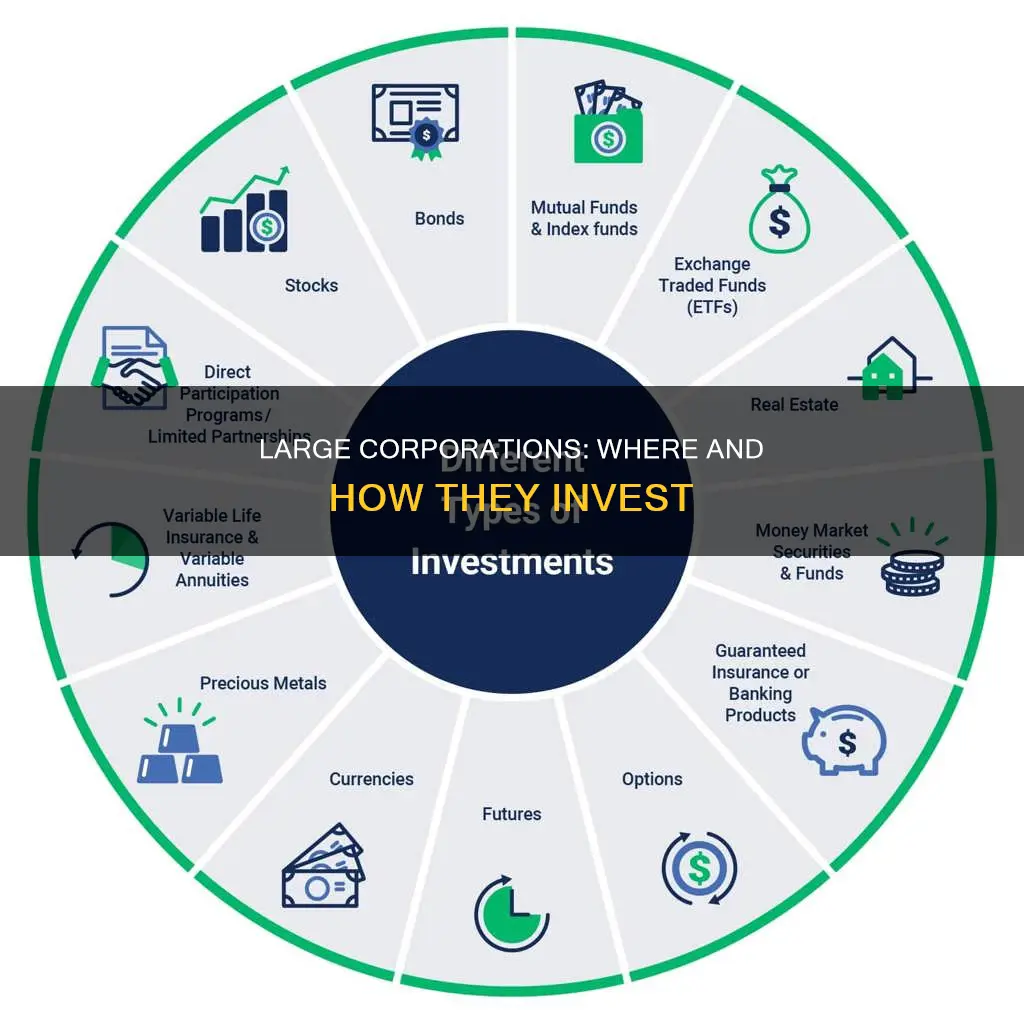

Large corporations make a variety of investments to further their long-term business goals and objectives. These investments can include physical assets such as real estate, manufacturing plants, and machinery, as well as financial investments such as stocks, bonds, and money market funds. The funds for these investments can come from a variety of sources, including cash on hand, loans, or issuing stock. For example, Amazon reported a net asset balance of $186.7 billion for property and equipment as of 2022, while also investing in stocks, bonds, and money market funds. Large corporations like Amazon make these investments to increase operational capacity, capture a larger market share, and generate more revenue.

| Characteristics | Values |

|---|---|

| Type of Investment | Capital investment, long-term |

| Aim | Further long-term business goals and objectives |

| Sources of Capital | Cash on hand, loans, issuing stock, bonds, venture capital deals |

| Examples of Investments | Land, buildings, machinery, equipment, software, money market funds, corporate bonds |

| Investment Decision Influencers | Interest rates, changes in productivity, business cycle, bank lending, economic uncertainty |

What You'll Learn

Capital investment in real estate, manufacturing plants, and machinery

Large corporations make a variety of investments, including capital investments. Capital investment is the acquisition of physical assets by a company to further its long-term goals and objectives. Real estate, manufacturing plants, and machinery are among the assets purchased as capital investments.

Capital investment is a broad term that can be defined in two ways. First, it can refer to an investment made by an individual, a venture capital group, or a financial institution in a business. Second, it can refer to an investment made by a company's executives in long-term assets such as equipment. In both cases, the money for the capital investment must come from somewhere, such as cash on hand, loans, or issuing stock.

Real estate capital investments are crucial for maintaining and enhancing the long-term value of properties. These investments cover major repairs, renovations, and improvements that extend the property's life and attract tenants or buyers. For example, roof repairs and replacements are considered capital expenditures as they significantly extend the life of the property and protect it from structural damage.

Manufacturing plants are another type of capital investment. These plants are used to produce goods and services and can increase a company's operational efficiency. For instance, a company may invest in a new manufacturing plant to increase its production capacity and efficiency, leading to higher profits.

Machinery is also a common capital investment. By investing in new and more efficient machinery, companies can improve their operational efficiency, reduce costs, and increase output. This type of investment can also improve the quality of goods produced. For example, a company may invest in state-of-the-art manufacturing equipment to increase its production capacity and efficiency.

Capital investments in real estate, manufacturing plants, and machinery can have both pros and cons. On the one hand, they can increase productivity, improve the quality of goods, and lead to cost savings over time. On the other hand, they can reduce earnings growth in the short term and be accompanied by additional operating expenses. Overall, capital investments are essential for companies to maintain their competitiveness and achieve long-term growth.

The Future of Investment Management: 2030 Vision

You may want to see also

Investment in equipment to improve efficiency and growth

Large corporations make investments in equipment to improve efficiency and growth. This is a form of capital investment, which involves businesses purchasing capital goods such as machinery, equipment, vehicles, and tools. These tangible assets are leveraged to produce goods or services more efficiently and effectively, boosting operational efficiency and overall growth.

Capital investments are long-term strategies that enable companies to generate revenue over many years by adding or improving production facilities. They are essential for research and development, facilitating the creation and introduction of new products and services to the market. By investing in updated equipment and technology, companies can increase labour productivity, making their operations more efficient and competitive.

The traditional efficiency-focused approach to IT management, investment, and governance views technology as a means to enhance operational efficiency. This approach involves regulating expenditures, ensuring high reliability, and striving for silent running. However, as digital transformation advances, a significant portion of IT investments are now focused on building technology platforms that enable organisations to compete for customers more effectively. This growth-focused strategy creates a more dynamic relationship between technology and the business, requiring a different governance and investment philosophy.

The growth framework involves developing technology that directly interacts with customers, improves their experience, and attracts new ones. This technology has a deeper intimacy with customers, employees, and the business itself. Companies are more willing to invest in these platforms to enhance their competitive capabilities and market share. Platforms evolve at a much faster rate than efficiency-focused technologies, requiring more iterations and change management.

Large corporations must navigate the dual needs of efficiency and growth. By investing in equipment and technology that serves both purposes, they can improve their operational efficiency and drive long-term growth.

Crafting a 5-Year Investment Plan: Strategies for Success

You may want to see also

Investment in permanent fixed assets

Large corporations make investments in permanent fixed assets, which are long-term, illiquid investments in physical assets such as real estate, manufacturing plants, and machinery. These investments are made to support the company's long-term business goals and objectives.

Permanent fixed assets are those that are not easily converted back into cash, and they are typically reported as non-current assets on a company's balance sheet. Examples of permanent fixed assets include land, buildings, machinery, equipment, and other long-term assets.

The acquisition of permanent fixed assets can be funded through various sources, such as cash on hand, loans, or issuing stock. These investments are often made to increase operational capacity, capture a larger market share, and generate more revenue. For example, a company may invest in new machinery that will help improve efficiency and reduce costs.

In the context of permanent fixed assets, "permanency" refers to the long-term nature of the investment, as these assets are intended to be held for an extended period. This is in contrast to short-term investments or current assets, which are more liquid and can be easily converted back into cash.

The decision to invest in permanent fixed assets can have both advantages and disadvantages. On the one hand, these investments can lead to increased productivity, improved quality of goods, and cost savings over time. On the other hand, they may limit short-term profitability and be accompanied by additional operating expenses.

When making investment decisions, large corporations consider various factors, including interest rates, changes in productivity, the business cycle, bank lending, and economic uncertainty. These investments play a crucial role in the growth of the company as well as the overall economy.

Maximizing Your HSA: Investing with Health Equity

You may want to see also

Investment in equity stakes in other companies

Large corporations make investments in equity stakes in other companies for several strategic reasons. Firstly, they may seek to diversify their portfolio by acquiring stakes in businesses operating in complementary or unrelated industries. This allows them to spread their risk and explore new areas for growth. Additionally, investing in equity stakes can help large corporations strengthen their market position and gain a competitive advantage. By investing in another company, they can establish strategic partnerships, access new technologies or resources, and potentially influence the direction of the invested company.

For example, Amazon's $16.8 billion investment stake in electric truck maker Rivian in 2022 showcases how large corporations utilise their cash reserves to support innovative ventures. Similarly, Intel reported a $427 million gain on equity investments, including the successful spinoff of Mobileye. These investments demonstrate the potential for substantial financial returns.

Equity investments also enable large corporations to forge alliances and exert influence over their industry. By acquiring stakes in other companies, they can gain voting rights, board representation, and a say in strategic decision-making. This allows them to shape the direction of the invested company and ensure that their interests are aligned.

Furthermore, equity investments can provide large corporations with access to new markets and distribution channels. By investing in companies operating in different geographical regions or with unique distribution networks, they can expand their customer reach and enhance their market presence. This is particularly advantageous when expanding into international markets, as local partnerships can facilitate a smoother entry and better understanding of the target market.

Lastly, equity investments offer large corporations the opportunity to gain expertise and insights into emerging trends. By investing in startups or innovative companies, they can stay at the forefront of technological advancements and potentially identify future acquisition targets. This allows them to remain agile and responsive to market changes, ensuring their long-term sustainability.

Understanding Investment Management Agreements: Key to Financial Success

You may want to see also

Investment in land, buildings, and assets under development

Investment in land, buildings, and other physical assets is a significant aspect of large corporations' strategies. This type of investment, often referred to as business investment, involves acquiring and developing physical assets such as real estate, factories, and infrastructure. These investments can have a substantial impact on the economy and local communities.

Large corporations have been increasingly investing in real estate, becoming prominent players in the housing market. They acquire residential properties, sometimes purchasing entire neighbourhoods or apartment complexes. This consolidation of ownership transforms the market by introducing corporate management and streamlining operations. On the positive side, these corporations can bring increased efficiency to property management, utilising their resources and expertise to ensure well-maintained properties and prompt repairs.

However, one of the significant drawbacks of corporate ownership in the housing market is reduced affordability. As companies acquire properties, they often raise rents to maximise profits, making it challenging for individuals and families to find affordable housing. This dynamic can lead to a lack of community involvement and a disconnect between the needs of residents and the financial motives of corporate owners.

The impact of large corporations in the housing market extends beyond affordability. Their presence can transform the character and culture of neighbourhoods. Renovations and redevelopments to meet corporate standards may result in the loss of unique architectural styles and local businesses that contribute to the area's distinctiveness. Long-term residents may be displaced as rents increase, disrupting social networks and eroding the sense of community.

Additionally, large corporations have been known to invest in developing commercial properties, such as office buildings, hotels, and shopping malls. They seek to maximise their returns by constructing or acquiring high-end, luxurious properties in desirable locations. This dynamic can further contribute to the homogenisation of urban spaces and the displacement of smaller businesses.

In conclusion, large corporations' investments in land, buildings, and assets under development have far-reaching consequences. They can influence housing affordability, community dynamics, and the cultural fabric of neighbourhoods. While these investments may bring efficiencies and streamline operations, they also raise concerns about the impact on local communities and the potential loss of unique characteristics that define our cities.

The Allure of Investment Management: Strategies, Challenges, and Rewards

You may want to see also

Frequently asked questions

Examples of large corporate investments include land, buildings, machinery, equipment, and software.

Large corporate investments can lead to increased productivity, improved quality of goods produced, and cost savings over time. They can also create a competitive advantage for the company, making it difficult for competitors to catch up.

Large corporate investments tend to reduce earnings growth in the short term, which is often undesirable for stockholders of a public company. Additionally, they may be accompanied by additional operating expenses and reduce the liquidity of the company if the capital asset is difficult to sell.

Large corporations can fund their investments through various sources, including cash on hand, loans, issuing stock, or bonds.