There is no one-size-fits-all approach to determining how much of your retirement savings should be invested in the market. However, a few key factors influence this decision, including your risk tolerance, age, financial goals, and income needs.

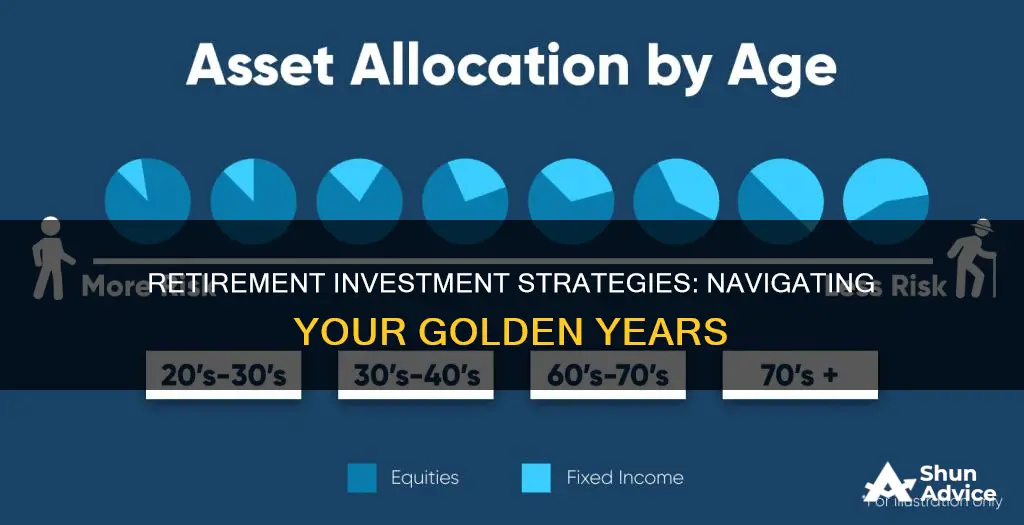

It is recommended to have a diversified and balanced portfolio with stocks, bonds, and cash, aligning with your short- and long-term goals. As you approach retirement, you may want to shift your portfolio towards more conservative investments, such as bonds, dividend-paying stocks, and annuities.

Additionally, it is essential to consider tax implications and regularly review and rebalance your portfolio to ensure it aligns with your risk tolerance and investment goals.

| Characteristics | Values |

|---|---|

| Age | The younger you are, the more you should invest in stocks. Older people should adopt a more conservative approach. |

| Risk tolerance | If you have a high-risk tolerance, you may want to invest more in stocks. If you have a low-risk tolerance, you may want to invest more in bonds and cash. |

| Time until retirement | The more time you have until retirement, the more you can invest in stocks. |

| Income | The higher your income, the more you can save for retirement. |

| Lifestyle | Your lifestyle in retirement will impact how much you need to save. |

| Emergency fund | It is recommended to have an emergency fund that can cover 3-6 months of expenses. |

| Tax | Consider the tax implications of different investments and use tax-efficient accounts where possible. |

| Diversification | It is important to diversify your portfolio across different asset classes. |

Stocks, bonds, and cash

Stocks:

Stocks are considered riskier than bonds but have historically offered higher returns over the long term. If you are young and saving for retirement, investing heavily in stocks can be a good option as you have time to ride out market turbulence. As you approach retirement age, you may want to reduce your stock allocation and shift towards more conservative investments.

Bonds:

Bonds are often seen as a less risky investment option compared to stocks. They are useful for diversifying your portfolio and providing a stable source of income. There are different types of bonds, such as municipal, corporate, government, and short-term bonds, each with its own risk and return profile.

Cash:

Cash, or cash equivalents, are important to have in your portfolio to cover short-term expenses and provide liquidity. This includes money in bank accounts, money market funds, or other highly liquid and safe investments. While cash doesn't offer the same growth potential as stocks, it plays a crucial role in preserving capital and providing flexibility.

Strategies for Allocation:

There are several strategies for allocating your retirement balance among stocks, bonds, and cash. The "bucket strategy" involves structuring your assets into three buckets based on longevity and cash needs. The first bucket is for cash and other liquid assets to cover the first years of retirement. The second, medium-term bucket focuses on bonds. The third, long-term bucket is for stocks to promote growth.

Another approach is the "100-minus-your-age rule," where you subtract your age from 100 to determine the percentage of your portfolio allocated to stocks, with the rest in bonds and cash. For example, if you are 60, this rule suggests having 40% in stocks and 60% in bonds and cash.

Your risk tolerance and financial goals will also influence your allocation. If you are comfortable with higher risk and aiming for higher returns, you may allocate more to stocks. If capital preservation is a priority, you may favour a larger allocation to bonds and cash.

Customization and Professional Advice:

Customizing your asset allocation depends on various factors, including your spending in retirement, income needs, and financial goals. It's important to remember that there is no one-size-fits-all approach, and you should regularly review and adjust your allocation as necessary.

Retirement planning can be complex, and it is always recommended to consult a financial advisor or planner who can provide personalized advice based on your unique circumstances. They can help you navigate the different investment options and strategies to ensure your retirement portfolio aligns with your goals and risk tolerance.

Turkey: Invest Now or Later?

You may want to see also

Emergency funds

Importance of Emergency Funds

During retirement, unexpected expenses can be challenging, especially with a fixed income. An emergency fund acts as a safety net, cushioning the impact of unforeseen events such as medical emergencies, family-related issues, or home and car repairs. Without an emergency fund, retirees might be forced to dip into their retirement savings, disrupting their financial plans and putting their future at risk.

Determining the Amount

The recommended amount for emergency savings during your working years is generally three to six months' worth of living expenses. However, in retirement, you may not need as much, as the risk of job loss is no longer a concern. Still, it's wise to have a substantial emergency fund to cover unexpected costs without tapping into your retirement savings.

Setting Up the Fund

To start an emergency fund, calculate the amount you need, considering potential emergency expenses. Then, set up automatic transfers to a savings or money market account after receiving your regular retirement or Social Security payments. You can start with small transfers and gradually increase them as your budget allows.

Maintaining the Fund

Once you've reached your initial savings goal, it's crucial to replenish your emergency fund after using it. Periodically review your fund to ensure it aligns with your living expenses and life changes. Adjust your savings rate accordingly to maintain a comfortable balance.

Investment Options

While traditional savings accounts are popular, they may not offer the best returns. Consider investing your emergency fund in low-risk, accessible options with reasonable returns, such as high-yield savings accounts, certificates of deposit (CDs), money market mutual funds, treasury bills and bonds, or short-term bond funds. Each option has its pros and cons regarding liquidity, minimum balance requirements, transaction limits, and interest rate fluctuations.

Where to Keep the Fund

You can keep your emergency fund in a dedicated bank or credit union account, ensuring its safety and accessibility. Alternatively, you can use a prepaid card, load it with the desired amount, and spend only what's on the card. Keeping cash at home or with a trusted person is another option, but it comes with risks like theft, loss, or destruction.

In conclusion, emergency funds are a vital component of retirement planning, offering peace of mind and financial resilience during unexpected events. By setting up and maintaining an adequate emergency fund, retirees can protect their retirement savings and ensure their financial well-being.

Unleashing Zelle Pay: A Guide to Investing in the Popular Payment Platform

You may want to see also

Growth vs income

When it comes to retirement planning, there are two main investment strategies that individuals can choose from: growth or income. So, what's the difference between the two, and which one is the best option?

Growth vs. Income: Understanding the Basics

Growth investing focuses on capital appreciation, aiming for long-term increases in the value of investments. On the other hand, income investing prioritises current income generation through dividends or interest payments, providing a more immediate source of passive income.

Factors Influencing the Choice

The decision to focus on growth or income depends on several factors:

- Risk Tolerance: Growth investing is generally considered riskier, as it involves taking on more volatile investments with the potential for higher returns. Income investing, especially in fixed-income instruments like bonds, is typically seen as a safer option.

- Time Horizon: Younger investors tend to favour growth strategies as they have a longer time horizon and can weather short-term losses. As investors approach retirement, they may shift towards income-generating investments to stabilise their portfolio.

- Retirement Needs: In retirement, individuals need to replace their earnings with income from various sources. Financial advisors suggest that retirees aim to replace around 75% of their working wages with income-producing securities.

Finding a Balance

Growth and income funds offer a balanced approach by combining both strategies. These funds invest in a mix of securities, including stocks, bonds, and real estate investment trusts (REITs), to provide both short-term income and long-term investment growth. This diversification helps reduce overall market risk and provides a more stable option for investors.

However, it's important to note that simply investing in a growth and income fund may not be sufficient for retirement planning. Individuals should also consider their asset allocation, risk tolerance, and income needs to ensure they have a well-diversified portfolio that meets their long-term financial goals.

Final Thoughts

Retirement planning is a complex and highly personalised process. While growth and income funds offer a balanced approach, individuals should regularly evaluate their investment strategies and seek professional advice to ensure their investments align with their risk tolerance, time horizon, and retirement income needs.

Retirement Savings: IRS Reporting and Investment Firm Obligations

You may want to see also

Risk tolerance

Investment Goals

If you are saving for retirement, how much risk are you willing to take with those funds? If you are using disposable income to attempt to earn extra income, you may be able to take on more risk. It is important to be realistic about your risk tolerance and not take on more risk than you are comfortable with.

Investment Experience

Your level of investing experience is also crucial when determining your risk tolerance. If you are new to investing, it is prudent to start with some degree of caution and gain experience before committing too much capital.

Time Frame

The time horizon of your investments matters. If you have a short-term investment horizon, your risk tolerance is likely to be lower, as you have less time to recover from potential losses. On the other hand, if you have a long-term investment horizon, you may have more flexibility to take on risk.

Net Worth and Risk Capital

Your net worth and available risk capital also play a role in your risk tolerance. Individuals with a higher net worth can generally afford to take on more risk, as they have more money to risk and potentially lose. Conversely, those with limited risk capital may be forced to sell a position too early if they take on too much risk.

Priorities and Investment Purpose

Understanding your priorities and what you are saving and investing money for is essential. Are you saving for retirement, a child's education, or something else? Being clear about your goals will help you determine how much risk you are comfortable taking on.

Asking yourself some specific questions can help you assess your risk tolerance:

- Are you willing to take on above-average risk for the potential of above-average returns?

- How anxious do you feel about the potential to lose money in the stock market?

- Would you be tempted to sell your investments if they lost money over a year?

- How many more years do you plan to work before retiring?

- What is your ideal retirement lifestyle, and how much money will you need to achieve it?

In conclusion, understanding your risk tolerance is crucial when deciding how to invest your retirement balance. It is important to carefully consider your personal financial situation, goals, and comfort with risk to make informed investment decisions.

Invest Now: Where to Put Your Money

You may want to see also

Retirement age

Savings Goals

It is recommended to have a substantial sum saved up for retirement. A common guideline is to aim for at least ten times your pre-retirement income by the time you retire. This can be broken down into milestones, such as having one times your annual salary saved by age 30, three times by age 40, six times by age 50, and eight times by age 60. However, these are just general guidelines, and individual circumstances may vary. It's important to assess your retirement needs and plan accordingly.

Investment Strategies

As retirement age approaches, it's crucial to assess your investment portfolio and make adjustments. While stocks are an important part of any retirement portfolio due to their growth potential, it's also essential to diversify your investments. This means including other assets such as bonds, cash, and even alternative investments like real estate or commodities. The exact allocation will depend on your risk tolerance, financial goals, and time horizon.

Income Streams

When planning for retirement, consider the various income streams that will support you. This includes Social Security benefits, annuities, pensions, rental properties, and other sources. It's important to understand how much income you can expect from each source and plan accordingly.

Emergency Funds and Short-Term Reserves

It is recommended to have an emergency fund that can cover at least three to six months' worth of expenses. Additionally, creating a short-term reserve equivalent to two to four years' worth of living expenses is advisable. This reserve can be invested in short-term bonds, bond ladders, or other fixed-income investments, providing a buffer during market downturns and helping to cover withdrawals from your portfolio.

Risk Tolerance and Asset Allocation

As you approach retirement, re-evaluating your risk tolerance becomes crucial. Generally, individuals approaching retirement become more risk-averse and seek to preserve their capital. This often leads to a shift towards more conservative investments, such as bonds, dividend-paying stocks, annuities, and government bonds. The traditional rule of thumb is that the percentage of your portfolio invested in bonds and cash should equal your age. However, this may not be suitable for everyone, and a personalised assessment is essential.

Tax Implications

Tax obligations play a significant role in retirement planning. Consider the tax implications of different investments and structure your portfolio accordingly. Utilise tax-deferred accounts, such as IRAs or 401(k)s, for investments that generate high taxable income. Take advantage of tax-efficient strategies, such as tax-loss harvesting, and consider consulting a tax professional for more complex strategies.

GME: The People's Investment

You may want to see also

Frequently asked questions

According to Fidelity, you should aim to save one times your annual salary by the time you're 30.

According to Fidelity, you should aim to save three times your annual salary by the time you're 40.

According to Fidelity, you should aim to save six times your annual salary by the time you're 50.