The National Pension System (NPS) is a government-backed retirement savings initiative in India. It offers investors a choice of two accounts: Tier I, which is a pension account with tax benefits and withdrawal restrictions, and Tier II, which is an optional, flexible savings account without tax benefits. There are 10-11 pension fund managers to choose from, and investors can select their preferred investment option or opt for the Auto choice, which allocates investments based on age and risk profile. NPS is one of the lowest-cost investment products available and offers triple tax benefits.

What You'll Learn

Tax benefits of investing in NPS

The National Pension System (NPS) offers a range of tax benefits to its subscribers. Here are the key tax advantages of investing in NPS:

Tax Benefits on Self-Contribution:

- Deduction under Section 80CCD(1): Employees investing in NPS can claim a tax deduction of up to 10% of their salary (Basic + Dearness Allowance) under Section 80CCD(1). This deduction is subject to a maximum limit of Rs. 1.5 lakh under Section 80CCE.

- Additional Deduction under Section 80CCD(1B): NPS subscribers can avail of an additional tax deduction of up to Rs. 50,000 under Section 80CCD(1B). This deduction is over and above the overall limit of Rs. 1.5 lakh specified under Section 80CCE.

- Self-employed Individuals: Self-employed individuals contributing to NPS can claim a tax deduction of up to 20% of their gross income under Section 80CCD(1), with a maximum limit of Rs. 1.5 lakh under Section 80CCE. They are also eligible for the additional deduction of up to Rs. 50,000 under Section 80CCD(1B).

- Tier-1 and Tier-2 Accounts: The tax benefits mentioned above are applicable to investments made in the NPS Tier-1 account. Only Central Government NPS subscribers can claim tax benefits for self-contributions made to a Tier-2 account under Section 80C, with a maximum deduction limit of Rs. 1.5 lakh.

Tax Benefits on Employer Contribution:

- Corporate Model: In the corporate model, employer contributions to the NPS Tier-1 account of up to 10% of the employee's salary (Basic + Dearness Allowance) are eligible for an additional tax deduction under Section 80CCD(2). This deduction is over and above the Rs. 1.5 lakh limit under Section 80CCE.

- Government NPS: Government NPS offers tax benefits to both state and central government employees for contributions made by the employer. State government employees can avail of a tax deduction of up to 10% of salary (Basic + Dearness Allowance), while central government employees can claim a deduction of up to 14% of their salary. This benefit is available under Section 80CCD(2) and is in addition to the Rs. 1.5 lakh limit under Section 80C.

Tax Benefits on Withdrawals and Annuity Purchases:

- Partial Withdrawal: NPS Tier-1 account holders can make partial withdrawals of up to 25% of their self-contribution up to three times during the investment tenure. These partial withdrawals are tax-free under Section 10(12B) of the Income Tax Act.

- Withdrawal at Superannuation: At maturity (when the subscriber turns 60), individuals can withdraw up to 60% of their Tier-1 account balance as a lump sum. This withdrawal is tax-free as per Section 10(12A).

- Annuity Purchase: It is mandatory to use at least 40% of the NPS Tier-1 account balance to purchase annuities at superannuation. The purchase of these annuities is eligible for tax exemption under Section 80CCD(5). However, the income received from these annuities is subject to tax as per the individual's income tax slab.

Mutual Funds in India: Best Time to Invest

You may want to see also

Differences between Tier I and Tier II NPS accounts

Overview

The National Pension System (NPS) is a government-sponsored pension programme launched in 2004. It offers two types of accounts: Tier I and Tier II. While Tier I is the primary NPS account for retirement savings, Tier II is a voluntary savings account that offers more flexibility.

Eligibility

To open a Tier I NPS account, one must be an Indian citizen between 18 and 65 years old (or 18 and 70 years old, according to some sources). For Tier II, one must have an active Tier I account and be an Indian citizen between 18 and 70 years old.

Minimum Contribution

The minimum contribution to open a Tier I account is Rs. 500, while for Tier II, it is Rs. 1,000.

Lock-in Period

Tier I accounts have a lock-in period until the investor turns 60, while Tier II accounts do not have any lock-in period, allowing subscribers to withdraw funds anytime.

Tax Benefits

Tier I contributions are eligible for tax deductions under Section 80C of the Income Tax Act, up to Rs. 1,50,000 annually. Additionally, Section 80CCD(1B) allows for further deductions of Rs. 50,000. Tier II contributions, on the other hand, do not offer any tax benefits, except for government employees who are eligible for a deduction under Section 80C after a lock-in period of 3 years.

Withdrawal Rules

Withdrawal rules for Tier I accounts are more restrictive. Withdrawals are not permitted during the first three years, and even after that, there are limitations on the amount that can be withdrawn. At maturity, investors can withdraw a lump sum of up to 60% of the fund value, while the remaining 40% must be used to purchase an annuity. Tier II accounts offer more flexibility, with no restrictions on withdrawals.

Management Charges

Both Tier I and Tier II accounts have similar fund management charges and the same available asset classes for investment.

Mutual Fund Investments: Where to Show Them in Your ITR

You may want to see also

How to pick the best fund manager for your NPS investment

The National Pension Scheme (NPS) is a government-backed retirement savings initiative that allows individuals to invest in a pension account during their working years. The NPS offers flexibility in choosing investment options, allowing investors to align their portfolios with their risk tolerance and investment preferences.

When it comes to picking the best fund manager for your NPS investment, here are some key considerations:

Understand the role of fund managers

Pension fund managers are professional institutions that manage your NPS investments. These fund managers are regulated by the Pension Fund Regulatory and Development Authority (PFRDA). They invest your money in four types of assets or classes: equity (Class E), government bonds (Class G), corporate debt (Class C), and alternative investment funds (Class A). Each of these asset classes has a different risk-return profile, and you have the flexibility to decide your NPS asset allocation.

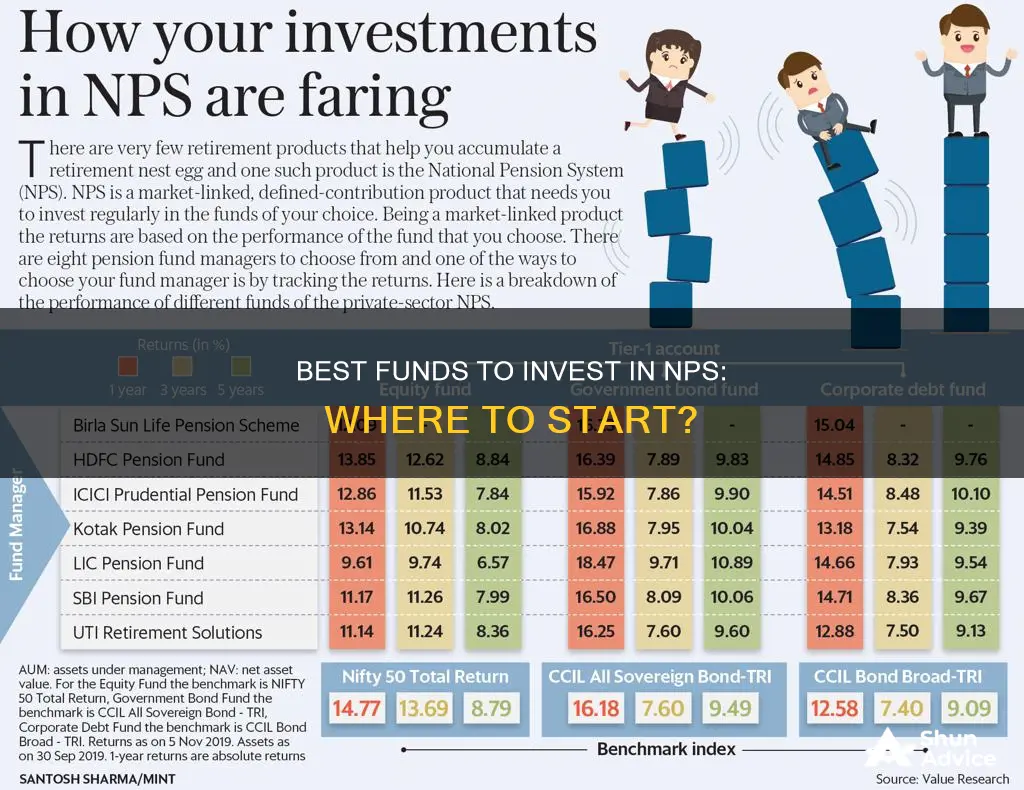

Evaluate fund manager performance

Analyze the performance of different fund managers in the four asset classes. Look at their rolling returns rather than just trailing returns to get a clearer picture. Consider factors such as average five-year rolling returns and how they compare to relevant indexes or benchmarks. Additionally, evaluate the volatility of their returns using metrics like the standard deviation.

Know your investment goals and risk appetite

Before choosing a fund manager, it is essential to understand your investment goals and risk appetite. Consider your time horizon until retirement and your preferred level of equity or debt exposure. If you prefer higher equity exposure, choose a fund manager who has consistently outperformed in equity funds. If you seek higher debt exposure, select a fund manager with a strong track record in debt funds.

Utilize available resources and tools

Review the performance of fund managers regularly by analyzing their portfolios, risk-return profiles, and historical returns. Utilize resources like the ET Money App or similar platforms to track the performance of NPS pension funds. Additionally, take advantage of the NPS calculator to estimate your expected returns based on your contributions, age, and investment strategy.

Consider diversification and flexibility

The NPS allows you to select multiple pension fund managers to manage different asset classes. This means you can choose the best-performing fund managers for each asset class. However, for Scheme A (alternative investment funds), you must choose one of the fund managers you've selected for the other schemes. Diversifying your NPS investment across different fund managers can help maximize returns.

Monitor and review your NPS investment

Keep a close eye on the performance of your chosen fund managers. If a fund manager consistently underperforms, you have the option to change your pension fund manager once a year under the current rules. Stay updated with the latest regulations and make adjustments as necessary to optimize your NPS investment.

By following these guidelines and conducting thorough research, you can make an informed decision when picking the best fund manager for your NPS investment. Remember to regularly review and adjust your investment strategy as needed to align with your retirement goals.

ETFs and Mutual Funds: Key Investment Considerations

You may want to see also

How to open an NPS account

The National Pension System (NPS) is a government-backed retirement savings initiative. Indian citizens, including NRIs, can invest in NPS to build a substantial corpus for retirement. The NPS also comes with tax benefits, making it an attractive retirement-planning tool for individuals.

There are two types of NPS investment accounts: Tier I and Tier II. Tier I is the primary pension account with certain withdrawal restrictions. It is designed to provide a retirement corpus and mandates a minimum contribution and a lock-in period until the age of 60. The funds invested in Tier I NPS are eligible for tax deductions. Tier II, on the other hand, is an optional investment account that offers flexibility in terms of withdrawals. It allows individuals to invest and withdraw funds without any lock-in period, but contributions made to this account do not qualify for additional tax benefits.

Online:

- Visit the eNPS portal of the CRA (Central Recordkeeping Agency) of your choice. You can choose from the following options: Computer Age Management Services Ltd (CAMS), K-Fin Technologies Private Limited, or Protean e-Gov Technologies Ltd (Formerly NSDL e-Governance Infrastructure Limited).

- Fill out the online form with the required details, including personal information, scheme preference, and bank details.

- Upload the necessary documents for KYC verification, such as a photograph, specimen signature, cancelled cheque/bank statement/passbook copy, and PAN copy.

- Make an initial contribution of a minimum of Rs. 500.

- Complete the payment through the available online payment platforms.

- On successful payment, you will be allotted a 12-digit PRAN (Permanent Retirement Account Number) and a PDF form will be generated.

- Your PRAN will be communicated to you via registered email and SMS.

- Complete the online e-sign or OTP-based confirmation to avoid physical submission of the registration form.

Offline:

- Visit your nearest PoP-SP (Point of Presence - Service Provider).

- Procure the PRAN application form from the PoP-SP or download it from the official website.

- Fill out the application form with all the necessary details and submit it along with the required KYC documents (proof of identity and address) to the PoP-SP.

- Make your first contribution (minimum of Rs. 500) at the time of applying for registration to any PoP-SP.

- Submit the NCIS (Instruction Slip) mentioning the details of the payment made towards your PRAN account.

- Track your PRAN application status using the receipt number provided by the PoP-SP at the time of submission.

Please note that the eligibility criteria for NPS accounts are subject to change, and it is recommended to refer to the official website or seek guidance from a financial advisor before proceeding with the account opening process.

Funding Sources for Your Real Estate Investment

You may want to see also

The role of fund managers

NPS fund managers work with investors' money to generate maximum returns at suitable risk levels. They pool money from investors and invest it across various asset classes, including stocks, corporate bonds, and government securities. The fund managers divide the funds among these asset classes, with the specific allocation depending on the investor's chosen strategy. The strategies offered are typically 'auto choice' and 'active choice'. The former sees investments allocated automatically based on the investor's age and risk profile, while the latter allows investors to choose their own allocation.

NPS fund managers are responsible for investing the pooled funds in accordance with the Investment Policy and Authority's regulations. They regularly evaluate the performance of the investments to ensure they are generating optimum returns. This involves conducting cyclical reviews to ensure the investments are operating effectively.

There are currently 10-11 NPS pension fund managers in India, including:

- Aditya Birla Sun Life Pension Management

- HDFC Pension Management

- ICICI Prudential Pension Fund Management

- Kotak Mahindra Pension Fund

- Max Life Pension Fund Management

- Tata Pension Management

- UTI Retirement Solutions

- SBI Pension Funds

- LIC Pension Fund

NPS investors can choose their fund manager based on their investment strategy and risk appetite. It is important to note that the choice of fund manager will impact the returns on their investment.

Mutual Fund Investment: Answers to Your Questions

You may want to see also

Frequently asked questions

There are two types of NPS accounts: Tier I and Tier II. Tier I is the primary pension account with certain withdrawal restrictions and a longer lock-in period until retirement. Tier II is an optional investment account that offers more flexibility in terms of withdrawals and functions more like a savings account.

NPS provides tax benefits under Section 80C and Section 80CCD(1B) of the Income Tax Act. It is also cost-effective, with relatively lower fees and charges compared to other investment options. Additionally, NPS offers flexibility in choosing investment options and allows investors to align their portfolios with their risk tolerance.

There are currently 10-11 pension fund managers for NPS subscribers to choose from. When selecting a fund manager, consider their performance in different asset classes and their overall ranking. You can also choose different fund managers for different asset classes to maximise returns.