The proper investment allocation for retirees in their 80s depends on a variety of factors, including life expectancy, lifestyle, risk tolerance, and time horizon. While there are general guidelines for asset allocation in retirement, the specific needs and circumstances of the individual should be considered.

As a retiree in their 80s, the focus is typically on income generation rather than growth, with stocks that provide dividend income or fixed-income bonds being common choices. Social Security benefits and pensions also play a significant role in financial planning at this stage. It is recommended to consult with a financial advisor to create a personalised plan that takes into account one's risk tolerance, spending needs, and long-term goals.

| Characteristics | Values |

|---|---|

| Age | 80s |

| Investment allocation | 40-70% in stocks |

| 30-50% in bonds | |

| 0-40% in cash or cash-like products | |

| Risk tolerance | Low |

| Time horizon | Short |

What You'll Learn

The older you are, the less investment risk you can take on

When it comes to investing, the general rule is that the older you get, the less risk you can take on. This is because older people have less time to recover financially from any losses. As such, financial security is important to retirees, as they cannot wait for the market to bounce back.

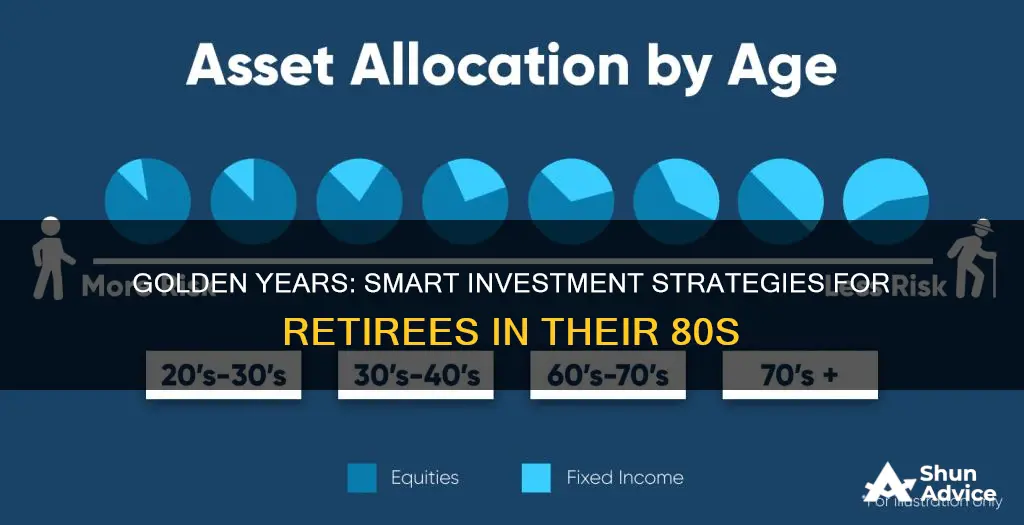

The rule of thumb for asset allocation used to be that you should subtract your age from 100, and that is the percentage of your portfolio that you should keep in stocks. For example, if you are 30, you should keep 70% of your portfolio in stocks. If you are 70, you should keep 30% of your portfolio in stocks. However, with people living longer, financial planners are now recommending that the rule should be closer to 110 or 120 minus your age. That is because if you need your money to last longer, you will need the extra growth that stocks can provide.

As you age, you should shift your assets towards more conservative investments. This is because, when you enter retirement, you no longer have an active income with which to replace losses. However, you will still need this money for years to come, so you shouldn't completely abandon your growth-oriented positions. Instead, you should strike a balance based on your personal spending needs.

For example, if you are retired and in your 60s or 70s, you may prefer a more conservative allocation of 50% in stocks and 50% in bonds, or perhaps 60% in stocks and 40% in bonds, depending on your risk tolerance. If you are in your 70s or 80s, you will likely be collecting Social Security benefits and perhaps a company pension. You will also need to start taking required minimum distributions (RMD) from your retirement accounts.

In summary, as you get older, you should reduce the amount of risk in your portfolio. While there are rules of thumb to help determine the best asset allocation for your age, it is important to consider your individual circumstances, such as your risk tolerance and life expectancy. Consulting a financial professional can help you make the right investment decisions for your situation.

Medicare and Investment Strategies: Exploring Pre-Payment Options

You may want to see also

Your risk tolerance is key

When it comes to investing, risk tolerance is a key factor in determining the right strategy for retirees, including those in their 80s. Risk tolerance refers to the degree of risk an investor is comfortable with, given the potential for losses or gains in the value of their investments. It's important to note that risk tolerance is a highly individual matter and can be influenced by various factors such as age, financial circumstances, and investment goals.

As people age, their risk tolerance tends to decrease. This is because younger investors have a longer time horizon and can be more aggressive in their investments, as they have more time to recover from any losses. On the other hand, retirees in their 80s have a shorter time horizon and may prefer more conservative investments to protect their principal investment. However, it's worth noting that with increasing life expectancies, retirees may still have a longer time horizon than expected and can consider a more balanced approach to investing.

When assessing risk tolerance, it's crucial to consider financial circumstances and investment goals. For example, if a retiree in their 80s has a substantial amount of savings and can afford to take on more risk, they may opt for a more aggressive investment strategy. On the other hand, if they have limited savings and are relying on their investments to fund their retirement, a more conservative approach may be preferable.

Additionally, the presence of other assets, such as a pension, Social Security benefits, or inheritance, can impact risk tolerance. If retirees in their 80s have multiple sources of income or a larger portfolio, they may be more tolerant of risk as they have a safety net to fall back on. In contrast, those with limited financial resources may need to be more cautious to ensure their investments last throughout their retirement.

It's important for retirees in their 80s to work with a financial professional to assess their risk tolerance and develop an investment strategy that aligns with their goals and circumstances. While there are general guidelines for investing at different ages, a personalised approach is crucial to ensure the right balance of risk and return.

Inflation-Proof Retirement: Navigating Investments in Uncertain Times

You may want to see also

Your time horizon is important

When it comes to investing, your time horizon is a critical factor. It refers to the period of time you expect to hold onto an investment before needing the money. This could be a few years, several decades, or somewhere in between.

The length of your time horizon will dictate the types of investments you should consider. Generally, the longer your time horizon, the more aggressive or risky your investments can be. This is because you have more time to ride out any market fluctuations and recover from potential losses.

For example, if you're in your 20s, you might opt for an asset allocation of 80% stocks and 20% bonds since you have a long time horizon and can benefit from compound interest. As you approach retirement age, you may shift to less risky investments like bonds and money markets to protect your savings.

However, it's important to remember that retirement doesn't necessarily mean a shorter time horizon. With people living longer, you may need your retirement savings to last for 20-30 years or more. Therefore, your investments should still include some growth-oriented assets to ensure your money lasts.

Additionally, your personal circumstances and risk tolerance will also play a role in determining your time horizon. Factors such as health, lifestyle, and spending habits will influence how you structure your finances in retirement.

In summary, your time horizon is a key consideration when investing, and it will help guide the types of investments you make to meet your financial goals. It's important to regularly review and adjust your investment strategy as your time horizon changes.

Retirement Investing: Understanding the True Cost of Fees

You may want to see also

You should shift towards more conservative investments

As people age, their investment strategies need to change. This is especially true for retirees in their 80s, who should shift towards more conservative investments. Here are some reasons why:

Reduced Income

Retirement often means a shift from active income to a fixed income. As such, retirees in their 80s may have less money to invest and less capacity to recover from any losses. More conservative investments tend to be lower-risk and lower-return, which suits this stage of life.

Longevity

People are living longer, and retirees in their 80s should plan for their money to last for several more decades. While conservative investments may not yield high returns, they are designed to protect your capital. This is important when you need your money to last for the long term.

Inflation

Inflation can significantly impact savings over time, and retirees may need to plan for their savings to last 20-30 years. Conservative investments can help protect against inflation, especially when combined with other income sources such as Social Security.

Risk Profile

Conservative investments are generally recommended for retirees as they are less volatile and provide more stable returns. This is important when you are relying on your investments for income and can't afford to take high risks.

Specific Investment Types

Some specific types of conservative investments recommended for retirees include:

- Certificates of Deposit (CDs): Offered by banks, these are low-risk, low-return products where you agree not to withdraw your money for a minimum period in return for a higher interest rate.

- Bonds: Debt notes issued by corporations or municipal governments that generate returns based on interest payments. Most bonds are relatively secure as large institutions tend to pay their debts.

- Money Market Funds: Historically a low-risk, stable option that offers the opportunity for your cash to grow.

- High-dividend blue-chip stocks: These offer stability, regular income, and the potential for stock appreciation if the company is undervalued.

- Fixed index annuities: These guard against market losses and provide a lifetime guarantee that the income will last as long as the recipient is alive.

In summary, retirees in their 80s should shift towards more conservative investments to protect their capital, generate stable returns, and ensure their money lasts for the rest of their retirement.

Planning for the Golden Years: Navigating UK Retirement Investment Options

You may want to see also

Stocks remain an important part of a retirement portfolio

While retirees in their 80s are no longer working, they still need their money to last them for decades, so it's important to strike a balance between conservative investments and growth-oriented positions. Stocks are a crucial part of a retiree's portfolio, offering the best chance to beat inflation over long periods. Here's why:

Historical Performance

Stocks have historically produced long-term gains that surpass those of other asset classes. Since 1926, large stocks have returned an average of 10% per year, without losing ground over any 20-year period. This makes stocks a more appealing option for long-term savings than other investments, such as Treasury bonds, which have had lower average annual gains over the same period.

Beating Inflation

The strong historical returns of stocks give them a better chance of outpacing inflation over time. This is crucial for retirees, especially those in their 80s, who need their savings to retain their value over what could be decades of retirement.

Growth Potential

Stocks have higher returns and growth potential than safer investments like bonds. While retirees in their 80s should generally shift towards more conservative investments, they still need their portfolios to generate returns to meet their spending needs. Stocks provide this growth potential, ensuring that retirees' portfolios can keep pace with their spending.

Diversification

Diversification is key to any investment strategy, and retirees can benefit from including stocks in their portfolios alongside other assets. In times of economic uncertainty, stocks can underperform, but they have historically recovered and gone on to see better returns. Holding stocks alongside other assets that perform well during economic downturns, such as U.S. Treasury bonds, can insulate retirees from the full impact of market volatility.

Long-Term Planning

While the traditional rule of thumb suggests that retirees should subtract their age from 100 to determine their stock allocation, this may not be sufficient for today's retirees, who are living longer. A retiree in their 80s may need their portfolio to last for another two decades or more, and stocks can provide the necessary growth to make this possible.

In conclusion, while retirees in their 80s should adopt a more conservative investment strategy overall, stocks remain an essential component of their portfolios. By including stocks, retirees can better protect their savings from inflation, generate the returns needed to meet their spending needs, and ensure their portfolios remain healthy for the long term.

Invest to Exit: A Guide to Early Retirement Through Smart Monthly Investments

You may want to see also