Dividends bring down investments under the equity method because they are treated as a return on investment. When a company pays dividends to its shareholders, its stockholders' equity is decreased by the total value of all dividends paid. This is because the value of the investment has decreased by the cash distribution. For example, if an investor owns $1,000 worth of stock that pays a $50 dividend, the stock's post-dividend price will drop, reducing the value of the shares to about $950.

What You'll Learn

- Dividends are a liability for companies, reducing total equity and the value of common stock

- Dividends are not treated as revenue under the equity method, instead, they reduce the value of the investment

- Cash dividends reduce stockholder equity, while stock dividends do not

- Dividends are treated as a return on investment, not taxable income

- Dividends are a distribution of company earnings to shareholders, rewarding current shareholders and attracting new investors

Dividends are a liability for companies, reducing total equity and the value of common stock

Dividends are a way for companies to return capital to shareholders, and they can be paid in cash, stock, or as dividends in kind. Dividends are considered assets for shareholders, as they increase their net worth. However, for companies, dividends are a liability before they are paid out. Once a dividend is declared, a liability is recorded on the financial records and reported on the corporation's balance sheet. Typically, dividends payable is reported as a current liability, reducing the company's cash balance by the same amount.

Cash dividends primarily impact the cash and shareholder equity accounts on the balance sheet. When a cash dividend is paid, the stock price generally drops by the amount of the dividend. For example, a company that pays a 2% cash dividend should experience a 2% decline in its stock price. As a result, the balance sheet size is reduced, as the company's assets and equity are reduced by the amount of the dividend payment.

Stock dividends, on the other hand, do not impact a company's cash position. Instead, they increase the number of shares outstanding by giving new shares to shareholders. While stock dividends do not reduce shareholder equity, they do affect the balance sheet by increasing the number of shares.

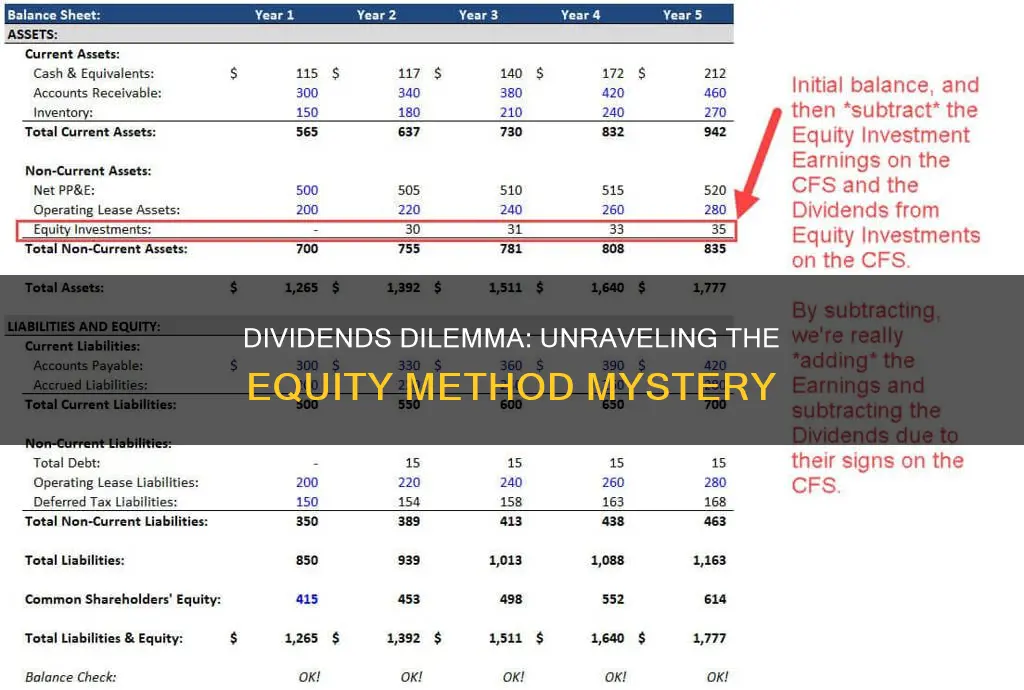

Under the equity method of accounting, dividends are treated as a return on investment and reduce the value of the investor's shares. The investment is initially recorded at its historical cost, and adjustments are made based on the investor's percentage ownership in net income, loss, and dividend payouts. Net income increases the value on the investor's income statement, while both loss and dividend payouts decrease it.

Ready to Invest? Here's What You Need to Know

You may want to see also

Dividends are not treated as revenue under the equity method, instead, they reduce the value of the investment

The equity method is an accounting technique used by a company to record the profits earned through its investment in another company. It is used when the investor company has significant influence over the company it is investing in, which is usually defined as owning 20% or more of the company's stock.

When an investor company has significant influence over the investee company, it can impact the value of the investee company, which in turn benefits the investor. As a result, the change in value of that investment must be reported on the investor company's income statement. The investment is initially recorded at its historical cost, and adjustments are made based on the investor's percentage ownership in net income, loss, and dividend payouts.

Net income of the investee company increases the investor's asset value on their balance sheet, while the investee's loss or dividend payout decreases it. This is because dividends are treated as a return on investment under the equity method. They reduce the value of the investor's shares.

For example, if an investor owns $1,000 worth of stock that pays a $50 dividend, the stock's post-dividend price will drop, reducing the value of the shares to about $950. An individual would record the $50 as dividend income, but a corporation using the equity method would not. Instead, the investor subtracts the cash dividend amount from the investment carrying value, as the value of the investment has decreased by the cash distribution.

If the investor company were to treat the dividend as revenue, it would constitute double-counting, as the profit from the investment has already been recorded in the income statement.

Movie Investors: Who Are They?

You may want to see also

Cash dividends reduce stockholder equity, while stock dividends do not

When a company issues dividends, it is usually a way to reward current shareholders and attract new investors. Dividends can be paid out in the form of cash, additional shares of stock, or a combination of both. However, the effect of dividends on stockholder equity depends on the type of dividend issued.

When a company pays cash dividends to its shareholders, stockholder equity is decreased by the total value of all dividends paid. This is because cash dividends are paid out of retained earnings, which directly reduces stockholder equity. In other words, the company's cash balance decreases, and so does the value of the investment.

On the other hand, stock dividends do not have the same effect on stockholder equity as cash dividends. Stock dividends distribute additional shares to shareholders without affecting the balance of stockholder equity. When a company issues a stock dividend, shareholders receive additional shares according to their current ownership stake. While the value of the stock dividend is deducted from retained earnings, it results in a transfer of funds from retained earnings to paid-in capital. In essence, stock dividends rearrange the allocation of equity funds without impacting the total stockholder equity.

To illustrate the impact of cash dividends on stockholder equity, consider the following example: Company ABC decides to issue a $1.50 dividend to its shareholders for each share owned, resulting in a total payout of $1.5 million for 1 million outstanding shares. The retained earnings section of ABC's balance sheet shows $4 million. When the cash dividend is declared, $1.5 million is deducted from retained earnings and added to the dividends payable sub-account of the liabilities section. Consequently, the company's stockholder equity is reduced by the dividend amount.

In contrast, a stock dividend does not reduce stockholder equity. For instance, if ABC declares a 5% stock dividend on its 1 million outstanding shares with a market price of $15, the dividend shares have a total value of $750,000. When the dividend is declared, this amount is deducted from retained earnings and transferred to the paid-in capital sub-account, with no net change in the total stockholder equity.

Retirement Reinvented: Navigating Post-Career Investment Strategies

You may want to see also

Dividends are treated as a return on investment, not taxable income

Dividends are a distribution of a company's earnings to its shareholders. They are issued as a way to reward current shareholders and to attract new investors. Dividends can be paid in the form of cash, additional shares of stock, or a combination of both.

Dividends are treated differently depending on the type of dividend and the context in which they are received. In the context of the equity method of accounting, dividends are treated as a return on investment. The equity method is used to record the profits earned by an investor company through its investment in another company. The method is typically applied when the investor company holds significant influence over the investee company, usually through a 20% or more ownership stake. In this case, dividends are not considered taxable income but rather a return on the investment, reducing the value of the investor's shares.

On the other hand, dividends are generally considered taxable income for the individual shareholder. The tax rate applied depends on the type of dividend, the shareholder's income, and the type of account the investment is held in. For example, dividends received from stocks held in a retirement account, such as a Roth IRA or 401(k), are typically not taxed. In contrast, dividends received from stocks held in a taxable brokerage account are usually subject to taxation. Additionally, the tax rate differs between qualified dividends, which meet certain requirements and are taxed at lower capital gain rates, and ordinary or non-qualified dividends, which are taxed at the regular income rate.

The Student Debt Dilemma: Invest or Repay?

You may want to see also

Dividends are a distribution of company earnings to shareholders, rewarding current shareholders and attracting new investors

Dividends are considered an indication of a company's financial well-being. A company can pay dividends when it is doing well and wants to reward its shareholders for their investment. A steady track record of paying dividends makes stocks more attractive to investors. Dividends are often expected by shareholders as their share of the company's profits, and dividend payments reflect positively on a company and help maintain investors' trust.

Dividends can also be used as a way to attract new investors. Stocks that issue dividends tend to be fairly popular among investors, so companies may pride themselves on issuing consistent and increasing dividends year after year. In addition to rewarding existing shareholders, issuing dividends encourages new investors to purchase stock in a thriving company.

From an investor's perspective, dividends are considered assets because they add value to their portfolio, increasing their net worth. Dividends can provide a stream of income, and dividend stocks can be a good investment strategy, particularly for those dependent on an income stream.

When a company pays cash dividends to its shareholders, its stockholders' equity is decreased by the total value of all dividends paid. However, the effect of dividends can vary depending on the type of dividend issued. For example, while cash dividends reduce stockholder equity, stock dividends do not.

The equity method is an accounting technique used by a company to record the profits earned through its investment in another company. When a company holds a significant influence over another company, it must use the equity method to report that investment on its income statement. Net income of the investee company increases the investor's asset value on their balance sheet, while the investee's loss or dividend payout decreases it.

In summary, dividends are a way for companies to distribute earnings to shareholders, rewarding current shareholders and attracting new investors. The distribution of dividends is indicative of a company's financial health and can impact the value of investments reported on income statements when using the equity method of accounting.

Act Now: Why Waiting to Invest is Costing You

You may want to see also

Frequently asked questions

Dividends bring down investments under the equity method because they are not treated as revenue. Instead, dividends are considered a return on investment, and the investor subtracts the cash dividend amount from the investment carrying value. This reflects the decrease in the value of the investment due to the cash distribution.

The equity method is an accounting technique used by a company to record the profits earned through its investment in another company. The investor company reports the revenue earned by the other company on its income statement, proportional to the percentage of its equity investment in the other company.

The equity method is used when the investor company has significant influence over the company it is investing in, which is usually defined as owning 20% or more of the company's stock.