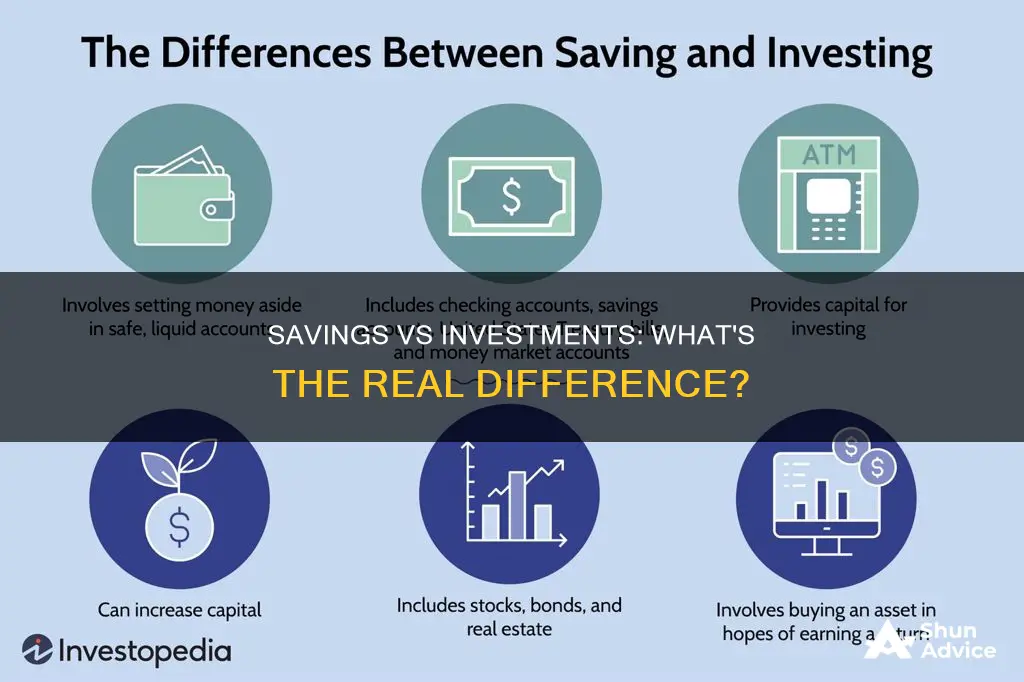

Savings and investments are both important concepts for building a sound financial future, but they are not the same thing. Savings typically refer to storing money safely in interest-bearing bank accounts, such as savings accounts, money market accounts, or certificates of deposit (CDs). On the other hand, investments usually involve depositing money into a brokerage account to purchase assets with the potential for higher growth over time, such as stocks, bonds, or mutual funds. While savings provide a foundation for financial security and are ideal for short-term goals, investments are used for long-term goals like retirement and come with a higher level of risk.

What You'll Learn

Savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC)

The FDIC insurance provides a sense of security and peace of mind for individuals who choose to save their money in insured accounts. It ensures that their hard-earned money is protected, even in the face of economic downturns or bank failures. This insurance coverage is particularly important for those who rely on their savings for financial stability and security. By having their deposits insured, individuals can have confidence that their money is safe and accessible when they need it.

The FDIC insurance plays a crucial role in maintaining trust in the US banking system. It helps to instill confidence in savers, knowing that their funds are secure. This, in turn, encourages individuals to deposit their money into banks, which contributes to the overall stability and liquidity of the financial system. The insurance coverage also promotes responsible banking practices as banks are held to certain standards and regulations to maintain their FDIC status.

It is worth noting that credit unions offer a similar level of protection. Accounts offered by credit unions are typically insured by the National Credit Union Administration (NCUA). This insurance functions similarly to FDIC insurance, providing protection for depositors' funds up to specified limits. Therefore, whether you choose to save with a bank or a credit union, you can benefit from the security and peace of mind that comes with deposit insurance.

In summary, the FDIC insurance on savings accounts provides a safety net for individuals, ensuring that their deposits are protected by the US government up to certain limits. This insurance encourages individuals to save their money in banks, contributes to financial stability, and promotes confidence in the banking system. When considering savings options, it is important to verify the insurance coverage provided by the financial institution to ensure your savings are protected.

CDs: Macroeconomics Investment or Savings Strategy?

You may want to see also

Investing has a higher potential for growth

While both saving and investing are important for achieving financial goals, investing has a higher potential for growth. This is because investments often carry more risk, which can lead to higher returns over time.

When you invest, you are typically putting your money into a brokerage account to purchase assets that may grow in value. These assets can include stocks, bonds, mutual funds, and exchange-traded funds (ETFs). While there is always the possibility of losing some or all of your investment, historical data shows that the potential for growth is significant. For example, from 2013 to 2023, the S&P 500, a stock market index tracking the 500 largest publicly listed companies, returned an average of more than 13% per year. This is in stark contrast to the average interest rate on savings accounts, which is typically much lower, around 0.47%.

The higher potential returns of investing can be attributed to the fact that you are taking on more risk. When you invest in stocks, for instance, you are purchasing a tiny piece of ownership in a company, and your returns depend on the company's performance. If the company does well, the value of its stock can increase significantly, leading to higher returns for investors. However, if the company performs poorly or goes bankrupt, you may lose some or all of your investment.

It's important to note that investing is generally recommended for long-term financial goals. This is because it allows time to ride out any short-term downturns in the market and recover potential losses. For example, if you are saving for retirement, investing in a 401(k) or IRA can provide tax benefits and allow your money to grow over time. Additionally, investing in a diversified portfolio can help reduce the overall risk by spreading your investments across different companies and industries.

While investing has the potential for higher growth, it is important to consider your financial goals, risk tolerance, and time horizon. If you need the money in the short term or cannot afford to lose any of your investment, saving may be a more suitable option. Saving is typically done through low-risk accounts such as savings accounts, money market accounts, or certificates of deposit (CDs), which offer modest returns but provide easy access to your funds.

In conclusion, investing has a higher potential for growth due to the increased risk associated with purchasing assets. However, it is important to carefully consider your financial situation and goals before deciding between saving and investing, as both can play important roles in achieving financial security.

Invest Wisely to Secure Your Dream Home

You may want to see also

Savings provide a foundation for financial security

The primary objective of savings is to provide financial security and protection. By putting money into savings accounts, money market accounts, or certificates of deposit (CDs), individuals can ensure their funds are readily available when needed. These savings vehicles are typically insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), offering a level of security and peace of mind.

Savings accounts are essential for building an emergency fund. Financial experts recommend setting aside three to six months' worth of living expenses in an emergency fund. This fund can be accessed in case of unforeseen events, such as job loss, medical emergencies, or unexpected expenses. By having a dedicated savings account, individuals can avoid resorting to high-interest loans or credit card debt during challenging times.

Additionally, savings accounts are ideal for short-term financial goals. Whether saving for a new gadget, a vacation, or a down payment on a car, savings accounts provide a safe and accessible way to achieve these goals. The flexibility and liquidity offered by savings accounts make them a reliable option for meeting short-term objectives.

While savings accounts may offer lower returns compared to riskier investments, they provide stability and security. The interest rates on savings accounts are often modest, but they help protect against inflation and preserve an individual's purchasing power. This is especially important for maintaining financial stability during periods of economic uncertainty.

Moreover, savings accounts are generally low-risk, meaning there is minimal chance of losing money. In contrast, investments carry a higher level of risk, and there is always the possibility of losing some or all of the invested capital. Savings accounts, therefore, provide a safeguard against potential losses and offer a more predictable financial outlook.

In conclusion, savings provide a strong foundation for financial security. They empower individuals to prepare for unexpected expenses, build emergency funds, and achieve short-term financial goals. By utilising savings accounts, individuals can benefit from liquidity, stability, and protection against financial shocks. While investing is crucial for long-term growth, savings are the cornerstone of a robust financial strategy, offering a safety net and a sense of financial control.

Smart Saving and Investing Strategies for Your Kids' Future

You may want to see also

Investing is used to pay for long-term goals

Investing is a way to pay for long-term goals. It is a means to grow your money over time by putting it in financial instruments such as stocks, bonds, and mutual funds. While investing has the potential for higher returns than savings accounts, it also comes with a level of risk attached.

Investing is a great way to reach long-term financial goals, such as saving for college, a down payment on a house, or retirement. It is important to choose investments that align with your goals, risk tolerance, and time horizon. The longer you can invest, the more risk you can take on, as you have more time to ride out the ups and downs of the stock market. For instance, investing in stocks and shares can be a risky business, with the potential for both gains and losses. However, if you have a long time horizon, you are more likely to see a positive return on your investment.

A 401(k) retirement plan is a good example of an investment vehicle that can be used to save for the long term. With a 401(k) plan, you contribute a percentage of your salary, and your employer may match your contribution up to a certain amount. The money is then invested in a portfolio of mutual funds, stocks, and bonds. The advantage of a 401(k) plan is that it offers tax benefits, as the money you contribute is deducted from your taxable income, and the investments grow tax-deferred. This allows your money to grow tax-free over time, potentially earning higher returns than a traditional savings account.

Another benefit of investing is the potential for compound growth. By investing consistently over time, you can benefit from compounding returns, which means your money can grow exponentially. This makes investing a powerful tool for building wealth over the long term.

However, it is important to remember that investing comes with no guarantees, and there is always the risk of losing money. Diversification can help reduce this risk, but it is still important to do your research and understand the potential risks associated with different types of investments.

Young Savers: Investing for the Future Now

You may want to see also

Savings are generally low-risk

Savings are generally considered low-risk. This means that your money is safe, but it also means that the interest rates received are low. Savings accounts are a good option if you need to access your money in the near future and can't afford to lose any of it. They are also a good way to meet short-term financial goals and prepare for unexpected situations, such as a car repair or medical bills. By putting aside money regularly, you can build up a cushion to help you through tough times.

Savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) and credit unions are insured by the National Credit Union Administration (NCUA). This means that your deposits are protected by the US government up to a maximum limit. For example, the FDIC guarantees bank accounts up to $250,000 per depositor, per bank, and ownership category. This makes savings accounts a safe option for storing your money.

While savings accounts are a secure place to store your money, the returns are low. This means that you could earn more by investing, but there is a risk of losing money. Savings accounts may also lose purchasing power over time due to inflation. Therefore, it is important to combine savings with other forms of investing, such as retirement accounts or the stock market, to achieve a balanced financial plan.

To ensure financial security, it is recommended to have enough savings in an emergency fund to cover several months' worth of expenses. It is also a good idea to have enough in your savings account to cover all your short-term needs, such as bills, rent, and groceries. This will provide a financial safety net and help you avoid taking out costly loans or racking up credit card debt.

Savings and Investments: Strategies for Success in Lean Times

You may want to see also

Frequently asked questions

Saving typically results in a lower return with little to no risk, while investing allows for the opportunity to earn a higher return, but you take on the risk of loss.

Some pros of saving include providing a financial safety net, liquidity for purchases and other short-term goals, and a low risk of loss. However, some cons of saving include missing out on potential higher returns from riskier investments and losing purchasing power due to inflation.

Some pros of investing include the potential for higher returns, the ability to grow your wealth over time, and the opportunity to achieve long-term financial goals. Some cons of investing include the risk of loss, the need for discipline and a long-term commitment, and the possibility of requiring longer time horizons.

Saving is generally better if you have short-term goals, such as saving for a new phone, laptop, or vacation. It's also a good idea to have an emergency fund in place before investing, typically covering three to six months' worth of living expenses.

Investing is better for longer-term goals, such as saving for retirement or a child's college fund. It's also a good option if you're eligible for an employer match in your retirement account, as this is essentially free money.