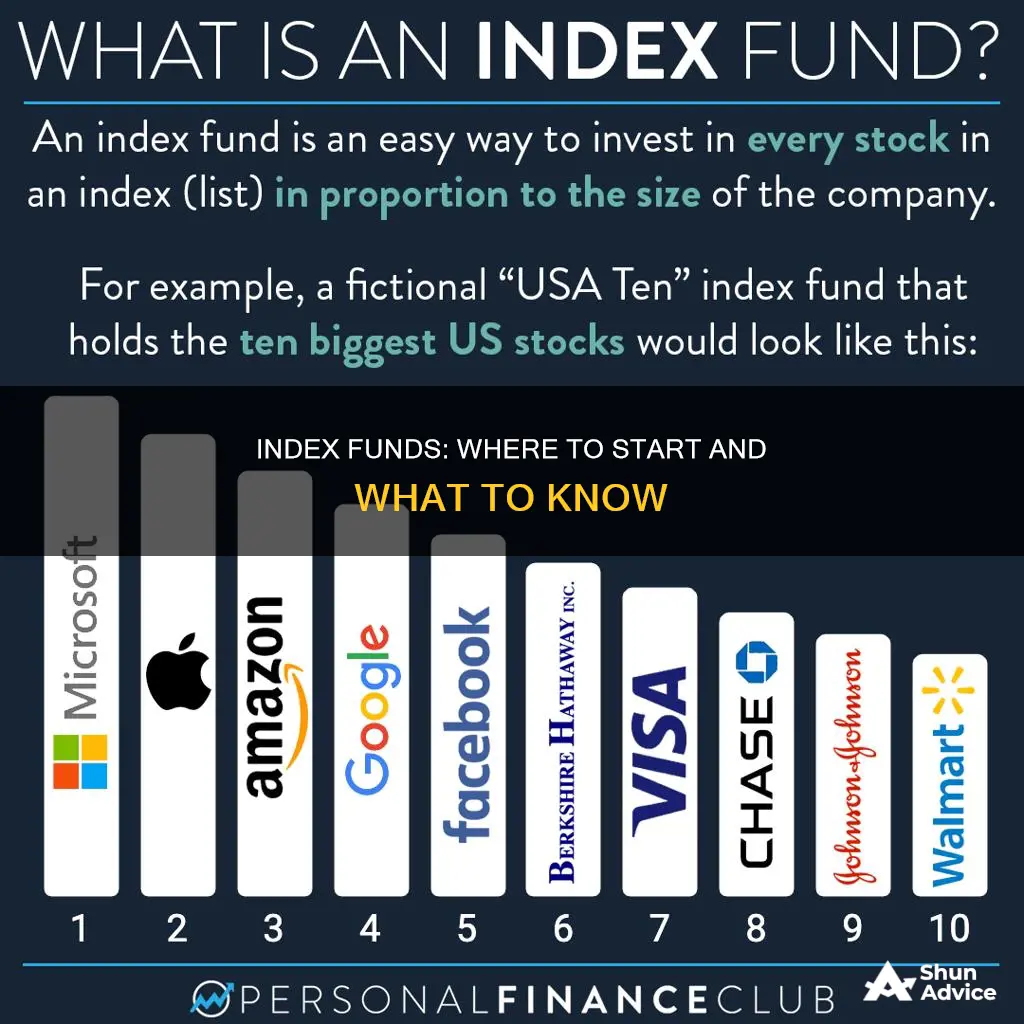

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are a passive investment strategy, meaning they aim to mirror the performance of a specific index rather than actively selecting stocks or trying to beat the market. This makes them a low-cost, low-fuss way to build wealth over the long term.

Index funds are ideal for beginners as they often charge low fees, require little maintenance, and provide built-in diversification. They are also less risky than investing in individual stocks, though it's important to remember that they can still lose money. When deciding where to start investing in index funds, it's essential to consider your financial goals, risk tolerance, and the investment platform or broker you want to use.

| Characteristics | Values |

|---|---|

| Definition | A type of mutual fund or exchange-traded fund (ETF) that aims to mimic the performance of an index |

| Types | Broad market, sector, domestic, international, bond, dividend, socially responsible, growth, value |

| Risk | Lower than individual stocks, but higher than cash or government bonds |

| Advantages | Low fees, built-in diversification, minimal maintenance, tax efficiency |

| Disadvantages | No ability to select stocks, less diverse than expected |

| How to invest | Choose an investment platform, open and fund an account, select an index fund, buy shares, monitor and adjust as needed |

What You'll Learn

Index funds vs. individual stocks

Index funds are a type of investment that tracks a market index, typically comprising stocks or bonds. They are passively managed, meaning they aim to mirror the performance of a specific index, such as the S&P 500, without actively selecting stocks. On the other hand, investing in individual stocks involves actively choosing which stocks to buy and sell, often requiring more research and attention to market performance.

Advantages of Index Funds Over Individual Stocks

Index funds offer several benefits compared to individual stocks:

- Lower fees: Index funds have lower fees because they are passively managed and require less active decision-making.

- Diversification: Index funds provide built-in diversification by tracking a broad market index, reducing the risk associated with investing in individual stocks.

- Minimal maintenance: Index funds require less maintenance because they automatically adjust their holdings to match the underlying index.

- Tax efficiency: Index funds buy and sell holdings less frequently, resulting in lower capital gains taxes.

Advantages of Individual Stocks Over Index Funds

Investing in individual stocks also has its advantages:

- Potential for higher returns: While riskier, investing in individual stocks can lead to higher returns if successful companies are chosen.

- More control: Investors have the freedom to select specific stocks that align with their interests, industry knowledge, or investment strategies.

- Potential for outperforming the market: While challenging, it is possible for skilled investors to outperform the market by choosing stocks that beat the performance of a particular index.

Both index funds and individual stocks have their advantages and disadvantages. Index funds are generally recommended for beginners or investors who want a more hands-off approach, while investing in individual stocks may be more suitable for those with the time, knowledge, and willingness to take on higher risk. Ultimately, the decision depends on an investor's goals, risk tolerance, and level of involvement in the market.

Vanguard Funds: Best UK Investment Options

You may want to see also

How to choose an index fund

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. Index funds are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup.

- Investment goals: Before investing in index funds, it's important to understand your financial goals and risk tolerance. Index funds can be a good option for long-term investing, such as for retirement, but may not be suitable for short-term or more speculative goals.

- Diversification: One of the benefits of index funds is that they provide diversification across various sectors and asset classes. When choosing an index fund, consider the underlying index it tracks and the level of diversification it offers. Broad market indexes, such as the S&P 500, offer exposure to a wide range of companies and sectors, while sector-specific indexes focus on a particular industry or market segment.

- Fees and expenses: Index funds are known for having lower fees and expenses compared to actively managed funds. However, it's important to review the expense ratio and other fees associated with the fund before investing. The expense ratio represents the percentage of your overall investment that goes towards paying the fund manager. Look for funds with low expense ratios to maximize your returns.

- Performance: While index funds are passive investments that aim to mirror the performance of their underlying index, it's still important to consider the historical performance of the fund. Compare the returns of the index fund to the returns of the index it tracks to ensure it is effectively mirroring the index's performance.

- Investment platform: Choosing the right investment platform or brokerage is crucial when investing in index funds. Consider factors such as the number of index funds available, the platform's fees, and the user-friendliness of their investment tools and resources. Some popular investment platforms for index funds include Vanguard, Fidelity, and Schwab.

- Tax implications: Index funds are generally considered more tax-efficient than actively managed funds because they tend to buy and sell holdings less frequently. However, it's important to consider the tax implications of investing in index funds, particularly if you plan to invest through a taxable account. Consult with a tax professional to understand the potential tax consequences of your investments.

Arbitrage Funds: Strategic Investment Opportunities for Savvy Investors

You may want to see also

Costs and fees

Index funds are a low-cost, passive investment strategy. They are typically cheaper than actively managed funds because they do not require a fund manager to actively select and trade stocks. Instead, they aim to mirror the performance of a particular market index, such as the S&P 500. This passive approach means lower fees for investors.

- Investment minimums: The minimum amount required to invest in a mutual fund can vary, ranging from nothing to a few thousand dollars. Some index funds that are traded as exchange-traded funds (ETFs) may allow you to purchase fractional shares, enabling you to get started with a small amount of money.

- Account minimums: This is different from the investment minimum. While a brokerage's account minimum may be $0, especially for retirement accounts like IRAs, this does not remove the investment minimum for a particular index fund.

- Expense ratio: This is one of the main costs associated with index funds. The expense ratio represents the fees charged by the fund manager, expressed as a percentage of your overall investment. These fees cover administrative costs and are subtracted from each fund shareholder's returns. Expense ratios can vary, so it's important to review them before investing.

- Tax-cost ratio: Investing in index funds outside of tax-advantaged accounts, such as a 401(k) or an IRA, may trigger capital gains taxes. These taxes, along with the expense ratio, can eat into your investment returns.

- Trading costs: When buying or selling index funds, you may incur trading costs or commissions. Some brokers or fund companies may charge higher fees for certain transactions, so it's important to review these costs before investing.

- Annual fee: Index funds typically charge an annual fee to cover administrative costs. This fee is usually included in the expense ratio, but it's important to understand what it covers and how it may impact your overall returns.

- Commission: When buying or selling shares of an index fund, you may be charged a commission by the broker or fund company. This is separate from the expense ratio and trading costs.

- Capital gains taxes: Investing in index funds that distribute capital gains (profits from sales) to shareholders may result in additional tax liabilities. To avoid this, consider investing in index funds that retain and reinvest capital gains.

Mutual Funds: Where Are Your Investments Going?

You may want to see also

Risks and downsides

Index funds are a popular investment choice, but they do come with certain risks and downsides. Here are some key considerations:

Lack of Downside Protection

Index funds are designed to mirror the performance of the market or a specific index. This means that when the market is doing well, the fund will provide upside and generate positive returns. However, during market downturns or corrections, the fund will also decline in value, leaving investors vulnerable to losses. In other words, there is no built-in mechanism to protect against downside risk.

Lack of Reactive Ability

Index funds do not allow for proactive or reactive adjustments to their portfolios. If a particular stock becomes overvalued, it will carry more weight in the index, which is the opposite of what astute investors would ideally want. This lack of flexibility can be a significant drawback, especially for investors who want to time their investments or make tactical adjustments.

No Control Over Holdings

Index funds are set portfolios, and investors have no control over the individual holdings within the fund. This lack of control can be frustrating for investors who have specific companies or sectors they want to invest in or avoid for personal or ethical reasons.

Limited Exposure to Different Strategies

Index funds primarily focus on passive investing and mirroring a specific index. This approach may limit investors' exposure to different investment strategies that could potentially provide better returns or be more aligned with their goals and risk tolerance.

Dampened Personal Satisfaction

Investing in index funds may not provide the same level of personal satisfaction or excitement as actively selecting individual stocks. Some investors enjoy the challenge and thrill of picking stocks, and index funds may not offer the same level of engagement or sense of accomplishment.

Underperformance and Market Risk

While index funds aim to match the performance of their underlying index, they may sometimes underperform, especially in the short term. Additionally, index funds are subject to market risk, and their performance is closely tied to the overall health of the economy and financial markets. During bear markets or economic downturns, index funds can experience significant declines, and investors may lose money.

Smart Mutual Fund Investments: 5K and Beyond

You may want to see also

Getting started

Index funds are a great, low-cost way to build wealth and are ideal for beginners. Here are the steps to get started:

- Decide on your platform: Choose an online brokerage or investment platform that suits your needs. Some factors to consider include the range of funds available, fees, and user-friendliness.

- Open and fund your account: Provide personal information, set up login credentials, and complete a questionnaire about your investment goals and risk tolerance. Then, deposit funds into your account, usually through a bank transfer.

- Select an index fund: Research different funds, considering factors such as performance history, management fees, and the indexes they track. Diversifying your portfolio by investing in several index funds can help manage risk.

- Buy shares: With your account funded, you can now purchase shares of your chosen fund(s) through your platform's website or app.

- Monitor and adjust: While index funds are typically long-term investments, periodically review your portfolio to ensure it remains aligned with your financial goals and make adjustments as needed.

Additional considerations

- Investment goals: Before investing in index funds, it's important to understand your financial goals and risk tolerance. Index funds are generally suited for long-term wealth building, particularly for retirement.

- Costs and fees: Index funds are known for their low costs, but be sure to consider the expense ratio (management fees) and any other applicable fees, such as trading commissions or account minimums.

- Types of index funds: There are various types of index funds, including broad market, sector-specific, domestic, international, bond, dividend, and socially responsible funds. Choose the type(s) that align with your investment strategy and goals.

- Brokerage accounts: You can purchase index funds through a brokerage account or directly from a mutual fund company. Brokerage accounts offer more investment options and tools but may have higher fees.

Investing Beyond Mutual Funds: Exploring Alternative Investment Avenues

You may want to see also

Frequently asked questions

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. Index funds are defined as investments that mirror the performance of benchmarks.

Index funds are a low-cost, easy way to build wealth. They are passively managed, meaning they don't require active fund managers to decide which investments to buy or sell. This results in lower fees for investors. Index funds also tend to be more diversified, reducing risk.

One of the main drawbacks of index funds is the lack of flexibility. They are designed to mirror a specific market, so they will decline in value when the market does. Index funds also include all the securities in an index, which may result in investing in overvalued or weak companies.

To start investing in index funds, you'll need to choose an investment platform or brokerage, open and fund an account, select an index fund to invest in, and then buy shares. It's important to monitor your portfolio periodically to ensure it aligns with your financial goals.