A significant percentage of people globally invest in the stock market. In the US, about 158 million adults or 61% of the adult population invest in stocks. This figure has been steadily increasing since 2013, when it was at 52%. The percentage of Americans investing in the stock market is higher than in other large advanced nations like the UK, France, Germany and Canada.

However, stock ownership is not equally distributed among different demographic groups. In the US, the top 1% of stock owners hold 49% of stocks, while the bottom 50% hold only 1%. Similarly, older generations, such as Baby Boomers, hold a larger share of stocks than younger generations. Additionally, there are racial disparities in stock ownership, with white Americans owning 88.8% of stocks, while Black and Hispanic Americans own a much smaller share.

| Characteristics | Values |

|---|---|

| Percentage of U.S. adults who invest in the stock market | 61% (2023) |

| 62% (2024) | |

| Percentage of U.S. families who invest in the stock market | 53% (2019) |

| 58% (2022) | |

| Percentage of U.S. families who directly hold stocks | 15% (2019) |

| 21% (2022) | |

| Percentage of U.S. adults who own stocks by race | 66% White (2022) |

| 39% Black (2022) | |

| 28% Hispanic (2022) |

What You'll Learn

Stock ownership by race

Stock ownership in the US is highly concentrated among the wealthy and white. In 2019, 53% of American families were invested in the stock market, a sharp rise from 32% in 1989. However, this ownership is disproportionately distributed, with only 15% of families owning stock directly.

White, non-Hispanic families are more likely to own stocks than Black and Hispanic families. In 2019, 61% of white, non-Hispanic families owned stocks, compared to 34% of Black and 24% of Hispanic families. This disparity is also reflected in the value of stock holdings, with 24% of white, non-Hispanic family assets in stocks, compared to 13% for Blacks and 10% for Hispanics.

The differences in stock ownership between white and non-white families are influenced by various factors, including income, wealth, and historical discrimination. Lower incomes among Black and Hispanic families leave less money for investments after covering essential expenses. Additionally, Black and Hispanic workers are less likely to have access to employer-sponsored retirement plans, such as 401(k)s.

The racial wealth gap is further exacerbated by differences in financial literacy and intergenerational wealth transfer. White families are more likely to receive inheritances and have higher levels of family support, contributing to their higher levels of stock ownership.

The disparities in stock ownership have significant implications for wealth accumulation. With stocks providing higher returns than other "safer" investments, the lower rates of stock ownership among Black and Hispanic families contribute to the racial wealth gap.

Efforts to encourage more Black and Hispanic individuals to become financial planners and increase financial literacy within these communities could help narrow the wealth gap over time.

Cola-Cola Investors: Who's Involved?

You may want to see also

Stock ownership by generation

Stock ownership is strongly correlated with age, with older Americans having had more time to build wealth and invest in the stock market. Baby boomers hold the largest share of stocks at 54% of stocks, valued at $21.58 trillion. This is unsurprising, as they've had more time to build wealth and tend to have more money to put into the stock market.

Gen Xers and millennials have also been increasing their stock holdings. Gen Xers own 20.9% of stocks, worth $8.36 trillion, while millennials own 7.3% of stocks, worth $2.9 trillion. 37% of Gen Z and 55% of millennial respondents own individual stocks, and 36% of Gen Z and 47% of millennials have retirement accounts.

Millennial investors are also nearly twice as likely to own cryptocurrency compared to Gen Z, viewing it as a less risky investment.

Stock ownership rates are highest for middle-aged Americans, but those 65 and older own the largest share of stocks. In 2019, families with a head of household aged 45 to 54 had the highest rate of stock ownership at 58%. However, the difference in ownership rates between age groups is not large. People 75 or older had the lowest ownership rate in 2019 at 47%, followed by those under 35 at 48%.

The value of stocks owned is much higher for older Americans, who have had more time to accumulate investments. In 2019, families with a head of household aged 65 or older held 43% of the total dollar value of stocks, with a median investment of $109,000 for stockholders aged 65 to 74 and $84,000 for those older.

XRP Investors: How Many?

You may want to see also

Direct vs. indirect ownership

According to Gallup, about 61% of Americans (approximately 158-162 million people) own stocks as of 2023. However, this figure includes both direct and indirect ownership. Direct ownership refers to individuals or entities that own shares in a legal entity, such as owning 20% of the shares in a particular company. On the other hand, indirect ownership occurs when a company or business entity in which an individual has shares owns another company.

In 2019, 53% of US families were invested in the stock market in some form, a significant increase from 32% in 1989. However, only 15% of US families directly owned stocks that year, with most families holding stocks indirectly. This trend has continued, with 58% of US families holding stocks in 2022, but only 21% holding them directly.

The rise in total stock ownership since 1989 has been driven by indirect investment, partly due to innovations like the introduction of 401(k) contributions being deducted from paychecks, the development of exchange-traded funds, and the creation of Roth IRA accounts.

The distribution of stock ownership is unequal, with the top 1% of Americans holding 49% of stocks by value, and the bottom 50% holding just 1%. Similarly, white Americans own 88.8% of stocks by value, while Black Americans and Hispanic Americans own 0.7% and 0.6% respectively, despite making up 13.8% and 18.9% of the population.

Safemoon Investors: Who's In?

You may want to see also

Income and stock ownership

Income is a key factor in determining stock ownership. In 2023, 84% of adults in households earning $100,000 or more owned stocks, while only 29% of those earning less than $40,000 did. This disparity is also evident when comparing income quintiles: 92% of the top 10% of income earners owned stocks, compared to 56% of the middle quintile (middle class) and 15% of the bottom 20%. The top 10% of income earners own 70% of the stock market's value, while the bottom 60% own only 7%.

The disparity in stock ownership is also evident when comparing net worth. In 2019, 94% of those in the top 10% of net worth owned stocks, compared to only 21% of those in the bottom 25%. The top 10% of income earners own 10 times as much of the stock market as the bottom 60%.

Stock ownership is also influenced by other factors such as race and age. White, non-Hispanic families are more likely to own stocks than Black and Hispanic families, with 61% of white, non-Hispanic families owning stocks in 2019 compared to 34% of Black and 24% of Hispanic families. Additionally, older Americans tend to own more stocks, as they have had more time to accumulate investments. Families with a head of household aged 65 or older held 43% of the total value of stocks in 2019.

Doge Investors: Who and How Many?

You may want to see also

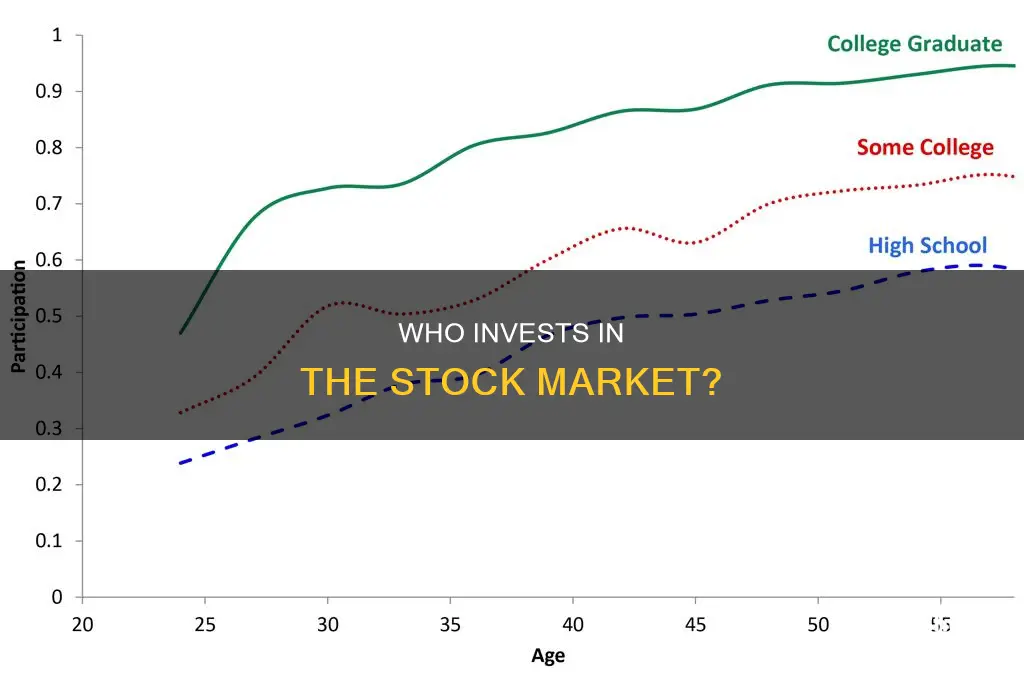

Stock ownership and age

Stock ownership varies by age, with older Americans being more likely to own stocks than younger people. This is likely due to the fact that older Americans have had more time to build up their wealth and invest in the stock market. It is also worth noting that older Americans may have different investment preferences, opting for stocks over safer investments such as bonds and bank accounts, which offer lower returns.

According to Gallup, 62% of U.S. adults aged 30 to 64 own stocks, compared to 31% of those aged 18 to 29 and 54% of those aged 65 and older. The data shows that older Americans have maintained their stock ownership rates since the 2008 financial crisis, while younger age groups have experienced declines. This could be attributed to the impact of the financial crisis on the investment outlook of younger generations.

The highest rate of stock ownership in 2019 was among families with a head of household aged 45 to 54, with 58% of these families invested in the stock market. However, the difference in ownership rates between age groups is not significant, with people aged 75 and older having the lowest ownership rate at 47%, followed by those under 35 at 48%.

When it comes to the value of stocks owned, older Americans hold a much higher value. Families with a head of household aged 65 or older held 43% of the total dollar value of stocks in 2019, with a median investment of $109,000 for stockholders aged 65 to 74 and $84,000 for those older. This is likely due to the compounding effect of long-term investments and the benefit of time in the market.

Additionally, the percentage of investors in the stock market among Gen Zers and millennials is 57%, indicating that younger generations are gradually increasing their participation in the stock market.

Restaurant Investment: Worth the Risk?

You may want to see also

Frequently asked questions

61% of Americans invested in the stock market in 2023.

About 58% of U.S. households owned stocks in 2022, according to the Federal Reserve's Survey of Consumer Finances. This is the highest on record.

In 2022, 66% of White families, 39% of Black families, and 28% of Hispanic families owned stocks directly or indirectly.

The top 1% of Americans hold 49% of stocks, while the bottom 50% hold only 1%.

Baby boomers hold the largest share of stocks at 54%. Gen Xers own 20.9% of stocks, and millennials own 7.3%.