E*TRADE is currently offering a cash bonus of up to $1,000 for customers who open and fund a new brokerage account with a qualifying deposit by July 31, 2024. To qualify for this promotion, customers must use the promo code REWARD24.

| Characteristics | Values |

|---|---|

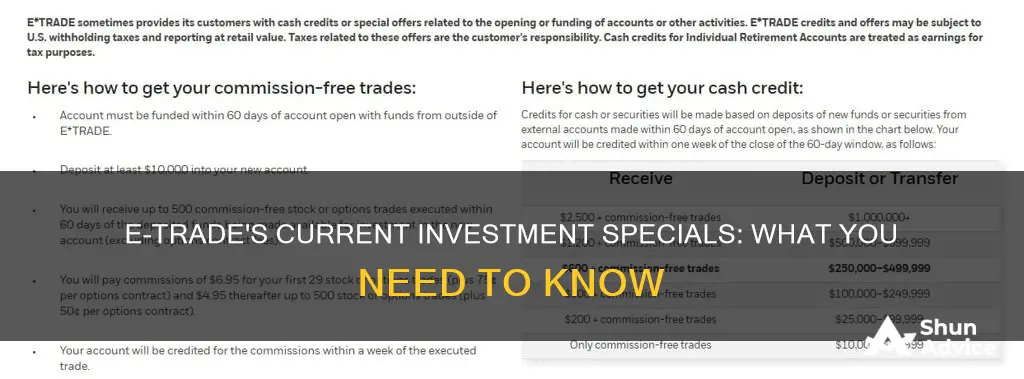

| Special Offer | Open a new eligible E*TRADE brokerage account, fund your account within 60 days of opening, and earn a cash bonus of up to $1,000, depending on the size of your deposit. Offer good for one use per customer, on a single account. |

| Promo Code | REWARD24 |

| Offer Expiry Date | 31 July 2024 |

What You'll Learn

No fees for selling stocks

E*TRADE is an online broker that offers a range of investment options, including stocks, bonds, ETFs, and more. One of its key features is that it charges no commission for buying or selling stocks, options, and ETFs, which means you can make trades without paying any fees. This is a significant advantage, especially for active traders or those who make large purchases or sales.

When you buy and sell stocks through E*TRADE, you can do so through their user-friendly platform and mobile app, which offer real-time quotes, market commentary, stock screeners, and account management tools. The Power E*TRADE platform is designed specifically for active traders and offers advanced features like technical studies, customizable options chain views, and trading ladders.

While E*TRADE does not charge commissions on stock trades, there are other fees to consider. For example, there is a $75 full transfer-out fee, and a $25 broker-assisted trade fee for trades placed outside of regular market hours. Additionally, there are fees associated with trading certain securities, such as futures contracts, over-the-counter stocks, and options orders.

It's important to note that E*TRADE also offers a wide range of no-load, no-transaction-fee mutual funds, which means you can invest in these funds without paying any commissions or transaction fees. This is a great option for those looking to diversify their investments beyond just stocks.

Overall, E*TRADE's lack of commissions on stock trades, combined with its advanced trading platforms and extensive educational resources, makes it a compelling choice for both beginner and advanced investors.

Cutting Out the Middleman: Strategies for Broker-Free Investing

You may want to see also

Mutual fund selection

E*TRADE is a popular online broker with a large mutual fund selection. It offers over 4,000 no-transaction-fee mutual funds, as well as thousands of other mutual funds.

Start With Your Goals and Risk Tolerance

Firstly, you should consider your investment goals and risk tolerance. Ask yourself: Are you looking for current income or long-term appreciation? Do you need the money in the short term or the long term? Can you tolerate a portfolio with extreme ups and downs, or do you prefer a conservative investment strategy?

Pay Attention to the Expense Ratio

The expense ratio is the cost of owning the fund and covers things like management advisory fees and basic operating expenses. A lower expense ratio means a higher return for you, so always compare the expense ratios of different funds before choosing one.

Avoid Mutual Funds With High Turnover Ratios

The turnover rate is the percentage of the portfolio that is bought and sold each year. High turnover can result in higher taxes, so it's generally better to choose funds with a lower turnover rate.

Look for an Experienced Management Team

Research the track record of the portfolio manager. Choose funds with managers who have a strong investment history and avoid those with a history of massive losses when the market has performed well. It's also a good sign if the managers have invested a substantial portion of their net worth in the fund.

Diversify Your Assets

Don't put all your eggs in one basket. Spread your assets across different companies, sectors, and industries to reduce the risk of your portfolio being hit hard by events affecting a specific sector or industry.

Use Dollar Cost Averaging

This strategy involves making regular, periodic investments of the same amount into one or more mutual funds. When the market is up, your money will buy fewer shares, and when the market is down, you'll get more shares for the same amount. Over time, this lowers the average cost basis of your shares.

Use a Good Fund Screener

Use a fund screener tool, like Morningstar's Basic Fund Screener, to help you research and compare different mutual funds based on various criteria.

Keep Fees and Expenses Low

Fees and expenses eat into your investment returns, so opt for mutual funds with low fees and expenses. No-load funds, for example, don't charge a sales fee, resulting in higher returns for you.

Riches in Art: Where the Wealthy Invest

You may want to see also

Futures trading

Futures contracts are less expensive than the underlying investment, meaning you can buy or sell more with less upfront cost. However, both gains and losses can be greater than the initial outlay. Futures can be traded in brokerage accounts and eligible IRAs.

E*TRADE offers a step-by-step guide to trading futures, which includes learning the basics, choosing a strategy, doing the research, picking a contract, and entering an order using Power E*TRADE or the Power E*TRADE app.

- Get up to speed: Understand the basic ideas and terminology of futures trading.

- Decide on a strategy: Determine how futures fit into your overall trading strategy.

- Identify potential opportunities: Utilize the tools and information provided by E*TRADE to find and evaluate possible trades.

- Choose your contract and month: Each futures quote has a specific ticker symbol followed by the contract month and year. E*TRADE offers over 60 futures contracts, including market indices, energies, metals, interest rates, currencies, and Bitcoin futures.

- Understand how money works in your account: Learn about "initial margin" and how equity in a futures account is "marked to market" daily.

- Place your order: Use Power E*TRADE to set up trades directly from the futures ladder on the platform or the app.

- Monitor and manage your trade: Keep a close eye on your positions as futures accounts and contracts have unique properties.

E*TRADE also provides specialized support from licensed Futures Specialists, who can be contacted during futures market hours.

In terms of specials, E*TRADE is offering up to $1,000 for a limited time when you open and fund a new brokerage account with a qualifying deposit by July 31, 2024.

Invest in Veneck: The Next Big Thing

You may want to see also

Educational resources

E*TRADE offers a wide range of educational resources to help investors make informed decisions. The platform provides webinars on various topics, including diversification, technical analysis, and options trading. These webinars are suitable for both beginner and advanced investors, covering basic to complex investment concepts.

In addition to webinars, E*TRADE also offers online investing courses that cover a host of topics. These courses are designed to provide a comprehensive understanding of investing and are easily accessible through the E*TRADE platform.

For those who prefer a more thematic approach, E*TRADE has a dedicated section on thematic investing. This section guides investors on how to align their investments with their values, helping them make decisions that reflect their personal beliefs.

The platform also offers a large selection of research reports and tools, going beyond what a typical discount broker provides. E*TRADE users can access independent research reports from companies like Thomson Reuters and Credit Suisse, as well as consensus price targets from analysts ranked on TipRanks.

Additionally, E*TRADE provides screeners for stocks, ETFs, and mutual funds, with a particular focus on options trading through its Power E*TRADE platform. The StrategySEEK tool, for example, allows users to search for options trades based on their predictions of a stock's future performance, helping to maximise profits and minimise costs.

For investors who are new to the platform, E*TRADE offers platform demos to familiarise themselves with the various features and functionalities. These demos can be particularly useful for navigating the basic web platform and the more advanced Power E*TRADE platform, ensuring that investors can make the most of the tools available.

Art Investments: Why the Hype?

You may want to see also

Customer support

E*TRADE offers 24/7 customer support via phone, email, and live chat. While the company offers round-the-clock support, some users have reported long wait times and sluggish responses. E*TRADE's phone support has resulted in mixed experiences, with some users having to wait a while to connect to an agent, but ultimately receiving relevant answers.

E*TRADE's customer support provides useful and relevant information. The company also provides a comprehensive FAQ section on its website, addressing common concerns such as opening an account, placing a trade, and ensuring the security and privacy of one's account.

In addition to its direct customer support channels, E*TRADE offers educational resources and support options to empower users to make informed decisions. These resources include webinars on diversification, technical analyses, and options trading, as well as online investing courses and a thematic investing section. E*TRADE also provides in-person customer service through its local and national branches, staffed by financial consultants.

For those seeking a more personalized experience, E*TRADE's robo-advisor service, E*TRADE Core Portfolios, offers automated investment management. This service constructs and manages client investment portfolios for an annual advisory fee of 0.30%, with a minimum investment of $500.

E*TRADE's customer support extends beyond traditional channels, aiming to provide users with the tools and knowledge they need to navigate their financial journey.

Ford: Invest Now or Never?

You may want to see also

Frequently asked questions

E*TRADE is offering up to $1,000 for customers who open and fund a new brokerage account with a qualifying deposit by July 31, 2024.

The promo code is REWARD24.

The deadline for the current E*TRADE promotion is July 31, 2024.

To qualify for the promotion, customers must open and fund a new brokerage account with a qualifying deposit by the deadline.

The amount of money customers can get from the promotion depends on the size of their deposit, with a maximum bonus of $1,000.