A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a retirement savings plan designed for small businesses with 100 or fewer employees. It combines employer and employee contributions, allowing both parties to put money into a traditional IRA set up by the business. Employees can choose from a range of investment options, including stocks, bonds, exchange-traded funds, mutual funds, and CDs. This type of plan offers tax advantages for both employers and employees and is easy to set up and maintain. When deciding how to invest in a SIMPLE IRA, it's important to consider factors such as risk tolerance, asset allocation, and the variety of investment options available.

| Characteristics | Values |

|---|---|

| Available to | Employers with 1-100 employees |

| Plan setup and administration | No third-party recordkeeper, third-party administrator, annual 5500 or discrimination testing required |

| Cost | Lower setup and annual fees than 401(k) plans |

| Tax benefits | Contributions are tax-deductible for employers; Pre-tax contributions are not taxed until withdrawn for participants; Roth contributions grow tax-free, and earnings are tax-free for qualified withdrawals |

| Contribution limits | Higher than traditional and Roth IRAs |

| Investments | Wide range, including stocks, bonds, exchange-traded funds, mutual funds, CDs, and target date funds |

| Default investment option | Not necessary as all investment selections must be made by participants |

What You'll Learn

Stocks, bonds, mutual funds, CDs and ETFs

A SIMPLE IRA, or Savings Incentive Match Plan for Employees, is a retirement savings plan designed for small businesses. It combines employer and employee contributions, allowing employees to defer a portion of their salary into their retirement account, which is then matched by the employer. Employees can choose from a variety of investment options for their SIMPLE IRAs, including stocks, bonds, exchange-traded funds (ETFs), mutual funds, and CDs.

Stocks are a type of security that represents ownership in a company, and they are typically bought and sold on stock exchanges. They are a popular investment choice as they offer the potential for high returns, and can help investors build wealth over time. However, investing in stocks comes with risks, as stock prices can be volatile and fluctuate significantly.

Bonds are a type of fixed-income security, where investors essentially lend money to a company or government entity in exchange for regular interest payments. Bonds are often used to diversify investment portfolios and reduce risk, as they are considered a safer investment option compared to stocks. The bond market is larger than the stock market in terms of aggregate market value.

Mutual funds are investment funds that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers, who invest the pooled capital on behalf of the fund's investors. Mutual funds offer several benefits, including diversification, professional management, and liquidity.

ETFs, or exchange-traded funds, are similar to mutual funds in that they also pool money from multiple investors to purchase a diversified portfolio of assets. However, ETFs differ from mutual funds in that they are traded on stock exchanges like individual stocks, and can be bought and sold throughout the trading day. ETFs typically have lower fees than mutual funds and offer more liquidity.

CDs, or certificates of deposit, are a type of savings account offered by banks or credit unions. They require the investor to deposit a sum of money for a specified period, during which the money earns interest. CDs are considered a low-risk investment option, as they are insured by the FDIC, and offer a fixed rate of return. However, investors may face penalties for withdrawing their money before the maturity date.

Bond Fund Strategies: Dynamic Investing for Maximum Returns

You may want to see also

Tax-deductible employer contributions

A SIMPLE IRA, or Savings Incentive Match Plan for Employees, is a retirement savings plan designed for small businesses. It allows employers and employees to contribute to traditional IRAs set up for employees.

Employer contributions to SIMPLE IRAs can be considered a tax-deductible business expense. This is one of the tax benefits of a SIMPLE IRA, which also include pre-tax contributions and tax-deferred growth for employees.

Employer contributions are mandatory and can be made in one of two ways. The first option is to match employee contributions dollar-for-dollar, up to 3% of their salary. The second option is to make an automatic contribution of 2% of the employee's salary. This means that the employer will contribute 2% of the employee's salary to their SIMPLE IRA even if the employee does not contribute themselves.

Employers can also make a nonelective contribution of up to 10% of compensation, or $5,000, in addition to the mandatory contributions. This option is available to all eligible employees, regardless of whether they make salary reduction contributions.

Employers are required to notify employees of the reduced limit within a reasonable time before the 60-day election period during which employees can enter into salary reduction agreements.

SIMPLE IRAs are limited to businesses with 100 employees or fewer and are a good option for small businesses that want to provide retirement benefits for their employees without the high costs and administrative burdens of larger retirement plans.

Savings Strategy: Mutual Funds Investment Allocation

You may want to see also

No minimum investment

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a retirement savings plan designed for small businesses. It allows both employers and employees to contribute to retirement savings. Employees can choose from a variety of investment options for their SIMPLE IRAs, including stocks, bonds, exchange-traded funds, mutual funds, and CDs.

One of the key advantages of a SIMPLE IRA is that employees do not need to meet a minimum investment to open an account. This makes it accessible to all employees, regardless of their financial situation. However, it is important to note that some investment options within a SIMPLE IRA may require minimum investments. Therefore, it is essential to carefully review the requirements of each investment option before deciding.

SIMPLE IRAs offer employees tax benefits similar to those of a 401(k) plan, with the convenience of a personal IRA. Each year, employees can decide how much of their salary they want to contribute to their SIMPLE IRA. These contributions are automatically deducted from their paychecks before federal income tax, reducing their taxable income. Additionally, any growth in the account is tax-deferred, meaning taxes are paid only when the money is withdrawn during retirement.

SIMPLE IRAs also provide flexibility for both employers and employees. Employers can choose to match employee contributions dollar-for-dollar up to a certain limit or make a fixed contribution. Employees have the freedom to choose their investment options and are not restricted by a minimum investment amount. This flexibility ensures that employees can customize their retirement savings plan according to their financial situation and goals.

In summary, a SIMPLE IRA is an attractive option for small businesses and their employees due to its accessibility, tax benefits, and flexibility. With no minimum investment requirement, employees can start saving for retirement without feeling burdened by initial contribution amounts. However, it is important to carefully consider the investment options available within the SIMPLE IRA to ensure they align with individual financial goals and strategies.

Maximizing SRS Funds: Where to Invest for Optimal Growth

You may want to see also

Tax-deferred growth

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a retirement savings plan designed for small businesses with 100 or fewer employees. It combines employer and employee contributions, with the latter being automatically deducted from employees' paychecks before federal income tax, providing the opportunity for future tax-deferred growth on that money.

With tax-deferred investments, you pay federal income taxes when you withdraw money from your investment, instead of paying taxes upfront. Any earnings your contributions produce while invested are also tax-deferred. This means that the investment earnings, such as interest, dividends, or capital gains, accumulate tax-free until the investor takes receipt of the profits.

The benefit of tax-deferred investments is that you gain from the tax-free growth of earnings. The tax savings can be substantial when investments are held until retirement, as the investor will likely be in a lower tax bracket and no longer be subject to premature tax and product withdrawal penalties.

For example, an employee earning $50,000 a year who contributes $3,000 to a tax-deferred account will only pay tax on $47,000. If, in 30 years, their taxable income is $40,000, and they decide to withdraw $4,000 from the account, their total taxable income will be $44,000.

It's important to note that early withdrawals from tax-deferred accounts, such as SIMPLE IRAs, may be subject to penalties and fees. Withdrawals prior to age 59½ may result in a 10% income tax penalty, and the penalty increases to 25% if the withdrawal occurs within the first 2 years of establishing the account.

In summary, tax-deferred growth in a SIMPLE IRA allows employees to reduce their taxable income while their investments grow tax-free, providing potential for larger returns when they withdraw funds during retirement.

Closed-End Investment Funds: Where and How to Trade

You may want to see also

Low fees

When it comes to investing in a SIMPLE IRA, fees are an important consideration. Here are some key points to keep in mind:

- No Account Fees: Some providers, like Fidelity, offer no account fees to open a SIMPLE IRA, making it more accessible and cost-effective for individuals.

- Low Trading Fees: Look for brokers that offer commission-free trading for stocks, ETFs, and options. For example, E-Trade offers commission-free trading for these assets and has a large selection of mutual funds with no transaction fees.

- No Transaction Fees for Mutual Funds: Mutual funds can be a great investment option within a SIMPLE IRA, but transaction fees can add up. Consider brokers like Charles Schwab, which offers thousands of mutual funds with no transaction fees.

- Low Management Fees for Robo-Advisors: If you prefer a hands-off approach, robo-advisors can manage your SIMPLE IRA for a small fee. For instance, Vanguard Digital Advisor charges a low annual management fee of approximately 0.20%, and Betterment charges 0.25% annually for their basic service.

- Low Expense Ratios for Mutual Funds and ETFs: Focus on brokers that offer low-cost mutual funds and ETFs, like Vanguard, which is known for its low-cost index funds.

- No Minimum Deposit or Low Minimums: Many brokers offer no minimum deposit requirements for SIMPLE IRAs, making it easier to get started. However, some brokers may have minimum investment requirements for certain funds, so be sure to check the fine print.

- Fractional Shares: Fractional shares allow you to invest in a portion of a share of stock or ETF, rather than purchasing a full share. This can be beneficial if you want to invest in a particular company but don't have enough funds for a full share. Some brokers, like Fidelity, offer fractional share investing.

Remember to carefully review the fee structure of any potential SIMPLE IRA provider to ensure you understand all the costs involved. By minimizing fees, you can maximize your returns over the long term.

Tips Mutual Funds: When to Invest for Maximum Returns

You may want to see also

Frequently asked questions

SIMPLE stands for Savings Incentive Match Plan for Employees. It is a retirement savings plan designed specifically for small businesses, usually with no more than 100 employees. It allows both employers and employees to contribute to retirement savings.

SIMPLE IRAs are easy to set up and less expensive to run than typical 401(k) plans due to lower administrative costs and regulations. They also offer tax advantages for both employers and employees.

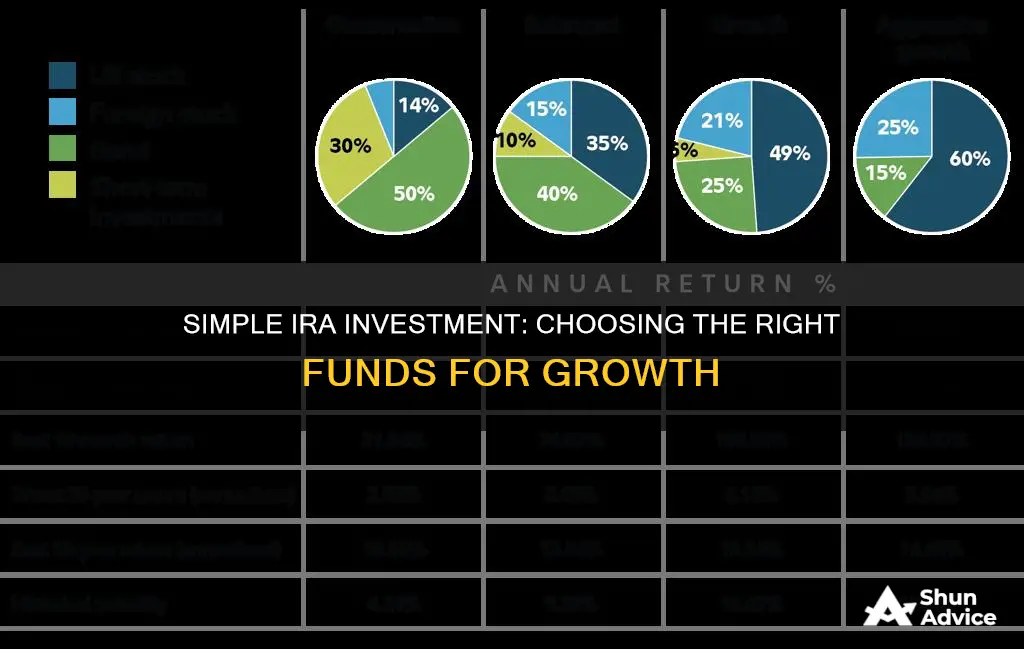

Employees can choose from a variety of investment options, including stocks, bonds, exchange-traded funds, mutual funds, and CDs. It is recommended to spread investments across different types of mutual funds for growth and income.

Yes, some investment options may require minimum investments and may not be available under the SIMPLE plan. Additionally, there is no Roth option available for SIMPLE IRAs, which means employers and employees cannot enjoy tax-free growth and withdrawals.

For 2024, employees under 50 years old can contribute up to $16,000, while employees 50 and older can contribute up to $19,500. Employer contributions are mandatory and can be made through dollar-for-dollar matching or an automatic percentage-based contribution.