Venture capital (VC) funds have become an increasingly attractive asset class for investors worldwide, with global investment in VC funds rising by over 350% in the last five years. VC funds have consistently outperformed the market, with top-tier VCs delivering extraordinary results. VC funds provide access to pre-IPO investment opportunities, disruptive innovation, and diversification across industries, business stages, and geographies. They also offer a portfolio approach that reduces overall risk and mitigates potential losses. Furthermore, VC funds provide investors with access to a high-quality, vetted deal flow, industry insight, and networking opportunities. However, it is important to note that investing in VC funds carries a higher risk than investing in established and publicly traded companies.

| Characteristics | Values |

|---|---|

| High returns | Outperformed the market, with top-tier VCs outperforming by a lot |

| Access to high-quality, vetted deal flow | Access to pre-IPO opportunities, disruptive innovation, and high-quality investment opportunities |

| Diversification | Access to a diverse range of industries, business stages, and geographies |

| Risk reduction | Lower risk profile through diversification, portfolio approach, and specialist fund managers |

| Increased deal flow and networks | Access to a large number of startups and increased networking opportunities |

| Co-investment opportunities | Ability to co-invest with well-known VCs and other investors |

| Time savings | No need to spend time vetting thousands of companies |

| Specialist knowledge | VCs have industry expertise and legal resources to ensure proper setup and enforcement of deals |

| Hands-on support | VCs provide additional support, industry insight, best practices, and stakeholder introductions to startups |

| Hiring and networking assistance | Well-connected VCs can assist founders in finding the right people when growing their team |

| Access to different deals | Access to B2B companies and early-stage startups with high growth potential |

What You'll Learn

Access to high-quality, pre-IPO investment opportunities

Venture capital funds have become an increasingly attractive asset class for investors worldwide, thanks to their historical returns and liquidity in recent years. The number of public companies in the US peaked in the late 1990s and has been declining since. Many companies now experience "hyper-growth" while still private (i.e. pre-IPO). For example, Slack, Lyft, and Uber saw stellar private market growth but lacklustre IPOs.

Venture capital provides access to these private, pre-IPO opportunities when valuations are lower, resulting in returns that outperform investing only in public companies.

Venture capital funds have consistently outperformed the market. According to University of Chicago's Steven Kaplan, the top quartile of venture capital fund managers generated a 46% IRR—2,800bps better than the average of the second quartile and 3,700bps better (or 5x higher) than the public comparable.

The best venture capital funds have a high chance of remaining top-tier in their successor fund. The best funds are difficult to access due to scarcity, but accessing them is a winning strategy.

New venture capital fund managers with smaller funds tend to outperform existing managers, larger funds, and new angel investors. This sub-sector of venture capital fund managers has gained traction with existing limited partners and attracted new entrants.

Venture capital funds are specialists in identifying the best founders and companies. They know what red flags to look for and have the legal resources to ensure documents are set up properly and enforced in later rounds as terms change and new investors enter. They will usually track metrics of their portfolio companies regularly and can spot issues ahead of time. All of this de-risks the investments and increases the chances of success.

Venture capital funds often interact with thousands of startups per year, filtering that down to a much smaller subset of companies that they invest in. By investing in a venture capital fund, you get to take advantage of this filter, which is extremely difficult to build out yourself.

Venture capital funds provide access to high-quality, pre-IPO investment opportunities that can be difficult for individual investors to identify and access on their own. By investing in a venture capital fund, you can benefit from the expertise and resources of the fund managers, who specialise in identifying and investing in the best founders and companies.

Hedge Funds: Why Institutions Invest and Their Benefits

You may want to see also

Diversification of investment portfolio

Venture capital (VC) funds are an attractive option for investors looking to diversify their portfolios. Diversification is a key component of any good investment strategy, and VCs offer a unique opportunity to access a diverse range of startups and industries.

VCs are like mutual funds or ETFs, but instead of investing in publicly traded equities, they focus on investing in startups. This provides investors with a level of diversification that is challenging to achieve on their own. The more startups in a portfolio, the higher the average performance and the lower the variance in performance.

By investing in a VC fund, you gain access to a wide range of startups across different industries, business stages, and geographies. This diversification helps to lower your overall risk profile. Instead of investing in one or two companies directly, your investment is spread across multiple companies, reducing the impact of any single investment on your portfolio.

Additionally, VC funds provide access to pre-IPO investment opportunities. Many companies experience their highest growth while still private, and VC funds allow investors to get in on the ground floor. This can lead to higher returns compared to investing only in public markets, as seen with companies like Slack, Lyft, and Uber, which had stellar private market growth but lackluster IPOs.

The top-performing VC funds have consistently outperformed the public markets, and even during the worst-performing years, the best VC funds generated returns that were more than double the public market benchmark.

However, it's important to note that not all VC funds are created equal. The dispersion between the best-performing and average-performing VC funds is significant. Therefore, it is crucial to carefully select the best VC funds to invest in, understanding their strategy, picking managers carefully, and conducting thorough due diligence.

In summary, investing in VC funds offers a compelling opportunity for investors to diversify their portfolios, access a wide range of startups, and potentially achieve higher returns by investing in pre-IPO companies. By choosing the right VC funds, investors can benefit from reduced risk and increased chances of success.

Mutual Funds: Investors Seek Diversification and Professional Management

You may want to see also

Exposure to disruptive innovation

Investing in VC funds offers exposure to disruptive innovation, providing a front-row seat to game-changers, high-tech innovations, and disruptive business models. This means investing in companies that are creating new opportunities in emerging markets, transforming industries, and driving sustainable growth. For example, the International Finance Corporation (IFC) supports tech ventures that are leveraging disruptive technologies, such as FinTech, to overturn existing business models and foster economic growth.

VC funds provide access to startups that are developing innovative solutions across various sectors, including healthtech, deep tech, ag/food tech, and edtech. These companies are often at the forefront of technological advancements, such as quantum computing, 5G networking, and next-generation composites. By investing in VC funds, individuals can gain exposure to these disruptive innovations and potentially generate significant returns.

Additionally, VC funds offer a longer-term private investment opportunity that is less susceptible to public market volatility. This allows investors to diversify their portfolios beyond traditional asset classes like stocks and bonds, reducing their overall risk. VC funds, particularly top-tier funds, have consistently outperformed the market, providing strong returns for investors.

The disruptive nature of VC-funded startups also extends to their business models and strategies. These companies are often led by entrepreneurs who are willing to take risks and challenge traditional industry norms. As a result, investors in VC funds have the opportunity to support and benefit from these disruptive business approaches, which can lead to significant growth and success.

Furthermore, VC funds provide a unique window into emerging trends and technologies. Investors gain insights into cutting-edge innovations and disruptive startups that are shaping the future across various industries. This allows investors to stay ahead of the curve and make more informed decisions about their investment strategies, aligning their investments with their values and interests.

Debt Funds: A Smart Investment for Your Money

You may want to see also

Alignment with personal values and interests

Investing in VC funds allows you to align your investment strategy with your values and interests. Each of us has values, beliefs, passions, areas of personal and professional interest, and investment theses. Venture capital, through targeted thematic funds, makes it easy to invest in areas that align with your values and interests, from impact investing to blockchain to seed-stage investing and more.

For example, if you are passionate about science, innovation, or supporting startups, you can find a venture capital fund that focuses on these areas. Investing in a venture brings much-needed capital to fuel the ideas, creativity, and relentless energy of innovators and entrepreneurs. Your investment can play a role in contributing to their good work and supporting the growth of companies with the potential to change industries.

Additionally, venture capital funds provide access to a diverse range of investment opportunities. By pooling capital from multiple investors, fund managers have more capital to invest in a broader array of companies, increasing the potential for better results. This diversification not only reduces risk by spreading it across multiple investments but also allows investors to support a wider range of ventures that align with their interests and values.

Furthermore, venture capital funds offer the advantage of specialised fund managers who have expertise in identifying the best founders and companies. They know what red flags to look for and have the legal resources to ensure that documents are properly set up and enforced. Regularly tracking metrics and spotting issues in their portfolio companies, these fund managers de-risk the investments and increase the chances of success.

Overall, investing in VC funds allows individuals to align their investment strategies with their personal values and interests by providing access to a diverse range of investment opportunities and the expertise of specialised fund managers.

Mutual Fund Strategies: Long-Term Investments for Financial Freedom

You may want to see also

Reduced risk compared to angel investing

Investing in venture capital (VC) funds can be a more secure option than angel investing. Here's why:

Diversification and Risk Reduction

Firstly, VC funds allow investors to spread their investments across multiple startups, reducing the risk associated with putting a large sum of money into a single company. Diversification is a powerful risk management tool, and VC funds provide access to a broader range of startups compared to angel investing. By investing in a portfolio of companies, the chances of achieving a good return on investment increase.

Professional Management

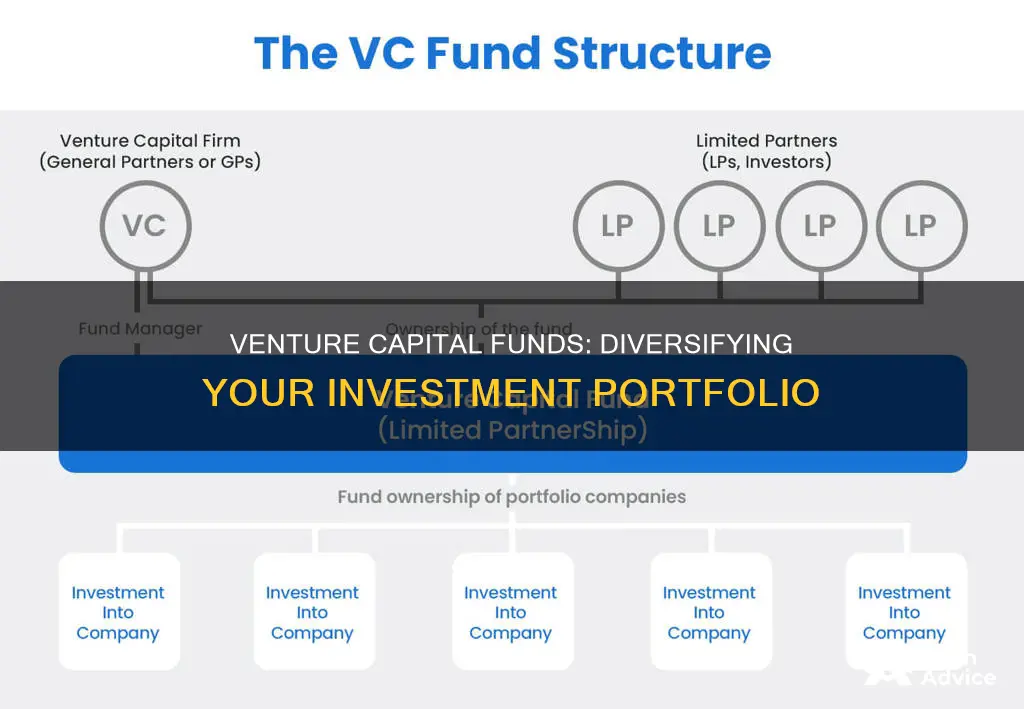

VC funds are managed by professional investors who are experts in their field. They know how to identify, evaluate, and support startups, and they have the experience to navigate the legal complexities of investing in private companies. This expertise gives limited partners (LPs) in VC funds peace of mind, knowing that their investments are being handled by seasoned professionals.

Due Diligence

Professional fund managers have the time and resources to conduct extensive due diligence. Research shows that angel investors who spent less than 20 hours on due diligence per deal achieved a return of just 1.1x on their investment. In contrast, VC fund managers, as full-time investors, dedicate significantly more time to due diligence, leading to potentially higher returns.

Network and Mentorship

VC funds also offer unique networking opportunities, connecting LPs with other successful investors, mentors, and industry experts. This network provides valuable insights, mentorship, and learning experiences that can help LPs make better investment decisions and navigate the complex world of startup investing.

Investment Size and Stage

VC funds typically invest larger amounts of capital, often in the millions of dollars, during the later stages of a company's growth, such as Series A rounds and beyond. This means that startups seeking significant investments to fuel their ambitious growth goals will often turn to VC firms rather than angel investors, who usually focus on seed and early-stage funding.

In summary, investing in VC funds offers reduced risk compared to angel investing through diversification, professional management, extensive due diligence, unique networking opportunities, and the ability to make larger investments during a company's later stages of growth.

Benefits of Investing in Managed Funds: Diversification and Expertise

You may want to see also

Frequently asked questions

VC funds have consistently outperformed the market, with top-tier VCs outperforming the markets by a large margin. VC funds provide access to pre-IPO investment opportunities, allowing investors to get in on the ground floor of potentially high-growth companies.

VC funds provide diversification, allowing investors to spread their investment across a range of companies and industries with a single transaction. VC funds also have teams of analysts and industry experts who vet and source deals, de-risking the investments and increasing the chances of success.

As with any investment, it is important to do your own research and understand the risks involved. VC funds invest in startups and scale-ups, which have a higher risk profile than established companies but also offer higher growth potential. It is also important to remember that when investing in a VC fund, you are handing control of your funds to the fund manager, who will decide how and when to invest and exit investments.