High-yield bonds, also known as junk bonds, are a type of investment that can offer higher returns than traditional bonds, but they also come with increased risks. When considering investing in high-yield bond funds, it's important to understand the potential benefits and drawbacks. These bonds are issued by companies with lower credit ratings, and while they offer higher interest rates, they also have a higher likelihood of defaulting. This type of investment may be suitable for those with a high-risk tolerance and a diversified portfolio.

| Characteristics | Values |

|---|---|

| What are high-yield bonds? | High-yield bonds are debt securities, also known as junk bonds, that are issued by corporations. |

| How do they work? | High-yield bonds pay higher interest rates because they have lower credit ratings than investment-grade bonds. |

| Who issues high-yield bonds? | Issuers of high-yield debt tend to be startup companies or capital-intensive firms with high debt ratios. |

| What are the advantages of high-yield bonds? | Investors choose high-yield bonds for their potential for higher returns. |

| What are the disadvantages of high-yield bonds? | While high-yield bonds offer higher returns, they also carry risks such as default risk, higher volatility, interest rate risk, and liquidity risk. |

| How to invest in high-yield bonds? | There are several ways to invest in high-yield bonds, including buying high-yield corporate bonds directly from broker-dealers or investing in a mutual fund or ETF that holds high-yield bonds. |

| What is the effect of interest rate changes on high-yield bonds? | When interest rates rise, the market value of high-yield bonds can decline as investors seek higher returns from newer bonds. However, rising interest rates can also benefit high-yield bonds as they tend to increase when the economy expands, improving the financial health of the issuing corporations. |

| Are high-yield bonds suitable for all investors? | High-yield bonds are suitable for investors with a high-risk tolerance and those seeking higher returns. Investors should consider their financial situation, income, net worth, investment goals, and risk tolerance before investing in high-yield bonds. |

What You'll Learn

High-yield bonds are also known as junk bonds

Junk bonds are typically issued by startup companies or capital-intensive firms with high debt ratios. They can also be issued by companies that were once investment-grade but have since been downgraded, known as "fallen angels".

Despite the risks, junk bonds can be an excellent option for investors. They offer a higher payout compared to traditional investment-grade bonds, and if the issuing company improves its credit standing, the value of the bond can increase. Additionally, bondholders are paid out before stockholders when a company fails.

Junk bonds can also be a good option for stock investors looking to fill out their portfolios. They are less vulnerable to fluctuations in interest rates, which can help to diversify and reduce the overall risk of an investment portfolio.

However, there are several negative aspects to consider when investing in junk bonds. They have higher default rates than investment-grade bonds, and their value can be affected by changes in the issuer's credit rating or interest rates. During a recession, junk bonds are often the first to go, as they cannot offer more attractive rates to investors.

Debt Fund Investment: Timing and Strategy

You may want to see also

They are issued by corporations

High-yield bonds are issued by corporations, also known as junk bonds, and they are a type of debt security. They are issued by companies with poor credit quality and are more likely to default. As a result, they pay higher interest rates than investment-grade bonds to compensate investors for the higher risk.

High-yield bonds are typically issued by startup companies or capital-intensive firms with high debt ratios. They can also be issued by companies that were previously investment-grade but have since been downgraded due to poor financial performance, known as "fallen angels".

High-yield bonds offer a higher potential return than investment-grade bonds, making them attractive to investors seeking higher yields. However, they also carry a higher level of risk, including default risk, higher volatility, interest rate risk, and liquidity risk.

When considering investing in high-yield bonds, it is important to carefully research the issuing company and assess its financial health and credit rating. The bond's prospectus can provide valuable information about the company's financial health, plans for using the proceeds, and the associated risks.

While high-yield bonds offer higher returns, they are generally considered riskier than traditional investment-grade bonds. They are also less liquid, meaning they may be more difficult to resell. Additionally, their value can be affected by changes in the issuer's credit rating and interest rates.

Overall, high-yield corporate bonds can be a good investment option for those seeking higher returns, but it is important to carefully weigh the risks and ensure they align with your investment goals and risk tolerance.

Dividend Funds: When to Invest for Maximum Returns

You may want to see also

They can be bought at most online brokerages

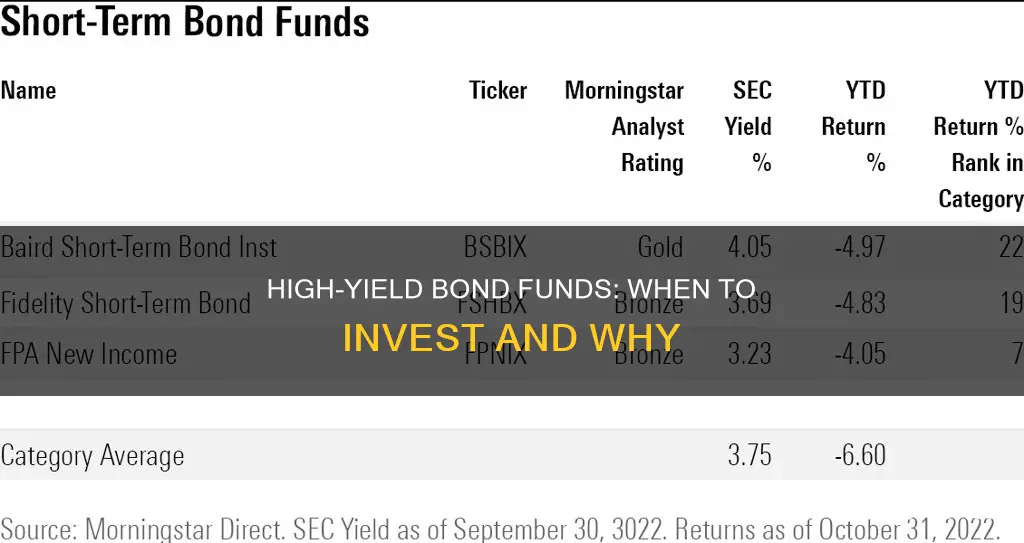

High-yield bond funds can be purchased at most online brokerages, but the selection of funds available to you will depend on the broker you choose.

Some brokers may offer a wider range of funds than others, so it's worth checking that the broker you're considering has the fund you want to buy. For example, mutual funds are not always offered by all brokers, so if you're interested in a particular mutual fund, it's worth checking that the broker you're considering offers it.

If you're looking to invest in bond ETFs, these are generally available at any of the best online brokers.

- Vanguard High-Yield Corporate Fund (VWEHX)

- IShares iBoxx $ High Yield Corporate Bond ETF (HYG)

- JPMorgan BetaBuilders USD High Yield Corporate Bond ETF (BBHY)

- SPDR Portfolio High Yield Bond ETF (SPHY)

- VanEck High Yield Muni ETF (HYD)

SEI Investment Operations: Exploring Mutual Fund Strategies

You may want to see also

They are riskier than traditional bonds

High-yield bonds, also known as junk bonds, are considered riskier than traditional bonds. They are issued by corporations with poorer credit quality and tend to have lower credit ratings of below BBB- from Standard & Poor's and Fitch, or below Baa3 from Moody's.

Default Risk

High-yield bonds have a higher likelihood of defaulting on their payments. This means that if the issuing company faces financial difficulties, there is a risk that they may not be able to make the interest or principal payments as promised. Default risk is the most significant risk associated with high-yield bonds, and it can result in losses for investors.

Higher Volatility

Junk bonds exhibit higher price volatility compared to investment-grade bonds. This means that their market prices can fluctuate more drastically in response to changes in the economic environment or the issuing company's financial health. Higher volatility adds uncertainty and risk to an investment portfolio.

Interest Rate Risk

All bonds are subject to interest rate risk, but high-yield bonds are more sensitive to changes in interest rates. When interest rates rise, the market value of high-yield bonds can decline as investors seek higher returns from newer bonds. This can lead to a decrease in the price of high-yield bonds, resulting in potential losses for investors.

Liquidity Risk

High-yield bonds generally have higher liquidity risk than investment-grade bonds. Liquidity risk refers to the possibility that an investor may not be able to sell the bond at the desired time or price. This risk is higher for high-yield bonds as there may be fewer buyers willing to purchase these riskier securities.

Migration Risk

The value of high-yield bonds is closely tied to the credit rating of the issuing company. If the company's credit rating falls further, the price of the bond can also decrease, negatively impacting the investor's return on investment. This migration risk is more pronounced for high-yield bonds as they are more susceptible to changes in the issuer's creditworthiness.

Recession Risk

Historically, the junk bond market has been vulnerable during economic recessions. When the economy enters a downturn, companies issuing high-yield bonds may struggle financially, increasing the risk of default. Additionally, investors may shift their capital towards safer investment options, further reducing demand for high-yield bonds.

Trust Fund Investment Strategies: Where to Begin?

You may want to see also

They are more stable than the stock market

It's important to note that the stability of high-yield bond funds in comparison to the stock market is a key factor to consider when thinking about investing in them. While stocks represent ownership in a company and are often subject to volatile market fluctuations, high-yield bonds are a form of debt, and their performance is tied to different factors.

High-yield bond funds, also known as junk bond funds, invest in the debt of companies that are considered riskier than investment-grade companies. These bonds typically offer higher interest rates to compensate for the increased risk of default. However, this doesn't mean that high-yield bond funds are inherently unstable or unpredictable. On the contrary, they can provide a more stable investment option in certain market conditions.

The stock market is influenced by a multitude of factors, such as economic news, company earnings, and investor sentiment, which can cause it to fluctuate significantly on a daily or weekly basis. On the other hand, high-yield bond funds are less susceptible to these short-term swings. The performance of bond funds is primarily driven by interest rates and the credit quality of the underlying bonds. While interest rates can impact bond prices, the effect is generally less pronounced and more gradual compared to the impact on stocks.

Additionally, high-yield bond funds offer diversification benefits. They are often less correlated to the stock market, meaning their performance doesn't always mirror that of stocks. This diversification can help smooth out the overall volatility of an investment portfolio, especially during periods of stock market turmoil. It's worth noting that high-yield bond funds are not completely immune to market risks, and there are specific considerations to keep in mind. For example, in times of economic uncertainty or rising interest rates, high-yield bond funds may experience price declines as investors shift their focus to safer investments. However, compared to the stock market, these movements tend to be less abrupt and severe.

U.S. Investment Fund Transition to Schwab: What, When, Why?

You may want to see also

Frequently asked questions

High-yield bonds, also known as junk bonds, are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. They are issued by corporations, often start-up companies or capital-intensive firms with high debt ratios.

High-yield bonds offer the potential for higher returns compared to investment-grade bonds. They also offer more attractive yields and a more reliable payout than stocks.

High-yield bonds carry a number of risks, including default risk, higher volatility, interest rate risk, and liquidity risk. They are also less fluid than investment-grade bonds, making them more difficult to resell.

High-yield bonds can be a good investment during economic expansions, as interest rates tend to increase during these periods, which can benefit corporations issuing the bonds and lower the risk of default.

High-yield bond funds can be purchased at most online brokerages, and bond ETFs are generally available at the best online brokers. Mutual funds may have more limited availability, so it's important to check with your broker to see if they offer the specific fund you're interested in.