Arbitrage funds are a type of mutual fund that aims to profit from price differentials in different markets. They are suitable for investors who want to profit from a volatile market without taking on too much risk. Arbitrage funds generally come with a low level of risk as securities are bought and sold simultaneously, eliminating the risks associated with long-term investments. They are also taxed similarly to equity funds, which can result in lower taxes on gains. However, the payoff can be unpredictable, and these funds may not be suitable for all investors or market conditions.

| Characteristics | Values |

|---|---|

| Risk | Low |

| Volatility | Works in favour of arbitrage funds |

| Returns | Reasonable |

| Tax treatment | Same as equity funds |

| Investment horizon | At least six to 12 months |

| Debt exposure | Small |

| Expense ratios | High |

What You'll Learn

Low-risk investment option

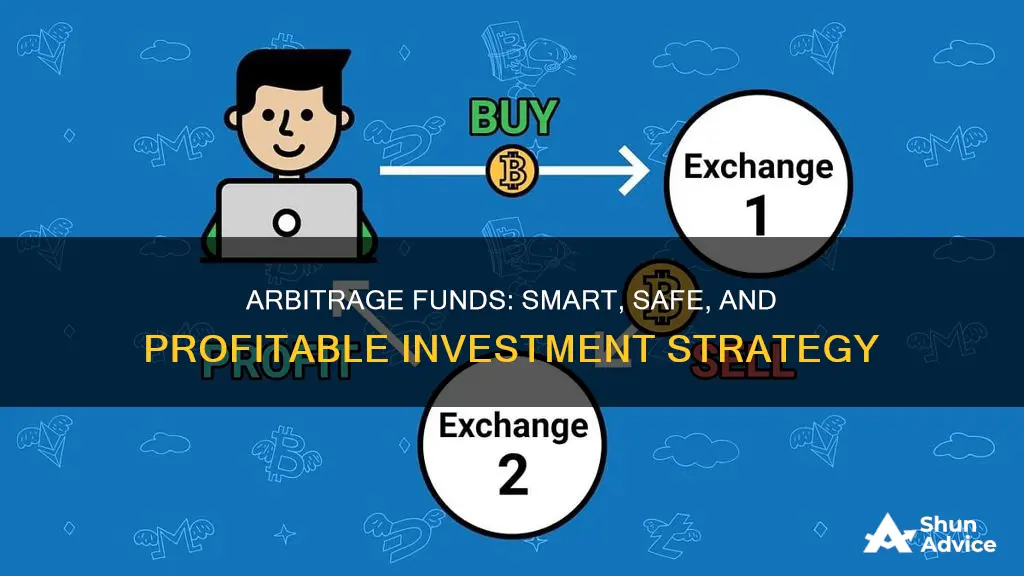

Arbitrage funds are a low-risk investment option. They are a type of mutual fund that aims to profit from the price differential of securities across different markets. This could be a pricing mismatch between two exchanges or different pricing in the spot and futures markets.

The fund manager of an arbitrage fund buys and sells shares at the same time, earning the difference between the selling price and the buying price. This is in contrast to other forms of investing, where an asset is purchased and held until its value increases. Fund managers only invest in equities when they can identify a clear opportunity to profit. If no such opportunities are available, the fund will invest in short-term money market instruments and debt securities.

Because the price difference between markets is usually very small, fund managers have to make several trades in one day to book a reasonable profit. This means that, while arbitrage funds are a relatively low-risk option, the payoff can be unpredictable.

Arbitrage funds are suitable for investors with a low-risk appetite. They are also a good option for those with short-term financial goals. For example, instead of putting money into a regular savings account, arbitrage funds can be used to create an emergency fund with higher returns.

In terms of taxation, arbitrage funds are treated similarly to equity funds. Short-term capital gains are taxed at 15%, while long-term capital gains are taxed at 10% without indexation.

Thematic Funds: Diversify Your Portfolio, Invest in the Future

You may want to see also

Outperform non-equity-oriented funds

Arbitrage funds are a type of hybrid mutual fund that aims to generate returns by simultaneously buying and selling securities in different markets. They are considered low-risk investments that can shine during market instability, offering potentially better returns than non-equity funds.

Low-Risk, High Returns

Arbitrage funds are considered low-risk investments as they seek to take advantage of price discrepancies rather than market direction. The returns generated are comparatively less volatile than those of pure equity funds. This makes them attractive to investors seeking stability compared to traditional equity funds.

Market Volatility

Arbitrage funds are one of the only low-risk securities that can actually flourish during times of high market volatility. When prices are unstable, the differential between the cash and futures markets increases. Arbitrage funds can take advantage of this price differential, allowing them to generate higher returns.

Tax Benefits

Arbitrage funds are taxed as equity funds since they are technically balanced or hybrid funds, investing in both debt and equity. This provides tax advantages, with long-term capital gains exceeding a certain threshold being taxed at a lower rate than short-term capital gains. These tax benefits can enhance the overall returns of arbitrage funds compared to non-equity-oriented funds.

Active Management

Arbitrage funds require active management to identify and capitalise on arbitrage opportunities. While this leads to higher expense ratios, it also means that fund managers can adapt their strategies based on market conditions. This active management allows arbitrage funds to be dynamic and responsive to market changes, potentially leading to higher returns.

Hedging Techniques

Arbitrage funds often employ hedging techniques to minimise risk, making them a steadier option than pure equity funds. By hedging their positions, arbitrage funds can lock in profits and protect against potential losses. This risk management strategy contributes to their ability to outperform non-equity-oriented funds.

India's Alternative Investment Funds: Exploring the Options

You may want to see also

Thrive in volatile markets

Arbitrage funds are a great way to thrive in volatile markets. They are a type of mutual fund that aims to profit from price differentials in different markets. This allows investors to benefit from market volatility without taking on too much risk.

When markets are volatile, arbitrage opportunities abound. For example, if a stock is trading at a higher price on one exchange than another, an arbitrage fund can buy the stock on the cheaper exchange and simultaneously sell it on the more expensive one, profiting from the price differential.

This strategy works particularly well in volatile markets because it relies on price differentials, which tend to be more significant when markets are fluctuating. In fact, volatility can be seen as an advantage for arbitrage funds, as it creates more opportunities for them to exploit.

The low-risk nature of arbitrage funds also makes them well-suited for volatile markets. Since securities are bought and sold simultaneously, there is little to no risk associated with longer-term investments. This means that even if the market suddenly moves in the opposite direction, arbitrage funds can still make a profit.

In addition, arbitrage funds can also invest in debt instruments, which are generally considered stable and can provide a hedge against market volatility. This makes arbitrage funds a relatively safe investment option, even in unpredictable markets.

However, it's important to note that arbitrage funds may not perform as well in stable markets, as the number of arbitrage opportunities decreases. Therefore, investors should carefully consider the current market conditions and their investment goals before deciding to invest in arbitrage funds.

Tax-Exempt Bond Funds: When to Invest for Maximum Returns

You may want to see also

Tax efficiency

Arbitrage funds are a type of mutual fund that profits from price differentials in different markets. They are considered tax-efficient options for parking short-term funds.

Arbitrage funds are taxed like equity funds. They are technically balanced or hybrid funds because they invest in both debt and equity, with the former being considered highly stable. However, since long equity accounts for at least 65% of the portfolio on average, they are taxed as equity funds.

If you hold your shares in an arbitrage fund for more than a year, any gains you receive are taxed at the capital gains rate, which is much lower than the ordinary income tax rate.

In India, profits made in arbitrage funds held for less than 12 months (short-term capital gains) are taxed at 15% plus applicable surcharge and cess. If units of arbitrage funds are sold after 12 months from the date of purchase, profits (long-term capital gains) of up to Rs 1 lakh are tax-exempt in a financial year. Long-term capital gains in excess of Rs 1 lakh are taxed at 10%.

For investors in the highest tax bracket, arbitrage funds can generate better post-tax returns than debt funds. However, for investors in the lower tax brackets, debt funds may be preferable.

Arbitrage funds are also a good option for investors who are unsure of their investment duration. They are ideal for tenures of a few months to more than a year.

International Funds: Diversify Your Portfolio, Gain Global Exposure

You may want to see also

Suitable for short-term investors

Arbitrage funds are suitable for short-term investors as they can generate short-term returns by taking advantage of low-risk buy-and-sell opportunities that may arise. They are also an excellent option for investors with short- to medium-term financial goals.

For example, instead of putting your money into a regular savings bank account, you could choose to park any excess funds to create an emergency fund and earn better returns through arbitrage funds.

Arbitrage funds are also suitable for investors with a low-risk appetite. They are considered a low-risk investment option because the fund manager purchases and sells securities simultaneously, with lower chances of risks or losses. Volatility works in favour of arbitrage funds. As long as the market keeps moving in either direction, arbitrage opportunities will be available, and fund managers will be able to capitalise on them.

However, arbitrage funds may not generate the desired returns when the market moves in a range. In such a scenario, arbitrage funds may generate below-average returns, which is one of the most notable risks associated with them.

The Mindset of Investment Fund Managers: Traits and Insights

You may want to see also

Frequently asked questions

Arbitrage funds are a great option for investors who want to profit from a volatile market without taking on too much risk. They are also taxed similarly to equity funds, which can result in lower taxes on gains.

Arbitrage funds are suitable for investors with a low-risk appetite. They are also a good option for those with short to medium-term financial goals.

Arbitrage funds have unpredictable payoffs and high expense ratios. They may also generate below-average returns when the market is stable or trading flat, as arbitrage opportunities will be limited.