University endowments are traditionally funded by donations, with the size of each endowment depending on how shrewdly a given university spends on its current student population. While universities could put their entire principal to practical use, most choose to invest the majority of their endowments to generate future income. The majority of an endowment's portfolio is invested to generate continuous income, with asset allocation models usually determined by an endowment's investment committee. Endowments allocate the largest percentages of their portfolios to alternative asset classes like hedge funds, private equity, venture capital, and real assets like oil and other natural resources.

Hedge funds are considered alternative investments. They are a pooled investment fund that holds liquid assets and makes use of complex trading and risk management techniques to improve investment performance and insulate returns from market risk. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are open-ended.

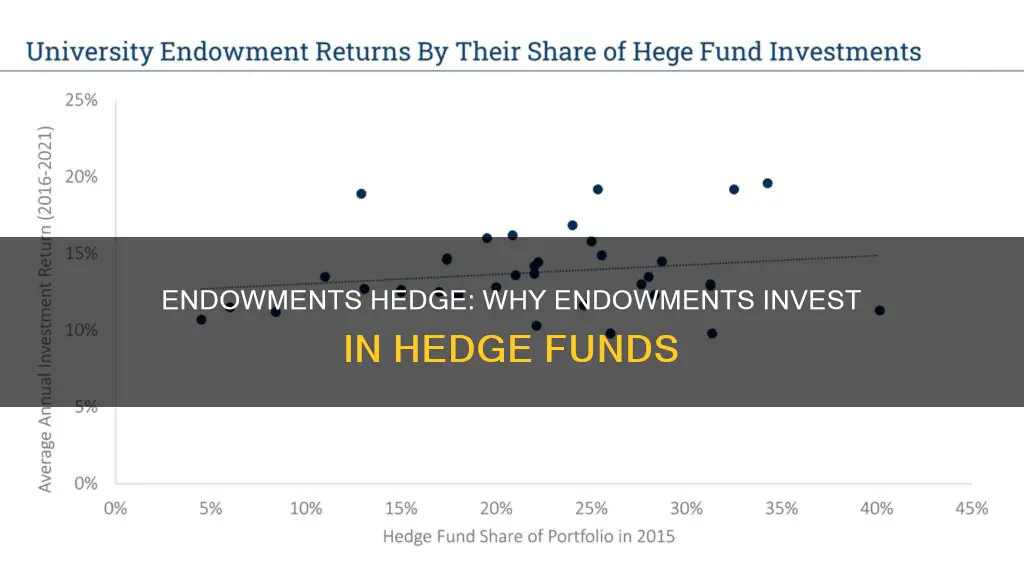

Endowments that invest more in hedge funds as part of their long-term strategy have grown faster than endowments that allocate less to hedge funds. An average university with a $5 billion endowment and a 10% allocation to hedge funds earns nearly $240 million more over five years than an endowment with no allocation to hedge funds.

| Characteristics | Values |

|---|---|

| Long-term investment | Endowments are set to be in hedge funds for the long haul |

| Diversification | Hedge funds are a useful source of diversification and growth for their endowments |

| Intergenerational equity | Endowments have an obligation to future generations to preserve the spending power of the endowment |

| High returns | Hedge funds have been known to generate high returns for endowments |

| Risk reduction | Hedge funds are used to protect endowments from market downturns and reduce the volatility of their returns |

| Tax exemption | Endowments are exempt from government taxes |

| Liquidity | Hedge funds hold liquid assets |

What You'll Learn

Endowments are set up for the long haul

Endowments have a different raison d'être, time horizon, and investment objective compared to other institutional investors. Most endowments exist to provide income for institutions engaged in charitable activities, and they have an obligation to future generations to preserve the spending power of the endowment. This concept is known as "intergenerational equity", coined by Yale economist James Tobin.

Endowments are managed in perpetuity, which means they can afford to take a very long-term view and have a different attitude to risk. Their return requirements are demanding, as their purchasing power must be measured in terms of academic inflation, which tends to outpace general inflation.

Endowments allocate the largest percentages of their portfolios to alternative asset classes like hedge funds, private equity, venture capital, and real assets. Hedge funds, in particular, have become an important component of endowment investment strategies. University endowments that invest more in hedge funds as part of their long-term strategy have been found to grow faster than those that allocate less.

The "endowment model" of investing, often credited to the late David Swensen, manager of Yale University's endowment, involves holding a broad array of unconventional assets, including hedge funds. This model has led to impressive growth in Yale's endowment fund, with an annual compound growth rate of 16.3% over 20 years, resulting in an extra $7.8 billion.

Endowments must balance spending to meet the needs of the current generation while ensuring they can also meet the needs of future generations, demonstrating that endowments are, indeed, set up for the long haul.

Mutual Funds: Why They're a Popular Investment Choice

You may want to see also

Endowments have a different attitude to risk

Endowments are managed with perpetuity in mind and can, therefore, take a very long-term view, which means they can have a different attitude to risk from funds that need to align their assets with their liabilities over a shorter time horizon. Endowments also have demanding return requirements as their purchasing power must be measured in terms of academic inflation, which tends to outpace general inflation.

Endowments tend to allocate the largest percentages of their portfolios to alternative asset classes like hedge funds, private equity, venture capital, and real assets. Hedge funds are considered alternative investments and are able to use leverage and more complex investment techniques than regulated investment funds. They are also able to employ a wide variety of financial instruments and risk management techniques. Hedge funds are usually open-ended, allowing investors to invest and withdraw capital periodically.

Hedge funds are attractive to endowments as they tend to provide returns uncorrelated with market returns, and endowments use them to protect their assets from market downturns and reduce the volatility of their returns. Endowments that invest more in hedge funds as part of their long-term strategy have grown faster than those that allocate less.

Baillie Gifford Fund: Where Should Your Money Go?

You may want to see also

Endowments are exempt from government taxes

Endowments are a critical source of funding for non-profit organisations such as universities, religious groups, and museums. They are typically funded by donations, which are tax-deductible for the donor. While the earnings accrued by endowments are usually tax-free, any payouts made to individuals from these earnings are generally subject to taxation.

In 2017, an exception was created in the US to impose a tax on the endowment earnings of certain private nonprofit colleges and universities. The Tax Cuts and Jobs Act (TCJA) levied a 1.4% tax on the net investment income of institutions with at least 500 students and endowment assets exceeding $500,000 per student. This legislation has been criticised for potentially threatening financial aid for low-income students and hindering social mobility and medical research.

Endowments play a crucial role in providing a stable source of income for non-profit organisations, allowing them to carry out their charitable activities and missions. By being exempt from government taxes, endowments can maximise their impact and better serve their beneficiaries. This tax exemption also encourages donations, as individuals and companies can benefit from tax deductions when contributing to endowment funds.

What's the Return on Investment for Founders?

You may want to see also

Hedge funds are considered alternative investments

Hedge funds are considered riskier investments than regulated funds due to their use of hedging techniques and more complex investment strategies. They are subject to fewer restrictions, but regulations have been introduced in the US and Europe following the 2007-2008 financial crisis to increase government oversight and eliminate regulatory gaps.

Hedge funds are often marketed to institutional investors and high-net-worth individuals. They have become an increasingly popular investment vehicle, with assets totaling around $3.8 trillion as of 2021. Their popularity is due in part to their ability to generate positive returns regardless of market conditions and their potential to reduce overall portfolio risk through diversification.

Endowments, particularly university endowments, have been early adopters of hedge funds as part of their long-term investment strategies. The success of the Yale Model, pioneered by David Swensen at Yale University, has led to a trend towards alternative investments, including hedge funds, by endowments seeking higher returns and long-term growth.

In summary, hedge funds are considered alternative investments because of their distinct characteristics, higher risk profiles, and the potential for higher returns compared to traditional investment funds. Their popularity among endowments and other institutional investors underscores the value proposition of hedge funds in portfolio diversification and long-term investment strategies.

Thailand's Climate Investment Funds: A Historical Overview

You may want to see also

Hedge funds are a risky investment

Hedge funds are not intended for the average investor. They require high minimum investments, typically ranging from $100,000 to upwards of $2 million, and are designed for institutional investors, such as pension funds, or accredited investors with a net worth of at least $1 million or an annual income of over $200,000.

The fees associated with hedge funds are also high, typically consisting of an asset management fee of 1-2% and a performance fee of 20% of the fund's profits. These fees can eat into overall returns, and hedge funds have historically underperformed stock market indices. From January 2009 to January 2018, hedge funds only beat the S&P 500 in a single year.

Despite the risks, hedge funds can provide growth despite market conditions and are a useful source of diversification for endowments. Endowments, particularly university endowments, have investment objectives that differ from those of traditional funds. Most endowments exist to provide income for charitable activities and have an obligation to preserve spending power for future generations. This long-term view allows endowments to tolerate higher levels of risk and seek out alternative investments such as hedge funds.

University endowments in the US have been particularly quick to take advantage of alternative assets. For example, the Yale endowment fund has achieved impressive growth under the leadership of Chief Investment Officer David Swensen, who developed the Yale Model. This model involves dividing a portfolio into five or six roughly equal parts, each invested in a different asset class with low correlation to the others. This approach has resulted in an annual compound growth rate of 16.3% over 20 years, adding over $7.8 billion to Yale's coffers.

While hedge funds carry risks, they can be a valuable component of a well-rounded asset allocation strategy for investors who can meet the financial requirements and tolerate the volatility.

Co-Investing: Why Funds Collaborate for Mutual Success

You may want to see also

Frequently asked questions

Endowments are set up to be in hedge funds for the long haul. Hedge funds are considered alternative investments and are a useful source of diversification and growth for endowments.

The "endowment model" of investing is often credited to David Swensen, manager of Yale University's endowment. It involves holding a broad array of unconventional assets, such as hedge funds, private equity, venture capital, and real assets like oil and other natural resources.

Hedge funds love having endowments and foundations as investors because they tend to have long time horizons and don't run for the exits during high volatility periods. This helps fund managers maintain liquidity and an even keel when other investors are pulling out.

Endowments and foundations can be a hard sell because they typically only add one or two new hedge fund investments in a year. They are also very picky because they look for capital preservation and are drawdown-averse.

A university endowment portfolio features many types of investments, with the overall goal of maximizing returns while limiting risk. Hedge funds tend to provide returns uncorrelated with market returns, which helps protect the endowment's assets from market downturns and reduce the volatility of their returns.