Enterprise Resource Planning (ERP) is a platform that integrates and automates a company's core business functions, such as finance, accounting, procurement, manufacturing, inventory management, and customer relationship management. One of the many modules within an ERP system is the finance module, which typically includes accounting, finance, and reporting functions. This module is often a company's foundation, providing critical insights into its financial health and performance.

Among the features of the finance module are accounts payable, accounts receivable, asset management, and cash management. It handles transactions, invoices, reporting, and revenue management, offering a comprehensive view of the company's financial situation.

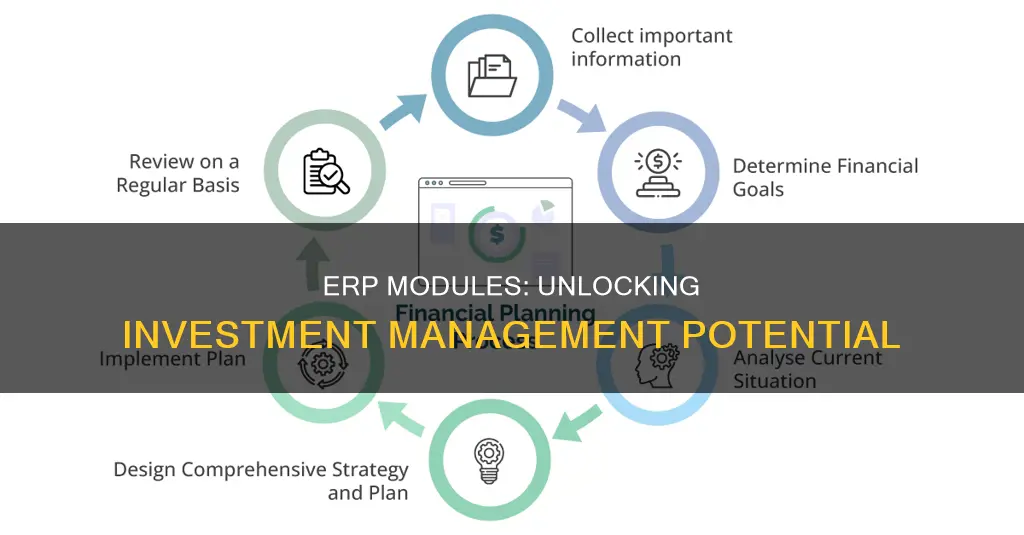

The investment management function is a part of the asset management feature within the finance module. It enables companies to track and manage their investments, such as stocks in other companies, and make informed decisions about their financial resources.

| Characteristics | Values |

|---|---|

| Creating appropriation requests | Captures every detail of a particular investment decision, like the object or asset to be invested in, the volume of investment, the projected benefits of the investment, the cost likely to be incurred, the different levels of approvals required for the investment, etc. |

| Planning investments | Includes a pre-planning phase and a planning phase. In the pre-planning phase, appropriation requests are created in the system. In the planning phase, all the relevant parameters are planned for the investment proposal and entered into the system. This phase mainly consists of cost and revenue planning, which includes the costs of an investment and its benefits to the organization over the entire life of the investment. |

| Preparing budgets | Creating budgets is not restricted to individual investment proposals. Budgets on an organization-wide level can be prepared on various criteria. For example, using enterprise structure as the criterion, you can allocate budgets to each business area and further split the budget down through lower levels of the hierarchy. |

| Creating the budget balance sheet | Lists all the large investments in assets as assets under construction. All the investments would be given the right accounting treatment as per their purposes and capitalization methods. |

| Executing the investment | Once assigned to the investment program, the budget is further distributed to investment measures for actual utilization. Investment measures collect the actual costs and can be appropriation requests, internal orders, or WBS elements. |

| Capitalizing assets and closing | The periodic settlement functionality can be used to settle the amounts of the investments to either cost center accounting or to fixed assets. |

What You'll Learn

General Ledger (GL)

The General Ledger (GL) is the core of an ERP system's finance package. It integrates with other finance modules, such as accounts payable, accounts receivable, and cash management, to provide a central repository of accounting data for financial reporting and other purposes. One of the key functions of the GL is to update the sub-ledger in real-time, eliminating the need for time-consuming reconciliations. The GL also provides summarised data for planning, control, and reporting.

GL is made up of several important components, including GL master data setup, GL integration setup with logistics modules, period and year closing, and integration with other modules. The GL master data setup involves creating a chart of accounts, which is a complete structure of ledger accounts used by the organisation. This can be structured at both the parent and individual company levels. The GL integration setup with logistics modules involves defining an integration mapping scheme for posting logistics transactions into finance. Examples of logistics transactions include making and releasing purchase orders, receiving materials, and registering supplier invoices.

The GL also plays a crucial role in period and year-end closing processes. Before closing a period, it is necessary to check its status, perform auditing and reconciliation, pass final correction entries, and rebuild the ledger history. The GL provides summarised data for financial reporting, including statutory reports. It also enables the preparation of financial statements such as the balance sheet and income statement.

The GL is a set of numbered accounts used by businesses to track financial transactions and prepare financial reports. Each account is a unique record summarising a specific type of asset, liability, equity, revenue, or expense. Certified public accountants (CPAs) and bookkeepers typically access and use general ledgers to track transactions and cash flow, compile information for business reports, and prevent accounting errors and fraud.

The GL functions as a collective summary of transactions posted to subsidiary ledger accounts, such as cash, accounts payable, accounts receivable, and inventory. It utilises the double-entry accounting method, where each item is divided into four main parts: a journal entry, a description of the transaction, a debit or credit value, and the resulting balance. During the bookkeeping process, transactions are recorded in journals or daybooks before being posted to the general ledger.

Investing in Apollo Global Management: A Comprehensive Guide

You may want to see also

Accounts Payable (AP)

The Accounts Payable (AP) module is a critical component of the finance segment of an Enterprise Resource Planning (ERP) system, facilitating the financial relationship with vendors who supply goods and services to the organisation. This module enables the functionality to enter, monitor, maintain and process invoices and credit notes received from vendors for payment.

The key functionalities of the AP module include:

- Immediate registration and tracking of incoming invoices

- Authorisation of invoices, including a separate procedure for approval of invoices exceeding user tolerances

- Entry of order-based and sundry invoices

- Automatic matching of invoices with receipts and purchase orders

- Self-billing invoices suitable for a Just-In-Time (JIT) environment, where receipt of goods automatically generates approved invoices paid through remittances without an invoice from the supplier

- Accounts classification for reconciliation

- Master data setup of AP, including blocking codes, aging analysis periods, price difference limits, and matching with receipt settings

- Linking ACP with the General Ledger (GL) through a schedule of chart of accounts

The AP module ensures efficient management of payments to vendors, providing visibility into the financial health of the company. It automates manual tasks, improves accuracy, and enables strategic decision-making by providing a single source of accurate data. This module is particularly beneficial for small and medium-sized businesses (SMBs) that may not have a dedicated accounting team, helping them avoid cash flow issues and ensure their long-term survival.

Protecting Your Managed Investments: Strategies for Success

You may want to see also

Accounts Receivable (AR)

AR is an important element in fundamental analysis, a method used by investors to determine the value of a company and its securities. It contributes to a company's liquidity, or its ability to cover short-term obligations without additional cash flow. A company with a healthy ratio of AR to AP is typically in a better financial position, as it has enough money coming in from accounts receivable to cover its expenses.

The AR process starts when a company sells a good or service and includes payment terms, discounts, or credit guidelines in an invoice to the customer. When payments arrive, receipts need to be returned, and the payment needs to be recorded. Companies need to have meticulous rules for issuing credit and collecting debts, and they must keep accurate records of customer data.

AR is also important because it can be sold by a company to a "factor", such as a bank or other financier, to raise money and boost cash flow. This practice is known as factoring, or the sale of accounts receivable. However, it involves paying a fee to the factoring company in return for the faster payment of accounts receivable.

Several vendors, including Oracle, Workday, and SAP, sell software for automating the management of accounts receivable and integrating the process with an Enterprise Resource Planning (ERP) system.

Building a Diverse Investment Portfolio: Strategies for Success

You may want to see also

Asset Management (AM)

Asset Management is a critical module within Enterprise Resource Planning (ERP) systems, which are essential tools for businesses to automate critical business processes and manage their operations efficiently. AM involves the systematic governance and optimisation of all assets under an organisation's or entity's responsibility. This includes tangible assets, such as physical objects like manufacturing plants, infrastructure, buildings, or equipment; and intangible assets, such as intellectual property, goodwill, or financial assets.

The primary objective of AM is to increase the value generated by assets while minimising costs and risks. This is achieved through a coordinated approach that involves developing, operating, maintaining, upgrading, and disposing of assets in a cost-effective manner. AM professionals, also known as portfolio managers or financial advisors, play a crucial role in this process by actively managing investments and providing recommendations based on clients' risk tolerances and financial health.

The ISO 55000 series of international standards provides a framework for AM, defining an asset as "an item, thing, or entity that has potential or actual value to an organisation." AM is particularly relevant for organisations with significant physical assets, complex processes, or infrastructure to manage.

Within the context of ERP systems, AM is often integrated with other modules such as inventory management, procurement, and supply chain management. This integration allows for seamless data exchange and more effective decision-making, ensuring that the management of assets is aligned with the organisation's broader strategic objectives.

By effectively utilising the AM module within ERP systems, businesses can improve their overall efficiency, minimise costs, and make more informed decisions about their assets to achieve their goals.

Purchasing a Condominium: Saving or Investing?

You may want to see also

Cash Management (CM)

The cash management module within an Enterprise Resource Planning (ERP) system provides information relating to an organisation's cash flow by processing and analysing all cash and bank transactions. This includes transactions arising from the payment of supplier invoices, receipt of sales invoices, standalone payments, and unallocated payments/receipts.

The ERP cash management module also enables the analysis of financial transactions over a given period, providing insights into sources and use of funds to ensure liquidity and meet payment obligations. This analysis includes information on accounts payable and receivable, general ledger transactions, and master data maintenance.

One of the primary objectives of CM is to maximise liquidity and minimise the cost of funds. By effectively managing cash balances, companies can maintain financial stability, meet working capital needs, and optimise earnings opportunities.

CM can be integrated with a company's online banking, providing administrators with access to funds at all times. This integration also offers greater control over cash flows and accessibility, which can be customised to meet the unique needs of each business.

Additionally, CM includes functionalities such as payment/receipt methods, bank relations, payment authorisation, and cash flow forecasting. These features help businesses to efficiently manage their cash position, make informed decisions, and ensure they have the necessary funds to meet their financial commitments.

In summary, CM is a vital function for any business, and the ERP cash management module provides the tools and insights needed to effectively manage cash inflows and outflows, ensuring financial stability and liquidity.

Building a Robust Investment Portfolio with Just $500

You may want to see also

Frequently asked questions

An ERP finance module is a software component that handles the main accounting and financial management functions of an enterprise resource planning system. It contains standard accounting records, such as the general ledger and balance sheet, generates financial reports, and handles transactions such as invoicing and expense reporting.

The main features of an ERP finance module include:

- General ledger

- Accounts payable

- Accounts receivable

- Fixed asset management

- Purchasing

- Risk management

- Reporting

- Profit tracking

- Tax management

ERP finance modules are important because they help organisations manage and integrate their financial data and processes. This ensures accounting accuracy and compliance with financial regulations and reporting requirements. The consolidated financial data provided by ERP finance modules also enables organisations to measure and improve their performance.