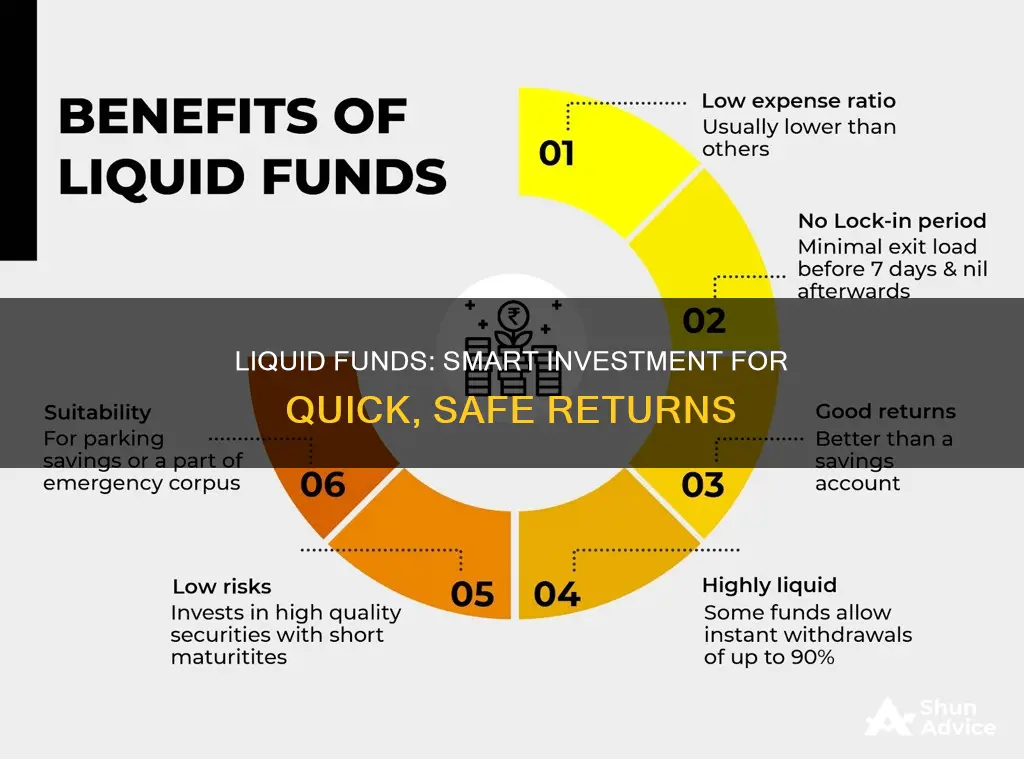

Liquid funds are a type of debt mutual fund that invests in short-term debt securities and money market instruments. These funds are known for their high liquidity, which means that investors can easily access their money when needed. Liquid funds are a good investment option for those seeking stable investment options with good returns. They offer high liquidity and lower risks, making them ideal for investors with a short investment horizon, those who want to park a large corpus temporarily, or for use as a medium to route funds into other long-term funds. Liquid funds are also suitable for investors who want an alternative to bank deposits as they can offer greater returns for a shorter period of time.

| Characteristics | Values |

|---|---|

| Type of fund | Debt mutual fund |

| Investment type | Short-term debt securities and money market instruments |

| Liquidity | High |

| Investment horizon | Up to 7 years |

| Risk | Low |

| Returns | Competitive, stable, higher than savings accounts |

| Redemption | Quick, within 24 hours |

| Taxation | Short-term capital gains tax (STCG) if units are sold within three years; long-term capital gains tax (LTCG) if units are sold after three years |

What You'll Learn

Low-interest rate risk

Liquid funds are a type of debt fund that carries a low interest rate risk. This is due to their short maturities—they invest in fixed-income assets with maturities of up to 91 days. The shorter maturity period means that liquid funds are less prone to changes in interest rates.

Liquid funds are a good option for investors with a short investment horizon, as they invest in securities with comparable maturities. These funds are also suitable for investors who want to keep a contingency fund, as they are highly liquid and offer stable returns.

Liquid funds are also a good choice for investors who want an alternative to bank deposits. They can offer greater withdrawal flexibility and better returns than traditional savings methods. Liquid funds also have a flexible holding period, allowing investors to retain their investments for as long as necessary.

The low-interest rate risk associated with liquid funds is further reduced by the fact that they invest in high-quality securities with low default probabilities. This means that even when interest rates rise, liquid funds are relatively insulated from capital losses.

Liquid funds are a good option for investors seeking low-risk, stable returns with quick and easy access to their funds.

Global Investment: Largest Funding Sources in Banking

You may want to see also

Low-cost structure

Liquid funds are a type of debt mutual fund that invests in short-term debt securities and money market instruments. They are highly liquid, meaning investors can easily access their money when needed. This makes them a convenient option for short-term investments with stable returns.

Liquid funds are a cost-effective investment option, operating with expense ratios typically below 1%. This affordability ensures that investors receive a maximised effective return on their investment. The low-cost structure of liquid funds can be attributed to the following factors:

- Less Active Management: Liquid funds are not as actively managed as other types of debt funds. This relatively passive approach results in lower management fees, contributing to their cost-effectiveness.

- Short Maturities: Liquid funds primarily invest in short-term debt instruments with maturities of up to 91 days. The shorter maturity period reduces the interest rate risk associated with longer-term investments. This lower risk profile contributes to the overall cost efficiency of liquid funds.

- No Entry and Exit Load: Liquid mutual funds typically do not charge extra fees for buying or selling. The absence of entry and exit loads makes liquid funds more affordable for investors, especially those who need to make frequent transactions.

- Variable Minimum Investment: Liquid funds offer flexibility in investment amounts, accommodating various budgets. This variable minimum investment structure allows investors to participate with smaller amounts, making it a cost-effective option for those with limited funds.

- High Liquidity: The highly liquid nature of liquid funds enables investors to withdraw their funds quickly, often within 24 hours. This liquidity provides investors with easy access to their money, making it a cost-effective option for those seeking short-term investment opportunities.

Mutual Funds: Where Are Your Investments Going?

You may want to see also

Flexible holding period

Liquid funds offer investors a flexible holding period, allowing them to retain their investments for as long as they want. Although there is a minor exit load for redemptions within seven days, liquid funds have flexible holding periods. This allows for simple entry and exit while delivering safe, market-linked returns for the duration of the investment.

Liquid funds are ideal for investors who want to maintain a contingency fund. They are also a good option for those who need to park their funds temporarily. For example, investors can temporarily park a large sum of money from a bonus, property sale, or inheritance in a liquid fund until they decide how to invest the corpus.

Liquid funds are also suitable for investors transitioning from conservative investments to growth-oriented investments, such as equity funds. They offer stability, low-risk returns, and the flexibility to gradually transition to higher-risk options.

Liquid funds are a good choice for investors with a short investment horizon, typically up to three months, as the funds invest in securities with comparable maturities.

Emergency Fund Placement: Where in Your Portfolio?

You may want to see also

High liquidity

Liquid funds are a type of debt mutual fund that provides investors with high liquidity, meaning they can easily access their money when needed. This makes liquid funds a convenient option for short-term investments.

No Entry or Exit Load

Liquid mutual funds are highly liquid and do not typically incur extra charges for buying or selling, such as an entrance or exit load. This makes it easy for investors to enter and exit the investment.

Quick Redemption

Liquid funds offer rapid redemption, with requests usually processed within one business day. Some funds even provide instant redemptions, made possible by investing in highly liquid securities with minimal default risk. This ensures quick access to funds when needed.

Flexible Holding Period

Liquid funds offer flexible holding periods, allowing investors to retain their investments for as long as necessary. While a slight exit load may apply to redemptions within seven days, this structure still accommodates easy entry and exit.

Variable Minimum Investment

Liquid funds offer flexibility in investment amounts, catering to various budgets. The minimum investment amount can vary among fund houses but generally starts from as low as ₹500 or ₹1,000.

The Best Places to Invest in Exchange-Traded Funds Directly

You may want to see also

Low risk

Liquid funds are a type of debt mutual fund that invests in short-term debt securities and money market instruments. They are considered a low-risk investment option due to their focus on capital preservation and stable returns. Here are some key points highlighting the low-risk nature of liquid funds:

Low-Interest Rate Risk

Liquid funds primarily invest in fixed-income assets with short maturities, typically up to 91 days. This shorter maturity makes the funds less prone to changes in interest rates, resulting in lower interest rate risks compared to other debt funds. The shorter maturity of the underlying instruments also allows investors easy access to their funds, making liquid funds suitable for those seeking stability and liquidity.

No Entry or Exit Load

Liquid mutual funds typically do not have an entrance or exit load, allowing investors to buy and sell without incurring additional charges. This feature provides flexibility and makes liquid funds an attractive option for short-term investments.

Low-Cost Structure

Liquid funds have a cost-effective structure, with expense ratios usually below 1%. This affordability is due to less active management compared to other debt funds, maximising the effective return for investors.

Flexible Holding Period

Liquid funds offer a flexible holding period, allowing investors to retain their investments for as long as needed. While there is a minor exit load for redemptions within seven days, the overall structure accommodates easy entry and exit. This flexibility enables investors to earn secure, market-linked returns throughout their investment period.

Swift Redemption

Liquid funds offer quick redemption, processing requests within one business day, and some funds even provide instant redemptions. This efficiency is possible because liquid funds invest in highly liquid securities with low default probabilities.

Safety and Liquidity

Liquid funds are highly liquid and are designed to provide safety and liquidity to investors. They are suitable for those seeking low-risk, stable returns and are often viewed as substitutes for short-term bank deposits.

Alternative to Bank Deposits

Liquid funds can provide higher returns than traditional bank deposits, making them an attractive alternative for investors seeking greater returns with minimal risk.

Suitable for Short-Term Investors

With underlying assets typically maturing within 91 days, liquid funds are well-suited for investors who want to stay invested for a short duration, usually up to three months.

Baillie Gifford Fund: Where Should Your Money Go?

You may want to see also

Frequently asked questions

A liquid fund is a type of debt mutual fund that invests in short-term debt securities and money market instruments. These funds are known for their high liquidity, which means that investors can easily access their money when needed.

Liquid funds offer investors high liquidity, low risk, and potential for competitive returns. They are a convenient option for short-term investments with stable returns.

Liquid funds are an excellent choice for investors seeking stable investment options with good returns. They are a preferred option for short-term investors, cash reserve holders, investors transitioning to equity funds, and those looking to build emergency funds.

Liquid funds pool money from multiple investors to generate steady, short-term returns while ensuring high liquidity. Managed by professional fund managers, liquid funds invest the pooled capital in a diversified mix of short-term debt instruments, typically with lower interest rate risk due to their shorter maturity.

While liquid funds are considered low-risk, they are not entirely risk-free. They are subject to credit risk, interest rate risk, and liquidity risk, although these risks are generally lower than in other types of funds.