There are several reasons why people might not invest in the S&P 500. Firstly, while the index has historically outperformed active investors, investing solely in the S&P 500 does not provide broad diversification, which can minimise risk. For instance, investors are exposed to losses during economic downturns and bear markets. Moreover, the past performance of the S&P 500 does not guarantee future success.

Secondly, investing in the S&P 500 alone means missing out on the advantages of investing in other markets and asset classes, such as REITs and small-cap companies.

Thirdly, index funds and ETFs that track the S&P 500 lack downside protection, the ability to react to market changes, and control over holdings. Additionally, they offer limited exposure to different strategies and may dampen personal satisfaction due to a lack of involvement in the investment process.

Finally, the S&P 500 consists of only large-cap US stocks, and investing in a variety of market caps and international stocks can help to further diversify a portfolio and reduce risk.

| Characteristics | Values |

|---|---|

| Lack of diversification | Only one level of diversification—diversification by industry |

| High risk | Vulnerable to economic downturns and bear markets |

| High cost | Expensive to purchase individual stocks |

| Lack of control | No control over individual holdings |

| Reactive ability | Unable to act on overvalued or undervalued stocks |

What You'll Learn

Lack of diversification

The S&P 500 index fund is a type of mutual fund that buys stock in the top 500 American companies on the stock market. While this index fund is fairly diversified, investing solely in the S&P 500 does not provide the broad diversification that minimizes risk.

The S&P 500 provides diversification by industry, with companies operating across sectors like finance, technology, and pharmaceuticals. However, it falls short in other areas of diversification. Firstly, all the companies in the index are US-based, so a nationwide economic crisis could result in significant financial losses. Secondly, the index comprises only large-cap companies, which offer limited growth potential compared to small-cap companies in the introductory stage of their business. Lastly, the index consists solely of stocks, so investors are exposed to the volatility of the stock market without the counterbalance of other asset classes like bonds and REITs.

As such, investors who put all their money into the S&P 500 miss out on the benefits of investing in other markets, asset classes, and companies at different stages of their lifecycle. This lack of diversification can lead to substantial financial losses during economic downturns or bear markets.

To achieve broad diversification, investors should diversify by asset class, market/country, industry, market cap, and time. This means investing across stocks, bonds, and REITs; in both developed and emerging markets globally; in companies across various industries; in a mix of large-cap, mid-cap, and small-cap companies; and by investing early and consistently over time.

By diversifying their portfolios, investors can minimize risk, maximize returns, and smooth out market swings. While the S&P 500 is a good investment option, it should be one part of a broader investment strategy.

Investing: Personal Definitions of Risk and Reward

You may want to see also

Exposure to economic downturns

The S&P 500 is a weighted index of the 500 largest publicly traded companies in the United States. It captures approximately 82% of the total US equity market value and is considered a gauge for the US equity market. However, it is important to note that the index includes companies across various industries, and a downturn in one industry can affect the overall performance of the index.

During the 2000s, for example, the S&P 500 experienced two major bear markets attributed to the dot-com crash in the early 2000s and the financial crisis of 2007-2008. Investors who had put all their money into the S&P 500 during this time may have faced significant losses.

To minimize the risk of economic downturns, investors should consider diversifying their portfolios. This includes diversifying across asset classes, such as stocks, bonds, and REITs, as well as across different markets and industries. By investing in a range of assets and markets, investors can reduce their exposure to any single market or industry and lower their risk.

In summary, while the S&P 500 has historically performed well, it is important for investors to remember that it is vulnerable to economic downturns and bear markets. To minimize risk, investors should consider diversifying their portfolios and not rely solely on the S&P 500 as their only investment strategy.

Rich People: The Only Investors?

You may want to see also

Lack of control

One of the main drawbacks of investing in the S&P 500 is the lack of control investors have over their holdings. The S&P 500 is a set portfolio, meaning that investors cannot choose the individual stocks that make up their investment. This can be problematic for investors who want to invest in specific companies that they believe in or have a personal connection to. Additionally, investors cannot take advantage of opportunities outside of the index, which may limit their ability to react to market changes and make advantageous decisions.

For example, if a particular stock becomes overvalued, it will carry more weight in the index. Usually, this is when astute investors would want to lower their portfolios' exposure to that stock. However, if they are investing solely through the S&P 500, they will be unable to do so. This lack of control can be frustrating for investors who want to have a more hands-on approach to their investments and make decisions based on their own research and preferences.

Furthermore, the S&P 500 does not provide broad diversification, which is important for minimizing risk. It only offers diversification by industry, as the companies in the index operate across various sectors. However, all the companies are based in the United States, so a nationwide economic crisis could result in significant financial losses. Additionally, the index only includes large-cap companies, which limits the potential for capturing growth compared to small-cap companies in the introductory stage of their business.

Therefore, investing solely in the S&P 500 may not be a wise strategy for investors who want more control over their investments and the ability to react to market changes. It may also not provide the level of diversification needed to minimize risk effectively.

Investor's Losing Bet: Why Double Down?

You may want to see also

Unrealistic expectations

The S&P 500 has delivered phenomenal returns in the past, but this does not mean that investors should expect the same in the future. Even those who have benefited from the past decade's returns could fall into the trap of creating unrealistic expectations about what the future might hold.

The S&P 500 provides only one level of diversification—diversification by industry. Companies in the index operate across various sectors, including finance, technology, and pharmaceuticals. If market factors in one industry cause a downturn, growth in other industries will counterbalance that downturn, protecting investors' funds.

However, investing solely in the S&P 500 does not offer any other layers of diversification. All the companies are based in the United States, so a nationwide economic crisis could result in huge financial losses. Additionally, all the companies are at the peak of their lifecycle (large-cap companies), meaning there are limited opportunities for capturing growth compared to small-cap companies in the introduction stage of their business.

Similarly, the index only consists of stocks. When the stock market experiences a downturn, there are no other asset classes, like bonds and REITs, to counterbalance the loss. This lack of diversification means that investors are exposed to undiversified risk, which has been proven to lead to substantial financial loss.

The S&P 500's performance is also heavily influenced by the performance of the US economy. When the US economy is doing well, the index tends to be higher, but when the economy struggles, the index can decline. For example, during the first ten years of the index, from 1957 to 1967, the value rose to nearly 700 points, reflecting the economic boom following World War II. However, from 1969 to 1981, the US economy struggled with stagnant growth and high inflation, causing the index to fall to under 300 points.

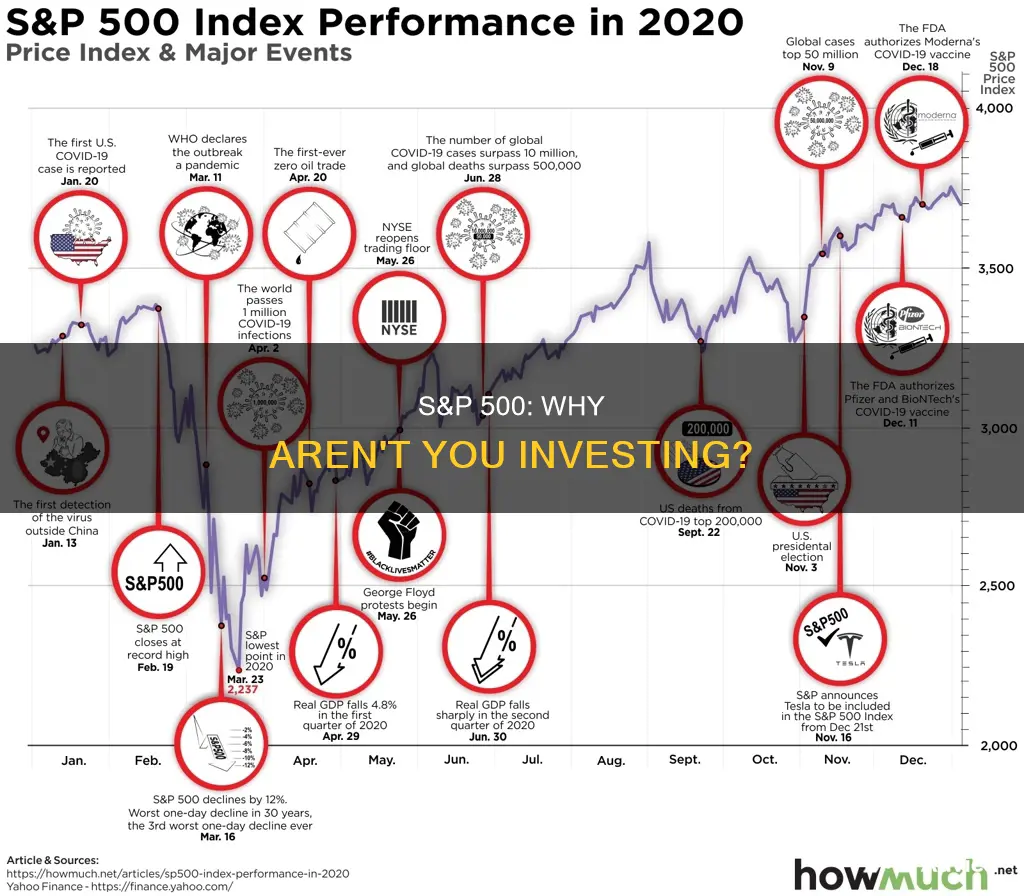

More recently, the S&P 500 has been influenced by factors such as interest rate changes, global economic growth, the rise of the middle class, technological innovations, the political climate, and commodity prices. For example, during the COVID-19 pandemic, the Federal Reserve added a large amount of liquidity to the system to support the economy. As a result, there was too much money chasing too few goods, leading to high inflation. The Federal Reserve then had to raise interest rates, which often causes investors to forgo the risk of the stock market and stick with the guaranteed return of the bond market.

In summary, while the S&P 500 has delivered strong returns in the past, investors should not expect this to continue indefinitely. The index is vulnerable to economic downturns and stock market corrections, and it lacks the diversification to counterbalance these risks. Additionally, its performance is closely tied to the US economy and can be influenced by various market factors. Therefore, investors should be cautious about having unrealistic expectations regarding the S&P 500's future performance.

Young Investors: Roth or Not?

You may want to see also

Lack of downside protection

The S&P 500 has delivered phenomenal returns in the past, but investing in an index fund that tracks it will leave you vulnerable to market corrections and crashes. Investors with heavy exposure to stock index funds can choose to hedge their exposure to the index by shorting S&P 500 futures contracts or buying a put option against the index. However, because these move in opposite directions, using them together could defeat the purpose of investing. In most cases, hedging is only a temporary solution.

The S&P 500 provides only one level of diversification—diversification by industry. Companies in the index operate across various sectors, so if one industry experiences a downturn, growth in other industries will counterbalance that. However, investing solely in the S&P 500 does not offer any other layers of diversification. For example, all the companies are US-based, so a nationwide economic disaster could create a huge financial loss.

Additionally, all the companies are large-cap companies, which means there are limited opportunities for capturing growth compared to small-cap companies in the introduction stage of their business. Similarly, the index only includes stocks, so if the stock market experiences a downturn, there are no other asset classes like bonds and REITs to counterbalance the loss.

One way to achieve downside protection is to blend a highly uncorrelated asset with an S&P 500 fund. For example, the ProShares Ultra S&P500 ETF (SSO) is a leveraged fund that aims to deliver twice the daily return of the S&P 500. Investors can combine it with the ProShares VIX Short-Term Futures ETF (VIXY), which tends to climb when stocks fall. During periods when the market is not in distress, a portfolio that allocates most of its assets to a leveraged stock ETF can benefit from its higher returns, while the long-term market value decline in the uncorrelated asset only partially offsets this benefit.

Another option is the Simplify US Equity PLUS Downside Convexity ETF (SPD), which invests in the S&P 500 and buys cheap OTM put options for downside protection. SPD underperforms when markets move up, sideways, or slightly down, but matches the performance of the S&P 500 when markets are moderately down and significantly outperforms when markets are down by 50% or more.

A third option is the Invesco S&P 500 Downside Hedged ETF, which seeks to achieve positive total returns in rising or falling markets that are not directly correlated to broad equity or fixed-income market returns. It does this by allocating its assets among three components: equity (represented by the S&P 500 Index), volatility hedge (represented by the S&P 500 VIX Short-Term Futures Index), and cash.

China's Bubble: Global Investment Risk

You may want to see also

Frequently asked questions

Investing all your money in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses.

The S&P 500 consists of only large-cap US stocks. A truly diversified portfolio includes mid- and small-cap companies, international companies, and other asset classes such as bonds, cash, and real estate.

The S&P 500 is a well-known stock market index, and investing in it is a simple and effective way to invest for the long term. It's also a low-cost way to add a very well-diversified pool of stocks to your portfolio.

The simplest way to invest in the S&P 500 is through index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account or a tax-advantaged account like a 401(k) or IRA. You can also buy individual stocks of companies in the S&P 500.