Exchange-traded funds (ETFs) are a popular investment vehicle, particularly for younger investors, due to their low fees, liquidity, and ability to provide a diversified portfolio. However, there are several reasons why one may choose not to invest in ETFs. Firstly, ETFs are typically associated with passive investment strategies, tracking specific indexes such as the S&P 500 or the Dow Jones Industrial Average. While this can provide broad market exposure, it may not allow for more targeted or active investment strategies that aim to beat the market. Additionally, ETFs cannot be closed to new investors, which can be a structural flaw in certain situations where there may be diminishing returns as the fund grows too large. Furthermore, critics argue that ETFs can facilitate risky or inappropriate investments, such as packaging derivatives that are typically off-limits to retail investors. Finally, while ETFs provide tax advantages in certain jurisdictions, these benefits may not apply universally, and investors should carefully consider the tax implications based on their specific circumstances.

What You'll Learn

ETFs are not ideal for older investors

While there are many advantages to investing in ETFs, there are also some drawbacks, especially for older investors. Here are some reasons why ETFs may not be ideal for retirees or those close to retirement age:

Less diversification

ETFs that focus on specific sectors or foreign stocks may only offer exposure to large-cap stocks due to a narrow group of equities in the market index. This lack of exposure to mid- and small-cap companies could limit potential growth opportunities for ETF investors.

Intraday pricing might cause unwise trading

Intraday pricing, or the ability to trade throughout the day, can be a disadvantage for longer-term investors. Older investors with a time horizon of 10 to 15 years or more may make impulsive decisions based on short-term price movements, deviating from their investment strategy.

Costs could be higher

While ETFs are often compared to other funds, if you compare them to investing in a specific stock, the costs are higher. The commission paid to the broker might be the same, but there is no management fee for owning a stock directly.

Lower dividend yields

Although there are dividend-paying ETFs, the yields may not be as high as those obtained by owning high-yielding stocks or a group of stocks. If an investor is comfortable with taking on more risk, owning individual stocks can result in significantly higher dividend yields.

Skewed leveraged ETF returns

Leveraged ETFs use financial derivatives and debt to amplify the returns of an underlying index. However, these speculative investments can result in losses greater than the value change of the tracked index if held for an extended period. For example, a double-leveraged natural gas ETF may not always yield double the return of the index if held for multiple days.

May not suit older investors' risk tolerance

As people approach retirement age, they often prioritize safe investing over capital growth. Older investors are generally more comfortable with lower-risk investments and tend to own more bonds than stocks. ETFs, which can be complex and involve various risks, may not align with the risk tolerance of retirees or those close to retirement.

Betterment's ETF Investment Strategy: How It Works

You may want to see also

They are a risky investment

Why Investing in Age ETFs is Risky

While investing in ageing population ETFs can be tempting, it is important to remember that they are a risky investment. Here are some reasons why:

Market Risk and Volatility

Ageing population ETFs are subject to market risk and volatility. The performance of these ETFs is tied to the performance of the underlying companies and industries that cater to the ageing population. If the market experiences a downturn or if the targeted companies and industries underperform, the value of the ETF can decline, resulting in potential losses for investors.

Limited Track Record

Ageing population ETFs are still relatively new, and as a result, they have a limited track record of performance. This makes it more challenging to predict their long-term behaviour and potential returns. Investing in newer financial products can carry higher risks due to the lack of historical data and established patterns.

Concentration Risk

These ETFs focus on a specific segment of the population, which can lead to concentration risk. If the companies or industries targeted by the ETF face challenges or negative events, it can significantly impact the performance of the entire investment. Diversification across different sectors and asset classes is essential to mitigate this risk.

Higher Expenses

While ETFs generally have lower fees compared to mutual funds, investing in ageing population ETFs may involve higher expenses. The management and administration of these specialised ETFs could result in higher costs, which can eat into the returns generated by the investment.

Regulatory and Policy Changes

The companies and industries targeted by ageing population ETFs may be subject to regulatory and policy changes. For example, changes in healthcare policies, retirement plans, or social security benefits can significantly impact the performance of companies serving the ageing population. These external factors are beyond the control of investors and can affect the value of their investments.

Suitability for Short-Term Goals

Ageing population ETFs may not be suitable for short-term financial goals. The performance of these ETFs is tied to long-term demographic trends and may not provide the liquidity or quick returns needed for short-term investments. Investors with shorter investment horizons may need to consider other options.

Triple-Leveraged ETF: What You Need to Know Before Investing

You may want to see also

They are not tax-efficient

While ETFs are generally considered tax-efficient compared to actively managed funds, they are not as tax-efficient as some other investment options. Here are some reasons why ETFs may not be the most tax-efficient investment choice:

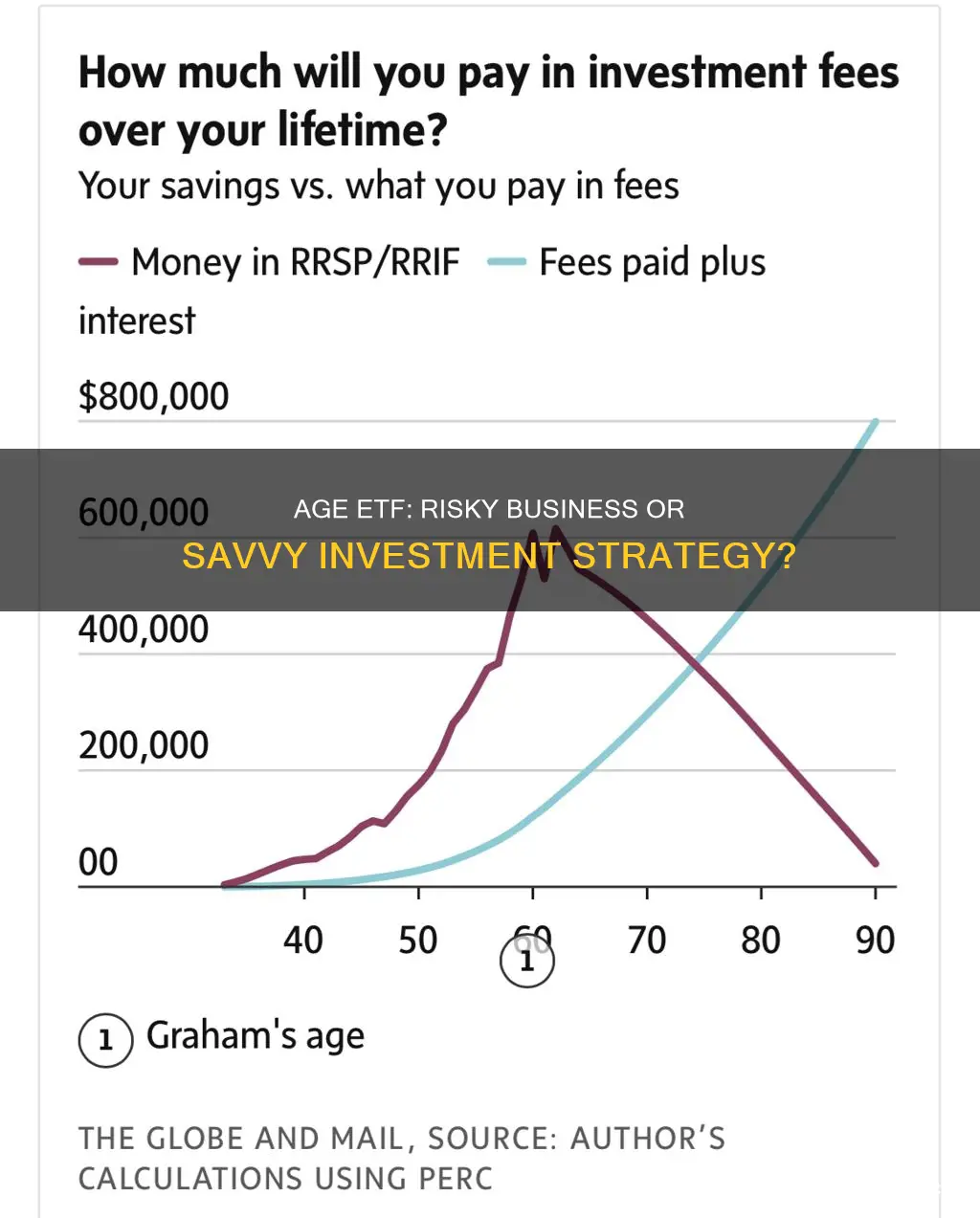

- Tax Efficiency in Retirement: While ETFs offer tax advantages, these benefits may be less significant for retirees. Taxes become increasingly important as investors approach retirement, as their portfolios tend to be at their largest right before and during this stage of life. Managing taxable income effectively during retirement can lower an investor's tax bill, reduce the taxation of Social Security income, and decrease susceptibility to Medicare premium surcharges for high-income retirees. However, bond ETFs and equity ETFs differ in their tax advantages. Bond index funds and ETFs do not offer significant tax benefits compared to actively managed bond funds. In contrast, equity index funds and ETFs provide superior tax efficiency relative to their actively managed counterparts. As such, for retirees or those close to retirement, the tax advantages of ETFs may be diminished, especially if their portfolios are primarily composed of bond funds.

- Tax Efficiency Compared to Mutual Funds: The ETF structure provides tax efficiency by allowing investors to defer capital gains taxes until they sell their investments. This advantage is particularly relevant in the US, where ETFs have gained popularity due to their tax benefits over mutual funds. However, it is important to note that this tax efficiency may not apply in other countries with different tax regulations. In countries without similar tax laws, the tax advantages of ETFs may not be as significant, and thus, they may not be the most tax-efficient option for investors in those regions.

- Tax Efficiency for High-Risk Strategies: While ETFs are generally tax-efficient, this efficiency may be reduced when employing certain high-risk strategies. For example, packaging derivatives into ETFs provides access to complex instruments typically off-limits to most retail investors. However, this regulatory workaround can potentially lead to higher taxes for investors, as derivatives are often taxed at a higher rate than traditional investments. As such, investors employing sophisticated strategies with ETFs may find that their tax efficiency is diminished compared to more traditional investment approaches.

- Tax Efficiency and Fund Size: ETFs have a structural limitation regarding fund size, as they cannot be closed to new investors. Consequently, as an ETF grows in size, it may experience diminishing returns, impacting its tax efficiency. When an ETF becomes too large, the increasing number of investors and assets under management can lead to reduced tax benefits for individual investors. In contrast, mutual funds can be closed to new investors, allowing them to maintain a smaller size and potentially offering better tax efficiency in certain situations.

ETFs: A Smart Investment Strategy for Your Portfolio?

You may want to see also

They are not a stable investment

Why Investing in Age ETFs May Not Be a Stable Investment

Age ETFs are Exchange-Traded Funds that focus on companies that target their business models at older age groups. While this may seem like a good idea, there are several reasons why investing in age ETFs may not be a stable investment.

Firstly, the companies that age ETFs focus on may be more susceptible to economic downturns. For example, during an economic recession, older adults may choose to cut back on expenses, which could negatively impact the performance of companies specifically targeted at this demographic. This could result in decreased revenue and profitability for these companies, leading to a decline in their stock prices.

Secondly, the performance of age ETFs is heavily dependent on the underlying companies' success and the overall state of the economy. If the companies within the ETF experience financial difficulties or the economy enters a downturn, the value of the ETF can be significantly impacted. This is because ETFs are designed to track the performance of a specific index or sector, so if the underlying companies struggle, the ETF will likely underperform.

Thirdly, age ETFs may not provide adequate diversification. These ETFs are often focused on a specific sector or industry, such as healthcare or pharmaceuticals, which are essential for older adults. However, this narrow focus can lead to increased risk if the sector or industry experiences challenges. A more diversified portfolio that includes a mix of stocks, bonds, and other asset classes may provide a more stable investment strategy.

Lastly, the demographics of an ageing population can be unpredictable. While the proportion of older adults is generally increasing, there can be variations in different regions and countries. This can impact the performance of companies targeting this demographic, as they may face challenges in expanding their customer base or maintaining profitability if the ageing population does not grow as expected.

In conclusion, while age ETFs may provide an opportunity to invest in companies targeting older adults, they may not be a stable investment due to economic vulnerabilities, lack of diversification, and unpredictable demographic changes. It is essential for investors to carefully consider the risks and potential rewards before investing in any ETF, including those focused on ageing populations.

Artificial Intelligence ETFs: Smart Investment Strategies

You may want to see also

They are not a long-term investment

Exchange-traded funds (ETFs) are not ideal for long-term investment, and here's why:

Firstly, younger investors with less capital and a basic understanding of investing typically favour ETFs. The funds are ideal for those who want to test the investment waters without committing large sums of money. The low fees and high liquidity of ETFs make them a good entry point for new investors. However, as investors gain experience and confidence, they may want to explore other investment options that offer more control and potential for higher returns.

Secondly, ETFs are often associated with passive investment strategies and are commonly used to track specific indexes. While this can be a safe and low-cost approach, it may not yield the same level of returns as more active and dynamic investment strategies. Over time, investors may seek more control over their investment decisions and prefer to select individual stocks or sectors rather than relying solely on index-tracking.

Thirdly, ETFs are subject to market risks and the performance of the underlying assets. In a declining market, ETFs may underperform, and investors may seek alternative investment options to mitigate their losses. Additionally, ETFs cannot be closed to new investors, which can be a structural flaw in certain areas where there can be diminishing returns if the fund becomes too large.

Finally, while ETFs offer diversification and low fees, they may not be the best option for long-term wealth accumulation. As investors approach retirement, they may want to explore other investment vehicles that offer higher returns or guaranteed income streams. For example, investing in dividend-paying stocks, real estate, or retirement savings plans may be more suitable for long-term financial goals.

In conclusion, while ETFs have their advantages, they may not be ideal for long-term investment goals. Investors should carefully consider their financial objectives, risk tolerance, and time horizon before deciding whether to include ETFs in their portfolios.

Vanguard ETF Minimum Investments: How Much to Invest?

You may want to see also

Frequently asked questions

Exchange-traded funds (ETFs) are a great way to start investing, especially for younger investors. ETFs are highly liquid, can be traded throughout the day, and many have relatively low fees. They are also highly adaptable and flexible, allowing investors to choose from a wide variety of markets and sectors.

ETFs can be risky, like all investments. If the market that an ETF tracks goes down, you could lose money. Additionally, ETFs cannot be closed to new investors, which can be a structural flaw in some areas. The share creation-and-redemption process that underpins the ETF ecosystem may also be susceptible to hidden fault lines that could be exposed during a market crisis.

When choosing an ageing Population ETF, consider the methodology of the underlying index, the performance of the ETF, its size, cost, age, income, domicile, and replication method.