401(k) portfolio for election-year volatility

In the context of election years, investors often face heightened market volatility and uncertainty. Diversification is a key strategy to mitigate these risks and ensure your 401(k) portfolio remains stable and aligned with your long-term financial goals. Here are some strategies to consider:

- Asset Allocation: Review and adjust your asset allocation within the 401(k) plan. Typically, a well-diversified portfolio includes a mix of stocks, bonds, and alternative investments. During election years, consider rebalancing your portfolio to favor more defensive assets. For instance, increase your bond allocation as they are generally less sensitive to market fluctuations. Stocks, especially those in the S&P 500, might experience increased volatility, so a more conservative approach could be to hold a mix of large-cap and mid-cap stocks across various sectors.

- Sector Allocation: Diversify your investments across different economic sectors. Election outcomes can impact various industries differently. For example, a change in political leadership might affect sectors like healthcare, energy, or technology. By holding a broad range of sectors, you reduce the risk associated with any single industry's performance. Consider adding investments in sectors like utilities, consumer staples, or real estate investment trusts (REITs), which are often seen as safe havens during turbulent times.

- International Exposure: Expanding your 401(k) portfolio's international reach can be a strategic move. International markets often react differently to domestic political events, and this can provide a hedge against domestic volatility. Invest in international exchange-traded funds (ETFs) or mutual funds that track global markets. This approach allows you to gain exposure to diverse economies and potentially reduce the impact of election-related market swings.

- Alternative Investments: Explore alternative investment options within your 401(k) plan, such as real estate investment trusts (REITs), commodities, or private equity funds. These investments can provide portfolio diversification and potentially offer protection against market downturns. For instance, REITs can provide stable dividend income and exposure to the real estate market, while commodities like gold or silver can act as a hedge against inflation and market uncertainty.

- Regular Review and Rebalancing: Election years can be a good reminder to review and rebalance your 401(k) portfolio. Regularly assess your asset allocation and make adjustments to maintain your desired risk level. Over time, market conditions change, and your investment strategy should adapt accordingly. Rebalancing ensures that your portfolio remains aligned with your risk tolerance and investment goals, providing a more stable long-term performance.

By implementing these diversification strategies, you can navigate election-year volatility and potentially minimize the impact of market fluctuations on your retirement savings. It's important to remember that diversification does not guarantee profit or protect against losses in a declining market, but it can provide a more stable investment experience over the long term.

Investing in Multiple Assets: A Smart Strategy?

You may want to see also

Tax Implications: Learn about potential tax changes and their impact on your retirement savings

The tax landscape can significantly influence your retirement savings, especially during election years when political decisions often bring about changes in tax policies. Understanding these potential shifts is crucial for making informed investment choices in your 401(k) plan. Here's a breakdown of the tax implications and how they might affect your retirement strategy:

Tax Code Changes: Election years often witness revisions to the tax code, which can directly impact your 401(k) contributions and withdrawals. For instance, the Tax Cuts and Jobs Act (TCJA) of 2017 introduced significant changes, including increased standard deduction amounts, which reduced the number of itemizers. This shift potentially affected how individuals approached their retirement savings contributions. It's essential to stay updated on such changes to ensure your retirement strategy remains aligned with the latest tax laws.

Retirement Savings Contributions: Tax policies can influence the tax treatment of your 401(k) contributions. For example, if tax rates are expected to rise in the future, individuals might consider contributing more to their 401(k)s to take advantage of the current lower tax rates. Conversely, during years with anticipated tax rate decreases, some may opt to reduce contributions or explore alternative investment options. Understanding these dynamics can help you optimize your retirement savings strategy.

Withdrawal and Distribution Rules: Tax laws also dictate the rules for withdrawing funds from your 401(k) during retirement. Changes in tax rates can impact the tax liability on withdrawals. For instance, if tax rates are lower during retirement, you might pay less in taxes on your 401(k) distributions. Additionally, understanding the rules for required minimum distributions (RMDs) is crucial. RMDs are mandatory withdrawals from traditional 401(k) accounts after a certain age, and changes in tax laws could affect the timing or amount of these distributions.

Investment Options and Tax Efficiency: Election years might prompt employers to review and adjust their 401(k) investment menus. This could include adding or removing specific investment options. When considering new investments, it's essential to evaluate their tax efficiency. Some investments may offer tax advantages, such as tax-deferred growth or tax-free distributions, which can significantly impact your long-term retirement savings.

Long-Term Strategy: While short-term tax changes are essential to consider, it's equally important to view your retirement savings strategy through a long-term lens. Historical data suggests that tax policies tend to stabilize over time, and election-year fluctuations often have a minimal, temporary impact. Focus on diversifying your 401(k) investments, regularly reviewing your portfolio, and staying committed to your retirement goals.

529 Savings Plans: Smart Investment Strategies, per Forbes

You may want to see also

Frequently asked questions

During election years, the markets can be volatile due to political uncertainty and potential policy changes. It's generally advisable to stick to more conservative investment strategies. Here are some safe options:

- Index Funds or ETFs: These offer diversification across various assets, reducing risk. Look for S&P 500 or total market index funds, which track the performance of a broad market index.

- Bond Funds: Fixed-income investments like bond funds provide a steady income stream and are less sensitive to market fluctuations. Consider government or corporate bond funds with a higher credit rating.

- Target Date Funds: These funds are designed to be more conservative as you approach retirement, automatically adjusting their asset allocation. They can be a good long-term strategy.

Diversification is key to managing risk. Here's a strategy:

- Divide your 401(k) between stocks and bonds. A common approach is to have a higher percentage of stocks for long-term growth and a moderate-to-high allocation to bonds for stability.

- Consider sector-specific investments. For example, invest in healthcare or consumer staples, which tend to be more defensive and less affected by market swings.

- Explore real estate investment trusts (REITs) or commodities, which can provide diversification and act as a hedge against market volatility.

While it's challenging to predict market movements solely based on elections, certain sectors might be more susceptible to political influence:

- Financials: Banks and financial institutions may be affected by regulatory changes.

- Energy: Political decisions on environmental policies can impact the energy sector.

- Defense and Aerospace: Government spending and policy shifts can influence these industries.

- Retail: Election outcomes can affect consumer spending habits and the performance of retail companies.

It's important to remember that investment decisions should be based on your risk tolerance, time horizon, and financial goals. Consulting a financial advisor can provide personalized guidance during such times.