M1 Finance offers a High-Yield Cash Account, which is a place for a dedicated cash reserve, powered by your M1 brokerage account. When you're ready to invest, you can do so seamlessly, with no hidden fees. You can set up Smart Transfers to automate your cash flow, for example, by setting a rule that automatically sends excess money in your High-Yield Cash Account to your investment portfolio. To open a High-Yield Cash Account, you need to open an M1 brokerage account. Once you have done this, you can transfer money into your High-Yield Cash Account and start earning interest.

| Characteristics | Values |

|---|---|

| Minimum Initial Deposit | $100 |

| Annual Percentage Yield (APY) | 5.00% |

| Daily ACH Transfer Limit | $50,000 |

| Transfer Time to M1 Investment Account | Instant |

| Transfer Time to M1 High-Yield Savings or Cash Account | Up to 4 business days |

| Transfer Time to External Bank Account | 1-2 business days |

| Transfer Time to Crypto Account | Immediate access to up to $5,000; remainder available after settlement |

| Transfer Time to M1 Personal Loan | 2-5 business days |

| Transfer Time to M1 Margin Loan | Within minutes |

What You'll Learn

M1 High-Yield Cash Account

The M1 High-Yield Cash Account requires an M1 Taxable Brokerage Account. Open a Cash Account (and brokerage account if you don’t have one already). There is no limit to the number of transfers to and from your Cash Account. However, you can only transfer a certain dollar amount per day. All clients with a High-Yield Cash Account have a daily ACH transfer limit of $50,000.

The High-Yield Cash Account is not a checking or savings account. It is an investment product offered by M1 Finance, LLC, a registered broker-dealer. The purpose of this account is to invest in securities, and an open M1 Investment account is required to participate in the M1 High-Yield Cash Account. All investing involves risk, including the risk of losing the money you invest.

Litecoin: Worth Your Investment?

You may want to see also

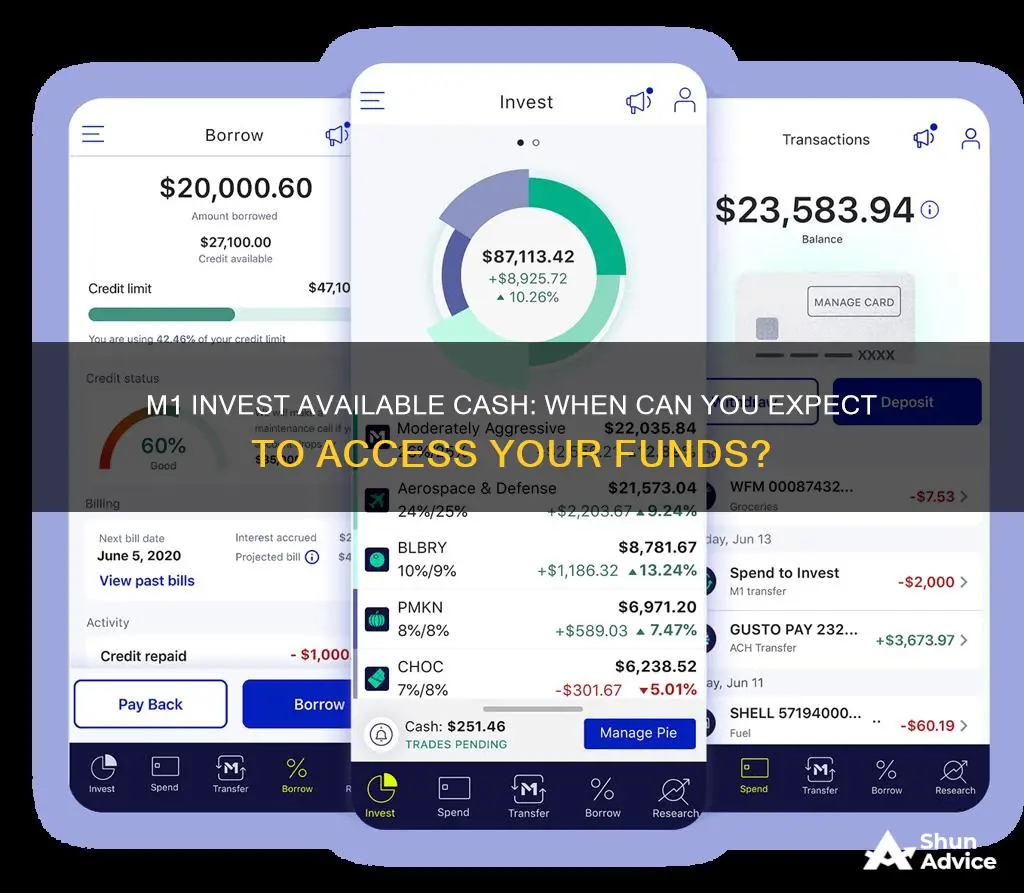

Instant transfers

However, there are some limitations to instant transfers. For example, external bank transfers to an M1 Invest Account can take up to 1 business day, while transfers to an M1 High-Yield Savings Account can take up to 4 business days. Withdrawals from an M1 Invest Account to an external bank account can take between 2-5 business days.

To make instant transfers between your M1 accounts, you can utilise the Transfers tab in the M1 app, which simplifies the process of moving money between accounts. Additionally, M1 offers Smart Transfers, which allow for the automatic transfer of money between M1 accounts based on "overbalance" and "underbalance" rules.

Retirement Planning: Why Saving and Investing is Essential for Your Future

You may want to see also

Unlimited withdrawals

M1 Finance offers unlimited withdrawals from your High-Yield Cash Account. This means you can take out money as often as you need. There is no limit to the number of transfers to and from your Cash Account. However, there is a daily transfer limit of $50,000.

The High-Yield Cash Account is a place for a dedicated cash reserve, powered by your M1 brokerage account. When you're ready to invest, you can seamlessly transfer money from your Cash Account to your investment portfolio in seconds. You can set up rules to automate this process, such as sending excess money in your High-Yield Cash Account to your investment portfolio.

M1 Finance provides a low-fee way to automate your investing using portions of pre-built portfolios called "Pies." It combines self-directed brokerage features with pre-built portfolios and automated portfolio management capabilities. The platform offers extensive portfolio customization, making it suitable for sophisticated investors.

M1 Finance has recently changed its fee structure by removing the M1 Plus program, which previously charged members a $36 annual fee for premium perks. As of May 15, 2024, M1 Finance charges a $3 monthly platform fee to clients without an M1 Personal Loan or with minimum balances of less than $10,000 in their total aggregated M1 accounts. However, members with a total balance of at least $10,000 or an M1 Personal Loan are exempt from this monthly fee.

Venture Cultivation: The Power of Investing Time in New Business Endeavors

You may want to see also

FDIC insurance

M1 Finance has recently rolled out High-Yield Cash Accounts to some clients for beta testing. M1's Cash Accounts offer access to 5.00% annual percentage yield (APY) on cash with FDIC coverage up to $3.75 million.

FDIC deposit insurance covers all types of deposits held at an insured bank. This includes deposits in a checking account, negotiable order of withdrawal (NOW) account, savings account, money market deposit account (MMDA), certificate of deposit (CD) or other time deposit account, as well as official items issued by an insured bank such as a cashier's check or money order.

It's important to note that FDIC insurance does not cover all financial products. It does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities or municipal securities, even if these investments are purchased at an insured bank. Additionally, FDIC insurance does not cover safe deposit boxes or their contents, and U.S. Treasury bills, bonds, or notes.

To calculate your FDIC insurance coverage, you can use the FDIC's Electronic Deposit Insurance Estimator (EDIE) tool, which helps you determine how much of your bank deposits are covered and if any portion exceeds the coverage limits.

The 8% Investment: Understanding the Timeline to Success

You may want to see also

Smart Transfers

M1's Smart Transfers are a feature available to M1 customers that allows them to set a rules-based strategy to allocate their excess cash. This can be used to save, max out annual IRA contributions, or invest through any of their brokerage accounts. Rules can be layered so that cash management is done automatically in a way that matches the customer's needs.

M1 also offers a range of other account services that give users flexibility with their money. Cash movement in and out of the platform is seamless, including the option to schedule auto deposits into the user's portfolio on a monthly, weekly, or bi-weekly basis. Users can also place individual trade orders, allowing for more flexibility.

Weighing the Benefits: Navigating the World of Investments

You may want to see also

Frequently asked questions

Transfers from an external bank account to an M1 Invest account can take up to one business day.

All new deposits to M1 Invest require a 6-business-day holding period before they can be withdrawn to any external bank. After 6 business days, the transfer to your bank begins.

Withdrawals that do not exceed your withdrawable cash amount usually arrive in external bank accounts in 1-2 business days. Withdrawals that exceed your withdrawable cash amount may take up to 5-7 business days.