The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and military members in the US. It offers five different individual investment funds for participants: the Government Securities Investment (G) Fund, the Fixed Income Index Investment (F) Fund, the Common Stock Index Investment (C) Fund, the Small Capitalization Stock Index (S) Fund, and the International Stock Index Investment (I) Fund. Each fund is invested in either US Treasury securities, bonds, or US or international stocks. The best fund for you to invest in will depend on your financial situation, risk tolerance, and retirement goals.

| Characteristics | Values |

|---|---|

| Type of Plan | Retirement savings and investment plan |

| Who is Eligible? | Federal government employees and members of the military |

| Tax Benefits | Same as a 401(k) |

| Number of Participants | Over 6.8 million |

| Total Assets | Over $736 billion |

| Number of Individual Fund Options | Five |

| Names of Individual Funds | Government Securities Investment (G) Fund, Fixed Income Index Investment (F) Fund, Common Stock Index Investment (C) Fund, Small Capitalization Stock Index Investment (S) Fund, International Stock Index Investment (I) Fund |

| Default Fund | Lifecycle (L) Fund |

What You'll Learn

The benefits of investing in the G Fund

The Thrift Savings Plan (TSP) is a retirement investment program that is only available to federal employees and members of the uniformed services. It is one of the simplest and most efficient retirement plans available today.

The TSP offers five core investment funds, four of which are diversified index funds. The fifth core fund, the G Fund, is a government securities fund. This fund is invested in very low-risk, low-yield government bonds. The G Fund is intended for conservative investors who want to protect their investment from loss.

Capital Preservation

The G Fund's primary objective is to preserve capital, meaning that investors want to keep their investment safe and are less concerned with making a return. The fund is backed by the full faith of the U.S. government, so investors can be confident that their principal and interest are guaranteed.

Low Risk

The G Fund is the lowest-risk fund of the five core TSP funds. It is the only fund in the TSP that guarantees the return of the investor's principal. This makes it ideal for those with a low tolerance for risk who want to prioritize the stability and preservation of their money.

Higher Returns than Short-Term U.S. Treasury Securities

The G Fund's investment objective is to generate returns above those of short-term U.S. Treasury securities. This is achieved by investing in long-term U.S. Treasury securities, which typically have higher interest rates. The G Fund rate calculation results in a long-term rate being earned on short-term securities, providing a higher rate of return.

No Credit Risk

The G Fund is invested in U.S. Treasury securities that are specially issued to the TSP. Because the payment of principal and interest is guaranteed by the U.S. government, there is no credit risk associated with this investment.

Protection from Market Downturns

The G Fund is not subject to market volatility and is protected from loss. This can be advantageous during market downturns when other funds may suffer significant losses.

While the G Fund offers these benefits, it's important to consider the potential downside, which is the risk of inflation. Because the G Fund has a low-yield, there is a chance that the return on investment will not grow enough to keep up with the increasing cost of goods and services due to inflation. Therefore, it is crucial to evaluate your financial goals, risk tolerance, and time horizon before investing.

Dave Ramsey's Investment Strategy: Specific Fund Choices

You may want to see also

The F Fund's performance against the G Fund

The F Fund and the G Fund are two of the five core investment funds available in the Thrift Savings Plan (TSP) offered to all US government employees. The F Fund is a fixed-income investment fund, while the G Fund is a government securities fund. Both funds are designed for conservative investors, but there are some key differences between the two in terms of risk, return, and investment objectives.

The F Fund, or the Fixed-Income Investment Index Fund, is invested in a broad range of debt instruments, including publicly traded treasury and government agency securities, corporate and non-corporate bonds, and asset-backed securities (ABS). The fund aims to match the performance of the Bloomberg Barclays U.S. Aggregate Bond Index, which represents the US Government, mortgage-backed, corporate, and foreign government sectors of the US bond market. The F Fund offers the opportunity for higher rates of return over the long term compared to short-term securities like the G Fund. However, it does come with some market and inflation risk. The fund has provided a higher average annual return than the G Fund, with an 11.50% return over the last 12 months compared to the G Fund's 2.46%.

On the other hand, the G Fund, or the Government Securities Investment Fund, invests in short-term US Treasury securities, providing an opportunity to earn rates of interest similar to those of long-term government securities without the risk of loss of principal. The payment of principal and interest is guaranteed by the US Government, making it a very low-risk investment option. However, the G Fund has historically provided the lowest rate of return among the core funds. For example, in the past 12 months, it has returned only 1.42%, which is below the average US inflation rate of around 3% per year.

When comparing the performance of the F Fund and the G Fund, it is important to consider their different risk and return profiles. The F Fund offers higher potential returns but comes with greater price volatility and the possibility of losing money. On the other hand, the G Fund provides a guaranteed return of principal with stable but lower interest rates. As of December 2023, the F Fund had assets of $33.1 billion, while the G Fund held a much larger proportion of assets in the TSP, with 32.6%.

In summary, the F Fund may be a good option for investors seeking higher long-term returns who are comfortable with some level of risk and volatility. On the other hand, the G Fund may be more suitable for those who prioritize capital preservation and are willing to accept lower returns in exchange for a guaranteed return of principal.

Vanguard Mutual Funds: Are They Worth the Investment?

You may want to see also

The C Fund's higher returns over time

The Thrift Savings Plan (TSP) is a retirement investment program offered to US government employees. It is one of the simplest and most efficient retirement plans available today. The TSP offers five core mutual funds to invest in, four of which are diversified index funds. Each index fund specialises in a different asset class or market segment, such as US equities, international equities, and corporate bonds.

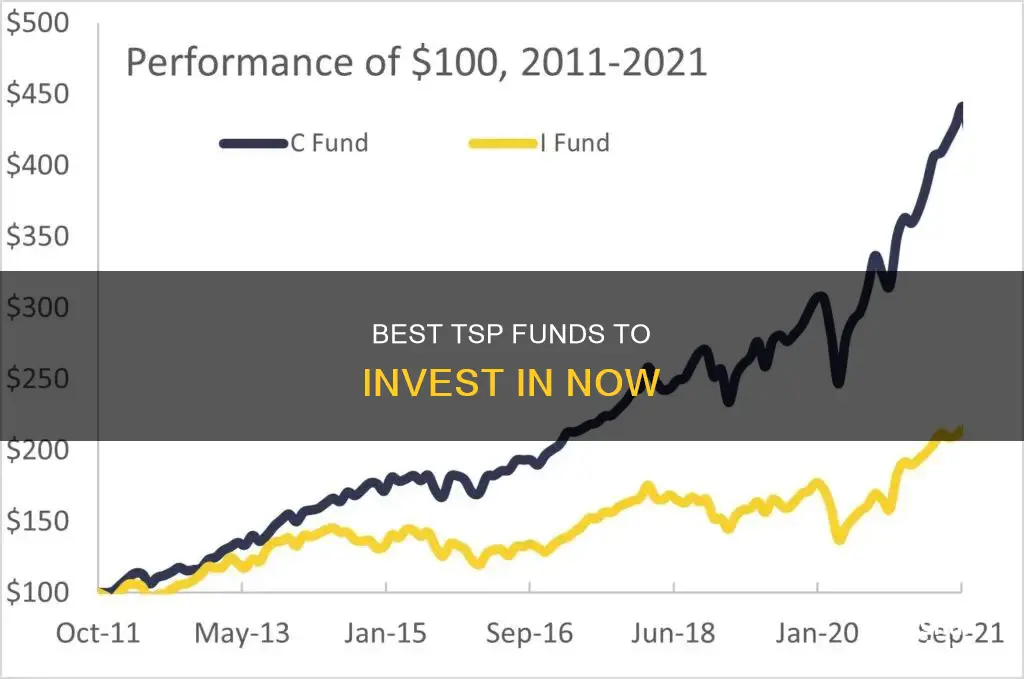

The Common Stock Index Investment (C) Fund is the most conservative of the three stock funds available in the TSP. The C Fund is invested in a stock index fund that tracks the Standard & Poor's 500 (S&P 500) Index, a broad market index made up of the stocks of 500 large to medium-sized US companies. The C Fund has experienced greater volatility than either the G or F Funds and has posted higher returns over time.

The C Fund offers the opportunity to experience gains from equity ownership of large and mid-sized US company stocks. The C Fund's investment objective is to match the performance of the S&P 500, which tracks the performance of major US companies and industries. The S&P 500 represents approximately 85% of the market value of the US stock markets.

The C Fund can be useful in a portfolio that also contains stock funds that track other indexes, such as the S Fund and the I Fund. By investing in all segments of the stock market, you reduce your exposure to market risk. The C Fund can also be useful in a portfolio that contains bonds. A retirement portfolio that contains a bond fund like the F Fund, along with other stock funds, will tend to be less volatile than one that contains stock funds alone.

The C Fund has higher returns over time compared to the G and F Funds. The C Fund has experienced greater volatility but has posted commensurately higher returns. The C Fund's higher returns over time make it a good choice for investors seeking higher investment returns associated with equity investments.

It is important to note that investing in the C Fund comes with market and inflation risk. C Fund returns move up and down with the prices of the stocks in the S&P 500 Index. Additionally, there is a risk that C Fund investments may not outpace or grow enough to offset the reduction in purchasing power.

Vanguard Windsor II: Uncovering its Security Strategy

You may want to see also

The S Fund's higher risk and higher returns

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the military. It offers five different individual investment funds for participants, each with varying levels of risk and potential returns. One of these funds is the Small Capitalization Stock Index Investment (S) Fund, which offers higher risk and the potential for higher returns.

The S Fund is a stock index fund that tracks the Dow Jones U.S. Completion Total Stock Market (TSM) Index. This index comprises small and medium-sized U.S. companies that are not included in the S&P 500 Index. Investing in the S Fund offers participants the opportunity to earn potentially higher investment returns associated with "small-cap" investments. It is considered one of the two funds with the greatest risk in the TSP and has outperformed the Common Stock Index Investment (C) Fund, which is the most conservative of the three stock funds available in the TSP.

The S Fund has greater volatility than the C Fund and has exhibited proportionately greater fluctuations over time. As of early 2023, the S Fund had grown to over $36 per share from $10 at its inception in mid-2003. This growth represents half of the expansion of the C and International Stock Index Investment (I) Funds but is double that of the Government Securities Investment (G) and Fixed Income Index Investment (F) Funds, which track treasury and corporate bonds.

When considering the S Fund, it is essential to keep in mind that it entails higher risk. In 2022, the S Fund lost money, along with the C, I, and F Funds, while the G Fund, which invests in low-risk government bonds, remained stable and even grew due to its government backing. Thus, the S Fund may not be suitable for those seeking a more conservative investment strategy or those nearing retirement, as it could potentially result in more significant losses during market downturns.

However, for those with a higher risk tolerance and a longer time horizon until retirement, the S Fund can provide the potential for substantial returns. By investing in smaller and less established companies than the C Fund, the S Fund offers greater growth potential. Additionally, the S Fund allows investors to diversify their portfolios and gain exposure to a broader range of U.S. equities.

Best S&P Index Funds: Top Picks for Your Portfolio

You may want to see also

The I Fund's international focus

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the military. It offers five different individual investment funds, one of which is the International Stock Index Investment (I) Fund.

The I Fund is an international fund that invests in stocks from overseas companies, providing investors with global equity exposure. It is based on the Morgan Stanley Capital International EAFE (Europe, Australasia, Far East) Index, which focuses on developed markets and countries. The fund invests in securities mirroring this index, which is comprised of primarily large companies in 21 to 22 developed countries worldwide.

The I Fund presents a unique opportunity to invest in international stock markets and gain exposure to companies outside the United States. It is regarded as one of the two high-risk funds in the TSP, historically posting a higher average annual return than the C Fund, which tracks the Standard & Poor's 500 Index.

While the I Fund has experienced fluctuations and challenges, such as losses in 2022, it has also had several breakout years. In late 2007, it outperformed the S Fund by 20% and the C Fund by over 40%. Additionally, the I Fund has the potential to do well in the long term due to several factors. Firstly, the value of the companies in the fund is relatively better than those in the C and S Funds, with a lower price-to-earnings ratio. Secondly, the I Fund offers a more attractive dividend payout than the C or S Funds. Thirdly, positive world events, such as the relaxation of pandemic travel restrictions and the upcoming Summer Olympics in France, are expected to boost international travel and tourism, positively impacting the economies of the countries in the index. Finally, the eventual end of the war in Ukraine will lead to a massive nationwide rebuilding effort, providing opportunities for companies in Europe and worldwide.

When considering TSP investment options, it is recommended to focus on the C, S, and I Funds. A suggested allocation for a well-diversified portfolio is 80% in the C Fund, 10% in the S Fund, and 10% in the I Fund. Alternatively, a 60-20-20 split among these three funds can also be considered.

Real Estate Fund Investing: What You Need to Know

You may want to see also

Frequently asked questions

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the military. It includes the same tax benefits as a 401(k) and many agencies offer matching contributions.

The TSP offers five different individual fund options, each one invested in either U.S. Treasury securities, bonds, or U.S. or international stocks. The five funds are:

- The Government Securities Investment (G) Fund

- The Fixed Income Index Investment (F) Fund

- The Common Stock Index Investment (C) Fund

- The Small Capitalization Stock Index Investment (S) Fund

- International Stock Index Investment (I) Fund

This depends on your financial situation and goals. The G and F Funds are low-risk but have limited growth potential. The C, S and I Funds offer higher risk and potentially higher returns. A Lifecycle (L) Fund is also available, which automatically adjusts the ratio of the five individual funds according to your age and time horizon.