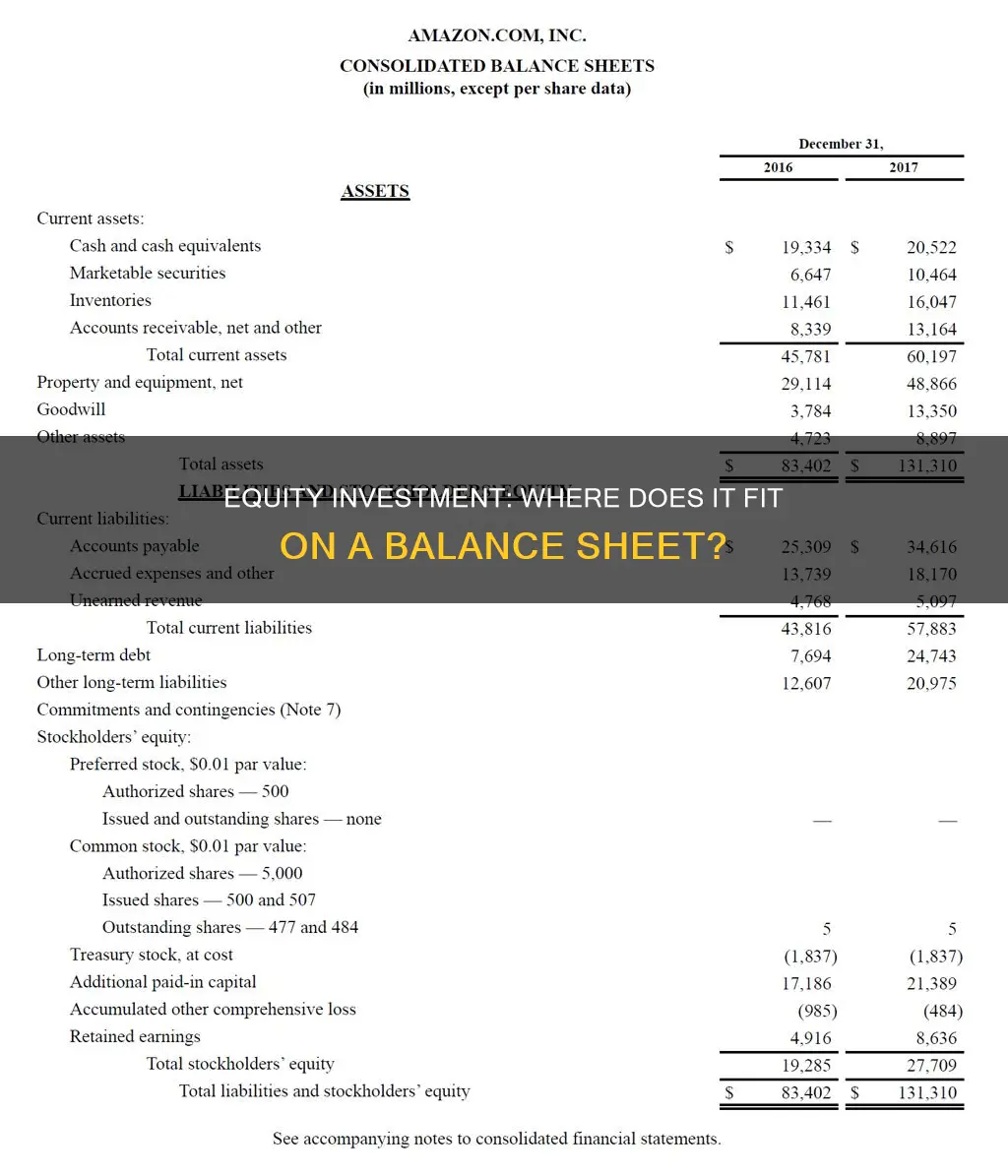

A classified balance sheet is a financial statement that provides a detailed overview of a company's assets, liabilities, and equity. It is more complex than a standard balance sheet, breaking down these broad categories into subcategories to offer greater transparency and insight into the company's financial health. This allows investors, creditors, and business owners to make informed decisions and accurately evaluate the company's financial position, including the value of its assets and debts.

Equity investments are classified based on the company's intent regarding the length of time they will hold the investment. If the company intends to sell the investment within a short time, it is classified as a trading security and considered a short-term asset. If the company plans to hold the investment for the long term, it is classified as a long-term investment. This classification impacts how the investment is valued and reported on the balance sheet.

Current assets

A classified balance sheet is a financial statement that presents a company's assets, liabilities, and shareholders' equity in a categorised format. This format is more readable than a simple listing of accounts and allows for a more detailed analysis of a company's financial condition.

- Cash and cash equivalents: This includes not only physical cash but also highly liquid assets that can be readily converted to cash, such as marketable securities, short-term investments, and money market funds.

- Accounts receivable: Money owed to the company by customers for goods or services provided on credit. These are expected to be converted into cash within a short period.

- Inventory: This includes raw materials, work-in-progress, and finished goods that are available for sale.

- Short-term investments: These are investments that are easily convertible to cash, such as marketable securities, money market funds, or other liquid assets.

- Prepaid expenses: Expenses that have been paid in advance and will provide benefits within one year, such as insurance or rent.

The classification of current assets is important as it helps assess the company's ability to meet its short-term obligations and maintain liquidity. It also provides insight into the company's operational efficiency and cash management practices.

Equity Investments: Halal or Haram?

You may want to see also

Long-term investments

On a classified balance sheet, long-term investments are listed as a separate category from current assets and typically include investments that will not be liquidated within a year. This distinction is essential for understanding the company's financial health and strategy. Long-term investments may include:

- Land purchased for speculation

- Funds set aside for plant expansion programs

- Funds redeemable from insurance policies

- Investments in other entities

- Stocks and bonds

- Real estate

- Treasury bonds

- Equipment

The classification of long-term investments as a separate category on the balance sheet provides valuable insights into the company's financial strategy and stability. It indicates the company's willingness to commit to long-term gains and its ability to withstand market fluctuations.

In summary, long-term investments are a vital component of a company's balance sheet, offering a glimpse into its financial strategy, stability, and potential for profitability. By categorising these investments separately, classified balance sheets provide transparency and insight into the company's long-term vision and financial health.

Saving and Investing: Building Wealth and Security

You may want to see also

Fixed assets

The fixed assets section of a classified balance sheet may include subcategories to provide additional insights into the business's activities and the specific details of its cash flow. For example, the fixed assets section may be divided into categories such as property, plant, and equipment.

The property, plant, and equipment section includes the land, buildings, and equipment productively in use by the company. This category may further break down the types of equipment included as fixed assets, such as software, IT equipment, and manufacturing machinery.

Another possible subcategory within the fixed assets section is intangible assets. Intangible assets are those that lack a physical form and can be challenging to assign a value. However, they provide value and influence the business's chances of success. Examples of intangible assets include intellectual property, such as trademarks, copyrights, and patents.

Building an Investment Portfolio: A Comprehensive Guide

You may want to see also

Intangible assets

Internally developed intangible assets do not appear on a company's balance sheet. For example, if a company conducts expensive research for many years and eventually creates a valuable patent from this research, all of the associated costs are charged to expense as incurred—no intangible asset can be capitalized. However, if the same organization were to buy the patent from another company, it could recognize the fair value of the patent in its balance sheet because it was purchased.

Equity Investment Basics: What You Need to Know

You may want to see also

Shareholder equity

In a classified balance sheet, shareholder equity is typically divided into several subcategories, including common stock, preferred stock, additional paid-in capital, treasury stock, and retained earnings. These classifications provide a more detailed view of the company's financial position.

Adjusting Your Investment Portfolio: Strategies for Success

You may want to see also

Frequently asked questions

A classified balance sheet is a financial statement that presents a company's assets, liabilities, and equity in separate categories. It provides a detailed view of a company's financial position, including its cash flow, sources of revenue, and debt.

Equity investment is reflected in the shareholder's equity section of the classified balance sheet. This section includes the amounts paid into a business by investors, plus any retained earnings.

Common types of equity include common stock, preferred stock, additional paid-in capital, treasury stock, and retained earnings.

Equity investments are typically classified as long-term investments, which are held for more than one year. Other investments, such as trading securities, are considered short-term and are expected to be sold within a short time of their purchase.