Negative cash flow is when a company spends more money on its investing activities than it receives from them. This does not always imply a loss for a business, but it can indicate that the company is investing in future growth and profitability. However, if a company is constantly reporting negative cash flow, it could be a sign of poor financial health.

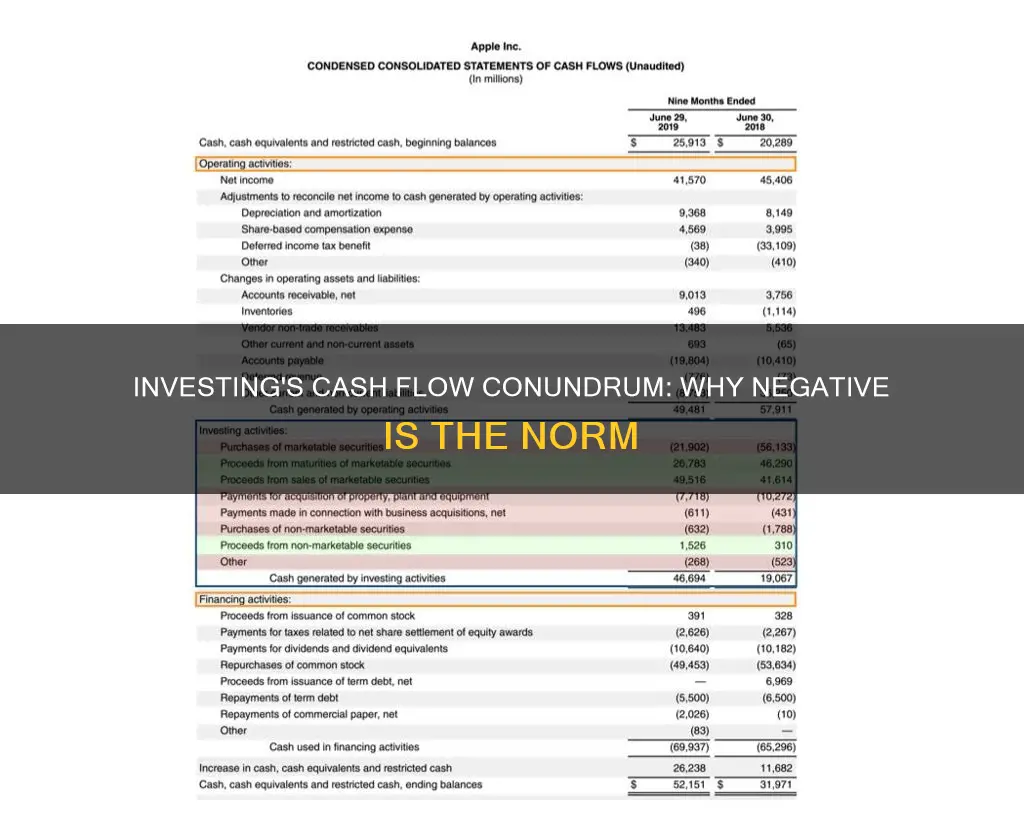

Negative cash flow from investing activities is one of the three components of the cash flow statement, alongside operating cash flow and financing cash flow. It tracks the cash inflow and outflow from a company's investing activities, such as purchasing and selling investments, as well as earnings from those investments.

While negative cash flow is typically seen as a bad sign, this is not always the case with cash flow from investing. A company's cash flow will take a hit when investing for future growth, which is a common occurrence for growing companies.

| Characteristics | Values |

|---|---|

| Definition | When a company spends more cash on its investing activities than it receives from them. |

| Occurrence | Common with new businesses, young companies, and growing companies. |

| Implication | Not always a bad sign, as it may indicate that the company is investing in its future growth and profitability. |

| Action | Investors should review the entire cash flow statement to decide if the negative cash flow is positive or negative. |

What You'll Learn

Negative cash flow from investing activities is not always bad

Negative cash flow from investing activities is not always a negative indicator for a company. While it could be a warning sign that the company's management is inefficient, it could also mean that the company is positioning itself for future growth.

A company's cash flow statement can reveal what phase the business is in. For example, a company in the early stages of startup may be eager to grow its business quickly and its cash flow statement may show that it is purchasing facilities or equipment. On the other hand, a mature business may be developing new lines of business or acquiring rivals.

It is not uncommon for a growing company to have a negative cash flow from investing activities. This may be due to investments in long-term fixed assets, such as property and equipment, which are necessary for the company's future growth. Even well-established companies make such investments from time to time, which may cause a temporary negative cash flow.

For example, a company may sell goods and accrue profit but not receive the money immediately. If customers have agreed to a payment term of 60 days, for instance, the company will not receive the money for 60 days. Late payments from clients can lead to losses in one month and profits in another.

A company can be profitable while having negative cash flow. Negative cash flow is not necessarily bad as long as it is not chronic or long-term. It could be due to an unusual expense or delay in receipts for that period, or it could be due to an investment in the company's future growth.

To determine whether negative cash flow from investing activities is positive or negative, investors should review the entire cash flow statement and all its components.

Coinbase: The Ultimate Investment and Trading Companion

You may want to see also

Interpreting negative cash flow

Negative cash flow occurs when a company has more cash going out of its business than entering it. This is common for new businesses with high start-up costs, but it can also be a result of poor timing of income and expenses. For example, a company might sell goods and accrue profit but not receive the money immediately. If bills are due before a customer pays an invoice, the company will not have cash on hand to cover expenses.

Negative cash flow is not always a bad thing. A business could be making a net profit while experiencing negative cash flow. It could also be a sign that management is positioning the company for future growth. For example, a company might be investing in long-term fixed assets such as property and equipment.

To determine whether negative cash flow is a positive or negative development, investors should review the company's cash flow statement. This will reveal what phase the business is in. Is it a startup eager to grow, or an established business developing new lines?

There are three types of negative cash flow: initial, temporary, and chronic. Initial negative cash flow is common for new and growing businesses that invest heavily in resources to increase brand awareness and market authority. This is usually temporary and not a negative sign. Temporary negative cash flow can also occur when an established business adopts an expansion strategy, or experiences seasonal growth. Chronic negative cash flow is a sign of worry and could lead to unpaid bills and increased layoffs.

Investing in People: The Church's Role

You may want to see also

A company's cash flow statement can reveal its business phase

For example, a company in its early startup phase will likely show negative cash flow from investing activities as it purchases facilities or equipment to ramp up its operations. On the other hand, a mature business may show positive cash flow from investing activities as it divests assets or receives cash from the sale of assets.

A company's cash flow statement can also indicate whether it is in a growth phase or a maintenance phase. A company investing heavily in long-term assets, such as property, plant, and equipment, may show negative cash flow from investing activities, indicating that it is focused on future growth. Conversely, a company with positive cash flow from investing activities may be in a maintenance phase, using cash inflows from divested assets to fund its ongoing operations.

Additionally, the cash flow statement can provide insights into a company's financial health and operational efficiency. It can show how well a company manages its cash position, including its ability to generate cash to pay debts and fund operating expenses. A company with positive cash flow from operations is generally considered to be in a stronger financial position than one with negative cash flow.

In summary, by analyzing the cash flow statement, investors and stakeholders can gain insights into a company's business phase, financial health, and operational efficiency, enabling them to make more informed decisions.

Planning for the Golden Years: Navigating Cash Investments for Retirement

You may want to see also

Negative cash flow from operations

To identify the source of negative cash flow from operations, analysts can calculate it by subtracting payables from receivables. If this results in a negative number, it indicates that the company's income is less than its expenses. This calculation is an important metric for evaluating the financial health of a company's core business operations.

It's important to note that negative cash flow from operations does not always imply a loss for a company. Young companies, for instance, may report negative cash flow due to constant reinvestments aimed at financing growth. As long as these reinvestments accelerate revenue and increase margins in the future, this type of negative cash flow can be viewed positively by investors.

To assess whether negative cash flow from operations is a cause for concern, it's crucial to consider the stage of the corporate lifecycle, the cause of the negative cash flow, the nature of capital investments, and the funding sources.

In summary, negative cash flow from operations occurs when a company's expenses exceed its income, and it can have various causes and implications depending on the context and industry. While it may be a warning sign, it can also indicate that a company is investing in its future growth.

Invest in Wells Fargo: Now or Never?

You may want to see also

Negative cash flow from assets

Negative cash flow from investing activities is not always a bad sign. It could indicate that the company is investing in its future growth and profitability. For example, a growing company may invest in long-term fixed assets, which will appear as a decrease in cash within the company's cash flow from investing activities. Even well-established companies make investments in long-term assets such as property and equipment from time to time, causing a temporary negative cash flow.

However, negative cash flow from investing activities could also be a warning sign that the company's management is not efficiently using its assets to generate revenue. To determine whether negative cash flow from investing activities is positive or negative, investors should review the entire cash flow statement and the company's particular situation in greater detail.

There are several ways to improve negative cash flow from investing activities, including selling or disposing of underperforming assets, optimising the utilisation of existing assets, selecting and prioritising the most profitable projects, and negotiating better terms with suppliers.

It is important to note that negative cash flow from assets is different from negative free cash flow, which occurs when there is no cash left over after meeting operating, capital, and adjusting for non-cash expenses.

Planning for Prosperity: Strategies for Late-Stage Retirement Investing

You may want to see also

Frequently asked questions

Negative cash flow means a business has more outgoing money than incoming. This can be common for new businesses, but it cannot be sustained long-term.

Negative cash flow can be a positive sign if it is due to a company investing in its future growth. For example, a company may invest in long-term fixed assets, which can appear as a decrease in cash flow.

Negative cash flow can be a warning sign if it is due to a company overinvesting or losing money over time. This can lead to unpaid bills and increased layoffs.

A business can improve negative cash flow by selling off underperforming assets, optimising the use of existing assets, selecting profitable projects, and negotiating better terms with suppliers.