The world of cryptocurrency has been a rollercoaster since its inception in 2009. Bitcoin, the first cryptocurrency, was created by pseudonymous developer Satoshi Nakamoto, who mined the first 50 Bitcoins and launched the practice of crypto mining. Cryptocurrency is a digital payment system that doesn't rely on banks to verify transactions; instead, it uses a decentralized system to record transactions and issue new units. The aim of encryption is to provide security and safety.

The early days of Bitcoin saw little real-world value, with one famous tale from 2010 seeing a software developer buy two pizzas for 10,000 Bitcoins. At Bitcoin's peak, those pizzas would have been worth over $600 million. However, the developer never regretted his decision, believing it was a crucial step in the growth of the crypto ecosystem.

Since then, the cryptocurrency market has seen huge growth, with the total market capitalization of cryptocurrencies exceeding $800 billion by 2018. The market has also experienced bubbles and crashes, with the most recent crash in 2021-2023 seeing the value of Bitcoin drop by more than 70%.

Despite the volatility, cryptocurrency continues to gain mainstream adoption, with El Salvador becoming the first country to accept Bitcoin as legal tender in 2021. The world of cryptocurrency is still relatively new and considered highly speculative, but it has captured the interest of investors and the general public alike.

| Characteristics | Values |

|---|---|

| When it was introduced | 2009 |

| Who introduced it | Satoshi Nakamoto |

| Market cap | Over $1 trillion |

| Number of cryptocurrencies | Nearly 10,000 |

| Collective market cap | More than $2 trillion |

| Examples | Bitcoin, Ethereum, Tether, Solana, Binance Coin |

| How to buy | Through a broker or a cryptocurrency exchange |

What You'll Learn

How to buy cryptocurrency

If you're new to the world of crypto and are looking to buy your first cryptocurrency, here's a step-by-step guide to help you get started:

Choose a Broker or Crypto Exchange:

Firstly, you need to decide whether to use a broker or a crypto exchange to buy crypto. Brokers offer an easy-to-use interface but may charge higher fees, while exchanges provide a platform for buyers and sellers to meet and trade, often with lower fees but more complex interfaces. Some popular brokers include Robinhood and SoFi, and well-known exchanges are Coinbase, Gemini, and Binance.US.

Create and Verify Your Account:

Once you've chosen a platform, you'll need to sign up and create an account. This usually involves providing personal information, such as your name, email, and verifying your identity with a driver's license or passport. This step is crucial to prevent fraud and meet regulatory requirements.

Deposit Funds to Invest:

Before you can start investing, you need to add funds to your account. You can do this by linking your bank account, initiating a wire transfer, or using a debit or credit card for payment. However, be cautious with credit card deposits as they can incur higher interest rates and additional fees.

Place Your Cryptocurrency Order:

With funds in your account, you're ready to place your first order. Research the hundreds of cryptocurrencies available, from well-known ones like Bitcoin and Ethereum to lesser-known options. Decide on the cryptocurrency you want, enter its symbol (e.g. BTC for Bitcoin), and specify the amount you wish to purchase. Many platforms allow you to buy fractional shares, so you don't need a large sum to start.

Select a Storage Method:

Now that you've purchased cryptocurrency, you need to choose a secure storage method. You can leave it on the exchange in a hot wallet, which is convenient but more susceptible to theft. Or you can transfer it to a separate "cold wallet," which is offline and more secure but less accessible. Consider your security needs and preferences when choosing a storage option.

Bonus Tips:

- Compare fees and security features when choosing an exchange.

- Understand the risks: Cryptocurrency is a volatile and risky investment. Only invest what you can afford to lose.

- Do your research: Learn about different cryptocurrencies, blockchain technology, and white papers before investing.

- Consider your investment goals and risk appetite: Evaluate if crypto aligns with your financial objectives and tolerance for risk.

Holding Companies: Exploring Bitcoin Investment Opportunities

You may want to see also

Hot and cold wallets

Hot wallets and cold wallets are two types of cryptocurrency wallets that differ in their level of connectivity.

Hot Wallets

Hot wallets are cryptocurrency wallets that are always connected to the internet or another connected device. They are used as temporary key storage and to send and receive cryptocurrencies. They store your private keys, which allow only you to access your cryptocurrency. Examples of hot wallets include MetaMask, Coinbase Wallet, and Edge Wallet.

Hot wallets are generally easier to set up, access, and accept more tokens. However, they are more susceptible to hacking, possible regulation, and other technical vulnerabilities. They are best suited for those who want to store a small amount of cryptocurrency in an easy, convenient location. It is recommended to only keep small amounts in your hot wallet and to back it up with security measures such as encryption and a secure password.

Cold Wallets

Cold wallets, on the other hand, are entirely offline. They can come in software forms such as apps used on computers or smartphones, or as hardware devices that are plugged in but remain offline. Cold wallets do not store your private keys online, making them less vulnerable to hacking. Examples of cold wallets include Trezor and Ledger.

Cold wallets are considered more secure than hot wallets, but they do not accept as many cryptocurrencies. They are also more expensive, typically costing close to $80 USD or more. Cold wallets are ideal for those who want to store a large amount of cryptocurrency safely. However, they are not suitable for quick or regular transactions due to the inconvenience of transferring cryptocurrencies to and from the wallet.

Both hot and cold wallets have their advantages and disadvantages. Hot wallets offer convenience and ease of use but are less secure, while cold wallets provide enhanced security but are less convenient for trading and come with a higher price tag. The choice between a hot or cold wallet depends on your specific needs and preferences.

Grove Coin: A Smart Investment Decision?

You may want to see also

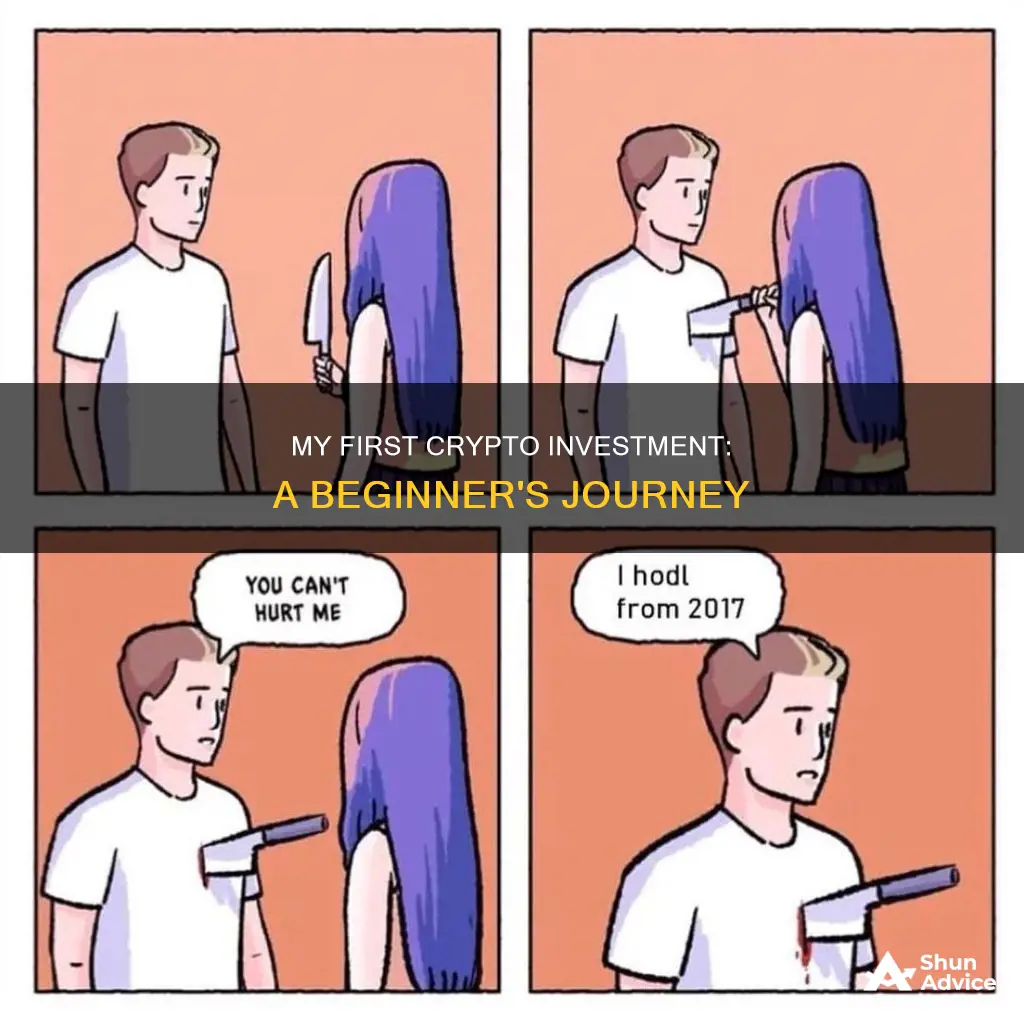

Volatility and risk

The high volatility of cryptocurrencies also means that they are a risky investment. Investors need to be prepared for the possibility of major price drops and should only invest what they are willing to lose. While there is the potential for high returns, there is also the risk of substantial losses. It's important for investors to carefully consider their risk tolerance and investment goals before deciding to invest in cryptocurrencies.

To manage the risk associated with cryptocurrency investments, investors can consider diversifying their portfolios and including both hot and cold wallets in their investment strategy. Hot wallets are connected to the internet and are convenient for frequent trading, but they are more vulnerable to hacking and theft. On the other hand, cold wallets are offline and provide greater security but are less convenient for frequent transactions.

Additionally, it's crucial for investors to conduct thorough research before investing. This includes understanding the technology behind cryptocurrencies, such as blockchain, and reading white papers that outline the specifics of a particular cryptocurrency project. Performing test transactions can also help investors familiarise themselves with the process and ensure successful transfers.

Overall, while cryptocurrency investments offer the potential for high returns, they also come with significant risks and volatility. Investors need to carefully weigh these factors and ensure they have a comprehensive understanding of the market before making any investment decisions.

Ravencoin: A Smart Investment Move?

You may want to see also

Blockchain technology

The system has built-in mechanisms that prevent unauthorized transaction entries and create consistency in the shared view of these transactions. For example, in the case of a property transaction, blockchain creates one ledger each for the buyer and the seller. All transactions must be approved by both parties and are automatically updated in real time in both of their ledgers.

Other use cases for blockchain technology include:

- Energy companies creating peer-to-peer energy trading platforms and streamlining access to renewable energy.

- Traditional financial systems, like banks and stock exchanges, managing online payments, accounts, and market trading.

- Media and entertainment companies managing copyright data.

- Retail companies tracking the movement of goods between suppliers and buyers.

- Healthcare providers storing patients' medical records securely.

- Recording property rights, eliminating the need for manual document delivery and entry.

Mining Bitcoin: Free Ways to Earn Crypto

You may want to see also

Cryptocurrency as an alternative asset

Investing in cryptocurrencies is a hot topic in investment circles, and its popularity has significantly increased in recent years. While some investors view it as a risky alternative investment, primarily due to its speculative nature, others see it as a legitimate option for inclusion in any investor’s portfolio.

Cryptocurrency as an Alternative Investment

Alternative investments are investments that do not fit into conventional categories like stocks, bonds, or cash. They are non-correlated assets that can help diversify an investment portfolio. Alternative investments tend to have higher minimum investment requirements than traditional investments, but they also offer higher returns. Even when the market is down, alternative investments can remain relatively unaffected. This was evident during the 2008 financial crisis when traditional investments suffered significant losses while alternative investments held their own.

Cryptocurrency has become an increasingly popular choice of alternative investment in recent times. Here are some reasons why:

- Increasing Regulation: Cryptocurrency is no longer seen as the "wild west". In recent years, there has been a push for more regulation in the cryptocurrency space, with many companies choosing to operate within their jurisdiction's regulations. This will make cryptocurrencies more legitimate and attractive to investors.

- Ease of Exchange: With the advent of financial services such as Wirex, it is now easier than ever to convert cryptocurrencies into cash or spend them directly. This sets cryptocurrencies apart from other alternative investments, which can be illiquid and difficult to convert into cash.

- Diversification: Having a diversified portfolio is crucial for successful investing. Cryptocurrencies, as an alternative investment, can help even out the risk and protect the portfolio during times of financial crisis and economic events. Cryptocurrencies react differently to economic factors than traditional investments, providing a hedge against potential losses.

- Growing Market: As the cryptocurrency market matures, the trading market is also growing. The availability of hedge options and trading flexibility makes cryptocurrencies an appealing choice for investors looking for alternatives to traditional investments.

- Reputable Companies are Getting Involved: Blockchain technology, which is the backbone of cryptocurrencies, has attracted the attention of big names such as Google, Microsoft, Apple, JP Morgan, and Mastercard. These companies recognize the potential of blockchain and its various applications across multiple industries, including the financial sector.

Important Considerations

While cryptocurrency can be a great addition to an investment portfolio, it is important to remember that it is a high-risk investment. Only invest what you can afford to lose, just like with any other alternative investment. Cryptocurrencies have high volatility and are subject to dramatic price swings. Additionally, the potential for scams and fraud in the crypto space is a concern. It is crucial to conduct thorough research and understand the risks and rewards of investing in cryptocurrencies before making any decisions.

Convince Your Clients: Invest in Cryptocurrency's Future

You may want to see also

Frequently asked questions

Cohere has never invested in cryptocurrency.

I cannot say whether or not Cohere has any future plans to invest in cryptocurrency.

Cohere is an AI company that builds large language models. These models can be used by companies to develop applications such as chatbots, search engines, and copywriting. While Cohere's technology is integrated into some cryptocurrency platforms, Cohere itself has never invested in cryptocurrency.