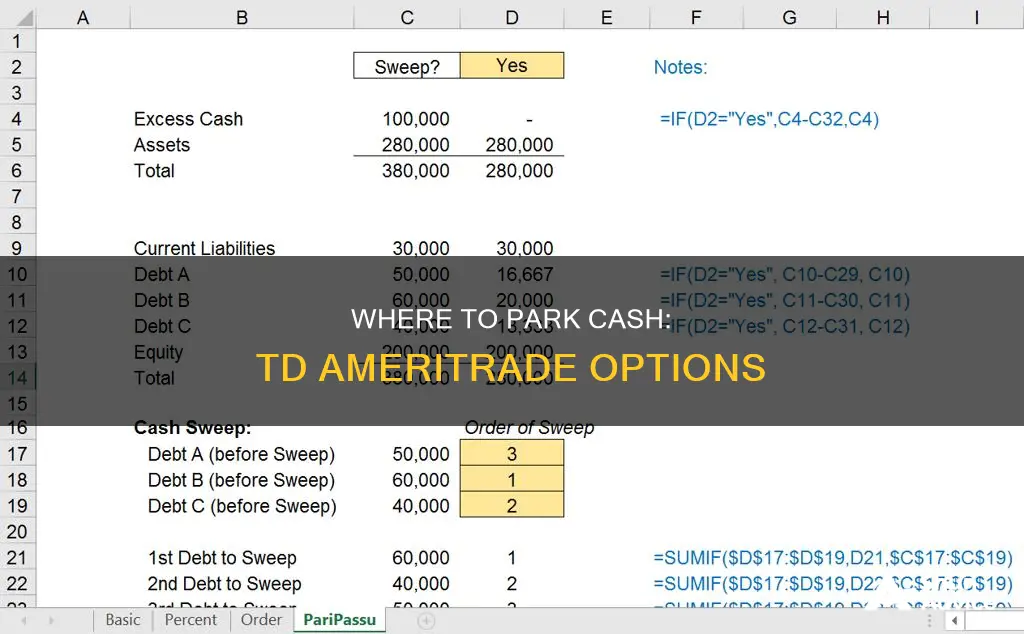

When opening a TD Ameritrade brokerage account, you will be presented with two options for where to place your excess cash: the TD Ameritrade FDIC-Insured Deposit Account, or the TD Ameritrade Cash account. The TD Ameritrade FDIC-Insured Deposit Account is held at TD Bank, earns interest, and is insured by the Federal Deposit Insurance Corp. (FDIC) against bank failure for up to $250,000 per depositor, per bank. On the other hand, the TD Ameritrade Cash account is protected by the Securities Investor Protection Corporation (SIPC) and also earns interest. Both accounts are insured up to $250,000, and currently have the same interest rates. TD Ameritrade does not require a minimum cash deposit to open an account, but if you want to do options or margin trading, you will need to have at least $2,000 in the account.

| Characteristics | Values |

|---|---|

| Cash when not invested | FDIC-insured deposit account or TD Ameritrade Cash |

| FDIC-insured deposit account | Cash balances are transferred into a deposit account held at TD Bank, N.A., TD Bank USA, N.A., or both |

| TD Ameritrade Cash | Cash balances are held in your brokerage account |

| Interest rates | The same for both FDIC and SIPC accounts |

| Insurance | Both accounts are insured up to $250,000 |

What You'll Learn

TD Ameritrade FDIC-insured deposit account

When signing up for a TD Ameritrade brokerage account, you will be asked what you would like to be done with the cash in your account when it is not invested in an asset. If you do not specify where you want your money to be held, it will be put in an FDIC-insured deposit account. You can also opt to have the money put into a TD Ameritrade account, which will earn interest and is protected by the Securities Investor Protection Corporation (SIPC).

The TD Ameritrade FDIC-insured deposit account is a good option for those who want their money to be easily accessible and protected. Uninvested cash balances are transferred into a deposit account held at TD Bank, N.A., TD Bank USA, N.A., or both, where they earn interest. These funds are insured by the Federal Deposit Insurance Corporation (FDIC) against bank failure for up to $250,000 per depositor, per bank. This means that even if TD Bank fails, your money is still protected up to a certain amount.

The FDIC-insured deposit account is a safe option for your uninvested cash, as it is insured by the FDIC, a US government agency that protects depositors' funds in the event of a bank failure. The FDIC was created by the Banking Act of 1933 to maintain public confidence and encourage people to keep their money in banks rather than hiding cash in unsafe places. Since its inception, no depositor has ever lost a penny of FDIC-insured funds.

The TD Ameritrade FDIC-insured deposit account is a good choice for those who want to keep their uninvested cash safe and easily accessible. With the same interest rates as the SIPC account, the FDIC-insured deposit account offers a layer of protection for your funds, giving you peace of mind.

QuickBooks: Recording Non-Cash Investing and Financing Activities

You may want to see also

TD Ameritrade Cash

When opening a TD Ameritrade taxable investment account, you will be presented with two options for where to place your excess cash: the TD Ameritrade FDIC-Insured Deposit Account or TD Ameritrade Cash. TD Ameritrade Cash is held in your brokerage account, earns interest, and is protected against broker failure by the Securities Investor Protection Corporation (SIPC). The SIPC protects up to $250,000 in cash held in a TD Ameritrade account. TD Ameritrade Cash offers the same interest rates as the FDIC-insured account, and both accounts are insured for the same amount.

When setting up a new account, you will be asked whether you plan to use the account for buy-and-hold investing or for more active trading. You will also be asked to specify what will happen to the cash in your account when it is not invested in an asset. If you do not specify where you want your money to be held, it will be put in an FDIC-insured deposit account. However, you can also opt to have the money put into a TD Ameritrade account, which will earn some interest and is protected by the SIPC.

Fidelity's Cash Policy: What Investors Need to Know

You may want to see also

Interest rates for FDIC and SIPC accounts

When it comes to holding cash that is not invested through TD Ameritrade, there are two options to consider: the TD Ameritrade FDIC-Insured Deposit Account and the TD Ameritrade Cash account, which is protected by the Securities Investor Protection Corporation (SIPC). Both accounts offer the same interest rates and insurance coverage of up to $250,000.

The FDIC-insured account option provides protection for your assets in a bank account, including checking and savings accounts. In the event that an FDIC-insured bank fails, your deposits are covered dollar-for-dollar, up to the insurance limit. FDIC insurance also covers various deposit types, such as negotiable order of withdrawal (NOW) accounts, money market deposit accounts, and time deposits like certificates of deposit (CDs). It's important to note that FDIC insurance does not cover non-deposit investments or certain financial products like municipal securities, life insurance policies, and U.S. Treasury bills.

On the other hand, SIPC insurance protects your assets in a brokerage account. If your brokerage firm fails financially, SIPC steps in to restore your cash and securities. SIPC insurance covers investors for up to $500,000 in securities and up to $250,000 in cash. However, it's important to note that SIPC does not protect against the decline in value of your securities or losses due to bad investment advice.

While both options offer the same interest rates, the key difference lies in the level of protection they provide. FDIC insurance offers broader coverage for various deposit accounts and provides dollar-for-dollar reimbursement in the event of bank failure. SIPC insurance, on the other hand, is specifically for brokerage accounts and provides coverage for securities and cash but does not protect against losses in value.

Therefore, when deciding where to hold your cash when not invested through TD Ameritrade, consider the level of protection you prefer and whether you want to include various deposit accounts under FDIC insurance or focus specifically on your brokerage account with SIPC insurance.

Extra Cash: Smart Investment Strategies for Beginners

You may want to see also

Insurance for FDIC and SIPC accounts

When opening a TD Ameritrade taxable investment account, you will be presented with two options for placing your excess cash: the TD Ameritrade FDIC-Insured Deposit Account or the TD Ameritrade Cash account, which is protected by the Securities Investor Protection Corporation (SIPC).

The FDIC—short for the Federal Deposit Insurance Corporation—is an independent agency of the U.S. government that protects you against losing your deposits in an FDIC-insured bank or savings association that fails. FDIC insurance covers depositors' accounts at each insured bank, dollar-for-dollar, including principal and any accrued interest through the date of the insured bank's closing, up to the insurance limit. The standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category at a bank.

The Securities Investor Protection Corporation (SIPC), on the other hand, is a nonprofit membership corporation created by federal statute in 1970. More than 3,500 brokerage firms are SIPC members. SIPC does not provide blanket coverage like the FDIC; instead, it protects customers of SIPC-member broker-dealers if the firm fails financially. SIPC insurance covers investors for up to $500,000 in securities and up to $250,000 in cash. SIPC does not protect investors if the value of their investments falls, nor does it protect individuals who are sold worthless stocks and other securities.

Both the FDIC and SIPC accounts offered by TD Ameritrade are insured up to $250,000. The interest rates for both accounts are the same.

Investing: How Cash Flow Affects Your Bottom Line

You may want to see also

Differences between FDIC and SIPC accounts

When signing up for a TD Ameritrade brokerage account, you will be asked to choose what happens to the cash in your account when it's not invested in an asset. You can choose to have your money put into an FDIC-insured deposit account or a TD Ameritrade account protected by the Securities Investor Protection Corporation (SIPC).

The Federal Deposit Insurance Corporation (FDIC) is a government agency that protects consumers against the loss of account balances at FDIC-insured banks and savings associations if those institutions fail financially. FDIC insurance protects money in FDIC-insured banks and other savings associations. Deposits are covered for up to $250,000 per depositor, per insured bank, for each account ownership category at a bank, in accordance with FDIC rules.

The Securities Investor Protection Corporation (SIPC) is a nonprofit membership corporation that protects customers of SIPC-member broker-dealers if those firms fail financially. SIPC protects brokerage accounts of each customer up to $500,000, including up to $250,000 for cash. SIPC insurance doesn't cover losses related to the decline in market value.

The main difference between the two is that FDIC insurance protects assets in banks or savings associations, while SIPC insurance protects consumers' brokerage account assets. FDIC-insured institutions could be considered a better choice for holding cash since, in the event of a bank failure, your funds are restored quickly and you won't need to file any claims or take any action. The SIPC process can be more cumbersome and time-consuming, as you will need to file a claim and monitor communications with your institution.

Strategies to Maximize Cash Investments in Just One Year

You may want to see also

Frequently asked questions

TD Ameritrade offers two options for holding your cash when it is not invested: an FDIC-insured deposit account or a TD Ameritrade Cash account protected by the Securities Investor Protection Corporation (SIPC).

The FDIC-insured account holds your cash in a deposit account at TD Bank, N.A., or TD Bank USA, N.A., where it earns interest and is insured by the Federal Deposit Insurance Corporation (FDIC) against bank failure for up to $250,000 per depositor, per bank. The SIPC-protected account holds your cash in your brokerage account, where it also earns interest and is protected against broker failure (up to $250,000) by the SIPC.

No, the interest rates for both FDIC and SIPC accounts are the same, and both accounts are insured up to $250,000.

No, TD Ameritrade handles the sweeps for you. You do not have direct access to the deposit account.

Typically, it takes 4 business days for a deposit to settle and show up as available for trading.