When it comes to deciding how to invest your retirement savings, there are a variety of options to consider, each with its own advantages and disadvantages. Here are some of the most common types of investments for retirement:

- Tax-Advantaged Accounts: These include 401(k)s, IRAs (Individual Retirement Accounts), and similar plans offered by employers. They provide tax benefits, such as tax-deferment or tax-free withdrawals, which can help your savings grow over time.

- Mutual Funds: These are professionally managed investment funds that pool money from multiple investors and invest in a variety of securities. Mutual funds offer diversification, lower costs, and ease of ownership.

- Index Funds: A type of mutual fund that passively invests in a specific stock market index, such as the S&P 500. Index funds are known for their simplicity and lower fees.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but can be traded on stock exchanges throughout the day. They offer the diversification and professional management of mutual funds with the flexibility of trading individual stocks.

- Individual Stocks and Bonds: Some investors prefer to research and purchase individual stocks and bonds to build a customised portfolio. This approach can provide a steady stream of income through dividend-paying stocks or bond ladders.

- Annuities: Annuities are insurance contracts that provide consistent, long-term income during retirement. They can be a good option for those seeking guaranteed income but may come with high costs and complex structures.

- Robo-Advisors: Robo-advisors use computer algorithms to provide low-cost, customised investment advice and portfolio management. They are a good option for those seeking a hands-off approach to retirement investing.

When deciding how to allocate your retirement savings across these investment options, it's important to consider your risk tolerance, time horizon, and overall financial goals. Diversification is key to managing risk and maximising returns. Additionally, it's crucial to start saving and investing early to take advantage of compound interest and give your investments more time to grow.

| Characteristics | Values |

|---|---|

| Type of account | Tax-advantaged accounts, taxable accounts |

| Tax treatment | Tax-deductible, tax-deferred, after-tax, tax-free |

| Investment options | Stocks, bonds, cash, dividend-paying stocks, rental property, annuities, mutual funds, index funds, ETFs, individual stocks and bonds, cash-value life insurance plans, nonqualified deferred compensation plans |

| Investment strategy | Robo-advisors, target-date funds, asset allocation, dividend investing, REITs, QLACs |

| Investor involvement | Actively managed, passively managed |

What You'll Learn

- Tax-advantaged accounts, such as 401(k)s and IRAs, offer tax-deferment or tax-free growth

- Asset allocation strategies help determine how much money to put into stocks, bonds, and cash

- Robo-advisors and target-date funds automatically rebalance your portfolio as you age

- Dividend-paying stocks provide a steady income stream, but may not offer exponential growth

- Annuities provide consistent, long-term income but can be costly and complex

Tax-advantaged accounts, such as 401(k)s and IRAs, offer tax-deferment or tax-free growth

Tax-advantaged accounts, such as 401(k)s and IRAs, are an excellent way to save for retirement. These accounts offer tax breaks that can help you reduce your tax burden and maximise your returns.

There are two main types of tax-advantaged accounts: tax-deferred and tax-exempt. With tax-deferred accounts, you don't pay taxes on your contributions or earnings until you withdraw the money during retirement. This allows your investments to grow tax-free until you retire. Traditional 401(k)s and IRAs are examples of tax-deferred accounts. On the other hand, tax-exempt accounts, such as Roth 401(k)s and Roth IRAs, allow you to contribute with after-tax dollars, but your withdrawals in retirement are tax-free.

When deciding between tax-deferred and tax-exempt accounts, consider your current and expected future tax rates. If you expect your tax rate to be higher in retirement, a tax-deferred account like a traditional 401(k) or IRA can provide immediate tax benefits. However, if you anticipate being in a higher tax bracket in the future, a tax-exempt account like a Roth 401(k) or Roth IRA may be more advantageous as your withdrawals won't be subject to taxes.

Additionally, tax-advantaged accounts can be offered by your employer or through a brokerage firm or bank. Employer-sponsored retirement plans, such as 401(k)s, often include automatic payroll deductions and may provide matching funds, further boosting your savings. IRAs, on the other hand, can be opened at a bank, brokerage firm, or mutual fund company, offering flexibility and a wide range of investment options.

By utilising tax-advantaged accounts, you can take advantage of tax breaks, maximise your savings, and grow your investments over time to build a comfortable retirement nest egg.

XRP: Invest Now or Miss Out?

You may want to see also

Asset allocation strategies help determine how much money to put into stocks, bonds, and cash

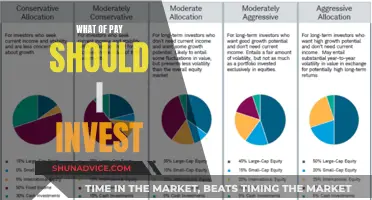

Asset allocation is a strategy that helps investors decide how much money to put into stocks, bonds, and cash. It is the mix of different investment assets you own.

Each type of security has advantages and disadvantages. Stocks, for example, have a higher rate of return than bonds but come with more volatility. Bonds, on the other hand, reduce the volatility in a portfolio but at the cost of lower expected returns.

The decision between stock and bond allocations can be difficult. Income, balanced, and growth asset allocation models can help guide this decision. An income portfolio, for instance, allocates 70% to 100% of funds to bonds, while a growth portfolio allocates 70% to 100% to stocks.

Within the stock allocation, investors may also consider geography (US vs international stocks) and market capitalization (small companies vs large companies).

It's important to note that asset allocation is not a one-time decision. Investors should periodically review their portfolio to ensure it aligns with their financial goals, risk tolerance, and investment horizon.

The Debt Dilemma: Pay Off in Full or Invest?

You may want to see also

Robo-advisors and target-date funds automatically rebalance your portfolio as you age

Robo-advisors and target-date funds are both popular investment options for people who want a hands-off approach to building and managing their portfolio. They are similar in that they are both low-cost, simple, and widely available ways to obtain investment advice and build a diversified portfolio. However, there are some key differences to note.

Robo-advisors are online investment advisors that manage your money via computer algorithms. They select investments, rebalance your portfolio automatically, and look for tax-loss harvesting opportunities. They are highly customizable and can be tweaked to handle multiple investing goals, such as retirement and a child's college fund. Robo-advisors are ideal for investors who want flexibility and the ability to adjust their investments at any time. They are also a good option for those who want a more complex portfolio suited to their specific needs and risk tolerance.

Target-date funds, on the other hand, are mutual funds designed for retirement savings. They have a specific target date in mind and automatically adjust their holdings over time to reduce volatility and risk as the target date approaches. This means that target-date funds will shift from a more aggressive strategy with a higher percentage of stock-based investments when you are young to a more conservative strategy with a higher percentage of bond-based investments as you near retirement. Target-date funds are ideal for investors who want a simple, one-time setup, and a low-maintenance investment option.

Both robo-advisors and target-date funds have their advantages and disadvantages, and the best option for you will depend on your specific needs and circumstances. Robo-advisors offer more flexibility and customization, while target-date funds provide a simple, set-it-and-forget-it investment plan. Robo-advisors typically charge a management fee, while target-date funds only charge an expense ratio. However, it is important to note that target-date funds from different companies with the same retirement year can vary widely in their glide path, underlying fund choices, and management fees, so it is important to shop around and compare them.

The Dividend Dilemma: Navigating the Best Investment Strategies

You may want to see also

Dividend-paying stocks provide a steady income stream, but may not offer exponential growth

Dividend-paying stocks can be a great way to generate a steady income stream, making them an attractive option for those looking to invest for retirement. However, it's important to note that these stocks may not offer exponential growth, and there are some considerations to keep in mind when investing in dividend-paying stocks.

Dividend-paying stocks provide investors with regular payments, which can be made in the form of cash or additional stock. These payments are typically made on a monthly, quarterly, or annual basis and are seen as a share of the company's profits. Dividend investing can be a good strategy for those seeking to lock in profits as it provides a consistent income stream. Additionally, companies that consistently pay dividends are often viewed as being in good financial health, as missing dividend payments can indicate financial troubles.

While dividend-paying stocks can offer stability, they may not offer the same exponential growth potential as newer, smaller companies. This is because it is easier for a company with a lower share price to double its share value than a larger, more established company. Therefore, investors seeking high growth potential may want to consider other investment options.

When investing in dividend-paying stocks, it's crucial to diversify your portfolio to minimise risk. This can be achieved by investing in a variety of dividend-paying stocks across different industries, market capitalisations, and geographic locations. Additionally, investors should research the companies they are considering investing in and assess their financial health and track record of dividend payments.

It's also important to remember that dividend payments are not guaranteed and can fluctuate or be cut altogether if a company experiences financial difficulties. Therefore, investors should not rely solely on dividend payments for their income and should consider other investment options to balance their portfolio.

Overall, dividend-paying stocks can be a great option for those seeking a steady income stream during retirement, but they may not offer the same growth potential as other investments. By carefully researching and diversifying their investments, investors can maximise the benefits of dividend-paying stocks while minimising potential risks.

The Power of Paying Off Debt: Why It's a Smart Investment

You may want to see also

Annuities provide consistent, long-term income but can be costly and complex

Annuities are insurance contracts that provide consistent, long-term income payments. They are often chosen by retirees for safety and security. Annuities are widely advertised as a safe way to provide regular paychecks in retirement.

There are three main types of annuity contracts: fixed, variable, and index. Many retirement experts recommend fixed annuities, as they offer guaranteed repayments of your purchase price plus a modest return, and have lower fees than other types. Variable annuities offer no guaranteed payments, are confusingly written, and may cause you to lose money if the investments in the annuity perform poorly. Index annuities, or fixed index annuities, are a hybrid of fixed and variable annuities. They offer reduced investment growth compared to variable annuities but provide some protection against market downturns.

Annuities can be costly, so it is recommended to only buy one with the features you need. Variable annuities provide a guaranteed income that can increase with market returns, so an investor might want to be more aggressive with the investments inside the annuity and more conservative with those outside the annuity.

Annuities can be complex and difficult to understand, and it is important to be fully informed about what the annuity will and won't do for you. They are also illiquid, meaning that money put into an annuity is locked in and subject to withdrawal penalties. Because of this, annuities may not be suitable for younger individuals or those with liquidity needs.

Overall, annuities can provide a stable and guaranteed income stream for retirees, but it is important to carefully consider the costs and complexities involved before purchasing one.

Cardano: Invest Now or Miss Out?

You may want to see also

Frequently asked questions

There are tax-advantaged and taxable accounts. Examples of tax-advantaged accounts include 401(k)s, IRAs, and brokerage accounts. Taxable accounts include most brokerage and bank accounts.

Common retirement investments include mutual funds, index funds, exchange-traded funds (ETFs), individual stocks and bonds, annuities, dividend-paying stocks, and rental properties.

Asset allocation refers to the mix of stocks, bonds, and cash in your investment portfolio. It's important because it determines the level and types of risk your money is exposed to, as well as the returns you can expect. As you get closer to retirement, it's generally recommended to lower your risk of losses.

A target-date fund is a type of investment fund that automatically adjusts the mix of stocks and bonds based on your selected retirement date. For example, if you plan to retire in 2055, you would choose a target-date fund for people retiring in that year. The fund will start with a higher weighting in stocks and gradually shift to less risky assets as you approach retirement.

Investment fees can significantly impact your returns over time. Common fees include management fees, fund expense ratios, and transaction costs. It's important to understand the fees associated with your investments and consider lower-fee alternatives if necessary.