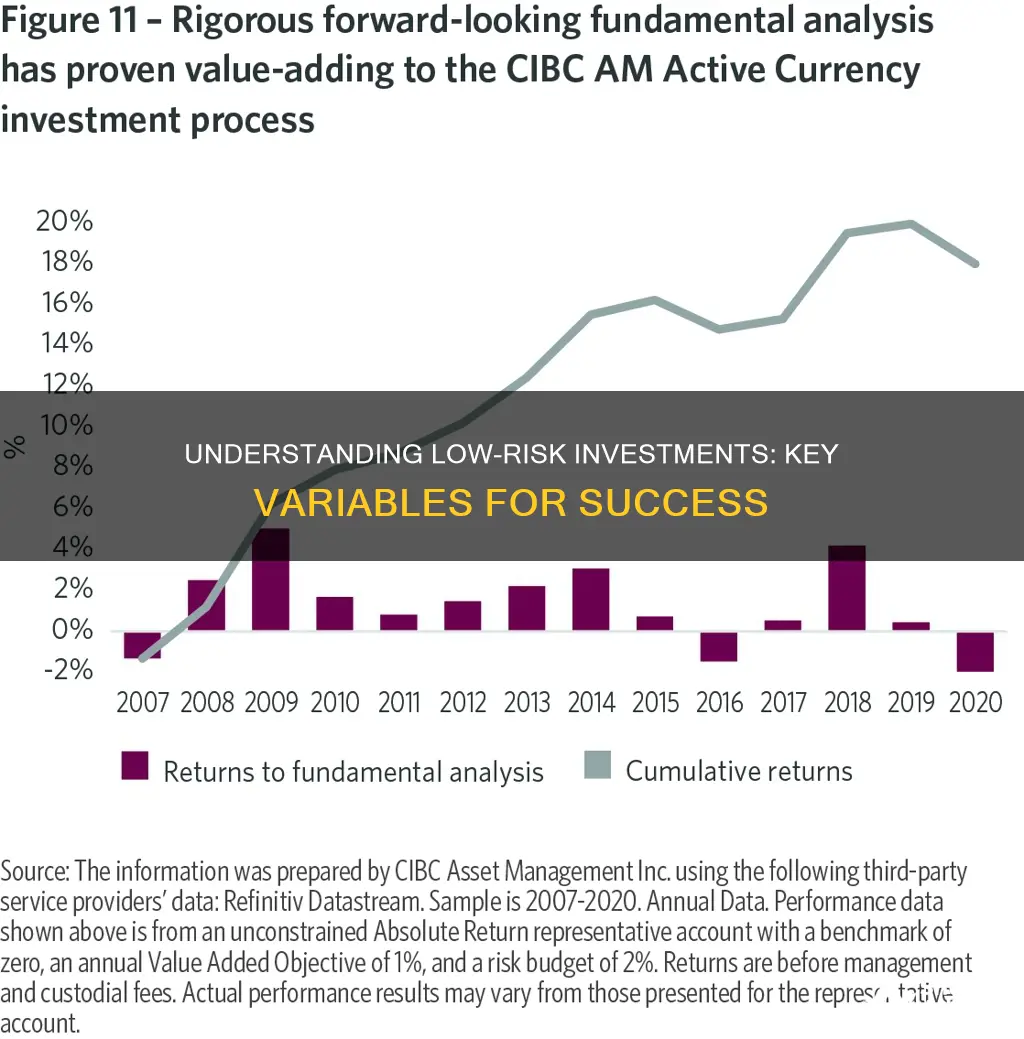

When it comes to investing, there is a natural trade-off between risk and potential returns. Low-risk investments are those where there is less at stake, either in terms of the amount invested or the significance of the investment to the portfolio. Low-risk investments provide stable but modest returns, and are often sought by older investors looking to preserve capital. On the other hand, younger investors with longer time horizons can afford to take on more risk, as they have time to recover from downturns. Each investor must decide how much risk they are willing and able to accept for a desired return, based on factors such as age, income, investment goals, and time horizon.

| Characteristics | Values |

|---|---|

| Risk-return tradeoff | Low levels of risk are associated with low potential returns |

| Risk-free rate of return | The theoretical rate of return of an investment with zero risk |

| Age | Younger investors with longer time horizons can take on more risk |

| Income | Low-risk investments provide stable but modest returns |

| Investment goals | Older investors nearing retirement may shift towards more low-risk securities to preserve capital |

| Liquidity needs | |

| Time horizon | |

| Personality | |

| Diversification | A well-diversified portfolio will consist of different types of securities from diverse industries that have varying degrees of risk and correlation with each other’s returns |

What You'll Learn

Risk-free rate of return

Low-risk investments are those where there is less at stake, either in terms of the amount invested or the significance of the investment to the portfolio. Low-risk investments are generally associated with low potential returns.

The risk-free rate of return is the theoretical rate of return of an investment with zero risk. It represents the interest you would expect from an absolutely risk-free investment over a specific period of time. The risk-free rate of return is the minimum return you would expect for any investment because you wouldn't accept additional risk unless the potential rate of return is greater than the risk-free rate.

The risk-free rate of return is often used as a benchmark to evaluate the performance of other investments. It is assumed that investors will only accept additional risk if the potential return is greater than the risk-free rate. This is known as the risk-return trade-off, where investors must balance their desire for low risk with their desire for high returns.

In practice, there are very few, if any, truly risk-free investments. However, some investments are considered to be relatively low risk, such as certificates of deposit (CDs) and US Treasury bonds, which provide stable but modest returns. These types of investments are often recommended for older investors nearing retirement who are looking to preserve their capital.

To minimise risk, investors can diversify their portfolios by investing in different types of securities from diverse industries, with varying degrees of risk and correlation to each other's returns. A well-diversified portfolio can help to reduce the overall risk while still allowing for potential growth. Ultimately, each investor must decide how much risk they are willing and able to accept based on their goals, risk tolerance, investment horizon, and other factors.

Private Equity: An Investment Management Strategy?

You may want to see also

Diversification

The risk-return tradeoff is the balance between the desire for the lowest possible risk and the highest possible returns. In general, low levels of risk are associated with low potential returns and high levels of risk are associated with high potential returns. Each investor must decide how much risk they are willing and able to accept for a desired return. This will be based on factors such as age, income, investment goals, liquidity needs, time horizon, and personality.

On the lower-risk side of the spectrum is the risk-free rate of return, which is the theoretical rate of return of an investment with zero risk. It represents the interest you would expect from an absolutely risk-free investment over a specific period of time. The risk-free rate of return is the minimum return you would expect for any investment because you wouldn't accept additional risk unless the potential rate of return is greater than the risk-free rate.

Experts typically recommend a diversified portfolio containing a mix of low, moderate, and high-risk assets tailored to your goals, timeline, and risk tolerance. Some higher-risk assets allow for growth potential, while maintaining a core of stable investments hedges against volatility.

When considering low-risk investments, investors must also think about both the likelihood and the magnitude of bad outcomes. By nature, with low-risk investing, there is less at stake in terms of the amount invested or the significance of the investment to the portfolio. There is also less to gain in terms of the potential return or the potential benefit in the longer term. Low-risk investing not only means protecting against the chance of any loss but also making sure that none of the potential losses will be devastating.

Understanding the Cost of Managed Investments: Average Expense Percentage Rates

You may want to see also

Risk-reward trade-off

Low-risk investments are those where there is less at stake, either in terms of the amount invested or the significance of the investment to the portfolio. There is also less to gain in terms of potential returns or benefits. Low-risk investing means protecting against the chance of any loss and ensuring that none of the potential losses will be devastating.

On the lower-risk side of the spectrum is the risk-free rate of return, which is the theoretical rate of return of an investment with zero risk. It represents the interest you would expect from an absolutely risk-free investment over a specific period of time. The risk-free rate of return is the minimum return you would expect for any investment because you wouldn't accept additional risk unless the potential rate of return is greater than the risk-free rate.

The most basic and effective strategy for minimising risk is diversification. A well-diversified portfolio will consist of different types of securities from diverse industries that have varying degrees of risk and correlation with each other's returns. Experts typically recommend a diversified portfolio containing a mix of low, moderate, and high-risk assets tailored to an individual's goals, timeline, and risk tolerance.

Equity Saving Schemes: A Guide to Investing Wisely

You may want to see also

Age and income

When it comes to age, the time horizon until retirement is a critical consideration. Younger investors have more time to ride out market fluctuations and recover from potential losses, so they can afford to take on more risk in pursuit of higher returns. For example, a young investor in their 20s or 30s may be comfortable investing in riskier assets such as stocks or cryptocurrencies, knowing that they have decades to build their portfolio and weather any short-term losses.

On the other hand, older investors nearing retirement typically have a shorter time horizon and may be more focused on preserving their capital. As a result, they may favour low-risk investments such as bonds, cash, or stable dividend-paying stocks. These types of investments may provide lower returns but offer more stability and security, which is crucial for those relying on their investments for retirement income.

Income also influences an investor's risk tolerance. Investors with higher incomes may have more financial flexibility and be able to absorb potential losses, making them more comfortable with riskier investments. Additionally, higher-income individuals may have a higher risk appetite, as they seek to maximise their returns and grow their wealth. Conversely, investors with lower incomes may be more conservative in their investment approach, opting for stable and secure investments that provide consistent, modest returns.

It's important to note that while age and income are significant factors in determining risk tolerance, they are not the only considerations. Investment goals, liquidity needs, personality, and risk tolerance also play a crucial role in shaping an investor's strategy. Ultimately, each investor must carefully assess their unique circumstances and decide on an appropriate balance between risk and return.

Diamond Investments: High Risk, High Reward?

You may want to see also

Investment goals

When considering investment goals, it's important to understand the variables that indicate low-risk investments. Low-risk investments are those that have less at stake, either in terms of the amount invested or the significance of the investment to the portfolio. They are also associated with lower potential returns.

The risk-return trade-off is a key concept in investing, where investors must balance their desire for low risk with their desire for high returns. Generally, low levels of risk are associated with low potential returns, while high levels of risk are linked to high potential returns. Each investor must decide how much risk they are willing and able to accept for their desired return, taking into account factors such as age, income, investment goals, liquidity needs, time horizon, and personality.

For example, younger investors with longer time horizons can typically afford to take on more risk, as they have time to recover from periodic downturns in volatile assets. On the other hand, older investors nearing retirement may shift towards more low-risk securities to preserve their capital.

The most basic and effective strategy for minimising risk is diversification. A well-diversified portfolio will consist of different types of securities from diverse industries, with varying degrees of risk and correlation with each other's returns. This helps to hedge against volatility and maintain a core of stable investments.

When setting investment goals, it's crucial to consider not only the potential returns but also the potential losses. Low-risk investing means protecting against any chance of loss and ensuring that none of the potential losses will be devastating. It's important to keep in mind that there is often a risk-reward trade-off, and to tailor your investment strategy to your goals, risk tolerance, and investment horizon.

Morgan Stanley: Leading the Way in Investment Management

You may want to see also

Frequently asked questions

A low-risk investment is one where there is less at stake, either in terms of the amount invested or the significance of the investment to the portfolio.

The risk-free rate of return is the theoretical rate of return of an investment with zero risk. It represents the interest you would expect from an absolutely risk-free investment over a specific period of time.

The risk-return trade-off is the balance between the desire for the lowest possible risk and the highest possible returns. In general, low levels of risk are associated with low potential returns and high levels of risk are associated with high potential returns.

The most basic and effective strategy for minimising risk is diversification. A well-diversified portfolio will consist of different types of securities from diverse industries that have varying degrees of risk and correlation with each other’s returns.

When deciding how much risk to take on, you should consider factors such as your age, income, investment goals, liquidity needs, time horizon, and personality.