Negative-yield bonds are an unusual type of investment where the investor receives less money than they paid for the bond when it matures. Despite this, investors still buy these bonds for several reasons. Firstly, they are often purchased as safe-haven assets in times of economic turmoil. Secondly, funds must meet certain requirements, including asset allocation, meaning they must hold bonds even if the financial return is negative. Thirdly, some investors believe they can make money through currency gains and deflation. Finally, investors may accept a small negative yield to avoid larger potential losses in the equity markets.

What You'll Learn

- Funds invest in negative-yield bonds for asset allocation and to reduce risk

- Negative-yield bonds are purchased as safe-haven assets in times of turmoil

- Investors may expect to make currency gains that offset the negative bond yield

- Negative-yield bonds are often issued by governments in countries with low or negative interest rates

- Some investors believe future bonds will offer worse returns than negative-yield bonds

Funds invest in negative-yield bonds for asset allocation and to reduce risk

Negative-yield bonds are an unusual situation in which issuers of debt are paid to borrow. When a bond has a negative yield, it means that the investor will receive less money when the bond matures than the amount they paid for it. This can happen when the price paid for the bond is much greater than its par value.

Funds, such as pension and hedge funds, invest in negative-yield bonds for asset allocation. Many funds have requirements that dictate that a portion of their portfolio must be allocated to bonds to create a diverse portfolio. This is done to reduce or hedge the risk of loss from other investments, such as equities. As a result, these funds must own bonds, even if they generate negative returns.

Negative-yield bonds are also seen as safe-haven assets during times of economic uncertainty. Investors may accept a negative-yielding bond if they believe it will result in a smaller loss compared to the potential for larger losses in the equity markets. For example, Japanese government bonds are known to have paid negative yields at times and are still sought after by international investors as a safe investment.

Baillie Gifford Fund: Where Should Your Money Go?

You may want to see also

Negative-yield bonds are purchased as safe-haven assets in times of turmoil

Negative-yield bonds are counterintuitive financial instruments that cause investors to lose money. Despite this, they are still purchased as safe-haven assets in times of economic turmoil. This phenomenon can be attributed to a few key factors, including the search for safe investments, the role of institutional investors, and the impact of monetary policies.

Firstly, investors view bonds as a safe haven during turbulent economic periods. Bonds are typically seen as a stable and secure form of investment, especially compared to riskier assets like equities. In uncertain markets, investors prioritise safeguarding their capital over pursuing high returns. As a result, they are willing to accept negative yields on their bond investments to minimise risk and protect their principal. This is known as the "flight-to-safety-trade" in the bond market.

Secondly, institutional investors, such as central banks, insurance companies, and pension funds, play a significant role in the negative-yield bond market. These institutions have specific requirements, including asset allocation mandates, that drive their investment decisions. For example, hedge funds and investment firms must allocate a portion of their portfolios to bonds to create a diversified portfolio and reduce the risk of loss from other investments. As a result, they are compelled to invest in bonds, even if they carry negative yields.

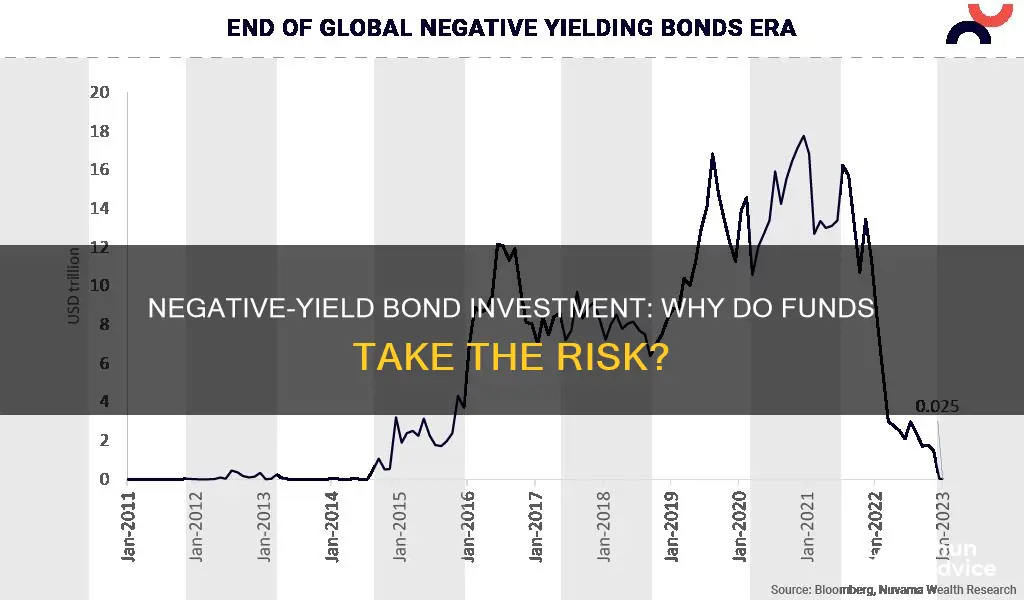

Lastly, monetary policies implemented by central banks can influence the prevalence of negative-yield bonds. For instance, in 2014, the European Central Bank (ECB) set a key interest rate into negative territory to stimulate economic growth. This decision effectively lowered the cost of debt and encouraged borrowing. Similarly, in 2020, the US Federal Reserve set the target Federal Funds rate to zero to support the economy during the Covid-19 pandemic. While the Federal Reserve has not followed the ECB in setting negative target rates, their actions still contributed to the environment of low-interest rates, which can indirectly lead to negative-yield bonds.

In summary, negative-yield bonds are purchased as safe-haven assets during times of economic uncertainty. Investors seek the relative safety of bonds, institutional investors have specific allocation requirements, and central banks implement accommodative monetary policies, all contributing to the demand for negative-yield bonds as a safe investment option.

Mutual Funds: Where to Invest for Maximum Returns

You may want to see also

Investors may expect to make currency gains that offset the negative bond yield

Investors may expect currency gains to offset the negative bond yield. This is particularly relevant for foreign investors who convert their investments into the issuing country's currency when buying a government bond. If the currency appreciates against their local currency by the time they sell the bond, they can make a profit on the currency exchange, even if the bond itself made a loss.

For example, a US investor buying a German bond yielding negative 0.75% could sell the EUR/USD exchange rate in one year's time for a higher price than the prevailing spot price, thus generating a yield. This is because currencies with lower interest rates are expected to trade at a higher exchange rate in the future.

Foreign investors may also be attracted to negative-yielding bonds because of the currency hedging premiums, which can be large enough to offset the negative yields. This is especially true if the foreign country has a steeper yield curve than the investor's local economy.

In addition, investors may expect a period of deflation, or lower prices in the economy, which would allow them to make money by using their savings to buy more goods and services.

India's Best Investment Funds: Where to Invest?

You may want to see also

Negative-yield bonds are often issued by governments in countries with low or negative interest rates

When a country has a negative interest rate, its central bank charges banks to keep deposits. This encourages banks to lend out money and stimulate the economy. As a result, government bonds are issued with sub-zero yields. Investors still buy these bonds because they are considered a safe investment and there are few safer options. As more fixed-income securities become negative-yielding, investors may buy bonds with negative yields because they believe future bonds will offer even worse returns.

Negative-yield bonds are also purchased as safe-haven assets in times of economic turmoil and by pension and hedge fund managers for asset allocation. Foreign investors may also buy negative-yield bonds if they believe the currency's exchange rate will rise, offsetting the negative bond yield.

Cooperative vs Investment Fund: Understanding the Key Differences

You may want to see also

Some investors believe future bonds will offer worse returns than negative-yield bonds

Some investors believe that future bonds will offer worse returns than negative-yield bonds. This is because, in an era of extremely low-interest rates, many large institutional investors are willing to pay a little over the face value for high-quality bonds. They accept a negative return on their investment for the safety and liquidity that high-quality government and corporate bonds offer.

Additionally, investors might expect a period of deflation, or lower prices in the economy, which would allow them to make money by using their savings to buy more goods and services. In times of economic uncertainty, investors might accept a negative-yielding bond because the negative yield might be far less of a loss than a potential double-digit percentage loss in the equity markets. For example, Japanese Government Bonds (JGB) are popular safe-haven assets for international investors and have, at times, paid a negative yield.

Moreover, investors in foreign debt may benefit from currency hedging premiums if they are large enough to offset negative yields. If another country has a steeper yield curve and there is a currency premium for domestic investors, hedging the local currency to the domestic currency can provide another component of return.

Finally, investors who buy bonds with a negative yield do not automatically lock in a loss on their investment. If the economic outlook worsens, bond prices may continue to rise, and investors can sell their bonds for a premium.

Maximizing Your HSA: Mutual Fund Investing Strategies

You may want to see also

Frequently asked questions

Funds invest in negative-yield bonds as they are seen as a safe haven in times of economic uncertainty. They are also used to diversify portfolios and reduce risk.

Negative-yield bonds are when an investor receives less money than they paid for the bond when it matures. This can happen when the price paid for the bond is much greater than its par value.

Negative-yield bonds are usually issued by governments with low or negative interest rates and are bought by investors who want to keep their money safe or avoid worse yields.

Some investors buy negative-yield bonds as they believe interest rates will continue to fall, and this will cause the bond price to rise. They can then sell the bonds at a profit.