Investment is a key component of aggregate demand, which is the total amount of goods and services that consumers are willing to purchase in a given economy during a specific time frame. An increase in investment will lead to a rightward shift in the AD curve, indicating a positive demand shock and an increase in aggregate demand. This occurs because higher investment leads to an increase in output, which results in higher incomes for individuals, who then spend more, causing a further rise in aggregate demand. Additionally, higher investment can stimulate economic growth and potentially cause inflation, especially if the economy is operating at full capacity.

| Characteristics | Values |

|---|---|

| Investment is a component of AD | AD = C + I + G + (X-M) |

| Percentage of AD | 15% |

| Effect of higher investment on AD | Higher economic growth and possible inflation |

| Effect of higher investment on AS | Increase in productive capacity |

| Effect of higher investment on AD in the short-term | Spare capacity in the economy may cause a knock-on effect, increasing output and income, which is then spent, causing a further rise in AD |

| Effect of higher investment on AD in the long-term | A stronger multiplier effect may cause a bigger increase in AD |

| Opportunity cost of investment | A higher share of GDP devoted to investment implies a lower share for consumption in the short-term |

| Interest rates and investment | Higher interest rates tend to reduce investment, while lower interest rates increase it |

| Level of economic activity | An increase in GDP is likely to shift the investment demand curve to the right |

What You'll Learn

- Higher investment leads to higher economic growth and inflation

- Increased investment can cause a knock-on effect throughout the economy

- Effective investment can increase the long-run trend rate of economic growth

- Interest rates play a key role in determining the relationship between investment and output demand

- Public policy can affect investment demand

Higher investment leads to higher economic growth and inflation

Investment is a key component of aggregate demand (AD), which also includes consumption spending, government spending, and exports minus imports. An increase in investment spending will boost AD and short-run economic growth. This is because investment spending involves capital expenditure, such as buying new machines or building bigger factories, which increases the productive capacity of the economy.

If there is spare capacity in the economy, an increase in investment can cause a knock-on effect throughout the economy, known as the multiplier effect. The initial rise in investment increases economic growth, and if firms gain more sales and profit, they will reinvest this in further investment. Additionally, households who gain employment from the investment will have more income to spend, further boosting AD.

In the long run, an increase in investment should also increase the productive capacity of the economy and aggregate supply. This can lead to a more sustainable increase in AD without causing inflation. However, if the economy is close to full capacity, rising AD will only cause inflation without a real increase in GDP.

Inflation, or an increase in prices, can be caused by an increase in aggregate demand. This can lead to a negative impact on growth rates and significant and permanent reductions in per capita income. Inflation can also reduce the level of business investment and the efficiency with which productive factors are used. Therefore, it is important for policymakers to keep inflation under control to promote long-run economic growth.

In summary, higher investment can lead to higher economic growth, especially if there is spare capacity in the economy. However, if the economy is close to full capacity, higher investment may lead to higher inflation without a real increase in economic growth.

Why Invest in Entertainment?

You may want to see also

Increased investment can cause a knock-on effect throughout the economy

Investment is a key component of aggregate demand (AD), which is the total amount of goods and services that consumers are willing to purchase in a given economy during a specific time frame. An increase in investment shifts the AD curve to the right, indicating a positive demand shock and a growing economy. This can have a knock-on effect throughout the economy, as outlined below.

Firstly, an increase in investment leads to a rise in output. This, in turn, results in higher incomes for people, which is then spent, causing a further rise in AD. This is known as the multiplier effect, which can lead to an even bigger increase in AD in the long term.

Secondly, investment affects economic growth. By increasing the stock of capital, investment contributes to economic growth and shifts the production possibilities curve outward. This also shifts the long-run aggregate supply curve to the right.

Thirdly, public policy can influence investment decisions. Government agencies invest in adding to the public stock of capital, and their tax and regulatory policies can impact the investment choices of private firms and individuals. For example, policies such as accelerated depreciation and investment tax credits can stimulate investment by reducing the cost of capital for firms.

Finally, changes in interest rates can also affect investment decisions. Higher interest rates tend to reduce investment, while lower interest rates encourage investment by making it cheaper to borrow money.

In conclusion, increased investment can cause a knock-on effect throughout the economy by raising output and incomes, stimulating economic growth, and influencing public and private investment decisions through policy and interest rate changes.

Wealth in the 16th Century: Investing in Land and Trade

You may want to see also

Effective investment can increase the long-run trend rate of economic growth

Investment is a key component of aggregate demand (AD). An increase in investment leads to an increase in AD and, therefore, short-run economic growth. If there is spare capacity in the economy, an increase in investment could cause a knock-on effect throughout the economy. This is known as the multiplier effect. The initial increase in investment leads to a rise in output, which results in higher income for individuals, who then spend more, causing a further rise in AD.

In the long run, effective investment can increase the trend rate of economic growth by increasing the productive capacity of the economy. This can be achieved through investment in skills and education, which increases labour productivity, or through investment in new technology and capital, which increases productivity and the economy's productive capacity. This helps to shift the long-run aggregate supply (LRAS) curve to the right. An increase in LRAS is essential for long-term economic growth, as it can increase economic growth without causing inflation.

The type of investment is important. For example, private sector investment or investment from overseas may be more effective in increasing productivity, as private firms often have more knowledge about the most effective types of investment. On the other hand, government investment in public goods such as roads, bridges, and infrastructure may be necessary to overcome supply bottlenecks and improve long-term economic growth.

The rate of economic growth also affects the level of investment. Businesses tend to increase investment when they see an improvement in economic forecasts, in order to meet future demand. Conversely, they will cut back on investment during an economic downturn.

Starbucks: A Brew Worth Betting On

You may want to see also

Interest rates play a key role in determining the relationship between investment and output demand

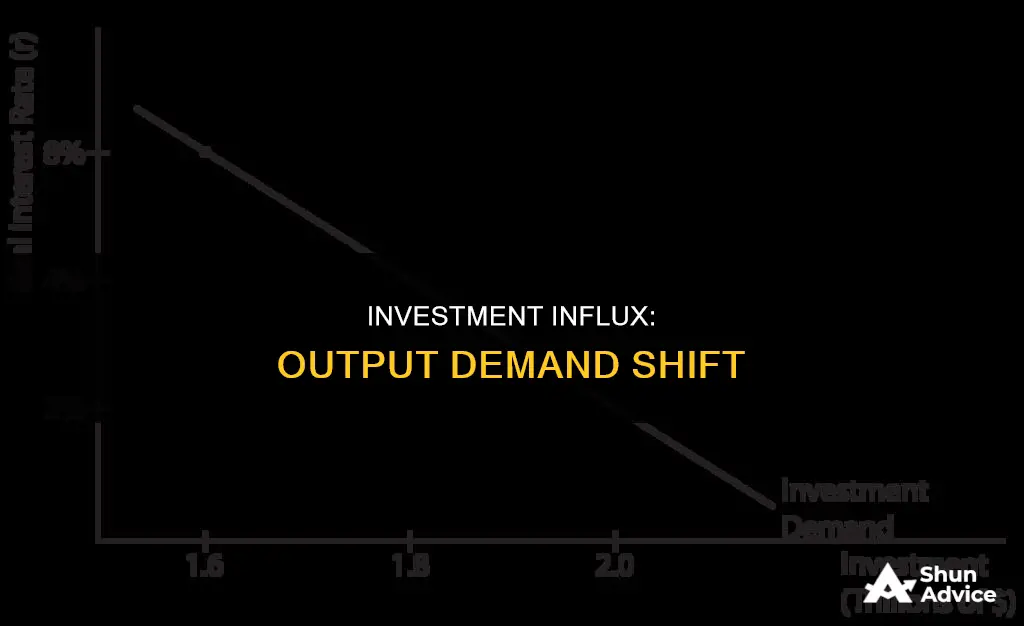

When interest rates are high, individuals and businesses tend to borrow less, leading to reduced investment spending. This shift in AD to the left indicates a decrease in aggregate demand and is typically viewed negatively, as it signifies a shrinking economy. On the other hand, lower interest rates stimulate consumption and investment demand. They make borrowing more affordable, encouraging businesses and consumers to take out loans for investments and purchases. This shift in AD to the right indicates an increase in aggregate demand and is generally seen as positive, reflecting economic growth.

The relationship between interest rates and investment demand is inverse. High-interest rates discourage borrowing, resulting in reduced investment. Conversely, low-interest rates encourage borrowing, leading to increased investment. This relationship is crucial in understanding the impact of interest rates on output demand.

Additionally, changes in interest rates can influence the components of AD, such as consumer spending, investment spending, government spending, and exports minus imports. For example, lower interest rates can increase consumer confidence, leading to higher consumption and a rightward shift in the AD curve. Similarly, businesses may be more inclined to invest in capital goods when interest rates are favourable, further contributing to the shift in AD.

It is worth noting that while changes in interest rates can significantly impact investment and output demand, other factors also come into play. These include consumer and business confidence, government spending and taxes, and net exports.

Smart Ways to Invest $20,000

You may want to see also

Public policy can affect investment demand

Public policy can have a significant impact on investment demand, which in turn affects output demand. Fiscal and monetary policies are the primary tools through which governments can influence investment demand.

Fiscal policy refers to changes in government spending and taxation. Expansionary fiscal policy, often employed during recessions, involves increasing government spending in areas such as infrastructure, education, and unemployment benefits. This can stabilise employment and stimulate investment demand. Conversely, contractionary fiscal policy aims to reduce government spending and debt by raising taxes or cutting spending. This can decrease investment demand.

Monetary policy, on the other hand, involves manipulating the money supply in an economy, which influences interest rates and inflation. Expansionary monetary policy, such as lowering interest rates, can encourage borrowing and investment, thereby increasing investment demand. In contrast, contractionary monetary policy tightens the money supply, making borrowing more difficult and less attractive, which can reduce investment demand.

Additionally, governments can influence investment demand through regulations, subsidies, and tariffs. For example, subsidies can make certain industries more profitable, while higher taxes and regulations can hinder businesses.

Overall, public policy can affect investment demand by altering government spending, taxation, interest rates, and regulatory frameworks. These changes can impact businesses' willingness and ability to invest, which, in turn, affects output demand.

REITs: Why Aren't More People Investing?

You may want to see also

Frequently asked questions

Investment is a component of AD (Aggregate Demand) and accounts for about 15% of it. When investment increases, AD increases, leading to a rightward shift in the AD curve. This results in an increase in the equilibrium quantity of output and the price level.

Changes in any of the components of AD, such as consumption spending, investment spending, government spending, and exports minus imports, can cause a shift in AD. An increase in any of these components will shift the AD curve to the right, resulting in a positive demand shock.

Higher interest rates tend to reduce investment as it becomes more costly to borrow money. Lower interest rates, on the other hand, stimulate investment and aggregate demand. A reduction in interest rates can lead to a rightward shift in the AD curve, while an increase in interest rates can cause a leftward shift.