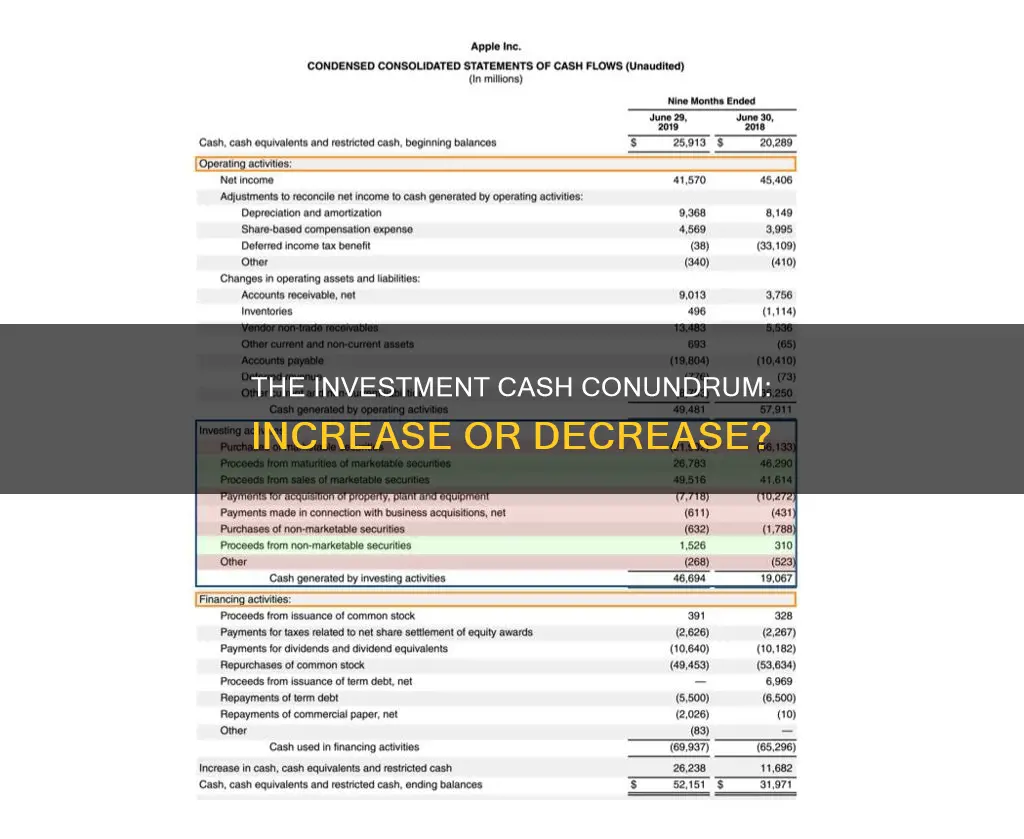

Whether an investment increases or decreases cash flow depends on the type of investment and the financial health of the company. For example, the purchase of investments such as stocks or bonds will decrease cash flow as cash is flowing out of the business. Conversely, the sale of an investment will increase cash flow as cash is flowing into the business.

A positive cash flow indicates that a company has enough money coming in to reinvest in the business, pay down debt, and withstand financial challenges. Conversely, negative cash flow can occur if operating activities don't generate enough cash to stay liquid. This can be due to profits being tied up in accounts receivable and inventory or due to excessive spending on capital expenditures.

It's important to note that negative cash flow from investing activities might not be a bad sign if management is investing in the long-term health of the company. For example, a company may invest in fixed assets such as property, plant, and equipment to grow the business, which may signal negative cash flow in the short term but could help generate cash flow in the long term.

What You'll Learn

- Investing in fixed assets, such as property, usually on credit, decreases cash flow

- Proceeds from the sale of fixed assets increase cash flow

- A company's cash flow decreases when it purchases inventory with cash

- Borrowing long-term debt increases cash flow

- Negative cash flow can occur if a company spends too much on capital expenditures

Investing in fixed assets, such as property, usually on credit, decreases cash flow

When a company invests in fixed assets, such as property, it typically involves a large outflow of cash. This outflow of cash is reflected in the company's cash flow statement, specifically in the investing activities section. The cash flow statement shows how the company's management generates cash to pay its debts and fund its operating expenses.

For example, if a company purchases a new building or land, the cost of the acquisition will be recorded as an outflow of cash in the investing activities section of the cash flow statement. This will result in a decrease in the company's cash balance, leading to a decrease in cash flow.

It is important to note that a negative cash flow from investing activities may not always be a bad sign. In some cases, it could indicate that the company is investing in its long-term health and future growth. For instance, a company may invest in fixed assets to expand its operations or upgrade its equipment. While this may lead to a short-term decrease in cash flow, it could potentially generate positive cash flow in the long term.

To evaluate the impact of investing in fixed assets on a company's financial health, investors should review the entire cash flow statement, balance sheet, and income statement. This will provide a comprehensive understanding of the company's financial position and help determine if the negative cash flow from investing activities is a positive or negative development.

Saudi Women's Rights: Investors' Dilemma

You may want to see also

Proceeds from the sale of fixed assets increase cash flow

The proceeds from the sale of fixed assets can increase cash flow, but this is not always the case.

Fixed assets are long-term tangible assets that companies use to generate revenue and run their business. They include property, plant, and equipment. These assets are crucial for most companies, especially capital-intensive ones.

When a company sells a fixed asset, the money it receives is referred to as the proceeds. If the proceeds from the sale are greater than the book value or carrying value of the asset, the company has made a gain on the sale. This gain is included in the net income reported in the operating activities section of the cash flow statement.

The proceeds from the sale of a fixed asset are reported as a positive amount in the investing activities section of the cash flow statement. This is because the sale of a fixed asset generates cash for the company.

However, it is important to note that the sale of a fixed asset can also result in a loss for the company if the sales proceeds are lower than the asset's carrying value. In this case, the loss is reported as a deduction from the net income in the operating activities section of the cash flow statement.

Overall, the proceeds from the sale of fixed assets can increase cash flow, but it depends on the specific circumstances of the sale and the company's overall financial health.

Retirement Investment Strategies: Navigating Your Golden Years

You may want to see also

A company's cash flow decreases when it purchases inventory with cash

A company's cash flow can be affected by various factors, including its inventory management. When a company purchases inventory with cash, its cash flow decreases. This is because the purchase of additional inventory requires an outflow of cash, which negatively impacts the company's cash balance.

Inventory management plays a crucial role in a company's cash flow. Ineffective inventory management can lead to higher inventory levels, indicating that the company is not selling its products efficiently. This results in a use of cash that decreases cash flow from operations. Therefore, it is essential for businesses to focus on maximizing net income and optimizing efficiency ratios to avoid declines in cash flow.

The cash flow statement (CFS) is a financial statement that summarizes the inflow and outflow of cash within a company, providing insights into its financial health and operational efficiency. The CFS is one of the three main financial statements, alongside the balance sheet and the income statement. It helps creditors and investors understand the company's liquidity and ability to fund its operations and pay down its debts.

The CFS consists of three main components: cash flow from operating activities, investing activities, and financing activities. Operating activities include any sources and uses of cash from the company's regular business activities, such as receipts from sales, payments to suppliers, and salary and wage payments. Investing activities cover sources and uses of cash from the company's investments, including purchases or sales of assets, loans, and mergers and acquisitions. Financing activities involve sources of cash from investors and banks, as well as payments to shareholders, such as dividends and stock repurchases.

Overall, a company's cash flow decreases when it purchases inventory with cash due to the outflow of cash associated with this transaction. This decrease in cash flow is reflected in the company's financial statements and can impact its overall financial health and operations.

Stable Interest Rates: Investors' Confidence Boost?

You may want to see also

Borrowing long-term debt increases cash flow

Borrowing long-term debt can increase cash flow for a business, but it is a double-edged sword. While it can provide a much-needed cash injection, it must be weighed against the future prospects of the company. Long-term debt is a liability that must be repaid, and it can become a heavy burden if not managed carefully.

Long-term debt is defined as debt that matures in more than one year. Examples include bonds, long-term notes, debentures, and mortgage loans. When a company borrows long-term debt, it initially shows as a cash inflow, but interest payments are an outflow of cash. The justification for assuming long-term debt is that it can lead to an improvement in the quality of the business, such as investing in income-producing plants and equipment.

The decision to borrow long-term debt should be strategic and carefully considered. A business must assess its ability to manage the debt in the long term and make payments without diverting too much attention from running the business. A high debt burden can reduce a company's operating flexibility and leave it vulnerable to economic downturns. Analysts and banks use debt ratios, such as long-term debt to equity, to evaluate a company's solvency. A high ratio suggests that a company may be too heavily indebted and at risk of financial trouble.

To increase cash flow, a company has several options, including issuing company stock or equity, borrowing debt from a bank or creditor, or issuing bonds. However, it is important to remember that negative cash flow is not always a bad thing, especially if the company can generate positive cash flow from its operations. Positive cash flow from financing activities indicates that more money is flowing into the company, boosting its asset levels.

In summary, borrowing long-term debt can increase cash flow for a business, but it should be approached with caution. It is essential to consider the company's financial health, prospects, and ability to manage the debt in the long term.

Robinhood: Where to Invest Today

You may want to see also

Negative cash flow can occur if a company spends too much on capital expenditures

Negative cash flow can be a sign of a company's poor performance. However, this is not always the case. Negative cash flow can occur if a company spends too much on capital expenditures. Capital expenditures (CapEx) are a popular measure of capital investment used in the valuation of stocks. An increase in capital expenditures means the company is investing in future operations. Companies with significant capital expenditures are usually in a state of growth.

Capital expenditures are a reduction in cash flow. For example, if a company purchases a fixed asset such as a building, its cash flow will decrease. The company's working capital will also decrease since the cash portion of current assets will be reduced. Conversely, selling a fixed asset will boost cash flow and working capital.

A company's cash flow statement can reveal what phase the business is in. For instance, if it is an early startup, it may be purchasing the facilities or equipment needed to ramp up. If it is a mature business, it may be acquiring rivals or developing new lines of business.

It is important to analyze the entire cash flow statement and all its components to determine if the negative cash flow is a positive or negative sign. The most effective way to evaluate a negative cash flow situation is to calculate a company's free cash flow. Free cash flow is the money the company has left after paying for capital expenditures and operating expenses. This is an important metric for investors because it shows how effective a company's management is at generating cash.

Kentucky Teacher Retirement System: Unveiling the Investment Portfolio

You may want to see also

Frequently asked questions

Cash flow is the net amount of cash and cash equivalents being transferred in and out of a company, usually over a specific reporting period.

An investment will decrease cash flow in the short term as cash is flowing out of the business. However, in the long term, it may increase cash flow by generating future earnings.

The purchase of investments such as stocks, bonds, or other financial instruments will decrease cash flow as money is being spent by the company.

Yes, if a company sells an investment for more than the purchase price, cash flow will increase as the company is receiving more money than they spent.