When it comes to managing your money and planning for the future, a financial planner or investment manager can be a valuable asset. But how do you choose the right one for your needs? Here are some key things to consider when selecting a financial planner:

- Credentials and Specializations: Financial planners can have various credentials and specializations, such as Certified Financial Planner (CFP), Registered Investment Advisor (RIA), or Chartered Special Needs Consultant (ChSNC). Look for professionals with relevant qualifications and expertise in the areas you need, such as tax planning, investment management, or estate planning.

- Fee Structures: Financial planners can charge in different ways, including fee-only, commission-based, or a combination of both. Fee-only planners charge a flat fee or an hourly rate, while commission-based planners earn commissions from selling financial products. Understand the fee structure to ensure it aligns with your budget and preferences.

- Fiduciary Duty: A fiduciary is legally bound to act in their client's best interests. Some financial planners, like CFPs, have a fiduciary duty, while others, like broker-dealers, only need to recommend suitable products. Understanding their duty can help you assess potential conflicts of interest.

- Investment Philosophy and Benchmarks: It's important to find a financial planner whose investment philosophy aligns with your own. Ask about their investment approach, diversification strategies, and the benchmarks they use to measure performance. Ensure their strategies match your risk tolerance and financial goals.

- Custodians and Tax Implications: Inquire about the custodian they use to hold your investments. Ideally, they should use an independent custodian for added safety. Also, discuss the potential tax implications of their investment strategies to ensure your advisor considers your tax bill when making financial decisions.

- Communication and Accessibility: Understand how often you will meet with your financial planner and whether they are accessible via phone or email outside of scheduled appointments. Clear communication and regular updates are essential for a successful working relationship.

- References and Background Checks: Don't hesitate to ask for references and check their background. You can use resources like FINRA's BrokerCheck tool, the CFP verification tool, or the SEC's Action Lookup tool to review their qualifications, disciplinary history, and any complaints.

- Interview Multiple Candidates: Before making a decision, interview at least three financial planners to compare their services, styles, and fees. This will help you find the best fit for your financial needs and ensure you are comfortable with the planner you choose.

| Characteristics | Values |

|---|---|

| Credentials | Certified Financial Planner (CFP), Registered Investment Advisor (RIA), Certified Public Accountant (CPA), Chartered Special Needs Consultant (ChSNC) |

| Services | Investment advising, debt management, budget assistance, college savings preparation, retirement planning, estate planning, long-term healthcare and insurance assistance, tax planning |

| Fiduciary duty | Legally bound to act in the client's best interests |

| Payment structure | Fee-only, fee-based, commission-based, hourly rate, flat rate, assets under management (AUM) |

| Specialisations | Tax planning, asset allocation, risk management, retirement planning, estate planning |

| Communication | Regular meetings, phone calls, emails |

What You'll Learn

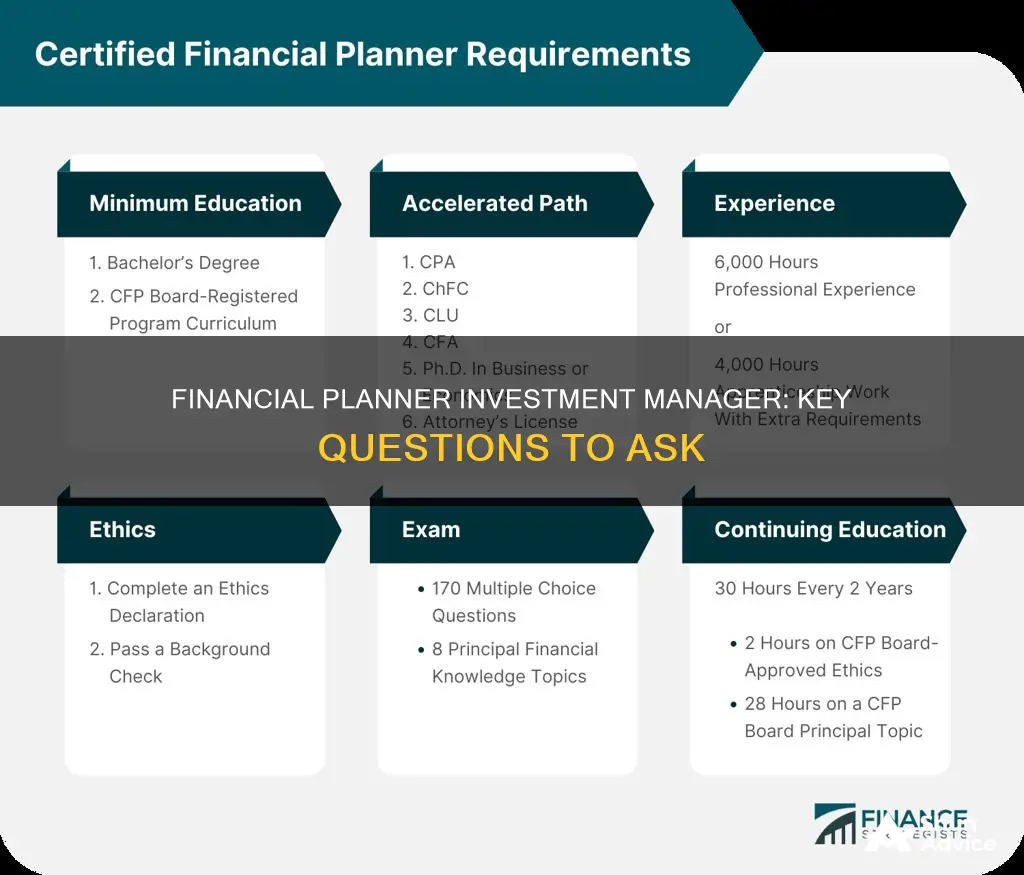

Credentials and qualifications

When it comes to the credentials and qualifications of a financial planner or investment manager, there are several aspects to consider. Firstly, it is important to distinguish between financial advisors, who provide general advice and services, and certified financial planners (CFPs), who have undergone rigorous education and training to attain their designation. CFPs are held to fiduciary standards, meaning they are legally obligated to act in their client's best interests and disclose any conflicts of interest. They must adhere to strict standards set by the Certified Financial Planner Board of Standards, including holding at least a bachelor's degree or equivalent experience, and completing 30 hours of continuing education every two years.

When evaluating the credentials of a financial professional, it is essential to verify their specific designations, licenses, and certifications. Some common credentials to look for include:

- Certified Financial Planner (CFP)

- Registered Investment Advisor (RIA)

- Chartered Special Needs Consultant (ChSNC)

- Certified Public Accountant (CPA)

These designations signify that the individual has undergone specialized training and possesses expertise in specific areas of finance. It is also worth noting that financial advisors who are fiduciaries are bound by law to act in their client's best interests, while non-fiduciary advisors only need to provide advice that is "suitable" for the client.

Additionally, it is important to review the disciplinary history of a financial planner or investment manager. Reputable sources such as the Certified Financial Planner Board of Standards' CFP lookup tool, FINRA's BrokerCheck tool, and the SEC's Action Lookup tool can provide information on any formal complaints or legal actions taken against a financial professional.

When choosing a financial planner or investment manager, it is crucial to ensure that their qualifications align with your specific needs and financial goals. Some financial professionals may specialize in certain areas, such as tax planning, estate planning, retirement planning, or investment management. Therefore, it is beneficial to select an individual who has the necessary credentials and expertise to address your unique financial situation and objectives.

Furthermore, it is essential to understand the regulatory framework governing financial planners and investment managers. While the term "financial advisor" is not regulated, certain designations, such as CFP and RIA, are regulated by specific organizations or government entities. For example, RIAs are regulated by the U.S. Securities and Exchange Commission (SEC) or state securities regulators, depending on the value of assets under management.

In summary, when evaluating the credentials and qualifications of a financial planner or investment manager, it is important to verify their designations, licenses, and certifications, review their disciplinary history, ensure their expertise aligns with your needs, and understand the regulatory framework governing their profession. By conducting thorough research and due diligence, you can make an informed decision when selecting a financial professional to work with.

Building a Solid Investment Portfolio: RIA Strategies

You may want to see also

Fee structure

When it comes to the fee structure of a financial planner or investment manager, there are a few options. It's important to understand how your financial planner will be compensated for their services, as this can impact the recommendations they make and their level of objectivity. Here are the most common fee structures:

Fee-Only

Fee-only financial planners charge a flat rate for their services, which can be an hourly rate, a project rate, or a percentage of the assets under management (AUM). They do not earn any commissions from selling financial products. This type of fee structure is often seen as more transparent and aligned with the client's interests, as the planner's income is derived solely from the fees paid by the client.

Commission-Based

Commission-based financial planners earn income by selling financial products and opening accounts on behalf of their clients. They receive payments or commissions from the companies whose products they recommend and sell. This type of structure can create a potential conflict of interest, as the planner may be incentivized to recommend products that generate higher commissions, even if they may not be the best fit for the client.

Fee-Based

Fee-based financial planners combine elements of both fee-only and commission-based structures. They typically charge a flat fee for their services but may also earn commissions from selling certain financial products. This structure allows them to offer a range of services and generate additional income through product sales. However, it's important for clients to be aware of potential conflicts of interest that may arise.

Percentage of Assets Under Management (AUM)

Some financial planners charge a percentage of the total assets they manage for the client. This structure is commonly used by investment advisors and wealth managers. The fee is typically calculated as a percentage of the total value of the client's investment portfolio, and it can range from 0.25% for robo-advisors to around 1% for traditional financial advisors. This structure creates an incentive for the planner to grow the client's assets, as their compensation increases with the size of the portfolio.

When choosing a financial planner, it is essential to discuss and understand their fee structure. Ask questions about how they are compensated, any potential conflicts of interest, and whether they act as a fiduciary, legally bound to act in the client's best interests. This information will help you make an informed decision and ensure that your financial planner is working in your best interests.

Brexit-Proof Your Investment Portfolio: Strategies for Volatile Markets

You may want to see also

Investment strategy

- Range of Services: Financial planners offer a range of services, from holistic financial planning to specialised investment advice. Some planners provide general investment guidance, while others create tailored investment strategies based on a client's risk tolerance, goals, and preferences. It is important to understand the scope of services offered by the planner to ensure they align with your needs.

- Credentials and Specialisations: Financial planners may hold various credentials and specialisations, such as the Certified Financial Planner (CFP) designation. When choosing a financial planner, look for relevant credentials and specialisations that match your investment goals. For example, if you are interested in impact investing, ensure your planner has experience in this area.

- Fee Structures: Financial planners utilise different fee structures, including fee-only, commission-based, or a combination of both. Fee-only planners charge a flat fee, an hourly rate, or a percentage of assets under management (typically around 1%). Commission-based planners earn commissions from selling financial products, which may create a conflict of interest. It is essential to understand the fee structure to ensure transparency and avoid unexpected costs.

- Investment Philosophy and Benchmarks: Understanding a financial planner's investment philosophy is crucial. Ensure their philosophy aligns with your investment goals and risk tolerance. Ask about their investment benchmarks and how they relate to your portfolio. A good planner should provide clear benchmarks and be able to explain their investment strategies.

- Asset Allocation: Asset allocation refers to the distribution of your investments across different asset classes, such as stocks, bonds, and alternative investments. A financial planner should create an asset allocation strategy that matches your risk profile and investment goals. Diversification across various asset classes is essential to balance risk and return.

- Custodians and Safety: It is important to inquire about the custodian who holds your investments. A financial planner who uses an independent custodian, such as a brokerage firm, provides an additional layer of safety and allows for easy verification of your investment performance and account information.

- Tax Implications: Investments can have tax implications, so it is crucial to understand the potential tax impact of any investment strategy. Ask your financial planner about the expected tax consequences of their recommended investments and how they plan to minimise taxes.

Retirement Investments: Strategies for Effective Money Management

You may want to see also

Risk tolerance

Understanding Risk Tolerance

Determining Your Risk Tolerance

Determining your risk tolerance involves evaluating your financial situation, investment goals, and personal risk appetite. It is essential to be honest with yourself about your comfort level with risk. If you are unsure, it may be helpful to consider your past investment behaviours and how you reacted to market fluctuations. Did you feel anxious during periods of high market volatility? Or were you comfortable with the potential for larger gains and losses? Assessing your emotional and financial response to risk can help guide your investment strategy.

Different investment options carry varying levels of risk. For example, investing in stocks or equity funds is generally considered riskier than investing in government bonds or placing your money in a savings account. Your risk tolerance will influence the types of investments you choose to include in your portfolio. Individuals with a higher risk tolerance may be more comfortable allocating a larger portion of their portfolio to stocks, while those with a lower risk tolerance may prefer more conservative investments.

Adjusting Risk Tolerance Over Time

It is important to note that risk tolerance can change over time as your financial situation and goals evolve. For example, younger investors may have a higher risk tolerance as they have a longer time horizon to recover from potential losses. As you approach retirement or have a significant financial goal in mind, you may find that your risk tolerance decreases as you seek to preserve your capital. Regularly assessing your risk tolerance and adjusting your investment strategy accordingly is an important part of financial planning.

Working with a Financial Planner

When choosing a financial planner or investment manager, it is essential to discuss risk tolerance. A good financial planner will take the time to understand your risk tolerance and create an investment strategy that aligns with it. They should provide you with a range of investment options that match your risk profile and explain the potential risks and rewards of each choice. Remember, it is your money, and you should feel comfortable with the level of risk you are taking.

Retirement Planning: 401(k)s and Investment Portfolios: What's the Connection?

You may want to see also

Financial goals

Setting financial goals is a key part of healthy money management. Financial advisors can help you figure out your short- and long-term financial goals and steer you toward a decision about hiring a financial planner or investment manager.

- Retirement planning: A financial planner can help you create a saving plan crafted to your specific needs as you head into retirement. They can also advise on the best investment opportunities for your retirement fund.

- College savings: A financial planner can help you devise strategies to save for your child's college education.

- Estate planning: A financial planner can help you identify the people or organisations you want to receive your legacy after you die and create a plan to carry out your wishes.

- Long-term healthcare and insurance: A financial planner can provide you with the best long-term solutions and insurance options that fit your budget.

- Tax planning: A financial planner can help you prepare tax returns, schedule tax-loss harvesting security sales, and plan to minimise taxes in retirement.

- Debt management: A financial planner can create strategies to help you pay off your debt and avoid debt in the future.

When setting financial goals, it's important to take an extensive look at your finances, including your net worth, expenses, income, and financial goals. This will give you a better sense of where you stand financially and what a financial planner may be able to help you with.

Managing Your Own Investment Portfolio: Is It Worth It?

You may want to see also

Frequently asked questions

A financial planner is a professional who takes inventory of your finances and creates a plan to help you meet your needs and long-term goals.

Financial planners advise and assist clients on a variety of matters, from investing and saving for retirement to funding a college education or a new business while preserving wealth.

There are generally five types of financial planners: registered representatives (stockbrokers), registered investment advisors, financial planners, wealth managers, and robo-advisors.

When choosing a financial planner, it is important to consider your financial needs, the planner's credentials and service types, their fees, and their background and experience.

A financial planner can help you make informed decisions about your finances, provide expert advice tailored to your needs, and assist you in achieving your short-term and long-term financial goals.