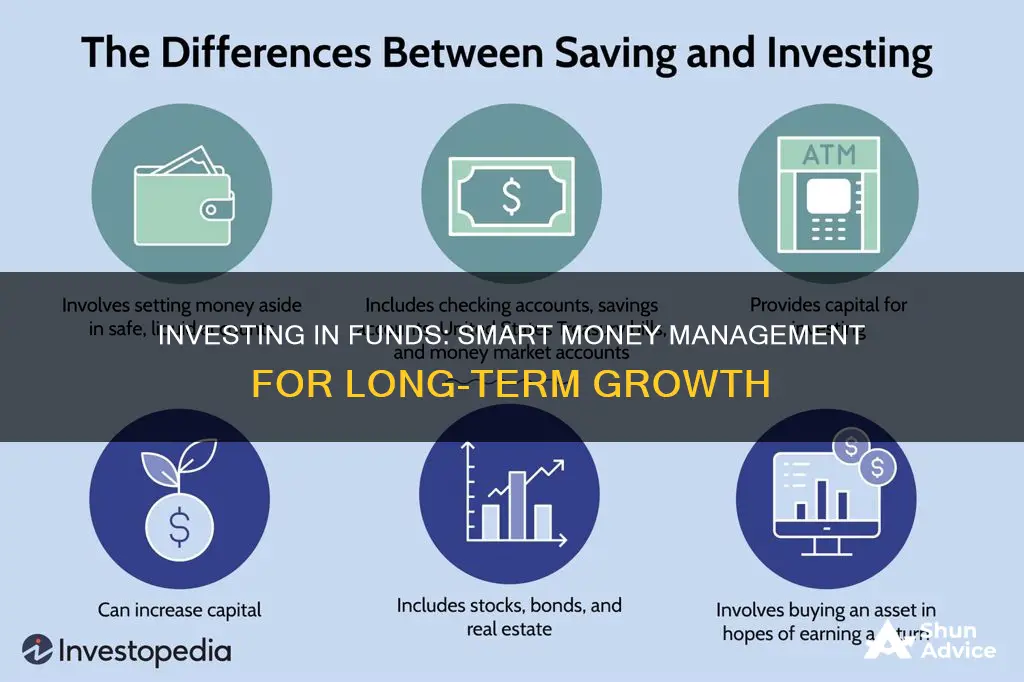

Investing is a way to make your money work for you and build wealth. While holding cash and having bank savings accounts are considered safe strategies, investing allows your money to grow in value over time. There are many different investment options, including stocks, bonds, real estate, and money market accounts. One option is to partner with a mutual fund, which helps make investment decisions for you. Mutual funds pool money from a group of investors and invest that capital in different securities, offering diversification, convenience, and lower costs. They are often safer and less complicated than investing in individual stocks.

| Characteristics | Values |

|---|---|

| Safer and less complicated | Mutual funds |

| Diversification | Mutual funds |

| Convenience | Mutual funds |

| Lower costs | Mutual funds |

| Build wealth | Mutual funds, stocks, bonds, real estate, small businesses |

| Generate future income | Mutual funds, stocks, bonds, real estate, small businesses |

| Increase value and equity | Mutual funds, stocks, bonds, real estate, small businesses |

| Reduce investment risk | Mutual funds |

| Avoid complicated decision-making | Mutual funds |

| Avoid frequent stock trades | Mutual funds |

| Avoid high interest credit card debt | Mutual funds |

| Avoid large founder salaries | Business investments |

| Avoid large debts | Business investments |

What You'll Learn

Compounding and long-term growth

Investing in funds is a great way to build wealth and have your money work for you. One of the key advantages of investing in funds is the potential for compounding and long-term growth.

Compounding refers to the process of reinvesting an asset's earnings to generate additional earnings over time. This is often referred to as "interest on interest" or "compound interest". The power of compounding lies in the fact that the investment generates earnings not only from its initial principal but also from the accumulated earnings of preceding periods. The more time your money has to compound, the larger the payoff will be.

For example, let's say you invest $100 and receive a 7% rate of return in the first year. In the second year, you receive another 7% return on that same investment. So, your original $100 grows as follows:

Year 1: $100 x 1.07 = $107

Year 2: $107 x 1.07 = $114.49

The extra $0.49 in the second year is the compounded interest earned on top of the initial $7 interest from the first year. This example demonstrates how compounding can lead to greater returns over time.

Compounding is particularly effective in long-term investment accounts. For instance, let's assume an account with a balance of $20,000 and an average return of 7%. By the end of the second year, the balance would have grown to $22,898, with $98 of that being compounded interest.

The key to maximizing compounding is consistency and patience. It's important to remember that the rate of return is an average assumed over decades, and there will be economic peaks and troughs along the way. Additionally, the sooner you put your money to work, the sooner it can start compounding and growing.

When investing for the long term, it's crucial to consider the impact of inflation. While savings accounts and certificates of deposit (CDs) offer compound interest, they may not keep up with rising prices. To stay ahead of inflation, investors may need to consider more aggressive investment options, such as dividend stocks, bonds, or real estate investment trusts (REITs).

Mutual funds, in particular, offer a great opportunity for long-term growth. They provide instant diversification by pooling money from multiple investors and investing in different securities and sectors. This diversification helps to minimize portfolio risk and is a key advantage of mutual funds over individual stock investing. Additionally, mutual funds benefit from economies of scale, as the cost of trading is spread across all investors, resulting in lower costs per individual.

In summary, compounding and long-term growth are essential factors to consider when investing in funds. By reinvesting earnings and adopting a long-term perspective, investors can harness the power of compounding to build wealth over time.

Safe Mutual Fund Investments: Picking the Right Option

You may want to see also

Diversification of investments

Diversification can be achieved by investing in different asset classes, such as stocks, bonds, real estate, or cryptocurrency. It can also be achieved by purchasing investments in different countries, industries, company sizes, or term lengths for income-generating investments.

The benefits of diversification include:

- Reduced risk: By investing in a variety of assets, the overall risk of the portfolio is lowered.

- Increased risk-adjusted returns: Diversification can lead to higher returns when factoring in the risk taken.

- Better opportunities: Diversification can lead to better investment opportunities due to wider exposure.

- Enjoyment: For some, diversifying can make investing more enjoyable as it involves researching new industries and companies.

However, there are also potential drawbacks to diversification, including:

- Lower returns: Diversification may result in lower portfolio-wide returns as it focuses on reducing risk rather than maximising returns.

- Time and cost: Diversification can be time-consuming and incur more transaction fees and commissions due to the higher number of holdings.

- Overwhelming for beginners: Diversification may be overwhelming for new or inexperienced investors due to the complexity and number of holdings involved.

Overall, diversification is a crucial concept in financial planning and investment management, helping to lower the overall risk of a portfolio.

Understanding Investment Funds: What Are They?

You may want to see also

Lower costs and management fees

One of the main benefits of investing in funds is the ability to lower costs and management fees. By pooling money from multiple investors, funds can spread the cost of trading across all investors, resulting in lower costs per individual. This is especially beneficial for individuals who may not have the capital to invest in a diverse range of securities on their own.

For example, consider the costs associated with buying and selling stocks. The gains from a stock's price appreciation can be offset by the costs of selling an investor's shares. With a mutual fund, these costs are distributed across all investors, resulting in lower overall costs. Additionally, mutual funds often have lower management fees compared to brokerage companies that offer individual stock trades.

Actively managed funds, such as mutual funds, tend to have higher fees as they require a portfolio manager to constantly update their holdings. On the other hand, passively managed funds, like index funds, have lower fees as they follow a buy-and-hold strategy. According to Morningstar, investors pay on average 1.2% in fees for actively managed funds, while electronic traded funds (ETFs) charge around 0.44%.

It is important to note that expense ratios, which include management fees, advertising costs, and other expenses, can significantly impact the returns on your investment. For instance, if a mutual fund returns 8% but has an expense ratio of 1.5%, your actual earnings are only 6.5%. Therefore, keeping these fees to a minimum can help maximize your investment returns.

To summarize, investing in funds can lead to lower costs and management fees, especially when compared to individual stock trades. By spreading the cost of trading across multiple investors and utilizing passive investment strategies, funds can offer more affordable investment opportunities while still providing access to a diverse range of securities.

Unlocking Sector Funds: A Smart Investment Strategy

You may want to see also

Instant diversification

Diversification is a crucial aspect of investing, and mutual funds offer an easy way to achieve instant diversification. By investing in a mutual fund, you gain exposure to a variety of different securities, industries, and sectors. This diversification helps to reduce your overall risk by ensuring that your investments are not concentrated in a single company, industry, or market.

Mutual funds pool money from multiple investors and invest in a diverse range of securities. This allows individual investors to access a wide range of investment options with a small amount of capital. For example, a single mutual fund may be comprised of dozens of different securities, providing instant diversification for investors.

One of the key advantages of mutual funds is that they offer instant diversification across different industries and sectors. Some funds focus on large-cap stocks, while others target companies with smaller market capitalizations or specific sectors like technology, healthcare, or raw materials. This diversification helps to reduce the risk associated with investing and ensures that a single event or downturn does not significantly impact your entire investment portfolio.

Mutual funds are also a convenient way to achieve instant diversification. Instead of spending time researching and selecting individual stocks, investors can rely on the expertise of fund managers who make investment decisions on their behalf. These fund managers are experienced professionals who constantly monitor the market and make buying and selling decisions to meet the fund's investment objectives.

Additionally, mutual funds provide diversification by investing in different types of securities. While stocks are a common component of mutual funds, they may also invest in bonds, short-term securities, exchange-traded funds (ETFs), or other asset classes. This diversification across different types of securities further reduces risk and provides a more balanced investment portfolio.

It is important to note that while mutual funds offer instant diversification, investors should also be aware of the potential drawbacks. Mutual funds may have management fees, which can vary depending on whether the fund is actively or passively managed. Additionally, investing in mutual funds means giving up some control over your investment decisions, as you rely on the fund manager's expertise. Despite these considerations, mutual funds remain a popular choice for investors seeking instant diversification and a more hands-off approach to investing.

Mutual Fund Investments: Reporting 1099-INT Details

You may want to see also

Potential for higher returns

Investing in funds can be an effective way to build wealth and have your money work for you. There are many reasons why someone may want to invest in funds, and one of the most important is the potential for higher returns.

When you invest in funds, you have the opportunity to benefit from the expertise of professional portfolio managers who actively select and manage investments to meet or exceed the performance of a specific benchmark. By pooling your money with other investors, you gain access to a diversified portfolio of stocks, bonds, or other securities, which can lead to higher returns over time.

Diversification is a key advantage of investing in funds. By spreading your investments across different industries, sectors, and asset classes, you reduce the risk of losing all your money if one particular stock or industry performs poorly. This diversification also allows you to capture returns from multiple sources, increasing your potential for higher returns.

Additionally, investing in funds can provide access to asset classes or sectors that may be difficult for individual investors to access directly. For example, some funds invest in foreign emerging markets, which can offer high returns during periods of rapid economic growth.

It's important to remember that investing in funds does not guarantee higher returns, and there is always the risk of losing money. However, by investing in funds, you benefit from professional management, diversification, and access to a broader range of investment opportunities, all of which increase your potential for higher returns compared to investing solely in individual stocks or other traditional investments.

Overall, investing in funds offers the potential for higher returns by leveraging the expertise of professional fund managers, diversifying your investments, and providing access to a broader range of investment opportunities.

Mutual Funds in India: Best Investment Options

You may want to see also

Frequently asked questions

Investing in funds is a way to have your money work for you and build wealth. It is an effective way to grow your money's value over time through compounding and long-term growth.

Investing in funds offers several benefits, including:

- Diversification: Funds allow you to invest in a variety of different sectors and reduce the risk of losing money.

- Convenience: Funds are managed by experts, saving you time and effort in researching and deciding on investments.

- Lower costs: The cost of trading is spread over all investors in a fund, resulting in lower costs per individual.

All investments carry some degree of risk, and it's important to understand that you could lose money. The level of risk depends on the specific fund and your risk tolerance. Some funds may be actively managed, which typically results in higher fees.

Investing in funds may be right for you if you are looking for a way to grow your wealth over time, want to diversify your investments, and are comfortable with the associated risks and fees. It's important to consider your financial goals, risk tolerance, and investment horizon before deciding to invest in funds.