Buying a house can be a good investment, but it depends on your financial situation and the timing of your purchase.

The idea that owning a home can be an investment is based on the fact that, historically, real estate values tend to increase over time. For example, the median home sale price in the US increased from $221,800 in 2010 to $425,150 in 2023. However, the prospect of an increase in value alone is not enough to make a house a true investment.

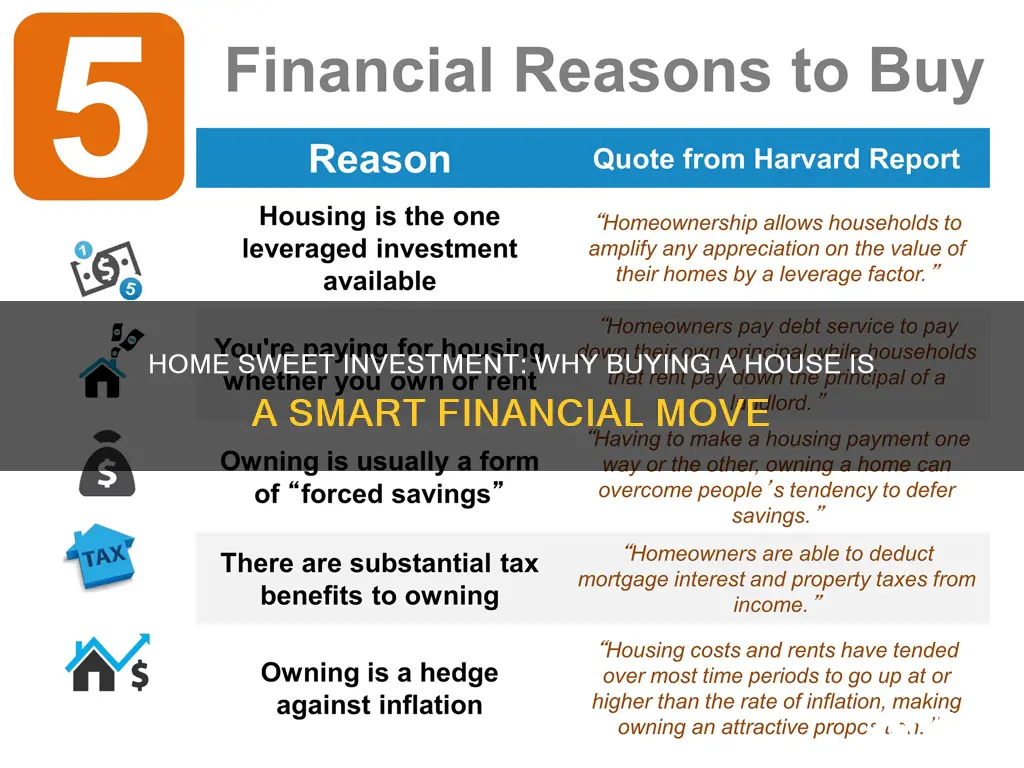

There are several benefits to buying a house as an investment. Firstly, it can lead to long-term home and equity appreciation. Secondly, it saves money on rent, which is unrecoverable, whereas money paid towards a mortgage builds ownership of something tangible that can increase in value. Thirdly, it can provide greater financial stability and build equity, which can be used to finance other investments. Additionally, there are certain tax benefits associated with owning a home, such as deducting mortgage interest and property tax payments on tax returns.

On the other hand, there are also drawbacks to consider. Buying a house requires a large cash outlay for a down payment and closing costs, which can be as high as 6% of the home's value. There are also ongoing maintenance costs, property taxes, and homeowners' insurance to consider. Additionally, appreciation is not guaranteed, and the value of a home can depreciate, especially during economic downturns.

Therefore, when considering buying a house as an investment, it is essential to carefully review your finances and the pros and cons of homeownership to determine if it aligns with your unique situation and goals.

| Characteristics | Values |

|---|---|

| Long-term appreciation | The value of a house is likely to grow over the long term. |

| Save on rent | Money that goes toward rent is unrecoverable. If you put that money toward a mortgage, you’re working toward fully owning something tangible that can increase in value over time. |

| Greater financial stability | Homeowners have an average net worth of $300,000, which is 37 ½ times the net worth of renters at $8,000. |

| Tax benefits | Certain tax benefits come with owning a home. For example, if you itemize your deductions on your tax return, you can deduct mortgage interest and property tax payments on your taxes every year. |

| Lifestyle benefits | Homeowners typically have more square footage than renters, and the extra space may be more conducive to raising a family. |

| Appreciation is not guaranteed | Appreciation is important to consider when determining whether a home is an investment. |

| Timing the market is difficult | It is difficult to purchase your home in a buyer's market and sell your home in a seller's market to maximize your profit. |

| High acquisition costs | Housing prices have skyrocketed, and mortgage interest rates also remain steep, which lowers your buying power and makes a home purchase today more expensive than it used to be. |

| Homeownership costs can increase | Property taxes, maintenance expenses and insurance premiums are likely to increase over time. |

| Renting offers more flexibility | As a renter, you can easily relocate anywhere you choose; it’s not as simple a process to sell a home. |

What You'll Learn

Long-term appreciation and equity

Long-term appreciation refers to the likelihood of a property's value increasing over time. This is influenced by several factors, including location, population growth, property condition, property type, government policies, and the economic climate.

Location is a critical factor in long-term appreciation. Properties in desirable areas with good schools and amenities tend to appreciate faster. Population growth can also increase demand for housing, leading to higher property values. The condition of the property is another important consideration, as a well-maintained property is more likely to appreciate.

Single-family homes generally appreciate faster than condominiums or townhouses. Government policies that encourage homeownership, such as tax incentives and low-interest rates, can also stimulate demand and increase property values. A strong economy typically leads to higher demand for properties, driving up prices.

Home equity is the difference between the appraised value of a home and the amount owed on the mortgage. It is the most valuable asset for a homeowner, and it can be used for various purposes, such as purchasing a new home, making improvements, retirement, or securing a second mortgage.

Equity builds as the property value grows or the debt is paid off. There are also more active ways to build equity, such as making additional payments each month towards the principal. This helps reduce the debt faster and improves the loan-to-value ratio.

Home improvements and renovations can also increase property value and build equity. Staying on top of basic upkeep, repairs, and maintenance is essential for maintaining and increasing a home's value.

While a home's appreciation is influenced by factors beyond an individual's control, such as interest rates and the housing market, proactive measures such as regular home improvements and upgrades can help grow its value over time.

The Magic of Compounding: Unlocking the Secret to Doubling Your Investments

You may want to see also

Save on rent

One of the biggest advantages of owning a home is that you’re not spending money on rent every month. Money that goes toward rent is unrecoverable. If you put that money toward a mortgage, however, you’re working toward fully owning something tangible that can increase in value over time.

Data from the Census and Economic Information Center (CEIC) estimates that house prices were up 3.9% year-over-year in June 2023. If you paid rent during this same period, you missed out on potential returns.

According to the National Association of Realtors, the median existing-home price in February 2024 was $384,500, the highest February median on record.

Zillow’s monthly Observed Rent Index shows that the typical U.S. rent in February 2024 was $1,959, a 3.5% year-over-year increase.

Homeownership provides greater financial stability. According to 2022 data from the National Association of Realtors Research Group, homeowners have an average net worth of $300,000, which is 37.5 times the net worth of renters at $8,000.

This can be attributed to homeowners building equity when they make mortgage payments and/or their home’s value increases. In some situations, homeowners have the option to tap into their home equity as a source of cash, whereas renters might have to rely on a personal loan or a credit card.

Certain tax benefits come with owning a home. For example, if you itemize your deductions on your tax return, you can deduct mortgage interest and property tax payments on your taxes every year. That said, you should only itemize your tax deductions if it makes financial sense.

According to the Internal Revenue Service (IRS), here are the standard tax deductions for tax year 2024:

- Head of household: $21,900

- Single taxpayers and married individuals filing separately: $14,600

- Married couples filing jointly: $29,200

To determine whether it’s worth it to itemize deductions, calculate your homeowner tax deductions and any other deductions you’re eligible for. If this number is greater than your standard deduction amount, it will likely be in your best interest to itemize.

Morgan Motor Company: Timeless Automotive Investments

You may want to see also

Greater financial stability

Homeownership can lead to greater financial stability for several reasons. Firstly, it allows individuals to build equity, which is essentially ownership of their home. As individuals pay down their mortgage and property values rise over time, their equity increases. This equity can be a valuable asset, providing financial flexibility and opportunities for investment.

Secondly, homeownership often results in lower monthly expenses compared to renting. Rent payments are unrecoverable, whereas mortgage payments build equity and can lead to long-term financial gains. Additionally, homeowners may benefit from tax deductions on mortgage interest and property taxes, further reducing their tax liability and increasing their disposable income.

According to the National Association of REALTORSⓇ Research Group, the average net worth of homeowners in 2022 was $300,000, compared to $8,000 for renters. This significant disparity highlights the financial advantages of homeownership. Homeowners also have the option to tap into their home equity as a source of cash, providing financial flexibility and stability.

Furthermore, homeownership offers stability in terms of fixed monthly mortgage payments, enabling better financial planning and budgeting. Unlike rent, which can fluctuate and increase over time, fixed-rate mortgages provide predictable and stable monthly payments. This stability can contribute to intelligent budgeting and a better understanding of financial management.

Lastly, homeownership can foster a sense of belonging and community, leading to stronger relationships and a sense of permanence. This sense of belonging can have positive financial implications, such as access to local networks and community resources. Overall, the combination of equity building, reduced expenses, tax benefits, and stable payments contributes to greater financial stability for homeowners.

Renewable Energy's Return: Does Green Energy Pay Dividends?

You may want to see also

Tax benefits

There are several tax benefits associated with buying a house as an investment. Here are some key points to consider:

Mortgage Interest Deduction

One of the most significant tax benefits of homeownership is the ability to deduct mortgage interest. Homeowners can deduct the interest paid on the first $750,000 of mortgage debt ($375,000 if married and filing separately). This can result in substantial tax savings. For example, a couple with an average mortgage of $250,000 at a 4% interest rate could save around $2,500 in taxes annually through this deduction alone.

Property Tax Deduction

In addition to mortgage interest, homeowners can deduct up to $10,000 ($5,000 if married and filing separately) from their property taxes and state and local income taxes. Known as the State and Local Taxes (SALT) deduction, this can be especially beneficial in areas with high property taxes.

Home Office Deduction

With the rise of work-from-home trends, the home office deduction has become increasingly relevant. Homeowners who run businesses or use part of their home exclusively for business can take advantage of this deduction. This includes freelancers, contractors, and small business owners.

Home Sale Exclusion

When selling a primary home, the Internal Revenue Service (IRS) provides a significant tax benefit. Homeowners can exclude up to $250,000 ($500,000 for joint filers) of capital gains from the sale. This means that if a couple sells their home and makes a gain of $200,000, this amount could be tax-free.

Tax Credits for Energy Improvements

The IRS offers tax credits for qualified first-time homebuyers and homeowners who invest in energy improvements such as solar panels and energy-efficient windows. These credits are even more advantageous than deductions as they are subtracted directly from the tax bill.

Other Deductions and Considerations

Other potential deductions for homeowners include mortgage points, private mortgage insurance (PMI), charitable donations, casualty and theft losses, gambling losses, unreimbursed medical and dental expenses, and long-term care premiums. Additionally, expenses related to the upkeep, maintenance, and improvement of an investment property may also be deductible.

It's important to note that to claim these tax benefits, itemizing deductions is usually required instead of taking the standard deduction. Consulting with a financial advisor or tax professional can help maximize tax benefits and ensure compliance with tax laws.

Buy-to-Let Beyond Borders: Exploring Europe's Top Investment Destinations

You may want to see also

Lifestyle benefits

There are many lifestyle benefits to buying a house as an investment. Firstly, homeowners typically have more square footage than renters, and the extra space may be more conducive to raising a family. Secondly, when you own your home, you have control over decorating and making changes to the property. For instance, as a homeowner, you can decide to paint the walls or add solar panels, whereas renters often have limited options for making changes to their living space.

Additionally, buying a house can be regarded as a better use of your money than renting, as you build home equity when you pay your mortgage, whereas rent payments go directly to the landlord with no ownership stake being built over time. Furthermore, owning a home can provide a sense of security and peace of mind, which can be especially beneficial for those looking to settle down and raise a family.

Lastly, property ownership allows you to become a landlord and earn rental income. If your local laws permit it, you can rent out a portion of your home while living there, helping to pay for your mortgage and other ownership costs. For example, you could buy a duplex, live in one unit, and rent out the other, or purchase a home with a separate apartment and rent that out.

College Loans or Investments: Navigating the Financial Crossroads

You may want to see also

Frequently asked questions

A house is likely to grow in value over the long term, and the median home sale price has increased significantly over the past 13 years. In addition, you can save money on rent, build equity, and enjoy tax benefits.

There are high acquisition costs, no guarantee of appreciation, and increased homeownership costs. Renting offers more flexibility, and there may be less liquidity as a homeowner.

Real estate investing is a long-term investment that can increase your net worth. It is typically less volatile than investing in the stock market, and you can live in a house but not in a stock fund or savings account.

The location of the home, real estate market conditions, the size of the home relative to nearby homes, mortgage interest rates, and the health of the economy can all impact the value of your home.