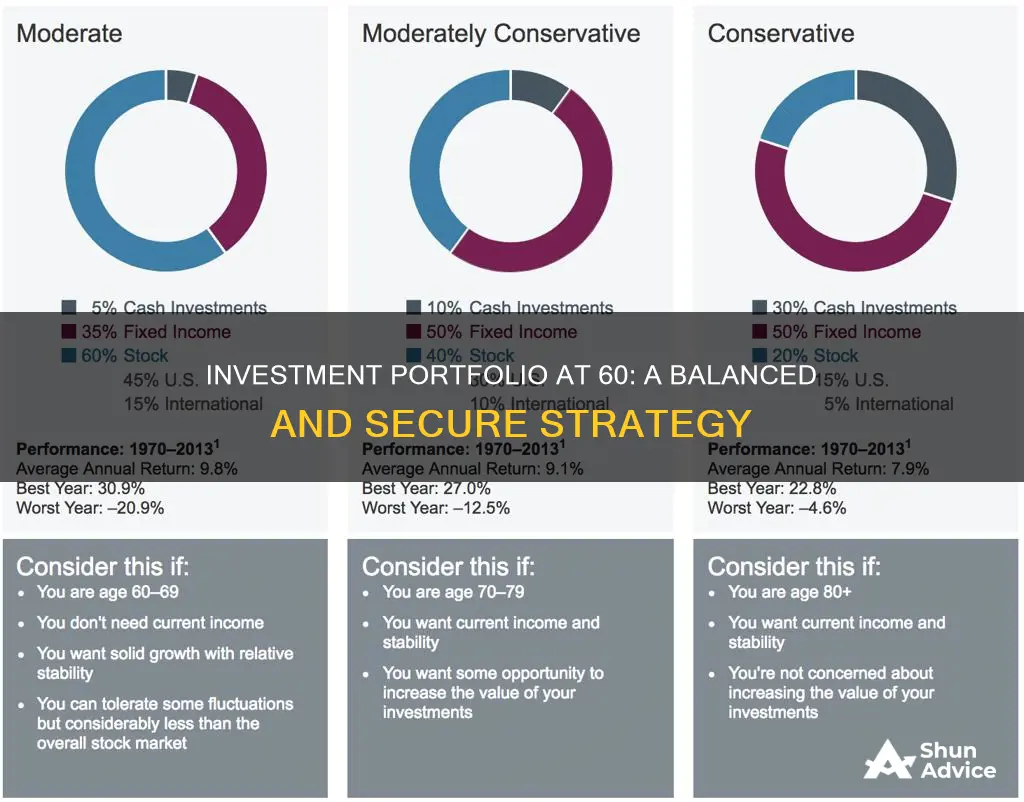

When considering what your investment portfolio should look like at 60, it's important to remember that you're likely nearing retirement age, and your risk tolerance decreases as you approach this stage of your life. The traditional rule of thumb for asset allocation has been to subtract your age from 100 and invest the resulting percentage of your portfolio in stocks. However, with increasing life expectancy, some experts now recommend subtracting your age from 110 or 120 instead, to maintain a more aggressive allocation. This would mean that a 60-year-old would allocate 40% to 60% of their portfolio to stocks, depending on their risk tolerance. The rest of the portfolio would typically consist of bonds, cash, and other relatively safe assets. It's also important to regularly review and rebalance your asset allocation to ensure it aligns with your financial goals and circumstances.

| Characteristics | Values |

|---|---|

| Percentage of stocks in portfolio | 40% or 50% |

| Other assets | High-grade bonds, government debt, and other relatively safe assets |

| Risk | Low |

| Focus | Income and dividend income |

What You'll Learn

Stocks, bonds, and cash

Stocks

Stocks, or equities, typically offer the highest rates of return but also carry the highest risk. They are the most volatile of the three asset classes, especially in the short term. However, over the long term, the return on stocks has generally been positive. For example, the S&P 500 index, a proxy for the US stock market, has historically returned an average of 10% annually. Younger investors are usually advised to allocate a higher percentage of their portfolios to stocks due to their higher risk tolerance and longer time horizon.

Bonds

Bonds are considered less risky than stocks and offer steadier returns. As a general rule, bond prices move in the opposite direction of stocks. When purchasing a bond, an investor is essentially loaning money to a company or government and receiving regular interest payments. Bonds are often seen as a more stable investment option, particularly for those approaching retirement age.

Cash

Cash, or cash equivalents such as certificates of deposit (CDs) or money market accounts, are the least volatile investment option. However, they typically offer very low returns. While cash holdings can be a safe option for emergency funds or short-term savings, they may not be ideal for long-term investment portfolios due to their low potential for growth.

Asset Allocation for 60-Year-Olds

Now, how does this translate into an investment portfolio for a 60-year-old individual? The traditional rule of thumb for asset allocation has been to subtract your age from 100, with the result being the percentage of your portfolio that should be in stocks. So, for a 60-year-old, this would mean 40% of their portfolio should be in stocks. However, with increasing life expectancies, some experts now recommend a more aggressive approach, suggesting the formula should be 110 or 120 minus your age. This would result in a 50% or 60% allocation to stocks for a 60-year-old.

It's important to note that these are just guidelines, and the specific allocation will depend on individual factors such as risk tolerance, investment goals, and time horizon until retirement. A 60-year-old who is still working and has a higher risk tolerance may opt for a higher stock allocation, while someone who is retired and seeking a more conservative approach may choose to allocate more to bonds and cash.

Additionally, it's crucial to regularly review and rebalance your portfolio to ensure it aligns with your changing financial circumstances and goals. Consulting a financial professional can help you make informed decisions about your investment strategy.

Understanding Pips: Portfolio Investment Strategy Basics

You may want to see also

Risk tolerance

However, it's important to remember that risk tolerance is a personal decision and can vary depending on individual factors. Some people may have a higher risk tolerance and be comfortable with a more aggressive investment approach, while others may prefer the stability of lower-risk investments. It's crucial to consider your own financial goals, risk tolerance, and time horizon when making investment decisions.

- Review and rebalance your asset allocation regularly to ensure it aligns with your financial goals and circumstances. As you get older, you may want to shift towards more conservative investments, such as bonds and cash equivalents, to protect your savings from market downturns.

- The old rule of thumb for asset allocation was to subtract your age from 100 to determine the percentage of your portfolio to keep in stocks. For example, a 60-year-old would keep 40% of their portfolio in stocks. However, with increasing life expectancies, some financial planners now recommend subtracting your age from 110 or 120 to maintain a more aggressive allocation to stocks. This means a 60-year-old might allocate 50% or more of their portfolio to stocks.

- As you approach retirement, you may want to consider allocating a larger portion of your portfolio to fixed-income assets, such as bonds and cash. These investments can provide a stable source of income during market downturns and allow time for the market to recover before you need to tap into your stock investments.

- If you are still working, continue contributing to your retirement accounts, such as a 401(k), to take advantage of any employer matches and grow your nest egg.

- Consider seeking professional financial advice to help you feel secure in choosing the right investment mix and determining when to retire.

Maximizing HSA Savings: Investment Strategies for Tax-Free Growth

You may want to see also

Time horizon

Understanding Time Horizon

Impact on Risk Tolerance

As your time horizon shortens, your risk tolerance typically decreases. This means that when you are closer to retirement, you have less time to recover from potential market downturns or losses. As a result, you may need to adjust your portfolio to reduce risk and preserve your capital.

Shifting Asset Allocation

The traditional approach to asset allocation has been the "Rule of 100," which suggests that you subtract your age from 100 to determine the percentage of your portfolio that should be in stocks. For example, under this rule, a 60-year-old would allocate 40% of their portfolio to stocks. However, with increasing life expectancies, some experts now recommend the "Rule of 110" or even "Rule of 120," which encourages a more aggressive approach with a higher percentage of stocks.

For individuals in their 60s, the shift towards a more conservative portfolio is common. This typically involves moving a larger portion of your investments into fixed-income assets like bonds and cash. These assets provide more stable returns and can serve as a source of income during market downturns, allowing your stock investments to recover over time.

Retirement Income Strategies

Once you enter retirement, your focus may shift from growth to income generation. This could mean investing in stocks that provide dividend income or fixed-income bonds. It's important to note that even during retirement, holding a mix of assets, including stocks, can help preserve your spending power and avoid the risk of outliving your savings.

Regular Review and Rebalancing

Regardless of your age, it's essential to regularly review and rebalance your investment portfolio. This ensures that your asset allocation remains aligned with your time horizon, risk tolerance, and financial goals. As you enter your 60s, you may want to seek professional advice to navigate the transition into retirement and make informed decisions about your asset allocation.

Invest Your Savings: Safe Strategies for Beginners

You may want to see also

Investment objectives

- Review Retirement Readiness: As you enter your 60s, it's essential to assess your retirement preparedness. Review your savings, pension plans, and expected Social Security benefits. If you feel uncertain about your financial readiness, consider delaying retirement to allow your savings to grow further. Make it a priority to pay off any debts and make significant purchases before retiring while you still have a steady income.

- Broaden Tax Diversification: Think about diversifying your tax strategies by exploring options like Roth IRA contributions or conversions. Withdrawals from Roth accounts are often tax-free, and they don't have required minimum distributions (RMDs) associated with them, giving you more flexibility.

- Adjust Your Asset Allocation: Traditionally, the rule of thumb for asset allocation was to subtract your age from 100 to determine the percentage of your portfolio to keep in stocks. For example, a 60-year-old would allocate 40% to equities. However, with increasing life expectancies, some experts now recommend subtracting your age from 110 or 120 to maintain a more aggressive stance on stocks. This approach recognises the need for longer-term financial growth.

- Focus on Fixed-Income Assets: As you approach retirement, consider shifting your portfolio towards fixed-income assets like bonds and cash. These assets provide a stable source of income and can help you navigate potential market downturns during retirement.

- Maintain Some Exposure to Stocks: While fixed-income assets become a larger part of your portfolio, it's still important to retain some exposure to stocks. Retirement can last for decades, and stocks provide the potential for long-term growth, helping your savings keep pace with inflation.

- Consider Target-Date Funds: Target-date funds are mutual funds designed for specific retirement years (e.g., 2035 or 2050). These funds automatically adjust their asset allocation to become more conservative as the target date approaches. They are a hands-off option but may not align perfectly with your unique retirement goals and risk tolerance.

- Seek Professional Advice: Retirement planning can be complex, and it's essential to consider your specific circumstances. Consult a trusted financial advisor or planner to help you navigate the intricacies of asset allocation, risk management, and tax strategies as you approach retirement.

Diversifying Your Portfolio: Optimal Number of Investments

You may want to see also

Retirement readiness

- Review your retirement savings progress: It's important to assess how much you have saved and how much you need to save to meet your retirement goals. A general rule of thumb is to save enough to have 11 times your ending salary by the time you retire. This can be achieved by setting aside 15% of your annual income, including any workplace plan company match.

- Take advantage of different account types: Utilize various account types, such as Roth IRA and Roth 401(k) accounts, which offer tax benefits for retirement savings. Withdrawals from these accounts are tax-free after age 59½ if held for at least five years.

- Maintain a balanced portfolio: As you approach retirement, it's crucial to maintain a balanced portfolio that includes stocks, bonds, and cash. While stocks remain an important part of your portfolio, consider adding a meaningful allocation to bonds to reduce risk. The general guideline is to subtract your age from 100 to determine the percentage of your portfolio that should be in stocks. For example, a 60-year-old should have 40% of their portfolio in stocks. However, with increasing life expectancies, some experts now recommend subtracting your age from 110 or 120 to determine the stock allocation.

- Consider your risk tolerance: Your risk tolerance plays a crucial role in your investment strategy. As you get closer to retirement, your risk tolerance typically decreases, as you can't afford significant losses in the stock market. Adjust your asset allocation accordingly to ensure it aligns with your risk tolerance.

- Seek professional advice: Consult a financial advisor or planner to help you navigate the complexities of retirement planning and investment strategies. They can provide personalized advice based on your circumstances and goals.

Remember, these are general guidelines, and each person's financial situation is unique. It's important to regularly review and adjust your investment strategy as you approach retirement to ensure a comfortable and secure future.

Savings Glut: When Saving Outpaces Investment

You may want to see also

Frequently asked questions

Asset allocation is an investment strategy that determines the ratio of different asset classes in your portfolio. It helps balance risk while aiming for the highest return within your investment timeframe. The three main asset classes are stocks, bonds, and cash.

At 60, you are likely nearing retirement age, so your portfolio should shift towards more conservative, less risky assets. This means a higher allocation of bonds and cash, and a lower allocation of stocks. The specific ratio depends on your financial goals, risk tolerance, and investment timeframe, but a common rule of thumb is to subtract your age from 100, 110, or 120, and allocate that percentage of your portfolio to stocks. So, for a 60-year-old, this would mean 40%, 50%, or 60% in stocks, respectively, with the rest in bonds and cash.

Your risk tolerance is a key factor in determining your asset allocation. If you have a low risk tolerance, you may want to decrease your stock allocation and increase bonds and cash, even if this may result in lower returns.

It is important to regularly review and rebalance your asset allocation to ensure it aligns with your changing financial circumstances and goals. There are no hard-and-fast rules, but generally, you should check in at least annually and rebalance whenever an asset allocation changes by 5% or more.

Target-date funds are mutual funds that hold multiple asset classes and automatically adjust their allocation to become more conservative as a target date (usually your retirement year) approaches. These funds can be a good "set it and forget it" option, but they don't account for individual risk tolerance or changing circumstances, and they often come with fees.