Qapital Invest is an investment platform that was launched in 2018. It is a robo-advisor service that offers a paycheck allocator service, which takes a user's direct deposits and divides them among fixed and discretionary expenses, investing the remainder based on a risk profile questionnaire. Qapital Invest is designed to be easy to use and flexible, allowing users to customise their investment goals and strategies. The platform offers five different portfolios, ranging from very conservative to very aggressive, and users can choose to invest in various asset classes such as large-cap stocks, international stocks, and investment-grade bonds. Qapital Invest also employs a long-term investment strategy, encouraging users to invest for their Qapital Goals, such as saving for a down payment or retirement.

| Characteristics | Values |

|---|---|

| Launch Date | Spring 2018 |

| Target Audience | Novice investors, millennials |

| Features | Robo-advisor, 5 portfolios, 15+ auto-invest options |

| Pricing | $3, $6 or $12 per month |

What You'll Learn

Qapital Invest's launch date

Qapital Invest is an investment platform that was launched in 2018. The platform is a part of the Qapital app, which was launched in 2012 and is led by Founder & CEO, George Friedman. Qapital is a new kind of banking experience that empowers people to maximize their happiness by saving, spending, and investing with their goals in mind.

The Qapital app is designed to help users better understand their saving, spending, and investing habits by highlighting the trade-offs made when managing money. It allows users to save for their real-life goals with customizable, automated deposits that are linked to their everyday actions, like riding the bus, going to the gym, or buying a coffee.

Qapital Invest, which launched in Spring 2018, brings a goal-based and automated approach to the world of investing, offering users an effortless way to grow their money and plan for their future. The platform is intended for novice investors and takes a user's direct deposits to divide the funds for fixed and discretionary expenses, investing the leftovers in a portfolio based on a risk profile questionnaire.

Qapital Invest offers five different portfolio options, ranging from very conservative to very aggressive. These portfolios are recommended to users based on the time horizon of their individual savings goals, which is the amount of time they will need to reach their investment goal. This could be for short-term goals, such as saving for a down payment on a house, or long-term goals, such as retirement.

The Qapital Invest platform is built on a subscription model, with fees of $3, $6, or $12 per month, depending on the level of service the user wants. The platform offers a 30-day free trial, after which users can choose from three membership tiers: Basic, Complete, and Premier. The Basic plan includes access to Qapital's saving, spending, and budgeting tools, while the Complete plan adds investment tools, and the Premier plan offers exclusive webinars and in-app challenges.

Inheritance Dilemma: Invest or Pay Off Mortgage?

You may want to see also

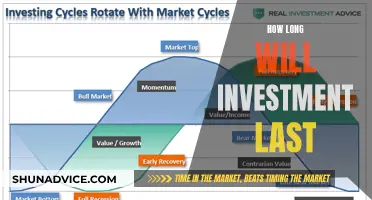

Qapital's investment strategy

Qapital members can invest for Qapital Goals, choosing a target amount and a Time Horizon, or the date when they will need the money. Based on the Time Horizon and an assessment of the individual's risk tolerance, Qapital recommends one of five different portfolio options, ranging from very conservative to very aggressive.

Qapital Invest is designed to be accessible to both experienced and new investors, offering robust features and flexibility. It is intended to prepare individuals for eventual collaboration with a financial advisor, empowering them to make informed financial decisions.

Ally Invest Dividends: Unlocking the Power of Passive Income

You may want to see also

Qapital's investment portfolios

Qapital Invest is a new investment platform by Qapital, a Swedish startup that has been helping millennials and the digitally-savvy save money since 2015. Qapital Invest is the company's first foray into the investment game, with a focus on making investing accessible to everyone.

Qapital Invest offers five different investment portfolios, ranging from very conservative to very aggressive. These portfolios are recommended to users based on the time horizon of their savings goal and a risk questionnaire. Each Qapital Invest Goal can have its own recommended portfolio and can be customised with a unique set of rules that align with the user's financial lifestyle and risk tolerance.

The underlying investments consist of 12 different asset classes, including large-cap stocks (e.g., Google, Apple), international stocks (e.g., Nestle), and investment-grade bonds (e.g., from companies like Coca-Cola). The investment strategy is based on Modern Portfolio Theory, which emphasises diversification across different asset classes to manage risk.

Qapital's investment platform is built on a subscription model, with fees of $3, $6, or $12 per month, depending on the level of service desired. The company aims to provide a simple, safe, and secure way for users to invest, with no hidden fees or transaction fees.

Smart Places to Invest $60K Today

You may want to see also

Qapital's pricing and plans

Qapital offers a 30-day free trial, after which you can choose from three membership plans: Basic, Complete, and Premier.

The Basic plan costs $3 per month and gives you access to Qapital's saving, spending, and budgeting tools, as well as its goal-based approach. The Complete plan costs $6 per month and is an all-in-one financial solution, integrating Qapital's tools into a complete picture, including investment tools. The Premier plan costs $12 per month and is for people who want a greater understanding of their money, offering exclusive webinars and in-app challenges in addition to the options of the lower plans.

Qapital's pricing structure has been criticised by some, who believe that only the Basic plan offers value for money. However, the app has generally received positive reviews, with many users praising its "set it and forget it" nature when it comes to saving money.

Qapital also plans to launch three new products: Qapital Dream Team™, Debt Wrangler™, and Qapital Cashback Hacks™. These products will provide users with an improved suite of easy money tools, such as the ability to manage loan payments and boost savings goals with cash-back rewards.

The Nasdaq Investor: Strategies for Success

You may want to see also

Qapital's savings and investment features

Qapital is a budgeting and savings app that helps users automate their financial plans and savings. The app offers a variety of savings and investment features to help users meet their financial goals.

Savings Features

Qapital's savings features are designed to help users save money without them having to actively put money into their savings accounts. The app offers a variety of "Rules" that users can set up to automate their savings. These include:

- Set & Forget Rule: This rule automatically transfers a set amount of money to the user's savings account on a daily, weekly, or monthly basis.

- Round-up Rule: This rule rounds up the user's card purchases to the nearest dollar amount and transfers the extra savings to their Qapital account.

- Guilty Pleasure Rule: This rule automatically saves a set amount each time the user makes a purchase at a designated "Guilty Pleasure" location.

- Spend Less Rule: This rule saves any money the user spends below their typical budget for a given store.

- Freelancer Rule: This rule automatically transfers a set percentage of the user's deposits to their Qapital account to save for tax payments.

- 52-Week Rule: Based on a popular savings challenge, this rule automatically saves a set amount based on the week of the year, starting at $1 for the first week and increasing by $1 each week.

- Apple Health Rule: Apple users can set this rule to automatically save a certain amount when they hit their goals in the Apple Health app.

- IFTTT (If This, Then That) Rule: Users can link other mobile apps to their Qapital account and set custom rules to save money when they use those apps.

Investment Features

In addition to its savings features, Qapital also offers investment options through Qapital Invest, an SEC-registered investment advisor. Users can create an investment account and set investing goals, choosing their level of risk. Qapital will then design an investing plan based on the user's goals and risk tolerance. The app offers five investing portfolios, ranging from very conservative to very aggressive, that are recommended based on the user's savings goals and risk profile. The underlying investments consist of ETFs from Vanguard, iShares, and SPDR.

Qapital's investment features are designed to be simple and accessible, particularly for novice investors. Users can add money to their investments automatically, choosing from 15+ ways to auto-invest, such as adding money when they get paid, when they spend, or when they exercise.

Investing for Your Imminent Retirement: Strategies for the Final Stretch

You may want to see also

Frequently asked questions

Qapital Invest was set to launch in Spring 2018.

Qapital is a new kind of banking experience that empowers people to maximize their happiness by saving, spending, and investing with their goals in mind.

By blending behavioural psychology with technology, Qapital provides people with the tools they need to make managing money easy.

Qapital Invest is a goal-based and automated approach to the world of investing, offering users an effortless way to grow their money and plan for their future.

Qapital Invest is intended for novice investors.