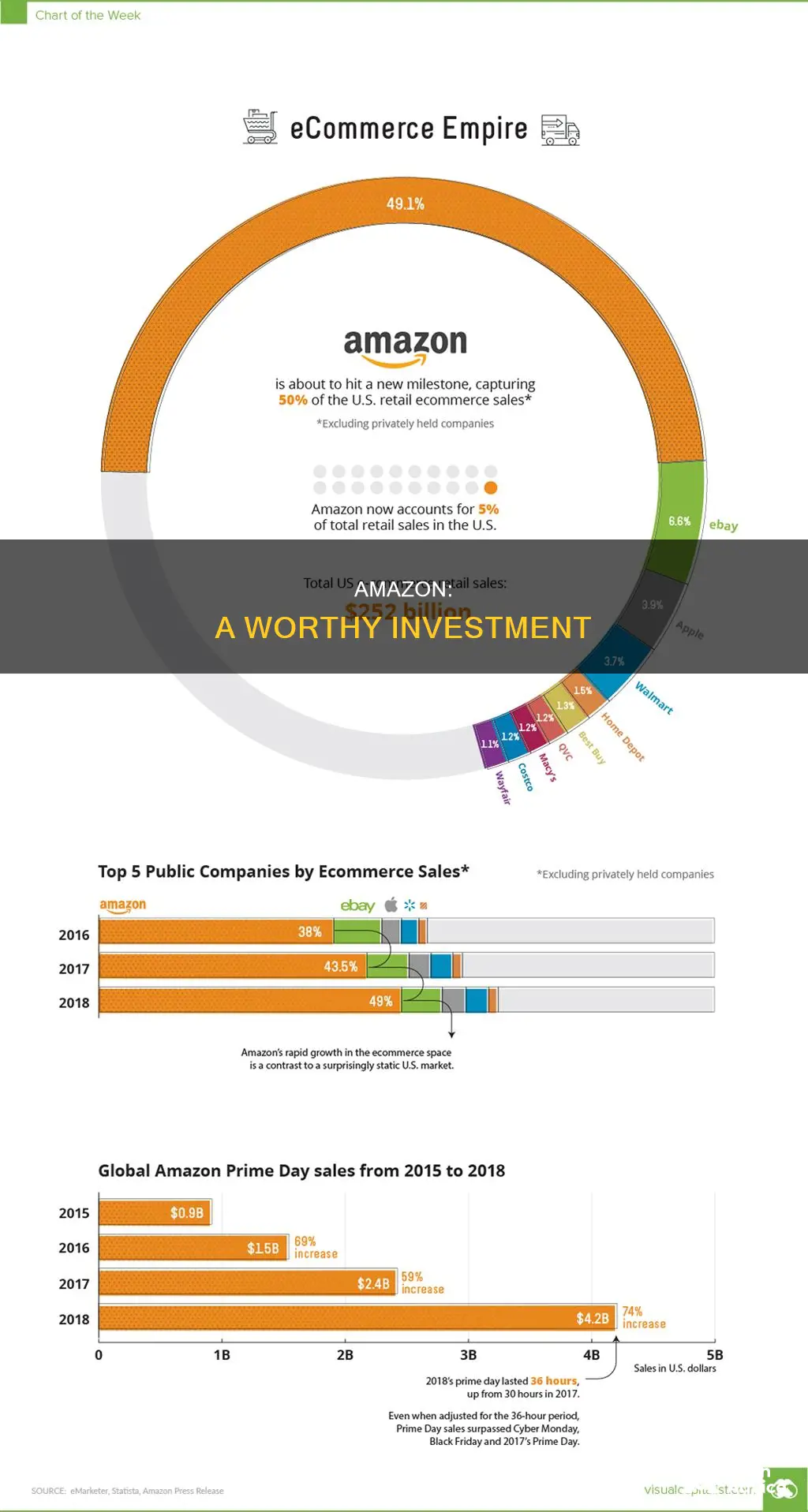

Amazon is one of the largest companies in the world, and its share price has grown phenomenally since its foundation. The company's incredible past success has not deterred investors, who continue to flock to the e-commerce giant.

Amazon's dominance in multiple industries makes it an attractive prospect for investors. The company's e-commerce business is well-known, but it has also quietly transitioned to a service business, with third-party seller services, advertising services, subscription services, and its cloud computing business, Amazon Web Services (AWS). AWS is a key profit driver for Amazon, contributing a third of the global cloud market and two-thirds of the company's operating income in 2023.

Amazon's margins have dramatically improved over the past decade, and its investments in same-day delivery and cost reductions are boosting profits. Amazon's cash flow is also improving, and its current stock price is towards the low end of its 10-year trading range. With a promising outlook, Amazon's stock offers significant upside potential over the next few years.

| Characteristics | Values |

|---|---|

| Market Capitalization | $1.8 trillion to $1.9 trillion |

| Revenue | $575 billion |

| Revenue Growth | 11.8% in 2023 |

| Operating Income | $37 billion in 2023 |

| Operating Income Growth | 200% in 2023 |

| Revenue from Online Stores | $57 billion in Q3 2023 |

| Revenue from Advertising | $11.8 billion in Q1 2024 |

| Revenue from AWS | $25 billion in Q1 2024 |

| Revenue from Prime Membership | $8.9 billion in Q3 2022 |

| Digital Ad Revenue | $46.9 billion in 2023 |

| Stock Price | $155 in 2024 |

| Stock Price Growth | 907% in the last 10 years |

| Price-to-Sales Ratio | 3.2 |

| Price-to-Cash-From-Operations | 22.5 |

What You'll Learn

Amazon's investments in same-day delivery are paying off

In the first quarter of 2024, Amazon achieved its fastest Prime delivery speeds ever, with nearly 60% of orders in the top 60 U.S. metro areas arriving the same or next day. This is a significant increase from 50% in the second quarter of 2023. The company's investments in same-day delivery have contributed to its overall financial performance and profitability.

Amazon's same-day delivery strategy includes the establishment of dedicated same-day delivery sites, which are smaller buildings located closer to major metro areas. These sites are stocked with a rotating selection of millions of items tailored to local customer demands. This strategy reduces the distance items travel from warehouses to customers and lowers the number of touchpoints, resulting in faster and more efficient deliveries.

The success of Amazon's same-day delivery can be attributed to several factors. Firstly, the company's heavy investments in its fulfillment and transportation network have paid off, allowing Amazon to shorten shipping times. Secondly, the shift from a national "hub and spoke" model to a regional model with local facilities has cut costs and boosted delivery speeds. Thirdly, Amazon's machine-learning technology has improved, allowing for better inventory planning and faster delivery times. Finally, the company's Prime membership, which offers next-day delivery and additional benefits such as Prime Video, keeps customers engaged and loyal.

Amazon's investments in same-day delivery have contributed to its overall success and profitability, making it an attractive prospect for investors. The company's ability to provide fast and reliable delivery has solidified its position as a leader in the e-commerce market and driven increased engagement and purchases from customers. As Amazon continues to expand and improve its same-day delivery capabilities, it is likely to maintain its competitive edge and attract more investors who recognize the potential for long-term gains.

Madoff's Web of Deceit

You may want to see also

Amazon's margins have dramatically improved

Amazon's margins have been boosted by the growth of its high-margin advertising business, which jumped 24% year-over-year to $11.8 billion in the first quarter of 2024. Additionally, Amazon's international retail operations swung to a $900 million operating profit in the first quarter of 2024, compared to a $1.2 billion loss in the same quarter of 2023.

The improvement in margins can also be attributed to CEO Andy Jassy's cost-cutting efforts, including slashing about 27,000 jobs and reshaping the company's fulfillment network to emphasize speed and efficiency. Amazon's shipping operations were regionalized, resulting in faster and cheaper deliveries, and the company implemented better cost controls in non-people categories like infrastructure.

The rise in service divisions has led to a significant increase in Amazon's gross margins over the past decade. This gives Amazon the potential for better profit margins, which have also improved in recent quarters. As Amazon transitions to becoming a company maximized for profits, margins will continue to be a key metric for investors to monitor.

Investments: Are They for Everyone?

You may want to see also

Amazon's cost reductions are boosting profits

Amazon's cost-cutting strategies have been a significant contributor to its improved profitability, particularly through the slashing of about 27,000 jobs. This has resulted in a dramatic decrease in overall spending and has helped to scale growth profitably.

Amazon's advertising cost reduction strategy involves identifying areas of overspending and reallocating advertising dollars to high-performing campaigns. By eliminating non-performing keywords, ASINs, and products with high ACOS or no conversions, Amazon can significantly cut down on its ad spending. Additionally, optimizing the cost per click (CPC) is crucial to staying within the daily ad budget.

The company has also implemented a "regionalization" strategy within its shipping operations, carving up its shipping network into eight regions. This has led to faster and cheaper deliveries, as packages travel shorter distances and are handled by fewer employees, thus lowering the "cost to serve."

Amazon's focus on cost-cutting has been a key driver of its improved financial performance, with net income more than tripling year-over-year to $9.9 billion in the third quarter of 2023. The company's operating margin, which is the profit left after subtracting costs, reached 7.8%, the highest since it recorded 8.2% in the first quarter of 2021.

Amazon's cost-cutting efforts have not only boosted profits but also contributed to its ability to reinvest in the business and develop or expand its operations.

American Century Investments: Public Opinion

You may want to see also

Amazon's stock offers significant upside

Amazon's current stock price is around $155, and it trades at a valuation of 22.5 times cash from operations on a trailing 12-month basis through 2023's third quarter. That is towards the low end of the stock's 10-year trading range by that metric. Applying a price-to-cash-from-operations multiple of 22.5 to its 2025 estimates would put the share price at $294, or 91% higher than the current price.

Amazon's high-margin cloud services business, Amazon Web Services (AWS), is also a key profit driver and is expected to continue to grow. In 2023, AWS was responsible for two-thirds of Amazon's $37 billion in operating income, while contributing 16% of the company's total revenue. AWS has a dominant position in the rapidly expanding cloud computing market, with a market share of almost a third in Q1 2023.

The company's e-commerce business is also delivering upside, with improved fulfillment capabilities and cost efficiencies. Amazon's international retail operations swung to a $900 million operating profit in Q1 2024, compared to a $1.2 billion loss in the same quarter of 2023. The North American operations contributed $5 billion in operating income, up 450% year-over-year.

Overall, Amazon's diverse business segments, improving margins, and strong cash flows make its stock an attractive long-term prospect for investors.

Wealthy Secrets: Investment Trends

You may want to see also

Dominating in multiple industries

Amazon's diversification into multiple industries has been a key factor in its success and its ability to attract investors. The company has evolved from an online book retailer operating out of Jeff Bezos' garage to a global conglomerate with a presence in numerous sectors. This diversification has allowed Amazon to dominate multiple markets and generate substantial revenue streams.

One of Amazon's most notable expansions was into the cloud computing space with the launch of Amazon Web Services (AWS) in 2006. AWS has become a significant profit driver for the company, contributing two-thirds of its operating income in 2023. AWS rents cloud-based computing power and other services to businesses and has established itself as a key player in the market, competing with the likes of Microsoft Azure and Google Cloud.

In addition to cloud computing, Amazon has also successfully ventured into other industries. It has become a small but growing rival to Facebook and Google in digital advertising. Amazon Studios, its film and television production arm, has started stealing awards from Netflix and HBO. With the acquisition of Whole Foods Market, Amazon has disrupted the traditional grocery industry and become a top-five grocer in the US. The company has also ventured into consumer electronics, digital streaming, artificial intelligence, and numerous other sectors.

Amazon's ability to dominate multiple industries has been a source of concern for competitors. Netflix CEO Reed Hastings, for example, has expressed awe at Amazon's ability to excel in so many diverse business areas. Amazon's diversification strategy has allowed it to cultivate new revenue streams, mitigate risks, and maintain its competitive advantage. By not putting all its eggs in one basket, Amazon has reduced its vulnerability to fluctuations in any single market and positioned itself for long-term growth and profitability.

The company's diverse business segments bring in substantial revenue, with its service divisions, including third-party seller services, advertising services, subscription services, and AWS, generating $92.9 billion in revenue compared to the commerce side's revenue of $75.7 billion. This diversification has improved Amazon's gross and profit margins and contributed to its overall financial performance, making it an attractive investment opportunity.

Madoff Victims: A Long List of Investors

You may want to see also