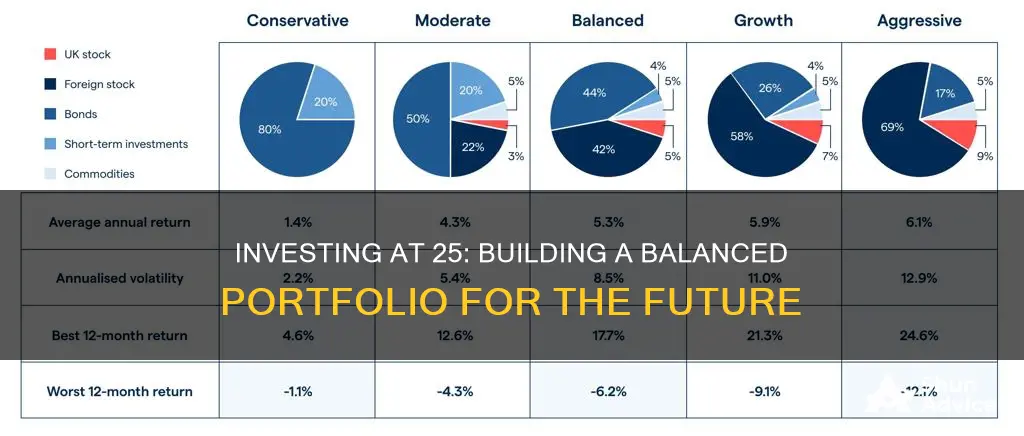

When it comes to investment portfolios, there is no one-size-fits-all approach, and the right portfolio mix will vary depending on factors such as age, risk tolerance, financial goals, and life expectancy. However, there are some general guidelines that can help individuals in their 20s make informed decisions about how to allocate their assets.

One traditional rule of thumb for asset allocation is to subtract your age from 100 to determine the percentage of your portfolio that should be in stocks. For example, a 25-year-old following this rule would hold 75% of their portfolio in stocks. However, with increasing life expectancies, some financial planners now recommend using 110 or 120 minus your age to account for the need for longer-term growth. This would result in a higher allocation to stocks, such as 85% or 95% for a 25-year-old.

It's important to remember that these are just guidelines, and individuals should consider their personal circumstances when making investment decisions. Younger investors are generally advised to focus on the growth potential of stocks, as they have a longer time horizon to ride out market volatility. Additionally, they can afford to take more risks due to their longer investment timeframe.

Other factors to consider when creating an investment portfolio include diversifying across different asset classes, such as stocks, bonds, cash, and alternative investments, and regularly reviewing and rebalancing your asset allocation to ensure it aligns with your financial goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Age | 25 |

| Investment portfolio | 70%-80% stocks, 20-30% bonds |

| Emergency fund | 3-6 months' worth of living expenses |

| Retirement savings | 15% of annual income |

Stocks vs. bonds

When you're 25, you ideally want to have just started investing. At this age, you can afford to take more risks with your investments and allocate a higher percentage of your portfolio to stocks.

The basic premise is that as we age, we become more risk-averse as we have less ability to generate income. We also don't want to spend our older years working. We are willing to trade lower returns for higher certainty.

Stocks typically offer the highest rates of return but with higher risk. They are the most volatile of these three categories: stocks, bonds, and cash. Over the long term, the return on equities (aka stocks) has generally been positive.

Bonds are traditionally less risky than stocks and offer steadier returns. A general rule of thumb is that bond prices move in the opposite direction of stocks. When you buy a bond, you are essentially loaning money to a company or government. You receive regular interest on the money you loan, and the principal you paid for the bond is returned to you when the bond's term is up. When buying bonds, investors generally accept smaller returns in exchange for the security they offer.

Cash or cash equivalents, such as certificates of deposit or money market accounts, are the least volatile investments, but they typically offer very low returns.

The classic recommendation for asset allocation is to subtract your age from 100 to find out how much you should allocate towards stocks. For example, if you're 30, you should keep 70% of your portfolio in stocks. If you're 70, you should keep 30% of your portfolio in stocks. However, with people living longer, many financial planners are now recommending that the rule should be closer to 110 or 120 minus your age. That's because if you need to make your money last longer, you'll need the extra growth that stocks can provide.

It's important to regularly review and rebalance your asset allocation to ensure it aligns with your changing financial circumstances and goals.

Savings or Investments: Open Economy, Open Question

You may want to see also

Cash allocation

When it comes to cash allocation, younger investors in their 20s tend to place a higher percentage of their assets in cash. According to data from Empower, investors in their 20s hold 30.8% of their assets in cash, which is higher than any other age group except retirees in their 70s, 80s, and 90s. The median cash balance for individuals in their 20s is $43,639, while those in their 30s keep an average of $62,449 (26.9%) in cash. This large cash holding may be due to younger investors' relative inexperience and potential risk aversion.

However, by keeping a significant portion of their financial assets in low-yielding cash instruments, young investors may be missing out on opportunities for long-term compounding, which could help their portfolios grow. As you gain more investing experience and become more comfortable with risk, consider allocating a smaller percentage of your portfolio to cash and explore other investment options that offer higher returns.

As you progress through your 40s and 50s, you may want to start prioritising other investments, such as stocks and bonds, over cash. During these decades, you may have more financial obligations, such as mortgage payments or funding your children's education, but you also have more time until retirement.

Once you reach your 60s and are nearing retirement, you may want to increase your cash allocation again. At this stage, fixed-income assets like bonds and cash can provide stability and help prepare you for potential market downturns when you retire.

While there are general guidelines for cash allocation based on age, it's important to remember that each person's financial situation is unique. Your cash allocation should be based on your individual goals, risk tolerance, and time horizon. Consult a financial professional to determine the right cash allocation strategy for your specific circumstances.

Building a Dividend Portfolio: Investing $12,000 with Schwab

You may want to see also

Risk tolerance

As a 25-year-old investor, you may want to allocate a significant portion of your portfolio to stocks, which typically offer higher returns but come with higher risk. This is known as a "growth-focused" or "aggressive" investment strategy. You may also consider investing in mutual funds or exchange-traded funds (ETFs) that hold a mix of stocks, providing diversification and potential for long-term growth.

However, it is important to keep in mind that risk tolerance is a personal decision and depends on various factors such as your financial goals, investment objectives, and risk comfort level. Some individuals may prefer a more conservative approach, even at a younger age.

As you get older, it is generally recommended to gradually shift towards more conservative investments, such as bonds and cash equivalents, to reduce the risk in your portfolio. This is because, as you approach retirement, you have less time to recover from potential losses and need to preserve your capital.

Remember, there is no one-size-fits-all approach to investment portfolios, and your risk tolerance may change over time as your financial circumstances evolve. It is always a good idea to consult with a financial professional to determine an investment strategy that aligns with your risk tolerance and goals.

Are 5% Monthly Investment Portfolio Gains Achievable?

You may want to see also

Retirement goals

Retirement may seem like a long way off when you're 25, but it's important to start planning for it now. Here are some tips to help you get started:

- Understand your options: Research the different types of retirement accounts available to you, such as employer-sponsored plans like 401(k)s and individual retirement accounts (IRAs). Each has its own contribution limits, tax advantages, and income restrictions.

- Take advantage of employer-sponsored retirement accounts: If your employer offers a 401(k) or similar plan, contribute as much as you can. Many companies will match your contributions up to a certain percentage, which is essentially free money for your retirement.

- Automate your retirement contributions: Set up automatic contributions from your paycheck or bank account to your retirement accounts. This ensures that you save consistently and makes it easier to plan your annual contributions.

- Create an emergency fund: Build a well-funded emergency fund to cover unexpected expenses. This will help you avoid dipping into your retirement savings and will give you financial security in case of unforeseen events.

- Use the power of compounding: Start saving and investing as early as possible to take advantage of compound interest. The earlier you start, the more time your money has to grow.

- Save a percentage of your income: Aim to save at least 15% of your income each year for retirement. This may include a combination of your own contributions and any employer matches.

- Invest in stocks: When you're young, you can afford to take more risks with your investments. Consider investing a higher percentage of your portfolio in stocks, which offer higher returns but come with higher risk.

- Diversify your portfolio: Don't put all your eggs in one basket. Diversify your investments across different asset classes, such as stocks, bonds, and cash, to manage risk and protect your portfolio from market downturns.

- Rebalance your portfolio: Regularly review and rebalance your asset allocation to ensure it aligns with your changing financial goals and risk tolerance. This may involve shifting towards more conservative investments as you get closer to retirement.

- Set savings benchmarks: Use savings benchmarks based on your age and salary to track your progress and stay motivated. For example, by age 35, aim to save one to one-and-a-half times your current salary for retirement.

Maximizing Your Investment Portfolio: Strategies for Success

You may want to see also

Long-term growth

When it comes to long-term growth, it's important to remember that investing is a journey that spans decades, and your investment portfolio should evolve with you. Here are some key considerations for your investment portfolio in your 20s with a focus on long-term growth:

Embrace a Long-Term Perspective

Your 20s is the ideal time to embrace a long-term perspective when it comes to investing. Time is one of your greatest assets at this age, allowing you to ride out market volatility and benefit from the power of compounding. Take advantage of this by focusing on investments with long-term growth potential, such as stocks. While stocks come with higher risk, your age affords you the ability to take on this risk and aim for higher returns.

Understand the Basics of Asset Allocation

Asset allocation is a fundamental concept in investing. It involves dividing your investments across different asset classes, such as stocks, bonds, cash, and alternative investments. The specific mix of these assets in your portfolio depends on factors like your risk tolerance, financial goals, and time horizon. Generally, younger investors can allocate a larger portion of their portfolio to stocks, gradually shifting towards more conservative assets like bonds and cash as they approach retirement age.

Diversify Your Portfolio

Diversification is a key pillar of long-term investing. By spreading your investments across various asset classes, industries, and individual securities, you reduce the impact of any single investment on your portfolio's performance. Diversification helps protect your portfolio from significant losses and increases the potential for long-term growth.

Take Advantage of Compounding

Compounding occurs when the returns generated by your investments are reinvested, leading to exponential growth over time. The earlier you start investing, the more time compounding has to work its magic. Even small contributions to investment accounts in your 20s can grow significantly over several decades.

Prioritize Growth Over Stability

While it's important to manage risk, your 20s are a time to prioritize growth potential. This means allocating a larger portion of your portfolio to growth-oriented investments like stocks, rather than stable but low-yield options like bonds or cash. You have the advantage of time to recover from any short-term losses, so embrace a growth mindset.

Regularly Review and Rebalance

Investing is not a "set it and forget it" endeavour. Regularly review your investment portfolio to ensure it aligns with your evolving financial goals and risk tolerance. Over time, market movements can shift your asset allocation, requiring you to rebalance by adjusting your holdings to return to your desired allocation.

Remember, investing is a highly personalized journey. While these guidelines provide a solid foundation, be sure to consult financial professionals and conduct thorough research to make informed decisions that align with your unique circumstances.

Understanding Your Investment Portfolio Report: A Guide

You may want to see also

Frequently asked questions

Asset allocation is an investment strategy that helps you decide the ratio of different asset classes in your portfolio to ensure that your investments align with your risk tolerance, time horizon, and goals.

There is no one-size-fits-all answer, but generally, younger investors can tolerate more risk and allocate a higher percentage of their portfolio to stocks. According to the old rule, you should subtract your age from 100, and that's the percentage of your portfolio that you should keep in stocks. So, for a 25-year-old, the ideal portfolio would be 75% stocks. However, with increasing life expectancy, some financial planners now recommend subtracting your age from 110 or 120. This would mean a 25-year-old should hold 85% or 95% in stocks.

The three broad groups, or asset classes, that are generally held in investment accounts are stocks, bonds, and cash. Stocks typically offer the highest rates of return but come with higher risk. Bonds are less risky and offer steadier returns. Cash or cash equivalents, such as savings accounts or money market accounts, are the least volatile but offer very low returns.