Investing $100 a month over 40 years can be a great way to build wealth over time. While it may not be possible for everyone to invest large sums of money each month, smaller amounts can still make a significant impact on your financial future. The key is to start early and be consistent with your contributions.

When it comes to investing $100 a month over 40 years, the potential returns can vary depending on your investment choices and risk tolerance. For example, investing in the stock market tends to be riskier due to its volatility, but it can also offer greater returns over time. On the other hand, investing in bonds is considered safer but typically yields lower returns.

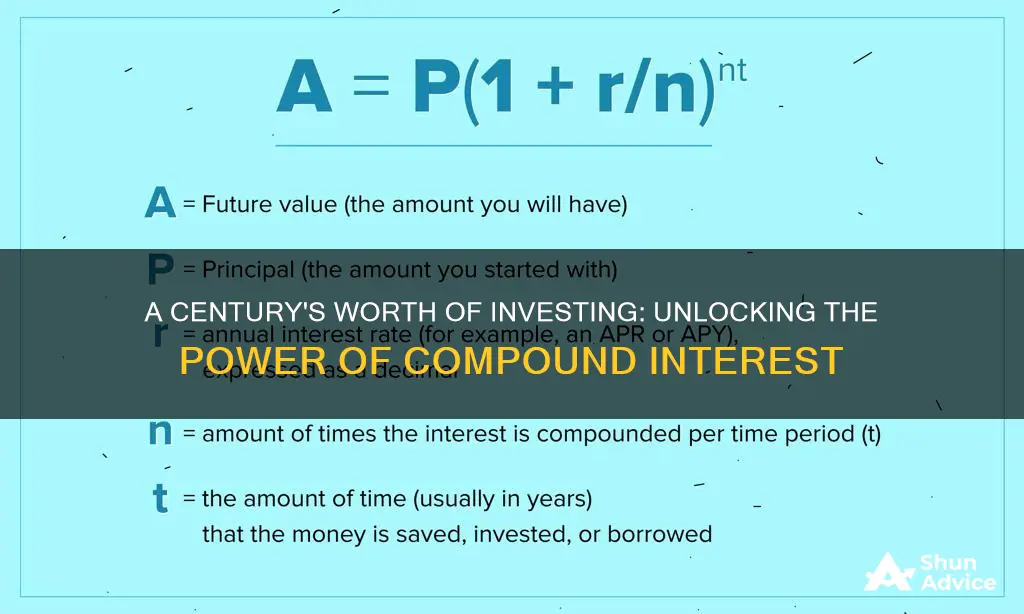

By investing $100 a month over 40 years, you can take advantage of compound interest, where your gains build upon themselves over time. This strategy can be a powerful way to grow your wealth, even if you don't have a large amount to invest upfront.

| Characteristics | Values |

|---|---|

| Amount | $100 |

| Frequency | Monthly |

| Investment Type | Stocks |

| Investment Period | 40 years |

| Average Annual Return | 10% |

| Ending Balance | $531,000 |

| Total Contribution | $48,000 |

| Total Gain | $483,000 |

What You'll Learn

Stocks are a better long-term investment than savings accounts

While saving is generally considered safer than investing in stocks, the latter is a better long-term strategy. Here's why:

Stocks Offer Higher Returns

Over the past 50 years, the stock market has delivered an average annual return of 10% (before inflation), as measured by the performance of the S&P 500 index. In contrast, savings accounts offer very low-interest rates, and the money deposited in them will likely lose value due to inflation over time.

Stocks Help You Beat Inflation

While the stock market can be volatile, historically, it has outperformed other investment options over several decades. Stocks are more likely to lose value in the short term than savings accounts, but they have proven to be a better long-term value.

Stocks Provide Compounding Returns

Compounding returns occur when gains build upon previous gains. Stocks generate dividends that can be reinvested, and over time, this creates a self-feeding source of financial growth. This is a powerful way to build wealth over time.

Stocks Offer Dollar-Cost Averaging

Investing in stocks allows you to benefit from dollar-cost averaging, which means you invest when the market is going up and when it is down. This strategy helps to minimise the impact of market volatility on your portfolio.

Stocks Provide Diversification

By investing in stocks, you can easily diversify your portfolio, especially if you choose to invest in an S&P 500 ETF or index fund. These funds track the S&P 500 index, which includes stocks from 500 of the largest and strongest companies in the US. By investing in such a fund, you instantly gain exposure to a diverse range of companies, limiting your risk.

Stocks Are a Hedge Against Inflation

Investing in stocks can help you beat inflation and increase your purchasing power over the long term. The target inflation rate set by the Federal Reserve is currently 2%, but it has been much higher in recent years. If your investment returns do not keep up with inflation, you are losing purchasing power.

In summary, while saving in a savings account is a safe and easily accessible option for your money, investing in stocks offers the potential for higher returns and a hedge against inflation. However, it's important to remember that investing in stocks comes with higher risk and volatility. It's always recommended to do your research and consult a financial advisor before making any investment decisions.

Pay Off Your Second Mortgage or Invest: Which Comes First?

You may want to see also

The stock market is a powerful way to build wealth

Compounding returns act like a snowball rolling downhill. The two key elements are reinvestment of earnings and time. Stocks generate dividends that can be reinvested, and over time, this creates a self-feeding source of financial growth. Your interest generates more interest, which then generates even more interest down the road.

Dollar-cost averaging is a strategy where you invest a fixed amount at regular intervals, regardless of market performance or economic conditions. This approach helps you buy shares at different price points, reducing the impact of market volatility on your investment.

When you invest in the stock market, you are taking on more risk compared to safer options like savings accounts or certificates of deposit (CDs). Stocks can be volatile, and their value can go up or down. However, historically, the stock market has outperformed these safer investments over the long term.

For example, the S&P 500, an index of 500 large and well-established US companies, has delivered an average annual return of around 10% over several decades. By investing in an S&P 500 index fund or ETF, you instantly gain exposure to a diversified portfolio of some of the strongest companies in the world, which are more likely to survive periods of market volatility.

While investing in the stock market can be unnerving, especially during volatile periods, it offers the potential for substantial gains. Even small amounts of money, invested consistently over time, can grow into a substantial sum.

Additionally, you don't need to be rich to start investing in the stock market. Time is your most valuable resource. Starting early and investing regularly, even with a small amount like $100 per month, can build an investment portfolio worth hundreds of thousands of dollars over time.

Of course, it's important to remember that investing in the stock market comes with risks, and there are no guarantees. Past performance does not ensure future results, and there may be periods of significant losses. It's essential to carefully consider your financial situation, risk tolerance, and investment goals before deciding how to invest your money.

Maximizing an Inheritance: Strategies for Investing Toward Retirement

You may want to see also

S&P 500 ETFs are a good option for beginners

Investing $100 a month over 40 years can be a lucrative strategy to grow your wealth over time. While there are countless investments to choose from, S&P 500 ETFs are a good option for beginners.

The S&P 500 is the major US stock market index, tracking the 500 largest US companies by market capitalisation. S&P 500 ETFs are exchange-traded funds that aim to duplicate the performance of the S&P 500 index. They are a cornerstone of countless investment portfolios, as it is nearly impossible to build an investment portfolio that outperforms the S&P 500 over the long term. Trillions of dollars are invested in funds that track the performance of the S&P 500, making it a basic investing benchmark.

S&P 500 ETFs are also a good option for beginners because they are affordable. The total expense ratio (TER) of S&P 500 ETFs is between 0.03% and 0.15% per annum, while most actively managed funds cost much more in fees per year. For example, the iShares Core S&P 500 ETF and the Vanguard 500 Index Fund both charge an annual expense ratio of only 0.03%.

In addition, S&P 500 ETFs are highly liquid, making it easy to buy and sell them on any given day. The SPDR S&P 500 ETF Trust, for instance, offers outstanding liquidity, with an average daily trading volume of around 81 million shares over the last three months.

Finally, S&P 500 ETFs are a good option for beginners because they are easy to buy. Unlike index funds, which often have investment minimums, ETFs are available for purchase at the per-share price and generally have no minimums to start investing.

In summary, S&P 500 ETFs are a good option for beginners because they are a straightforward, low-risk, affordable and highly liquid way to invest in the stock market.

Backpack Wheels: Invest in Comfort

You may want to see also

Stocks are volatile but safer in the long term

Stocks are a volatile asset class, and their value can fluctuate significantly in the short term. However, in the long term, stocks have historically provided strong returns and can be a safer investment option compared to other asset classes. Here are a few reasons why stocks can be a safer choice for long-term investors:

Time Horizon and Compounding

Investing in stocks for an extended period, such as 40 years, allows your investments to benefit from compounding returns. Compounding occurs when the gains made are reinvested, leading to exponential growth over time. The longer the investment horizon, the more time your money has to grow and recover from any short-term losses.

Historical Performance

Historically, the stock market has delivered impressive returns over several decades. For example, the S&P 500 index has provided an average annual return of around 10% over the past 50 years. While past performance doesn't guarantee future results, the long-term trend indicates that stocks tend to outperform other investments, such as savings accounts and bonds, over the long run.

Beating Inflation

Stocks are considered a hedge against inflation. In the current low-interest-rate environment, savings accounts and bonds may not even keep up with inflation, leading to a loss in purchasing power. Stocks, on the other hand, have the potential to provide returns that outpace inflation, helping you maintain or increase your wealth in real terms.

Diversification

Diversification is a crucial aspect of investing. By investing in a variety of stocks or stock funds, such as ETFs or mutual funds, you reduce the impact of any single stock's performance on your portfolio. Diversification helps to lower the overall risk and provides more stable returns. Additionally, investing in an S&P 500 ETF or index fund instantly diversifies your investment across 500 of the largest and strongest companies in the US.

Dividend Income

Many stocks, particularly mature and established companies, pay dividends, which provide a regular income stream. Dividend-paying companies often increase their payouts over time, resulting in higher income for long-term investors. Dividend stocks can be an attractive option for those seeking both capital appreciation and a steady income.

Long-Term Growth Potential

Stocks offer the potential for significant long-term growth. While there may be short-term volatility and market downturns, stocks have historically trended upwards over the long run. This makes them ideal for investors with a long investment horizon, such as those saving for retirement.

In summary, while stocks may experience short-term volatility, they have historically provided strong returns over the long term. By investing in stocks for 40 years, you benefit from compounding returns, diversification, dividend income, and the potential for substantial growth. However, it is important to carefully consider your risk tolerance, conduct thorough research, and diversify your investments to balance the risks associated with stock market investing.

Advertising's Impact: Exploring the Demand-Side Dynamics

You may want to see also

Compounding returns are a benefit of investing $100 a month

Compounding returns are a key advantage of long-term investing. While stocks may be more volatile than safer investments like bonds or savings accounts, the long-term returns are historically higher. This is because the longer time horizon enables investors to take measured risks that can pay off in the long run.

For example, let's say you invest $100 a month for 30 years and earn an 8% annual return. After 30 years, your portfolio will be worth $186,253.14. This is the power of compounding returns at work.

Compounding returns can also be applied to dividend-paying stocks or funds. Dividends are profits distributed to shareholders, and by reinvesting these dividends, you can further boost your returns over time.

To maximize the benefits of compounding returns, it's important to invest consistently over a long period. Even if you start with a small amount like $100 a month, your wealth can grow significantly over time thanks to the power of compounding.

Unleashing Investment Strategies: Exploring Options Beyond the Paid-Off Home

You may want to see also

Frequently asked questions

Yes, investing $100 a month can grow your wealth over time. While it may not be easy to do when you're on a tight budget, it is a good strategy to build up a lot of wealth over time.

Stocks are more volatile than safer investments such as bonds, savings accounts, or certificates of deposit (CDs). However, the long-term average return on stocks is historically higher than that of safer investments.

A good option is to invest in an S&P 500 index fund or ETF, which will track the performance of the S&P 500 index. This will give you a diversified portfolio of 500 of the largest and strongest US companies, reducing your risk.