Bitcoin is the world's largest cryptocurrency by market capitalization, and it has been touted as one of the best investment options in recent times. Its popularity as a compelling investment option stems from its continuous growth, consistent track record, liquidity, low inflation risk, and simplified trading.

Bitcoin's user base has grown significantly, with a 44% increase in users from 2020 to 2021, and it currently has approximately 100 million Bitcoin wallets with value. Its resilience in surpassing all-time highs and its status as an inflation hedge due to its limited supply of 21 million coins make it attractive to investors.

Additionally, Bitcoin's liquidity makes it ideal for short-term profit seekers and long-term investors due to its high market demand. Its decentralized nature, lack of control by a single entity, and independence from central banks and governments further enhance its appeal.

Despite the risks and volatility associated with Bitcoin, its unique features and strong performance have solidified its position as a significant financial instrument in today's market, catering to a diverse range of investors.

What You'll Learn

Bitcoin's decentralised nature makes it immune to government intervention

Bitcoin's decentralised nature is one of its most appealing features. Its blockchain technology and peer-to-peer system mean it is not controlled by a central authority, such as a government or bank, and it is not backed by tangible assets. This makes it immune to government intervention in several ways.

Firstly, Bitcoin's decentralised nature means it is not controlled by a single government, central bank, or company. This means that, unlike traditional, regulated currencies, it cannot be manipulated by a single authority to manufacture asset bubbles and crises.

Secondly, Bitcoin's decentralised nature also means it can be used to circumvent capital controls. For example, in China, citizens have an annual limit of $50,000 to purchase foreign currency. However, in 2020, more than $50 billion was moved from East Asia-based Bitcoin wallets to wallets in other countries, indicating that Chinese citizens may have converted local currency to Bitcoin to transfer money across borders and avoid government regulation.

Thirdly, Bitcoin's decentralised nature means it can be used to facilitate illegal activity. Its network is pseudonymous, meaning users are only identified by their address on the network. This, combined with the algorithmic trust that Bitcoin's network provides, means that illegal transactions can take place without trusted contacts at either end.

Finally, Bitcoin's decentralised nature means that, unlike traditional currencies, it is not backed by tangible assets. This means that, in its current form, it cannot be regulated by governments or central banks, and its supply cannot be controlled by a single group of authorities.

However, it is important to note that Bitcoin's decentralised nature does not make it completely free from government intervention. Governments can still choose to recognise or refuse to recognise Bitcoin as legal tender, or even ban it completely.

Bitcoin Investment: Is It Worth the Risk?

You may want to see also

It's a great hedge against inflation

Bitcoin has emerged as a potential option for those seeking a hedge against inflation. Its fixed supply of 21 million coins safeguards it from the inflationary pressures that traditional currencies face. By nature, Bitcoin cannot undergo dilution through inflation, making it attractive to investors.

The decentralised architecture of Bitcoin also disentangles it from manipulation or control by central banks and governments, adding an extra layer of security for investors wary of government interventions. Bitcoin's independence from government authorities is further demonstrated by the fact that its price does not decrease after policy uncertainty shocks.

However, it is important to note that the value of Bitcoin is driven primarily by market demand and supply, with no tangible asset backing it up. This can lead to high levels of volatility, which poses a risk for investors who may need to liquidate their holdings in times of market stress. For example, between late 2017 and early 2018, Bitcoin's price swung from nearly $20,000 down to just above $3,000.

Additionally, Bitcoin's relatively short history compared to traditional investment vehicles like gold means its performance in diverse economic scenarios, particularly during inflationary periods, remains largely untested. Given that inflation tends to occur over long timeframes, Bitcoin's longevity and stability in such conditions are yet to be fully evaluated.

The regulatory landscape surrounding cryptocurrencies is another critical factor to consider. Despite gaining wider acceptance, cryptocurrencies are still subject to legal and regulatory uncertainties across different jurisdictions. There have been instances where governments have restricted or banned their use, impacting their value and liquidity.

Therefore, while Bitcoin has potential as a hedge against inflation due to its fixed supply and decentralised nature, it is important to approach it with caution. Investing in Bitcoin should be based on thorough research and understanding of the asset and the broader cryptocurrency market. Incorporating it as part of a diversified portfolio can help to leverage its potential benefits while mitigating its risks.

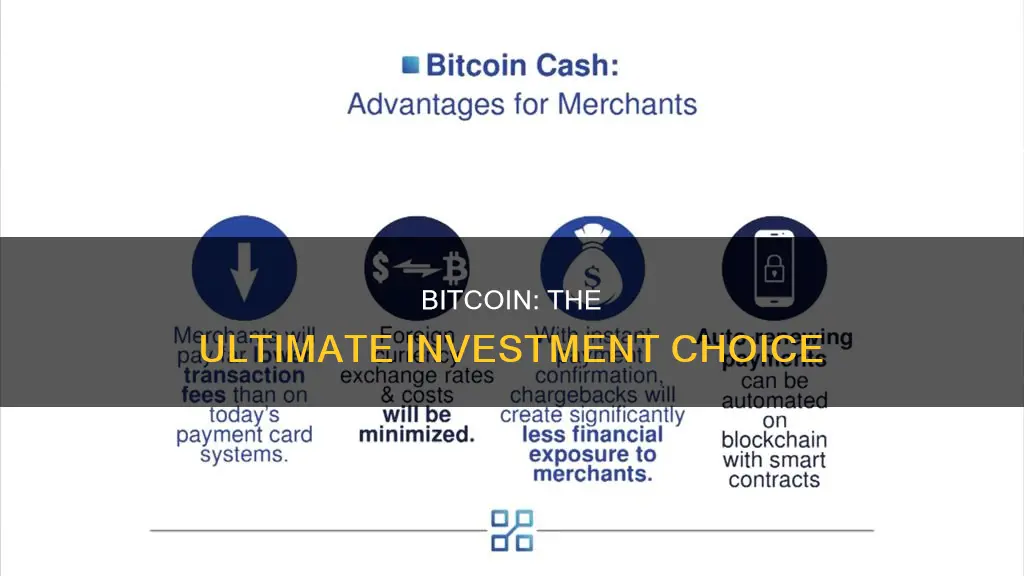

Why You Should Consider Investing in Bitcoin Cash

You may want to see also

Bitcoin's scarcity makes it a good store of value

Bitcoin's scarcity is supported by the Halving, which occurs every 210,000 Bitcoin "blocks" or roughly every four years. The Halving reduces Bitcoin's annual issuance rate by 50%, bringing the network one step closer to its terminal supply of 21 million. This reduction in supply has historically led to a significant increase in Bitcoin's price in the year following the Halving.

Bitcoin's scarcity is also protected by the laws of proof-of-work (PoW) consensus, which prevents the manipulation of its supply. The process of mining Bitcoin is financially intensive and subject to operational constraints, resulting in a slow and predictable supply schedule.

The scarcity of Bitcoin, combined with its decentralized nature and finite supply, makes it a unique asset and a good store of value. Its value is determined by the countervailing forces of supply and demand, with demand increasing as the supply of unrewarded coins decreases.

Bitcoin's scarcity is further enhanced by its divisibility, portability, and durability. One Bitcoin can be divided into up to eight decimal places, making it highly divisible. It can also be used across borders, allowing anyone with an internet connection to participate in the global economy. Additionally, as Bitcoin occupies a digital space, it can last as long as there is a digital area to store it.

While some critics argue that scarcity alone is not enough to justify Bitcoin's value, supporters believe that its decentralized nature, protecting it from inflation and dictators, is what makes it valuable.

The Wild Ride of Investing in Bitcoin

You may want to see also

It's easy to trade and accessible to investors of all experience levels

Bitcoin is a highly accessible investment option, with a simple trading process that is open to investors of all experience levels. Unlike stock trading, which often requires a broker and involves complex processes, Bitcoin trading is straightforward and minimalistic. Investors simply need to buy or sell Bitcoin on exchange platforms and store their holdings in a digital wallet. There is no need for a certificate, license, or broker to facilitate the transaction. This simplicity and ease of trading have contributed to Bitcoin's growing popularity and user base.

The decentralised nature of Bitcoin also contributes to its accessibility. It is not controlled by any single entity, government, or central bank, and transactions do not require third-party approval. This lack of central control means that Bitcoin is immune to government interventions and is not influenced by the policies of central banks or other financial institutions. As a result, investors have more control over their wealth and can make transactions without intermediaries.

Additionally, Bitcoin's use as a medium of exchange further enhances its accessibility. Cross-border transactions can be completed quickly and easily, without the high fees and slow transaction times typically associated with traditional remittance services. This makes it particularly attractive for individuals sending money to family in other countries, as it eliminates regulatory barriers and reduces costs.

The accessibility of Bitcoin is also evident in the variety of ways it can be purchased. Investors can acquire Bitcoin through crypto exchanges, brokers, or even Bitcoin ATMs. The low minimum investment amounts required by some platforms, such as eToro, which has a minimum of $10, also contribute to its accessibility. Furthermore, the option to dollar-cost average investments allows individuals to build their Bitcoin positions over time without needing a large lump sum.

Overall, Bitcoin's simplified trading process, decentralised nature, use as a medium of exchange, and the availability of various purchase options make it accessible to a wide range of investors, regardless of their experience level.

The Ultimate Guide to Investing in Bitcoin

You may want to see also

Bitcoin transactions are secure and transparent

Firstly, Bitcoin transactions are highly secure. This is due to the decentralised nature of blockchain technology, which makes it nearly impossible for hackers to alter information. Each block in the blockchain contains a unique hash, and each block also contains the previous block's hash. Therefore, if someone tries to alter a block, the hashes will no longer match, and the network will reject the altered block. Additionally, the distributed nature of blockchain means that information is stored across multiple devices, making it harder to tamper with.

Secondly, Bitcoin transactions are transparent. All transactions are stored publicly and permanently on the network, meaning anyone can see the balance and transactions of any Bitcoin address. This level of transparency makes it nearly impossible to hide or delete transactions, reducing the need for checks and balances. However, it is important to note that while transactions are transparent, the identity of the user behind an address remains unknown unless information is revealed during a purchase.

The transparency and security of Bitcoin transactions also have implications for privacy. While Bitcoin is often perceived as an anonymous payment network, it is actually very transparent. Bitcoin addresses should only be used once to protect privacy, as they become tainted by the history of all transactions they are involved with. Additionally, users should be careful about publishing their addresses in public spaces, as this can make it easier for someone to identify their transactions and purchases.

Finally, the secure and transparent nature of Bitcoin transactions can lead to cost savings for businesses and consumers. Blockchain technology removes the need for a central authority to manage transactions, reducing fees and speeding up transaction processing times. Additionally, the transparency of Bitcoin transactions can reduce financial reporting costs and make it easier for companies to comply with regulations.

In conclusion, Bitcoin transactions are secure and transparent due to the underlying blockchain technology. This security and transparency offer benefits such as increased privacy, reduced fees, faster transactions, and lower financial reporting costs.

The Next Big Investment: Beyond Bitcoin

You may want to see also

Frequently asked questions

Bitcoin is a good investment because it has a strong track record of continuous growth, with a significant increase in users and wallet value. It has a limited supply, making it less susceptible to inflation compared to traditional currencies. It is also easy to trade, making it accessible to investors of all experience levels.

Bitcoin is a very volatile asset, and its value can fluctuate drastically. It is also not backed by any central authority or government, so it does not have the same regulatory protections as traditional investments. Additionally, there are concerns about its use in illegal activities and the environmental impact of the energy required to run it.

You can buy Bitcoin through a crypto exchange such as eToro, Coinbase, Kraken, or Gemini. You will need to create an account, deposit funds, and then use those funds to purchase Bitcoin. You can then store your Bitcoin in a digital wallet.

There are thousands of other cryptocurrencies, including Ethereum, Binance Coin, Tether, and Dogecoin. You can also invest in crypto exchanges or blockchain technology. Additionally, you can invest in more traditional assets such as stocks, bonds, index funds, or commodities.